The level of immersion that VR offers is both a blessing and a curse. It produces highly visceral and satisfactory responses… but you have to see it to believe it. This was a major finding in the latest ARtillry Intelligence Briefing: VR Usage & Consumer Attitudes (excerpt below).

Specifically, VR headset owners showed high satisfaction compared to other categories of consumer tech products. However many non-owners (38%) reported disinterest in VR ownership; and the top reason (53%) was “just not interested.”

This creates a challenge to convert the masses by scaling up distribution, given inherent adoption barriers like price and technological invasiveness. Education, retail installations, VR arcades and mobile VR will be the ‘gateway drugs’ to reduce that friction and cultivate tomorrow’s VR owners.

Working closely with Thrive Analytics, ARtillry authored questions to be fielded through its established survey engine. This first wave of Virtual Reality Monitor™ (VRM) taps a sample of 2000 adults to reveal consumer behavior patterns that are examined throughout the report.

Part II. Non-Ownership Sentiments

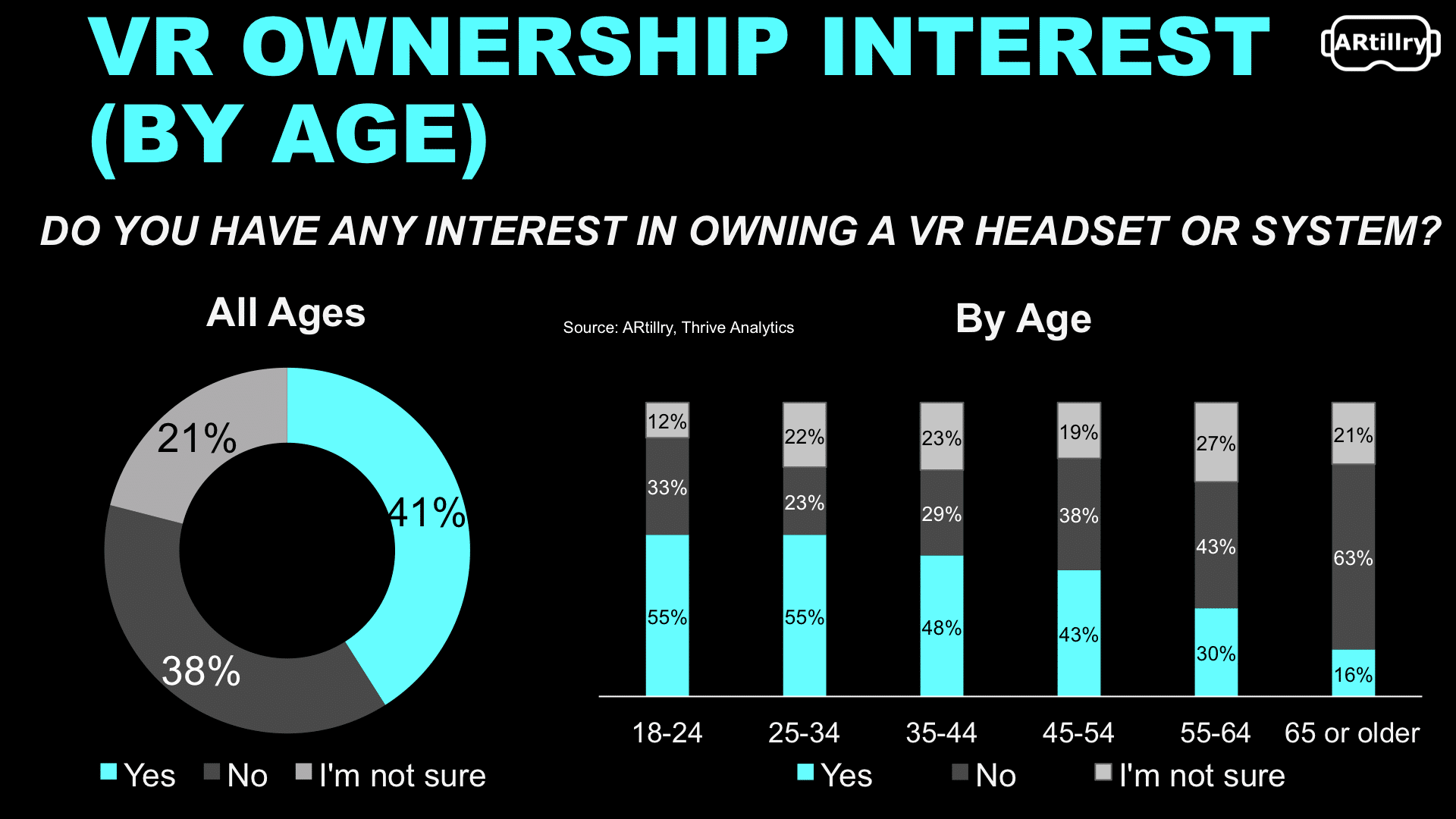

Moving on from VR owners, sentiments of non-owners can be a leading indicator for VR’s future growth. The results show moderate strength for near-term VR hardware growth, with 41 percent of respondents reporting interest. But that still leaves 38 percent uninterested and 21 percent unsure.

When looking at age breakdowns, interest levels unsurprisingly index higher for younger generations. There is in fact a clear correlation between youth and interest. ARtillry believes this is due to younger digital natives’ savvy, comfort and natural interest to experience emerging technology products.

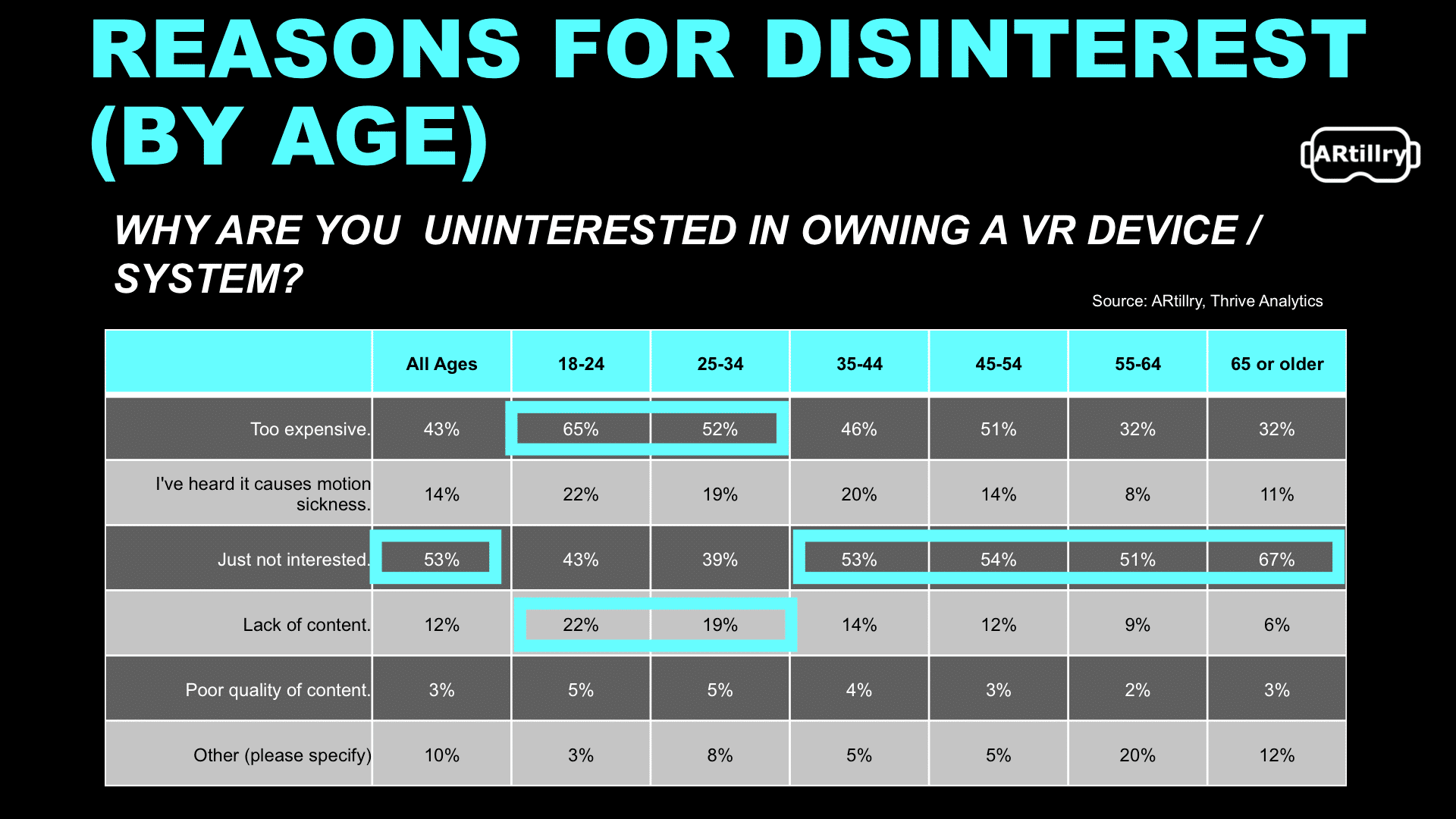

Drilling down one level, more insight can be gleaned from the reasons for disinterest. Among those who said “no” to the above question, a more telling question perhaps is “why not?” Price and content were factors (price is explored more later), but the biggest reason was “just not interested.”

This stark and definitive sentiment about disinterest was the largest single answer (53 percent) amongst the entire sample of all ages. ARtillry believes that this indicates two key challenges and areas of improvement for VR products/providers: education and distribution.

This goes back to the quote from Strata’s John Wright: Those who try VR for the first time are often hooked on the new experience and “blown away.” But the flip side to that coin is that the medium’s level of immersion dictates that you have to see it to believe it. And few people get that chance.

This is simply because friction involved in trying VR – or at least Tier 1 VR — is high. That includes not only cost, but technological invasiveness such as set up, rearranging furniture, etc.. This means that getting that “first taste” to the masses should be a key business objective for the VR industry.

There are a few adoption accelerants ARtillry has identified to accomplish that consumer acclimation:

1. Retail installations (such as product demos at Best Buy)

2. VR arcades and theme park rides

3. Mobile VR (tiers 1 & 2)

Retail installations are somewhat straightforward, and mobile VR is a topic explored in previous ARtillry Reports. VR Arcades and theme parks are worth examining briefly. Examples include large VR installations (see The Void) where customers experience VR-centric team competitions.

Also known as “location based VR,” it essentially lets people “rent versus buy” in terms of temporal experiences. In other words, it replaces VR’s ownership barriers with a more digestible experiential commitment – in both time and cost. Moreover, it accomplishes that “first taste,” on a larger scale.

And there’s an important historical parallel at play here. In the 70s and 80s, arcades were prevalent before home gaming console ownership became ubiquitous. VR Arcades could fill that same gap – albeit temporarily – for VR. This can help model a trajectory for VR’s directions and opportunities.

That will happen in tandem with an in increase in the volume of content available (explored earlier), as well as the lowering of another major barrier to adoption we’ll explore next: Price.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.