Yesterday the VR industry received disappointing news. HTC will abort plans it announced in May to distribute a standalone Google Daydream 3DOF headset in the U.S.. It’s moving forward instead with the 6DOF Vive Focus in Asia.

One theory for this move is U.S. price competition from Oculus Go. At $199, it’s priced to bring higher-end VR to a greater swath of the mainstream public, and to better seed the VR marketplace. But given HTC’s VR revenue model, it likely won’t compete at that price point.

To unpack that a bit, HTC is a company whose business model in VR is primarily about margins from hardware sales. Oculus conversely has the luxury (read: Facebook) of treating VR hardware as a loss leader to build market share and establish a longer-term platform strategy.

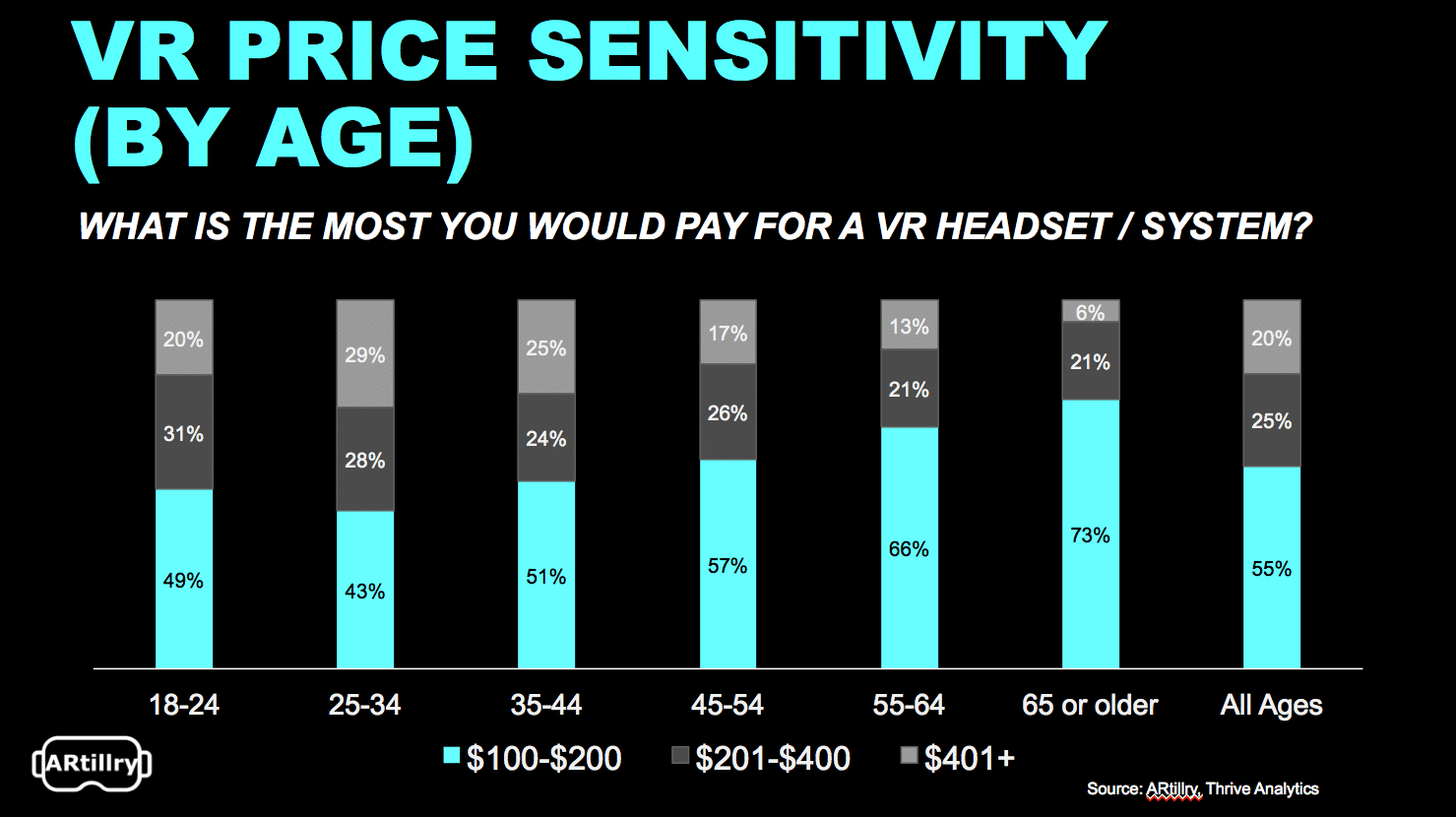

$200 is a threshold for VR adoption. Source: ARtillry, Thrive Analytics

$200 is a threshold for VR adoption. Source: ARtillry, Thrive Analytics

This is something Facebook missed by not launching a smartphone as a direct consumer touch point. It instead has to reach consumers through apps that operate on devices that Google and Apple control, so there’s no vertical integration nor hardware optimization it can control.

Given Mark Zuckerberg’s vision of a VR future, that’s not a barrier Facebook wants to face again. Though smartphones are highly conducive to social engagement and connectivity, Facebook sees VR as an even greater bedfellow for the future of digital social interaction.

But that long-term approach comes at a cost: to sacrifice margins for market share. Platform wars are often won through momentum set in early days to attract users by any means (including price). Then there’s a domino effect of developer interest, content creation… and more users.

Or as we wrote in a recent report:

ARtillry believes we’ll see continued price competition, as emerging tech sectors often involve trading margins and unit economics for market share. The latter can produce greater long-term value, given that “platform wars” can be won on gaining early market share through device penetration.

This can have a domino effect, as content volume on a given platform is a function of the size and

quality of the developer network working with that platform. Those developers are in turn attracted to platforms with the greatest revenue potential, which are often those with the greatest installed base.And that starts with device penetration and competitive pricing. The lesson is to watch headset pricing and adoption as leading indicators for VR opportunity.

Back to HTC, its model is more reliant upon unit economics for hardware sales in the near term. To be fair, it follows some platform dynamics given that SteamVR and Viveport content benefit from a network effect of users and developers. But hardware margins are primary.

![]()

And with hardware sales, when your core product becomes someone else’s loss leader, it’s never good. Just ask Garmin and GPS navigation devices that were decimated when Google offered comparable functionality in Google Maps for free, and on smartphones people already owned.

It’s not exactly the same, but HTC can’t justify lowering headset prices the way Oculus can. The looming question is if these competitive dynamics will impact Tier 1 VR: Given that Oculus has also been aggressive with Rift pricing, could it impact HTC’s flagship Vive in the same ways?

Overall, it’s a lesson in loss-leader economics, and in the strategic positioning in the early days of platform wars. We saw the same thing in the smartphone OS wars. And like we saw then, consumers benefit most. Prices should continue to drop, along with an arms race for VR quality.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.