AR and VR stakeholders claim that their market sizes will be massive. And we believe they’re right. But how big are they and how big will they realistically get?

ARtillry Intelligence quantified these sectors in more precise terms in its latest industry revenue forecast. And the Verdict? Global AR & VR revenues will grow from $4.1 billion in 2016 to $79 billion by 2021. This includes AR, VR and the enterprise and consumer segments of each.

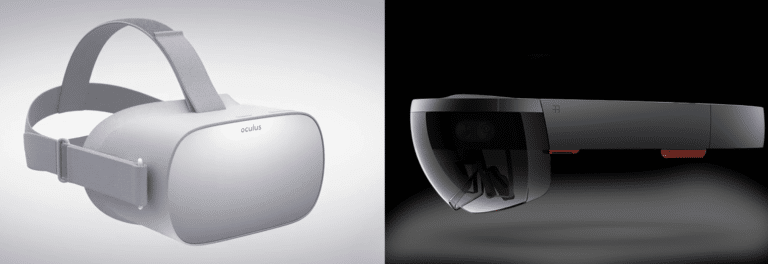

As for a breakdown of the major sub-sectors of the XR spectrum, consumer VR leads all categories today but will be quickly eclipsed by enterprise AR. Enterprise’s leading stake has a lot to do with clear ROI for enterprise buyers, and a form factor that supports all-day use.

See the rest of the breakdowns below, and preview more of the report (including explanation of methodology) here. You can also see our video companion below for additional narrative about revenue drivers and dynamics. To access the full report, subscribe to ARtillry Insights.

Key Takeaways

Global AR & VR revenues will grow from $4.1 billion in 2016 to $79 billion by 2021.

Enterprise AR will grow from $829 million in 2016 to $47.7 billion in 2021. It’s the fastest growing segment of AR & VR revenues and the largest revenue segment in 2021. Steep growth results from the category’s current small base, as well as software-dominant revenues in outer years that benefit from Saas dynamics (scalability and recurring revenue). Scale will also result from wide applicability across enterprise verticals; and a form factor that supports all-day use and clear ROI (e.g. manufacturing efficiencies). Near-term revenues will be hardware-dominant as it’s usually the first step in enterprise tech adoption. Hardware growth creates an installed base for software which, again, will dominate enterprise AR in outer years. Enterprise hardware adoption will also mature as it’s established in the enterprise, with replacement cycles outpaced by software refresh rates.

Consumer AR will grow from $975 million in 2016 to $15.8 billion in 2021. Until the 2020 introduction of Apple’s smart glasses, it will be dominated by the mobile form factor. Revenues will be software-dominant during that time (mobile devices aren’t counted in this forecast), and include app revenues such as in-app purchases. Much of this will evolve from the business model validated by Pokémon Go, which drove most 2016 consumer AR revenues. Niantic will also find success in its follow-up game to Pokémon Go, with architecture and game mechanics re-skinned to a Harry Potter theme. Consumer AR will hit an inflection point – and shift share towards hardware revenue – starting in 2020 as consumer-gear smart glasses finally arrive. Meanwhile, the development work put into mobile AR apps will be a training ground for an eventual glasses-dominant era.

Enterprise VR will grow from $665 million in 2016 to $4.4 billion in 2021. Though strong in its own right (46% CAGR), it will hold the smallest share of AR & VR revenues among the sub-sectors measured in this forecast. VR will be stronger as a consumer play (see below), while AR is stronger in the enterprise (see above). The latter dynamic stems from VR’s inherent isolation, which inhibits some job functions and share of time per working day. Like AR, VR’s near term enterprise revenue will be hardware-dominant as it’s the first step to tech adoption. That installed base will pave the way for enterprise VR software revenues to grow and overtake enterprise VR hardware revenues by 2019.

Consumer VR will grow from $1.6 billion in 2016 to $11.5 billion in 2021. Like enterprise VR, it will be hardware-dominant in early years as its installed base is established. Over time, software (in this case, games and apps) will eclipse hardware revenues with a faster refresh cycle. A greater installed base of hardware will also incentivize VR content creators to invest in long-form content, resulting in more robust VR content libraries and greater software spending per user (ARPU). Price competition among VR headset manufacturers (e.g. Oculus, Sony, Samsung) will also be a big consumer adoption driver. Oculus Go, at a $199 price point, will hit a sweet spot for quality and affordability, and will drive mainstream VR adoption and education starting in 2018. Oculus – with the advantage of Facebook-backing – has the flexibility to apply loss-leader pricing in order to trade margins for market share. That will give it a strong competitive position versus players that are dependent on hardware revenue (i.e. HTC, Samsung).

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.