“Behind the Numbers” is ARtillry’s series that examines strategic takeaways from its original data. Each post drills down on one topic or chart. Subscribe for access to the full library and other knowledge-building resources.

Many of us agree that XR will be transformative to life and business. But it’s a matter of when and how much. So ARtillry Intelligence ventured to quantify the revenue outlook in more precise terms. The result is our latest bi-annual XR revenue forecast, which tracks XR and its sub-sectors.

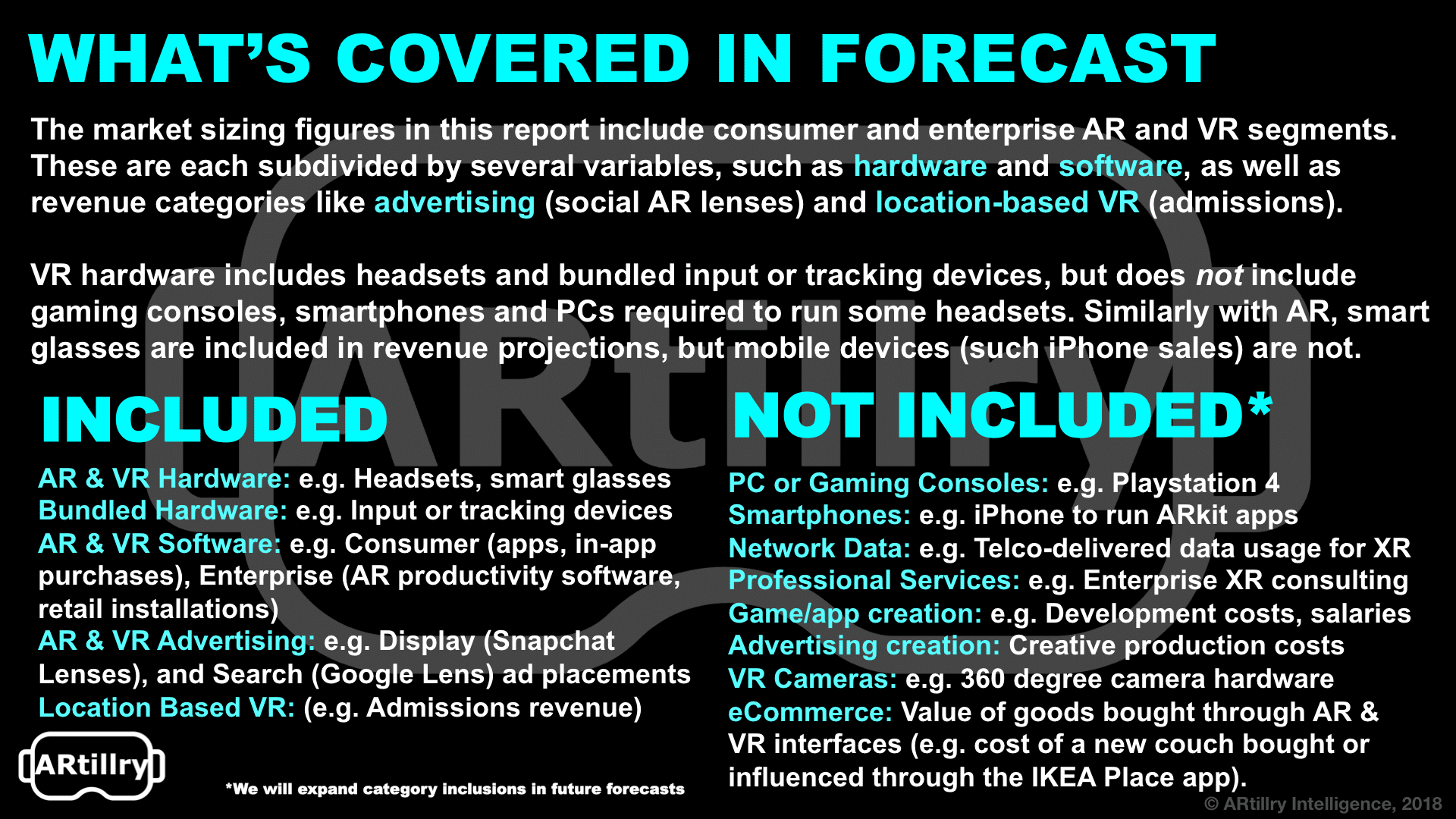

The high-level summary is that total global XR revenues will grow from $3.8 billion in 2017 to $56 billion in 2022. That includes AR, VR, and the enterprise and consumer segments of each. Those are then subdivided into revenue categories like hardware, software and advertising.

So where’s that money going? The largest sub-sector in outer years is enterprise AR, which will comprise roughly 51 percent of XR revenues by 2022. That has a lot to do with the scale achieved through wide applicability across enterprise verticals; and a form factor that supports all-day use.

Consumer Grade

Consumer AR will be the second largest XR sub-sector in the outer years of the forecast. We project it to grow from 12 percent of XR revenues in 2017 to 29 percent in 2022, totaling $16.5 billion at that point. That includes hardware (smart glasses) premium apps and in-app purchases.

Near-term revenues will be dominated by mobile. And within mobile revenue, software will be dominant, as we don’t count smartphone sales in this forecast (a ubiquitous device on which AR is secondary). So the software spend is mostly about apps and in-app purchases (IAP).

The latter will dominate software revenues, due to consumer hesitance to pay upfront for AR apps. This was shown in our survey data that indicates consumers are more comfortable with in-app payments, especially new and non AR users, which are the largest segment.

A leading indicator for IAP also comes from Pokémon Go, which validated the model with $2 billion in revenue to date. Niantic will also find success in Harry Potter, Wizard Unite. These and other apps, including those built on Niantic’s Real World Platform, will rely heavily on IAP.

Moving Target

Meanwhile, mobile AR’s killer apps could arrive in 2019 — likely built around a utility like visual search, or the viral growth of a social app. That will be two years after ARkit’s launch, a similar timeframe after the iPhone’s 2007 launch when we began to see killer apps like Uber and Waze.

Moving into outer years, consumer AR revenues will begin to shift towards hardware starting in 2021 as smart glasses (possibly from Apple) finally reach tenable specs and standards for consumer markets. It will take several more years for large-scale penetration though.

But interestingly, software at that time will begin to shift to premium apps (as opposed to in-app purchases) as it’s a model conducive to dedicated AR hardware like smart glasses. This is similar to how apps/games are purchased in VR, and will boost the premium app spend beyond 2022.

Meanwhile, we’ll see a progression of software innovation that starts with mobile apps, where the scale lies. But that will be part of a larger evolution, as the development work put into mobile AR apps will be a training ground for an eventual glasses-dominant era beyond 2022.

It’ll be a moving target and we’ll continue to size it up twice-per-year. Meanwhile, stay tuned for more data slices from this forecast, which we’ll continue to unpack here. You can also preview the report here, including methodology and breakdowns of what’s included in the figures.

For deeper XR data and intelligence, join ARtillry PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.