As we approach a new year, it’s time for our annual ritual of synthesizing the lessons from the past twelve months and formulating the outlook for the next twelve. Notably, when kicking off this thought exercise, we realized that several of the topics look similar to last year.

Though there are lots of developments and new insights, the topical containers that house those insights are beginning to coalesce into standard buckets. We’re talking mobile AR engagement & monetization; AR cloud development; enterprise AR and the gradual march of VR.

This standardization is good news in that it signals spatial computing’s exciting – yet insecure – early days have transitioned to an adolescent period of its lifecycle. We have a firmer grasp on what’s working….versus 2017’s wild speculation on the technology’s world-shifting impendence.

So where is spatial computing now, and where is it headed? What’s the trajectory of each of the above subsegments? This was the topic of the latest ARtillery report, Spatial Computing: 2020 Lessons; 2021 Outlook. It looks back and looks forward, including concrete predictions.

Prediction 2: Mobile AR Sets the Stage

After examining AR glasses in our first prediction last week, our second prediction focuses on mobile AR. Before AR’s fully-actualized era of face-worn hardware arrives, its near-term opportunity lies with formats that are activated through the smartphone camera.

In fact, one of mobile AR’s longstanding confidence signals is the sheer size of the smartphone installed base. Compared to the uphill battle that AR glasses face, mobile AR — though challenged in its own ways — has an easier climb due to ubiquitous hardware.

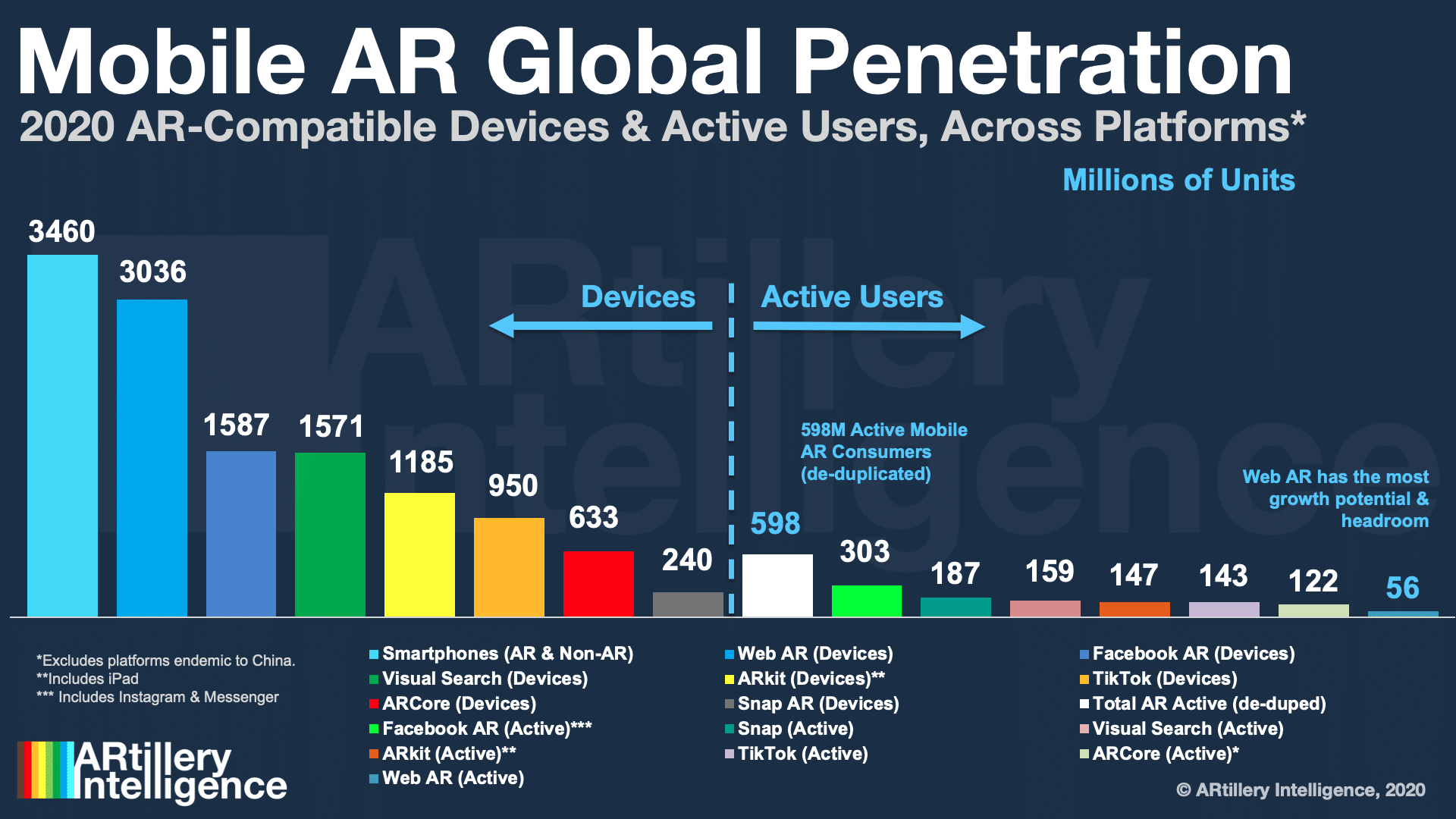

But more important than the smartphone base is the share of that universe that’s AR-compatible. That number has been paraded around industry events for the past few years as “1-billion+.” This originated in early 2019 as a then-accurate tally of ARkit and ARCore-compatible smartphones.

But things have gotten more complex as additional platforms gain ground. In fact, the fastest-growing AR compatibility in today’s smartphone landscape happens outside of the above platforms with Snapchat, Facebook and web AR, according to ARtillery Intelligence’s Mobile AR forecast.

The greatest compatibility comes from web AR, with 3.04 billion units. This results from work done by 8th Wall and others to make AR work on low-end hardware. That’s followed by Facebook (1.58 billion) ARkit (1.19 billion), TikTok (950 million), ARCore (633 million) and Snapchat (240 million).

Ready & Active

The keyword in the above analysis is “compatible,” as it tallies devices that are AR-ready. A more important figure is the subset that’s actively engaged in AR. Here we run into the reality of platform overlap, making it challenging to pinpoint one figure for global AR active devices.

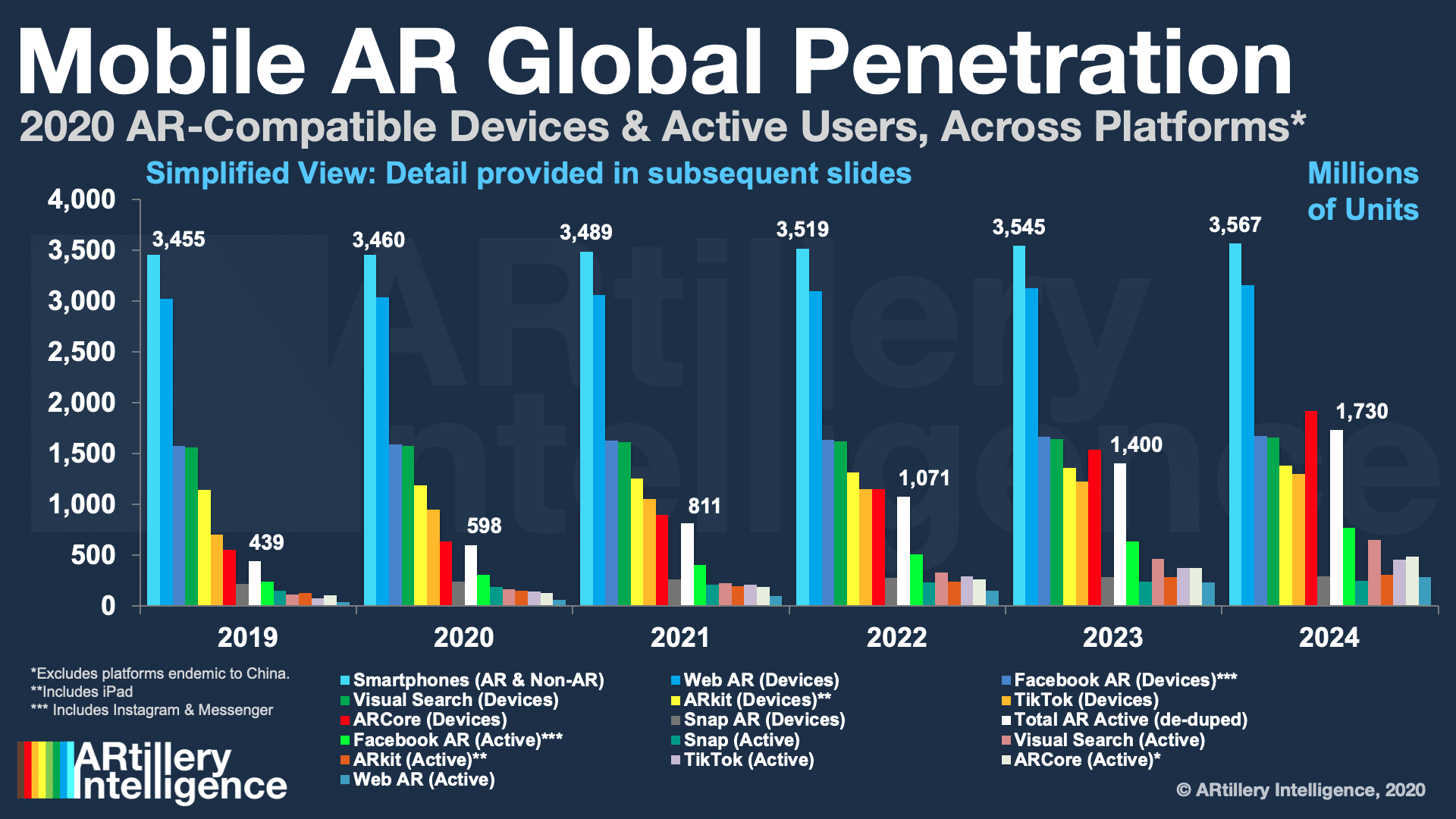

By applying a de-duplication formula to reconcile the overlap, ARtillery estimates that AR active devices at the end of 2020 total 598 million. This is projected to grow to 811 million in 2021 and 1.73 billion by 2024 as more advanced hardware cycles in, and as AR acclimates culturally.

But it’s important to note that there isn’t necessarily a correlation between compatibility and active-use. For example, web AR’s compatibility lead contrasts its trailing active use. This is a mark of growth potential and headroom for the nascent but promising web AR modality.

TikTok is in a similar boat with promising reach but underdeveloped AR. Snapchat conversely has the lowest compatibility among platforms (240 million) but the second-highest active use (187 million). Among competitors, it has the greatest share of its overall user base that’s AR active.

Facebook sits somewhere in the middle with a diversified AR approach (News Feed, Messenger, Portal). But Instagram could be the real ace up its sleeve given a cultural match with camera-forward users, and natural monetization with the product-discovery use case it’s conditioned.

Boiling it Down

To synthesize all of the above into a concrete set of potential market outcomes, here’s what we think will happen in 2021:

— Global AR active users will reach 811 million by the end of 2021, and 1.7 billion in 2024 (see chart above)

— Mobile AR will be propelled by the continued momentum of popular activities like social lenses, as well as progress from Snap, Instagram and others to create more rear-facing camera experiences, including Covid-fueled eCommerce.

— Speaking of Covid, it’s impacted the spatial computing spectrum unevenly. Mobile AR is one subsector that hasn’t been hit hard, given that it’s primarily deployed through software. This momentum will continue into 2021, including communications, entertainment and shopping.

— Further momentum will come from evolution in underlying hardware, especially as LiDAR trickles down from smartphone premium feature to standard issue (though that cycle will extend beyond 2021).

— Another accelerant will be the investments of consumer brands to create experiences that are promotional in both exposure (e.g., film releases) and utility (e.g., shopping and product visualization). More on that in the next prediction.

We’ll pause there and circle back in the next installment with another prediction from the report. Meanwhile, check out the full report here, and get more color in the video below.