This is the latest in AR Insider’s Campaign Tracker series. Running semi-weekly, it examines marketing campaigns that utilize AR visualization such as product try-ons, and their results. For a full list of campaigns, comparative ROI chart and deeper analysis, subscribe to ARtillery PRO.

Proof points continue to roll out for AR’s effectiveness as an advertising medium. Early-adopter brands are learning that AR lets them demonstrate products in immersive ways. That can include brand engagement (upper-funnel) or “try before you buy” (lower-funnel) visualization.

More evidence from the “upper-funnel” side of the AR commerce spectrum comes from the NFL’s AR lens for last year’s Superbowl LIII. In honor of the NFL playoffs kicking off — and to continue spotlighting examples of AR ad effectiveness — we’ll spotlight the campaign results.

The campaign involved sticker packs for each team — The New England Patriots and LA Rams — which fans could use in a variety of ways to show their support. The result was a high degree of user engagement through captured selfies that were augmented and shared, as AR lenses go.

But more interesting about this lens campaign was its reach. Run on Snapchat, it was viewed more than 303 million times. To put that into perspective, the Superbowl itself — often heralded as a benchmark for media reach and brand advertising — reached 98.2 million TV viewers.

With this quantity also comes quality. AR’s immersion can create quality impressions in terms of metrics like brand association and recall. There’s also more depth of engagement than other ad media, including metrics like session lengths and frequency (30x per day on Snapchat).

Specifically, Snapchat reports that its sponsored lenses average 10 to 15 seconds of playtime, 19 percentage-point lifts in ad awareness, 6-point lifts in brand awareness and 3.4-point lifts in action intent on average. They also achieve an average 9-point lift in post-engagement product sales.

“There is a depth of engagement [on Snapchat],” NFL Digital Media VP Blake Stuchin told Engaget. In fact, the NFL put its money where its mouth is, and has doubled down on Snapchat paid lens campaigns. It ran a similar campaign in advance of the following (current) NFL season.

That subsequent campaign included lenses to commemorate the 100th NFL season. Using Snapcodes (or the NFL logo), users activated lenses that superimposed classic NFL footage in their field of view. It also targeted geographically-relevant audiences with regional team lenses.

Both campaigns come as AR faces doubt from brand advertisers about ROI and reach. AR can be a low reach play at times, but it’s telling that the Superbowl LIII campaign achieved 300 million+ engagements. Though an outlier, it could be a leading indicator for AR’s performance as it grows.

Meanwhile the advertiser disconnect signals the need for education, as well as continued validation and experimentation from early-adopter brands like the NFL. Among the metrics outlined above, the key lesson here for reach-driven brands is the scale that AR can achieve.

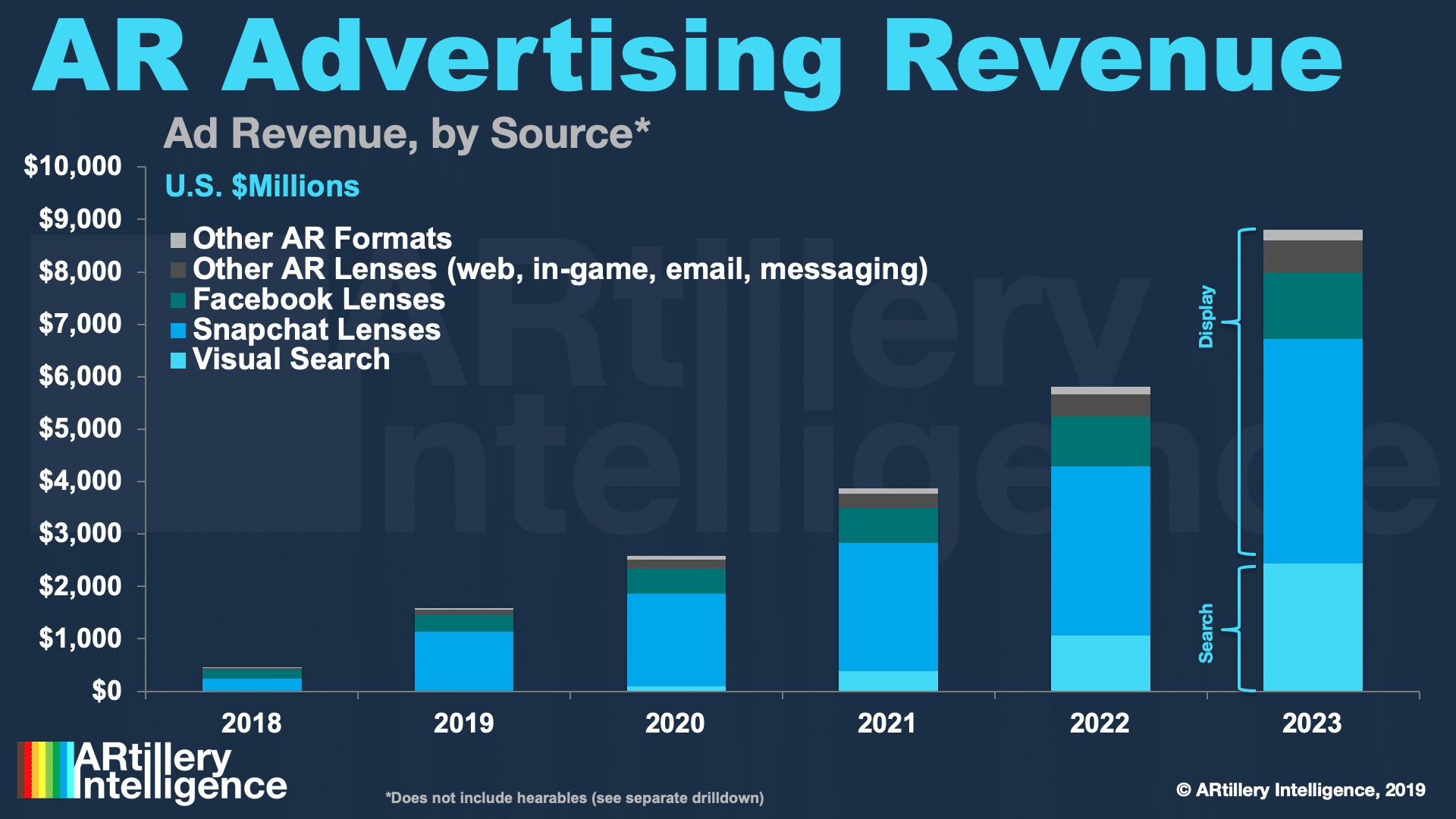

That realization and adoption by a larger share of brand advertisers will cycle in slowly, just as it did for mobile advertising. This is happening to the tune of $1.5 billion in AR ad revenue last year according to our research arm ARtillery Intelligence, on pace for $8.8 billion by 2023 (see above).

We’ll be back with more AR commerce proof points and takeaways in our Campaign Tracker series. There will be lots to watch and internalize as AR commerce evolves quickly from early and experimental stages to a firmer set of strategies around UX, user targeting, and distribution.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.