AR and VR seem to play in their own reality. Well, they do because it’s their nature – augmented and virtual realities. But that’s not really what I mean. I’m talking about the growth and monetization models that create value and generate revenue. While SaaS and cloud technologies are eating the world, AR and VR seem to stay in their slowly growing bubble.

In this article, I will show the impact of platform and marketplace models on the success of tech software products and why AR/VR companies need to leave their technology islands to fish in the big ocean – for customers and investment dollars. Indeed, technologies that precede AR and VR hold key lessons for growth and traction. We’ll examine those forbearing technologies and proven models.

For context and definition, I refer to AR and VR technologies in this article collectively as the metaverse. This is because the metaverse will be largely constructed from, and accessed by, AR and VR – in both consumer and enterprise markets.

Platforms build the foundation for tech growth

Think back 10 years. Hotel chains like Hilton and Marriott ruled the rooms around the globe. The offer was defined by the hotel companies. AirBnB changed the world and instead of owning hotel rooms, AirBnB built a platform that brought hosts and room seekers together. Better experience, more transparency, and value created by both hosts and guests.

In AR and VR, we largely have the Hilton landscape: providers of apps or tools for individuals or businesses to play, work or enjoy. Where are the platforms that serve millions of creators and consumers? Where do we see freemium models and product-led growth that have sent companies like Slack, Miro and Figma on their hypergrowth journeys? Where are we on the journey to reinvent existing markets and define new categories?

Where are the Salesforces, Slacks and Ubers of the metaverse?

Here’s something to think about: platforms use technology to connect people, organizations and resources. The goal is to enable participants to create and exchange value. Technology is the vehicle, not the value.

In 1990, Salesforce changed the software world. Salesforce founder Marc Benioff introduced “No Software.” With new technology (cloud) and a new business model (SaaS), Salesforce changed enterprise software while market leader Siebel Systems (on-premise, long-term contracts) was acquired by Oracle.

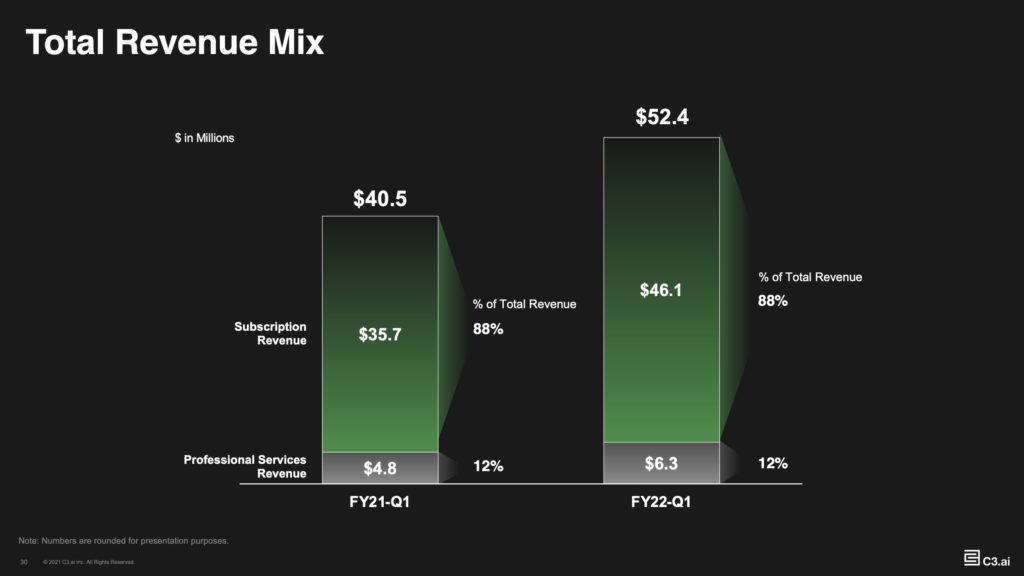

Interestingly, Siebel Systems founder, Tom Siebel, is back with an enterprise AI platform and has achieved $200 million annual recurring revenue (ARR) with the emerging tech solution.

Startups like Miro, Figma and Slack have shown in the B2B environment how to beat the big players in the industry and how to activate millions of users. Uber, AirBnB and Netflix are doing the same in the consumer markets.

New technologies have no blueprint when it comes to growth and monetization. We must take a look outside of the Metaverse bubble. Successful models from fast-growing industries can help to set the right course and avoid mistakes.

How to leverage successful models and frameworks

Entry into these models requires defining use cases, user profiles and their existing habits. How often is the product used? How long is the consideration time? And what is the targeted audience (B2C, B2B)? Answering these questions is critical when choosing the right model. The model is simply an orientation or starting point, while every product is different and needs an individual growth plan.

With that backdrop, here are five key considerations and components for building platforms and products for the metaverse:

1. Business models

Marketplace: A marketplace connects buyers and sellers. In this example, we assume a 2-sided marketplace. Typical marketplaces are Amazon and eBay when it comes to commerce. Wikipedia, Medium or OpenTable are examples from other areas where supply and demand are networked.

- Amazon Marketplace (B2C/B2B)

- AirBnB (B2C)

- eBay (B2C/B2B)

- Salesforce AppExchange (B2B)

- Meta’s Oculus Store (B2C)

Platforms: Platforms connect developers/creators of products/content with users and buyers. The difference to marketplaces is that the supply side builds the product(s) while marketplace companies are not directly involved in the supply side. There are different forms and combinations. Google uses the search engine marketplace as a platform for its own products such as YouTube.

- HubSpot (B2B)

- Uber (B2C)

- Snap AR lenses and Lens Studio (B2C)

- PTC Vuforia (B2B)

- Niantic Lightship (B2C)

- Unity 3D (B2B and B2C)

A big growth lever of marketplaces and platforms is network effects NFX. All hyper-growth companies in recent years have gone through the roof largely due to network effects. Simply put, network effects occur when a product or service becomes more valuable due to increased usage. Take Uber as an example: more drivers, faster availability, more rides, more users. Network effects tend to self-propel as they grow, also known as a flywheel effect.

Network effects break down into different types such as direct and indirect, local and global, data, social. NFX are not to be confused with viral effects. NFX increase the value of being on a platform and increase the defensibility.

The Network Effects Manual: 13 Different Network Effects (and counting)

Software-as-a-Service (SaaS): SaaS is a business model where the product is delivered over the internet and can be accessed without installing the software compared to on-premise models or native applications.

Salesforce is the SaaS pioneer and has prepared the software world for the growth of startups like Miro, Figma and Slack today. Large companies like Microsoft have adapted and now offer their products in a SaaS variant. Bessemer Ventures’ annual Cloud and SaaS report shows the immense growth and impact on valuations and go-to-market.

Typical for SaaS models are subscriptions in the monetization, which is not a prerequisite. Rather, it depends on the complexity of the products and the target group which model makes the most sense for users and buyers.

If a product is used daily or weekly then the monthly subscription is a good approach. There are a number of products that are used only once a year (tax software) or on certain occasions (wedding service, freelancer marketplaces like Fiverr) and thus annual subscriptions, multi-year contracts or transaction-based models are used. If the frequency of use and monetization do not match, friction arises.

- Atlassian Jira/Confluence (Monthly subscription)

- SurveyMonkey (Annual subscription)

- Figma (Monthly subscription)

- Microsoft Remote Assist (Monthly Subscription)

2. Growth and go-to-market models

Go-to-Market (GTM) is the process to bring your product to market by aligning product, marketing, sales and customer success teams to generate revenue and to build your brand. Many go-to-market strategies consist of a combination of different approaches, especially in the B2B sector. GTM models can be divided into three categories:

- Marketing-led: Focus on Inbound Marketing (SEO/SEM) with marketing automation for lead generation and nurturing

- Product-led: Product is the main vehicle for acquisition through easy access to testing and using

- Sales-led: Active sales outreach and account-based marketing for acquisition and retention

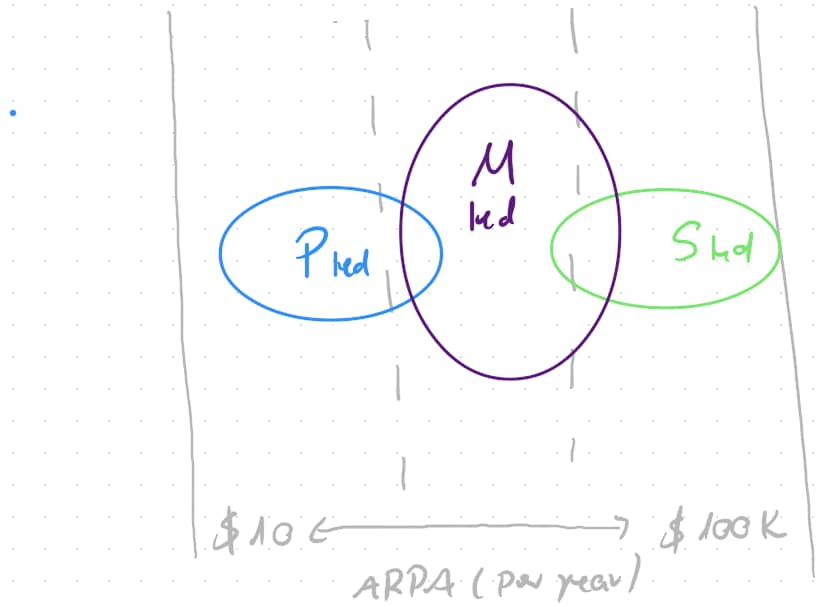

Choosing the right mix has a great impact on the success of the GTM plan. The decision for the “lead” depends on the Annual Customer Value (ACV).

Complex B2B products with several people involved in the buying process can be found in Sales-led and Marketing-led areas. No-touch consumer products are typical for product-led strategies.

The 3 Go-to-Market Highway Lanes: Marketing-led, Product-led, Sales-led

Whether B2C or B2B, many users and buyers today want to see the software as quickly as possible before there is any contact. Even with enterprise target groups, buyers are used to Uber, Amazon and Netflix from their consumer experiences, and appreciate seeing the look and feel of the software.

AR and VR products can leverage these models and build their go-to-market plan around the product experience rather than focusing on the technology. The tech approach plays a role with the early adopters, but to serve the mainstream markets, a more bottom-up user-centric plan is needed.

3. Sales approach

After choosing our business model and the appropriate GTM plan, the next step is the sales model. Depending on the target group, different approaches can be taken.

Top Down: Sales teams talk to decision-makers in big companies to sell their product. This is a classic approach for products with high average customer value, and for customers from the Fortune 100 (and comparable global indices). In the Metaverse, think about enterprise platforms for manufacturing companies and content creation platforms handling loads of data and files.

Sales-assisted: Remote expert applications in AR, as well as virtual tour platforms in VR, are typical examples of sales-assisted. The platforms can be tested and downloaded, but it takes sales or customer success teams on the vendor side to explain the products and ensure that everything is used.

Bottoms-up: As we move towards bottoms-up and self-serve models, we are moving away from traditional sales teams and towards product and marketing leads. In the process, the target groups are also changing, representing the mid-market, or individual teams within companies. Platforms like Unity3D or Snaps’ Lens Studio can fall into this category depending on the target group. Targeting takes place directly with users.

Self-serve: Now we arrive at the no-touch business. Whether B2C products or simple B2B applications, users can manage everything themselves, from registration to payment and use. The product must be designed for this and have very low friction.

Outside of AR, companies like Slack and Miro show how to start with self-serve and bottoms-up; then add enterprise sales to reach customers with higher ACV. While top-down and sales-assisted free trials are standard, the trend in bottoms-up and self-serve is increasingly towards freemium models, which reach a larger user base faster, and serve as an acquisition/upsell channel.

4. Growth fuel

After we have the rocket ship ready on the launchpad, it’s time to mix fuel and oxygen to finish the engine. Earlier, I described the importance of marketplaces and platforms and the value of network effects. Platforms with millions of users have the potential to grow much faster than individual apps.

Communities create the connections between individual users, creating a network rather than individual users. Collaboration and multi-player experiences ensure strong involvement, which further fuels growth. In the real world, we work, play, and live together. It needs the same in Metaverse products to enable hyper-growth and AR/VR unicorns.

And another thing that changes the game is activating users and establishing or changing their habits. That’s something that’s missing in the metaverse today, and that’s also why we’re not seeing the big checks from VCs yet.

You can sell your product, users can download and try it. But if they don’t quickly see the value and change their habit to the new product, monthly active users and retention numbers go down and churn goes through the roof.

Now, let’s go grow the metaverse

AR and VR have challenges that other typical software solutions do not. Complexity in technology has an impact on the user experience. New hardware like headsets present friction in their unfamiliarity to most users. This makes it even more important to focus on the product experience and to choose the right models to get the products to the right users with the right vehicles. When all that can be accomplished, the metaverse can truly scale as a new computing platform for enterprises and consumers.

Dirk Schart is CMO at RE’FLEKT where he helped lead the work augmentation platform into the No. 1 “best in class” Enterprise AR startup according to ABI Research. Follow him on Twitter at @DirkSchart.

Dirk Schart is CMO at RE’FLEKT where he helped lead the work augmentation platform into the No. 1 “best in class” Enterprise AR startup according to ABI Research. Follow him on Twitter at @DirkSchart.