As you may have heard, Oculus announced its “Summer of Rift,” sale yesterday, dropping the price of its flagship HMD from $599 to $399 for the next six weeks.

Though this is a limited-time offer, we believe it portends a standard price point we’ll soon see across tier 1 VR headsets (Rift, Vive & PSVR). And meanwhile, it could significantly impact sales, as the price is within the “sweet spot” for consumers’ willingness to adopt.

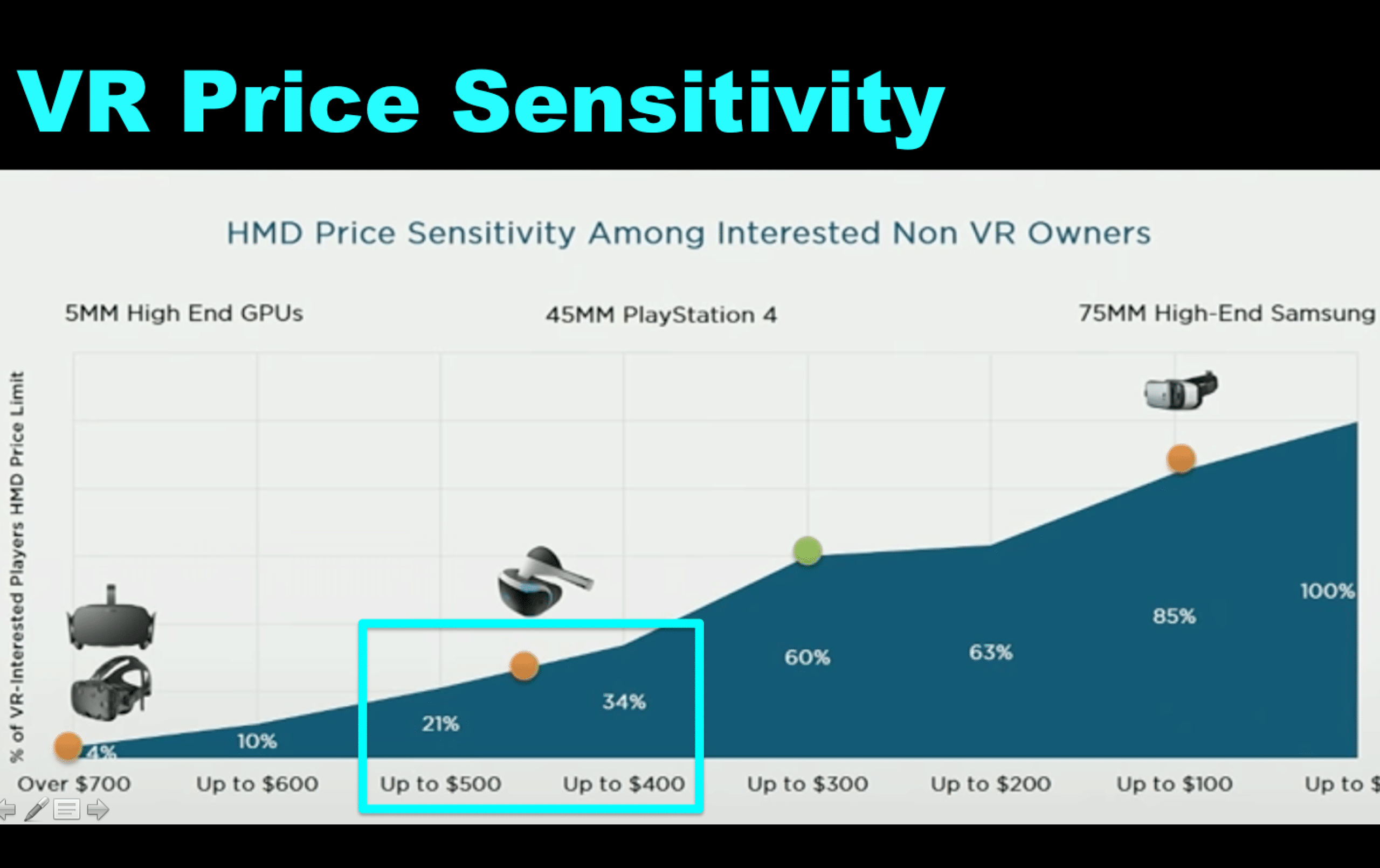

As we presented in May (video at bottom) and as published by Eedar, consumer interest in VR headsets grows considerably when the price dips below $400. It’s also no coincidence that the Rift’s sale price matches PSVR’s, which leads tier-1 in unit sales.

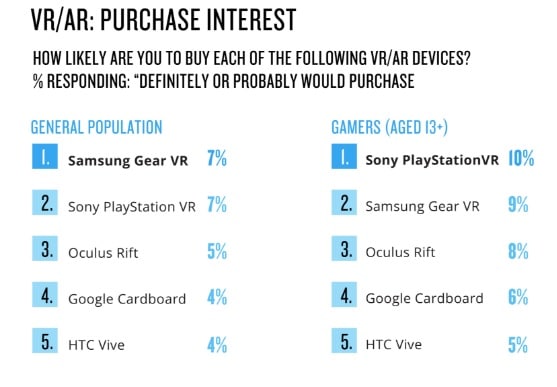

PSVR’s leading market share is partly due to an already paved installed base of 50 million compatible PS4s. But it also results from a $399 price tag, which beats HTC Vive ($799) and Rift’s pre-sale price ($599). Oculus knows this and wants to gain ground.

Indeed, the summer sale is a market share play, which Oculus will chalk up to marketing or customer acquisition cost. As we discussed yesterday, market share growth is a key success factor in any emerging tech area. That’s especially true when it’s a “platform war.”

As platform wars go, content and developer ecosystem flow directly from a solid installed base. The greatest distribution can be offered to developers by platforms with the largest installed base. And that’s in turn a function of early-stage consumer hardware adoption.

Put another way, the land grab for market share (headset adoption) will have a domino effect on the attractiveness of that platform to developers. That in turn drives the content available on a given platform and thus its ongoing attractiveness (see “chicken & egg” dilemma).

The equivalent to this principle in the AR world is ARkit. Building on an installed base of tens of millions of iOS devices, it creates the world’s largest AR developer platform overnight. And that will create a gravitational pull for developer talent, as we’re already seeing.

Back to VR, Moore’s law and price competition will put downward pressure on pricing. But there will still be consumer resistance in Tier 1, due to the need for high end processing (read: dedicated PC). The “all in” price will need to be sub-$1000 to reach meaningful adoption.

Disclosure: ARtillry has no financial stake in the companies mentioned in this article, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image caption: Oculus