ARtillry Briefs is a video series that outlines the top trends we’re tracking, including takeaways from recent reports and market forecasts. See the most recent episode below, and past installments are here.

We hear a lot about XR’s potential growth. Consisting of several sub-sectors, how big are they now and how big will they get? ARtillry Intelligence has quantified the revenue outlook and the result is our latest XR revenue forecast, unpacked further in ARtillry Briefs (below).

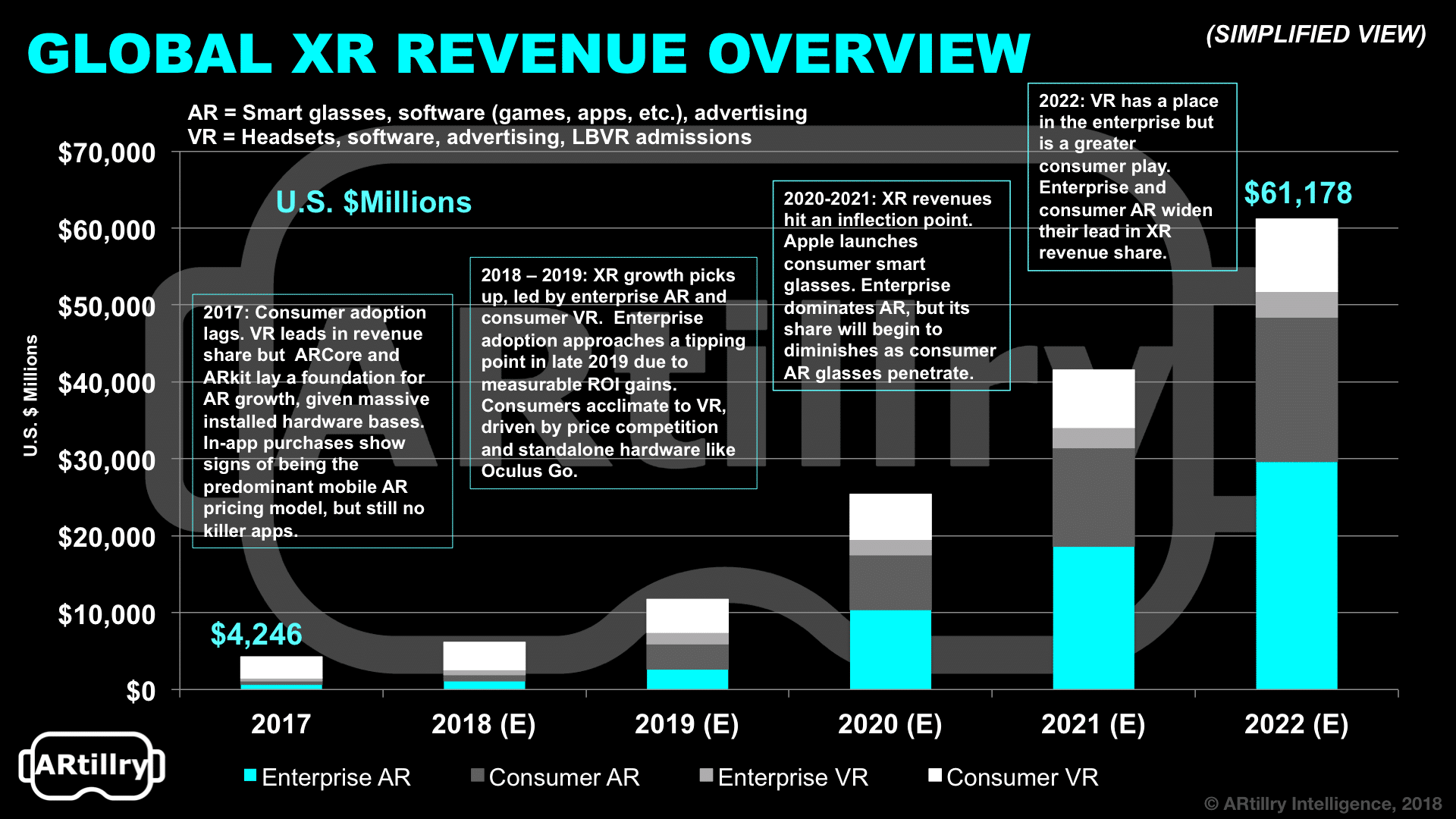

The high level summary is that total global XR revenues will grow from $4.2 billion in 2017 to $61 billion in 2022. That includes AR, VR, and the enterprise and consumer segments of each. Those categories are then subdivided by revenue categories like hardware, software and advertising.

Among these sub-sectors, the largest in outer years is enterprise AR, which will comprise roughly 48 percent of all XR revenues by 2022. That has a lot to do with the scale achieved through wide applicability across enterprise verticals; and a form factor that supports all-day use.

But despite those advantages, there’s still enterprise resistance and risk aversion. We believe momentum will build up to a tipping point around 2020, after which we’ll see accelerated adoption. So it will build slow then happen fast, just like with enterprise smartphone adoption.

Sticking with AR, its consumer segment is the second largest sub-sector in the outer years of our forecast, with 2022 projected annual revenues of about $18.8 billion. That will be driven by mobile AR in the near term, given its scale and large installed base of AR compatible smartphones

So that means the revenue source for consumer AR won’t be hardware and smart glasses but rather software from mobile AR apps and games. And that will evolve from the business model validated by Pokemon Go, including most notably, in-app purchases.

But what everyone’s really waiting for is an AR killer app, which we could see emerge sometime late next year when AR developers truly gain their native footing. And we believe that will be social and/or gaming oriented and rely on the developments of the AR cloud.

As a historical comparison, it took 2-3 years after the first iPhone before we saw killer apps, such as Waze and Uber around the 2010 timeframe. We could see killer apps in that same elapsed time from last year’s ARkit launch, not to mention the same lesson in native thinking and UX.

As for VR, it’s the opposite in that consumer markets will lead its revenue growth versus enterprise. Though it will find a home in enterprise functions like training and data visualization, its revenue potential will be limited because its isolation inhibits many industrial job functions.

Consumer VR on the other hand will accelerate this year due to Oculus Go, which carries the advantage of price, solid specs and a rich content library inherited from GearVR. And with a gift-able price tag of $200, holidays 2018 will be a moment of truth for its role as an accelerant.

That just scratches the surface, but you can see more of the report (and explanation of methodology) here. Stay tuned for more analysis as we unpack the data over the coming weeks and update it twice per year in what will be a moving target and an exciting time for XR.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.