Data Point of the Week is ARtillry’s weekly dive into data from around the XR universe. Spanning usage and market-sizing data, it’s meant to draw insights for XR players, or would-be entrants. To see an indexed archive of data briefs and slide bank, subscribe to ARtillry Pro.

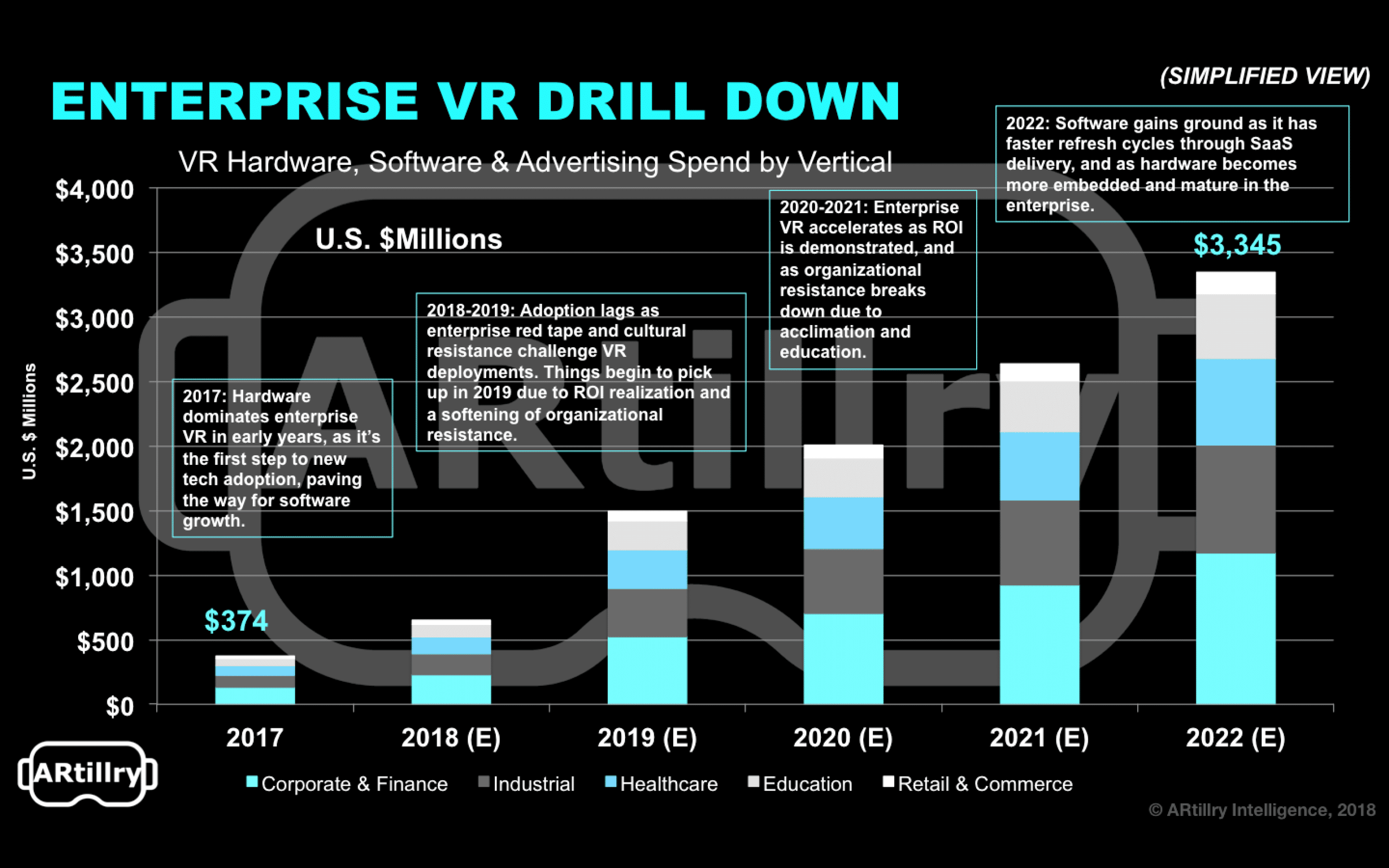

When vetting XR opportunities, it’s always important to do diligence on target markets. And that’s an exercise in prioritizing revenue opportunities and addressable markets in different industry segments — everything from corporate/finance to retail to industrial/manufacturing.

Usually the answer is inherent in a given XR product’s inception and original mission. For example: Non-XR folks within a given industry who step back to launch startups to bring more immersive tech to those markets (these types of XR startups have a knowledge edge).

But in other cases, there are widely applicable or “horizontal” XR technologies like training or visualization. And for them, it’s all about due diligence to determine the probability of success across different verticals, weighing everything from demand levels to spending power.

For example, demand is high and price resistance is low when selling technologies into sales organizations or departments. As a revenue center, they have lots of political capital and budget for things that make them more effective. There’s a similar dynamic in high finance.

“In financial markets people are literally competing based on who has the best information… giving them an edge is an extremely high value proposition,” said Virtual Cove CEO Bob Levy at January’s ARiA conference. “So you can envision a rank-ordered list of segments to go after based on the value of the problem that you’re solving.”

There’s also industry size. The classic example there is Strivr. It started as a VR training tool in sports, spun out of work done at Stanford with its football team. But after discovering that there are only so many football teams, it pivoted to retail and works with companies like Walmart.

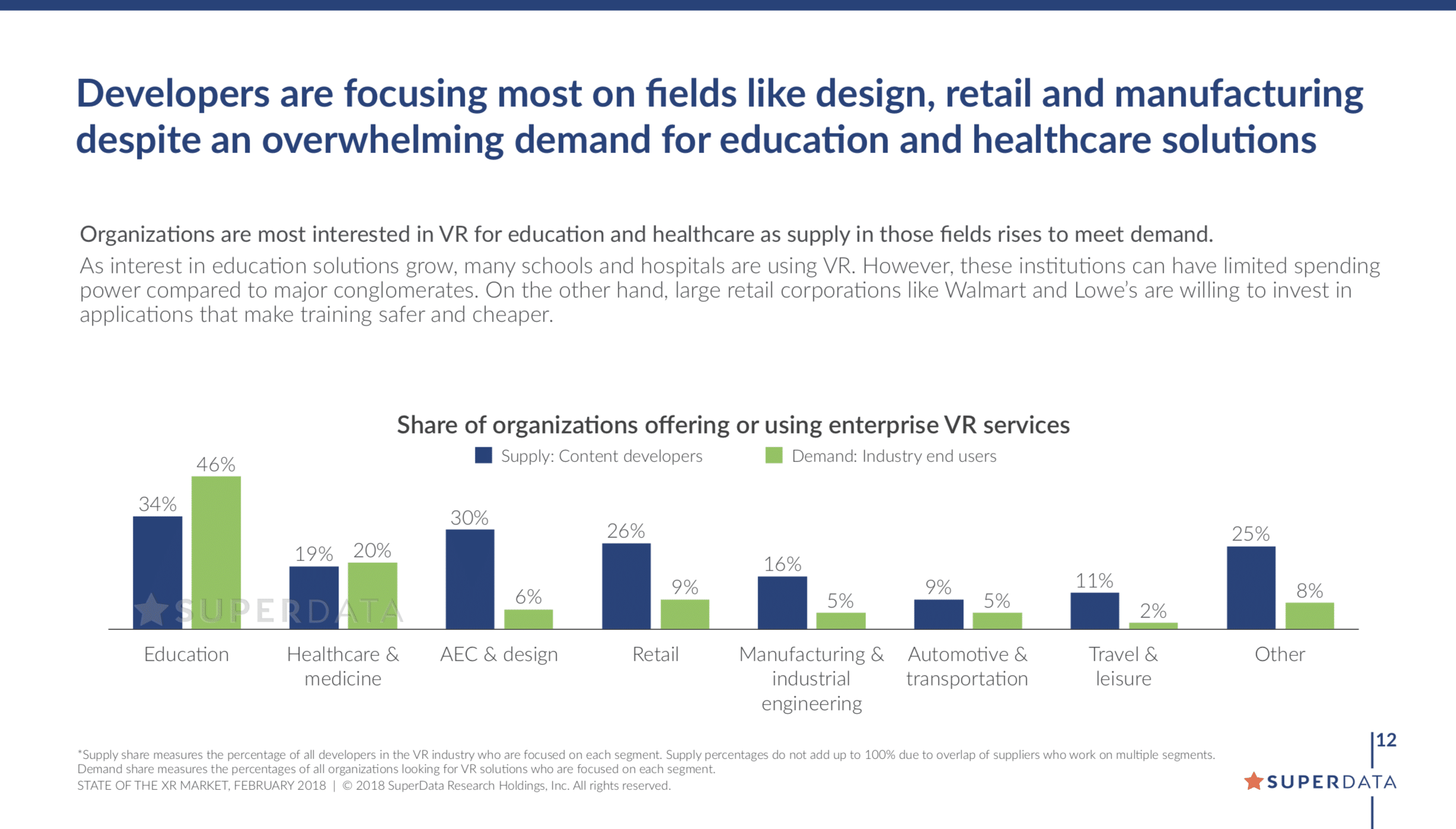

Another important metric was recently uncovered by Superdata: the supply/demand gap. Through its survey data, it uncovered supply and demand levels across VR’s target verticals. The verdict: healthcare has the biggest deficiency in supply, followed by education.

In fact, these are the only two verticals uncovered by this survey to have demand exceed supply (see above). This can be telling for companies looking where to place their chips and fill opportunity gaps. But as stated above, there are other factors to consider.

For example, there could be a supply shortage in these verticals for a reason. There could be challenges that have erstwhile deterred would-be entrants. Those include capital intensiveness, technological complexity, or relatively small addressable markets (think: heart surgeons).

Some challenges we’ve observed in these two verticals specifically include the fact that the barriers to entry are high. In healthcare for example, it’s a highly regulated environment where the potential buyers (doctors and health group administrators) aren’t always “tech-forward.”

In education, the demand is high as we’ve examined, but the opportunity is gated to some degree by spending power, especially in elementary and lower education environments. The story is different in higher education contexts with well-funded research or endowments.

Either way, there are several variables to examine when spotting opportunities in XR target markets. The supply/demand gap is certainly an important one. But also remember classic factors like product/market fit, vertical knowledge, spending power and total addressable market.

We’ll keep uncovering various signals to aid in the various parts of that complex formula.

For deeper XR data and intelligence, join ARtillry PRO and subscribe to the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Lifeliqe