This post is adapted from ARtillry’s latest Intelligence Briefing, The Camera is the New Search Box: Ads in AR. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

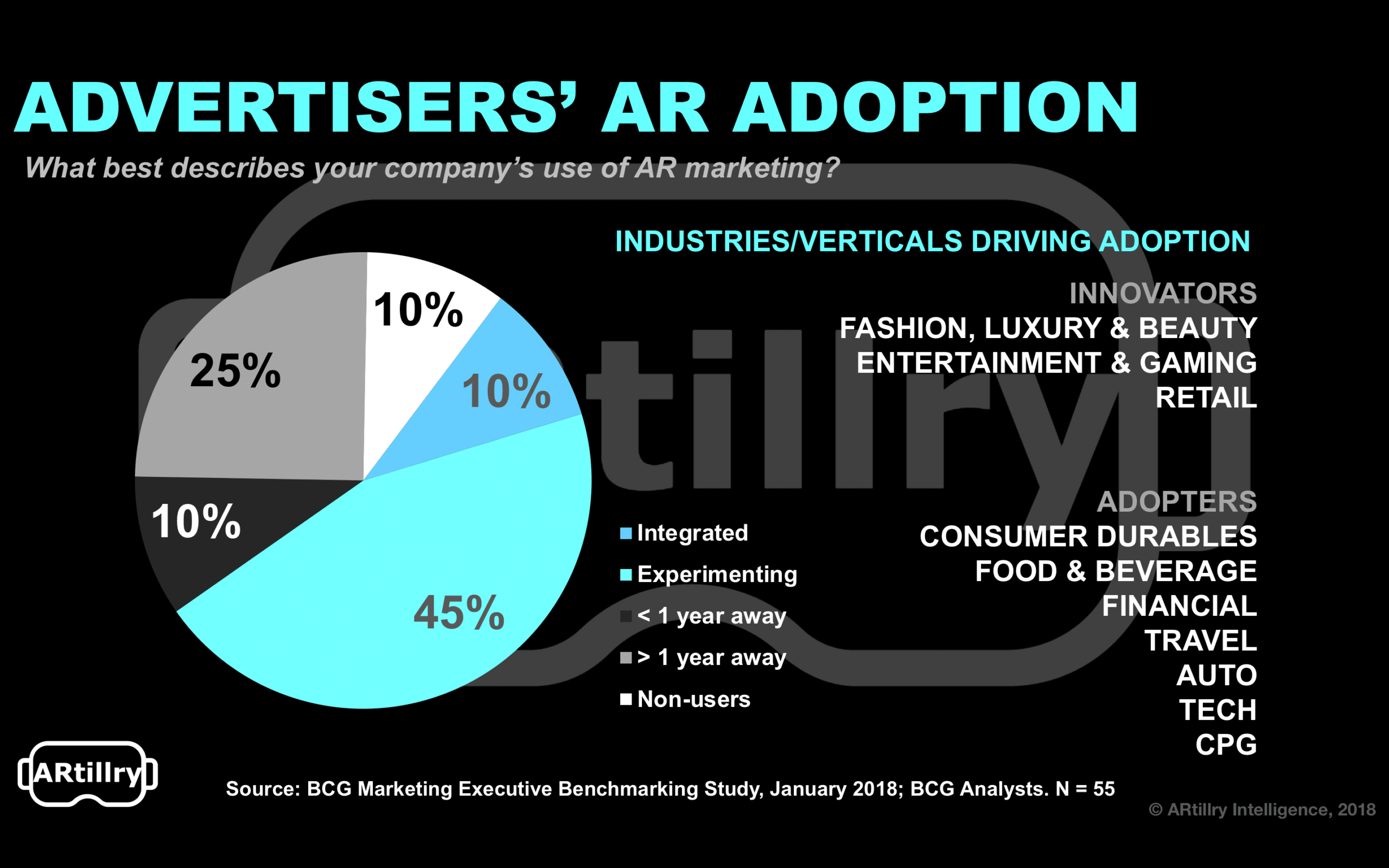

AR advertisers today represent an adoptive minority. How does the rest of the industry look? According to Boston Consulting Group (BCG), ten percent of companies have AR campaigns, 45 percent are interested, and 35 percent foresee campaign launches within two years (see below).

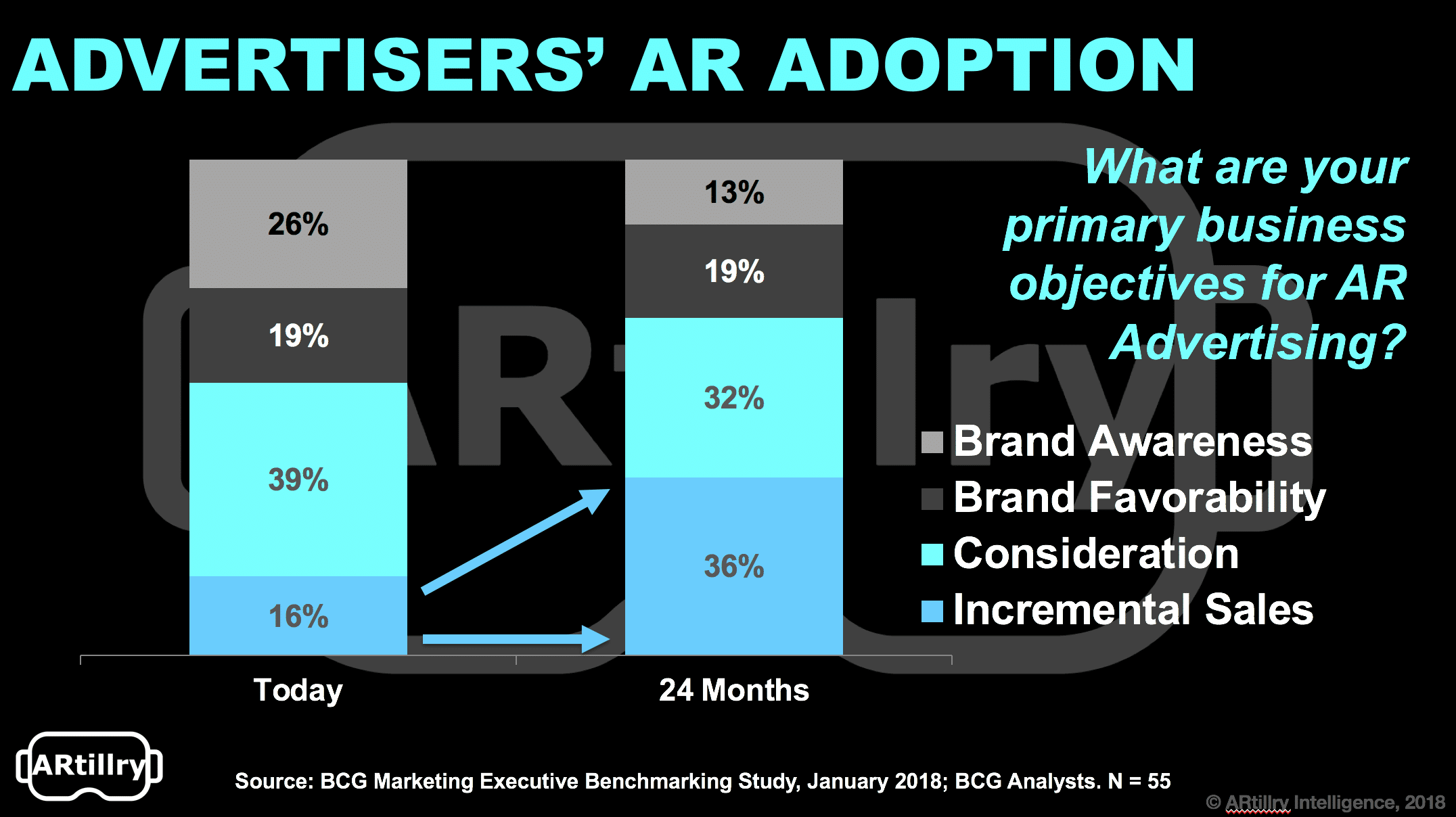

As for the stage in the consumer purchase funnel where AR is making a mark, it’s mostly in “consideration.” This makes sense, as higher-funnel stages like awareness are better served by reach media like TV. But as we’ve examined, AR can achieve full-funnel engagement.

Learning Curve

Advertisers see this potential: when asked where AR will be in two years, BCG’s survey respondents see it moving down the funnel. They also recognize that AR’s melding of the digital and physical makes it fitting to proximity-based engagement like Google Lens or in-store overlays.

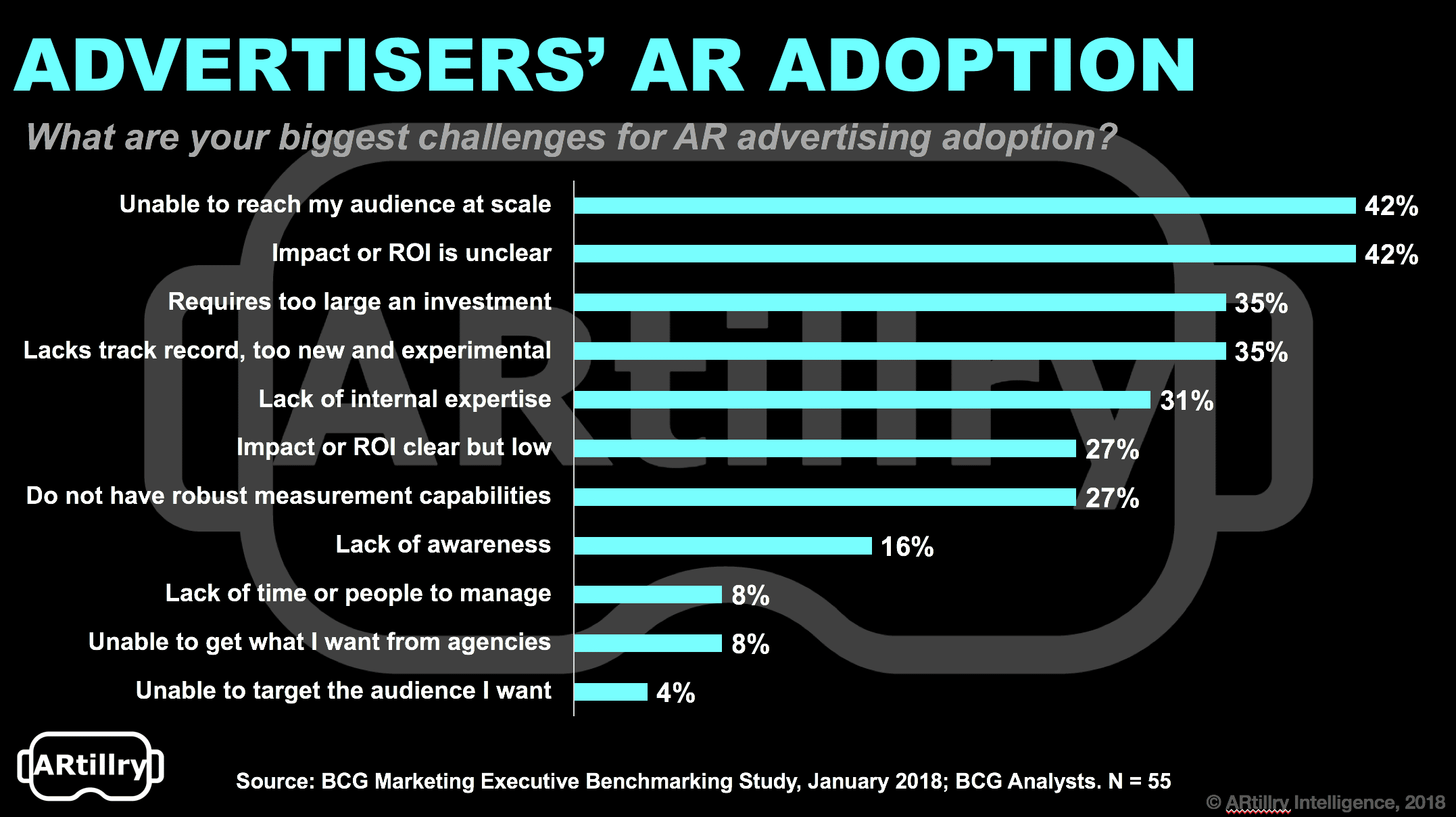

But advertisers’ feelings on the AR advertising opportunity aren’t all positive. They show lots of signs of doubt or uncertainty. Among those uninterested in AR advertising, top reasons for holding back include a lack of scale, internal expertise and unclear ROI (figures below).

This speaks to the need for education because the KPIs for AR’s advertising efficacy are certainly there. Advertisers just have to be made aware en masse, which will take a while if history is any indication. Their acclimation to smartphone advertising is still underway, ten years later.

But it goes beyond awareness and even real interest and adoption. AR ad campaign effectiveness and sustained spending will come down to execution. And that will be an even longer learning curve, which will be all about native ad design and measuring the right things.

In the meantime, there will be misfires as advertisers port legacy media to AR. We saw this in early days of smartphone ads and even today, given that the desktop-inherited banner ad persists in mobile. But AR’s eventual payoff will be big for those who think native or “AR-first.”

“In 2007 when Apple launched the iPhone, most of the apps were flashlights,” said Escher Reality CTO Diana Hu at TechCrunch Disrupt. “People didn’t know what to do yet. And there’s going to be this phase of learning. There’s a genesis of any technology when people need to experiment.”

The Bear Case: Does it Scale?

When it comes to AR’s ad scenarios, there are lots of potential strengths including the high user engagement and performance indicators we examined recently. But though that could be effective on an individual-impression basis, AR advertising could be challenged to scale in the aggregate.

In other words, AR in the next 12-18 months will continue to have a relatively niche status in media and advertising terms. This diminishes reach, which is a primary objective of most brand advertisers and ad agencies. There’s simply not enough scale yet in AR to get them excited.

“Advertising is something we’ve thought of,” Snaappy CEO Gal Shvebish told ARtillry recently. “At the moment, it won’t be interesting enough for brands because there isn’t enough muscle; there isn’t enough of a user base and critical mass. How many people will see their ads?”

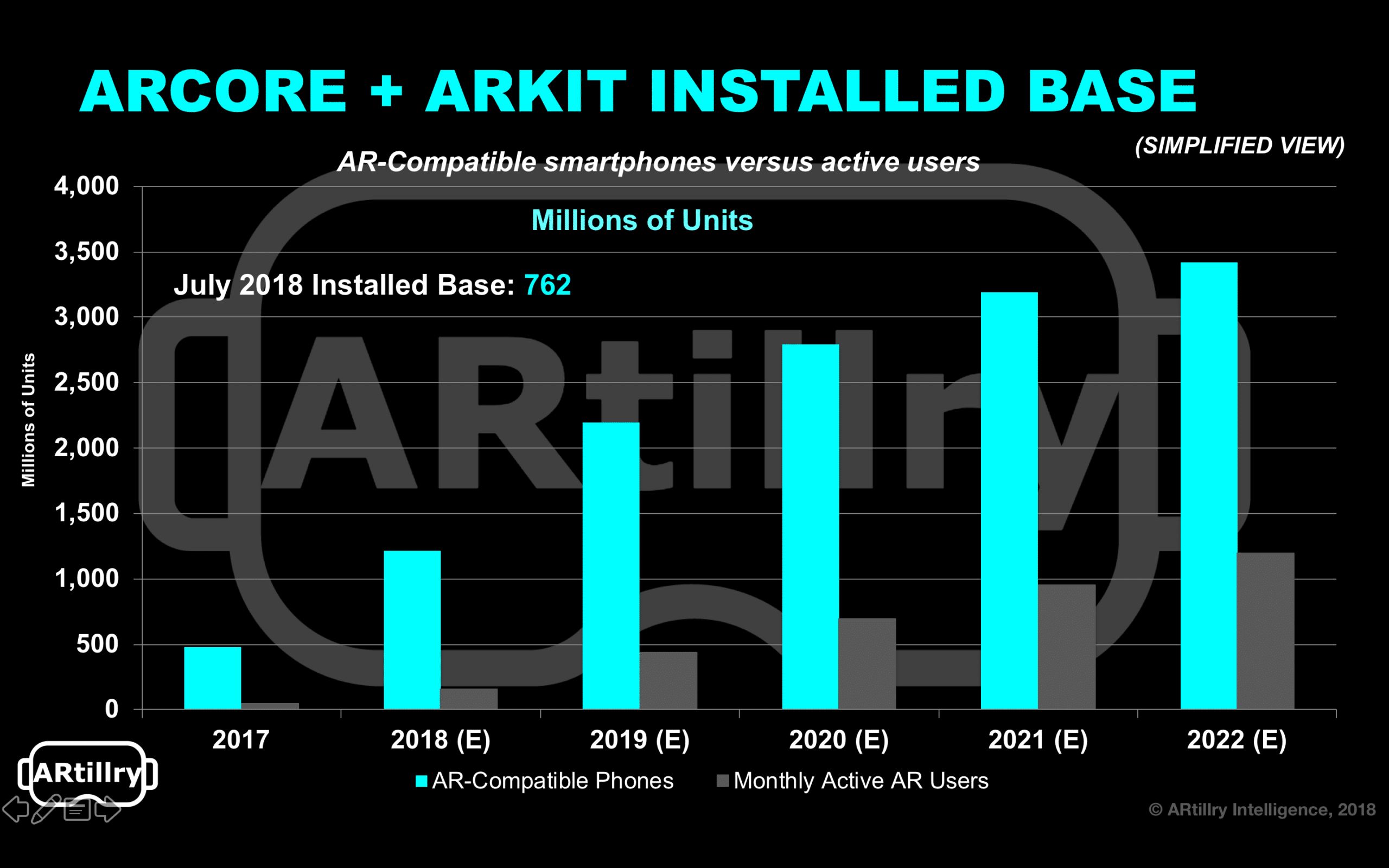

Quantifying that, there are about 2000 ARkit apps within a universe of about 2.2 million iOS apps. And there will be 1.21 billion AR-compatible smartphones by the end of 2018. That’s a strong addressable market, but a more relevant figure is the actual market of 158 million active AR users.

In other words, ad networks, media companies and publishers don’t sell ads based on hardware penetration (e.g. how many people own TVs). Ad sales happen based on specific and validated network or publisher reach (e.g. how many people watch CBS on Tuesday night).

Those 158 million users represent 13 percent of 1.21 billion AR-compatible smartphones. That percentage will grow as the industry evolves. Specifically, we project 1.19 billion mobile AR active users by 2022 which is 36 percent of the 3.4 billion AR compatible smartphones at that time.

Beyond active users, it’s also important to consider metrics for usage. For example AR session lengths are short due to arm strain of holding one’s phone up. Developers are learning and applying this to app design which is a good thing: but a by-product is diminished ad inventory.

Those ad inventory constraints combined with advertisers’ historically-validated pace of new technology adoption (further supported by above survey data) signal us that AR ad revenues will be relatively moderate in the near term. We’ll quantify that in more detail next week…

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.