Data Point of the Week is ARtillry’s weekly dive into data from around the XR universe. Spanning usage and market-sizing data, it’s meant to draw insights for XR players or would-be entrants. To see an indexed archive of data briefs and slide bank, subscribe to ARtillry Pro.

Walmart continues to be the poster child of VR in retail. As examined recently, there are several flavors of XR in retail including AR-assisted shopping (consumer facing), and employee productivity and training (retailer-facing). Walmart is sinking its teeth into both.

But the latest move involves the latter. Walmart has beefed up its arsenal of headsets to 17,000 Oculus Gos, reaching 1 million employees. It will ship four to each Supercenter and two to each Neighborhood Market. It’s not astronomical but is the latest in a steady uptick for enterprise VR.

Training simulations will include operating Walmart’s new pickup towers. These giant kiosks let shoppers order items in advance and pick up in store, usually with the help of a store associate. Since they’re not rolled out yet, advance virtual training helps employees hit the ground running.

This is just the latest in a series of Walmart moves to embrace VR for training. Beyond hardware purchases, it also continues to work with VR training company Strivr. Its software helps Walmart train employees for specific tasks in more immersive ways than dated orientation videos.

As a side note, Strivr is also a bit of a poster child when it comes to successful pivots sometimes seen in early/developing sectors. Incubated in Stanford’s Virtual Human Interaction Lab with Jeremy Bailenson, Strivr focused on VR training in sports, working with Stanford’s football team.

But after discovering that sports are a relatively limited total addressable market (finite number of teams), it has expanded to retail, QSR and other enterprise verticals. This adaptability and foresight is explicitly an attractive quality to investors in early-stage industries like VR.

Back to Walmart, its choice of Oculus Go is interesting. It certainly has a cost advantage, with a total hardware investment of $3.5 million. But will the lack of full positional tracking (6DOF) provide an adequate training experience? Strivr’s 3DOF demos and acclaimed UX suggest it could be.

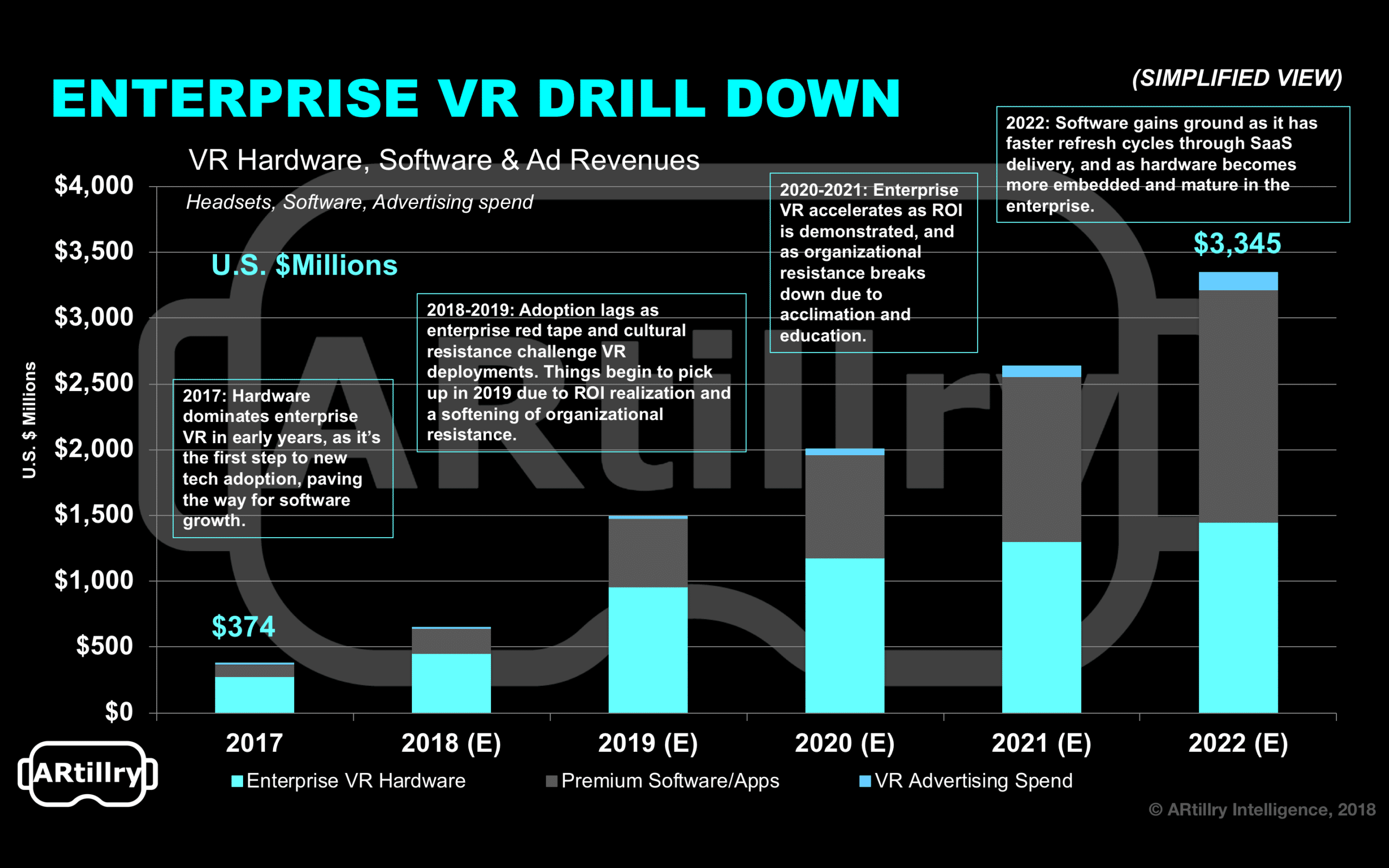

Either way, what’s needed next are proof points from early adopters like Walmart, so that a strong business case can be made by other retailers who aren’t as adaptive, or on the fence. We expect those ROI metrics and case studies will roll out, and we’ll be waiting eagerly to document them.

For deeper XR data and intelligence, join ARtillry PRO and subscribe to the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Walmart