This post is adapted from ARtillery Intelligence’s latest report, Social AR: Spatial Computing’s Network Effect. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

In the short history of AR, social experiences came first… or at least they were the first flavor of AR to go mainstream. Validating widescale appeal, social lenses from Snapchat have been the first AR use case to truly scale (along with Pokémon Go). And they’re fueled by social dynamics.

Before we continue, we must first address a point of contention. Many AR purists argue loudly that Snapchat lenses and Pokémon Go aren’t “true AR.” And technically, they’re right if weighed on the scale of AR’s true potential for dimensional precision (SLAM) and context-aware interactions.

Our take, in general and in this report, is that it doesn’t matter. These early and admittedly primitive forms of AR have done the technology a favor by validating its use cases, test marketing its appeal and warming up the world to its forthcoming “true” arrival. They are AR’s gateway drugs.

“I think one of the craziest debates of the past year was whether Pokémon Go was augmented reality or not,” Intel’s Chris Croteau said from the stage at the AR in Action conference last January. “The [750 million] people that downloaded that app…none of them care.”

Follow the Money

Another thing these gateway drugs have done is begin to validate business models. What AR features do consumers want to use? And what will they pay for? Pokémon Go and Snapchat have already begun to answer these and other strategic questions with large-scale market adoption.

Along with that has come real dollars. Indeed, anyone pointing fingers at Snapchat Lenses or Pokémon Go as being lesser forms of AR should remember they’re the few AR formats to produce any meaningful revenue so far. In emerging sectors like AR, it’s about following the money.

Pokémon Go (not social AR) for example has brought in more than $2 billion in revenue to date. It did this through in-app purchases and brand-collaborations to drive local offline commerce. These are just a few business models that will develop and drive mobile AR revenues.

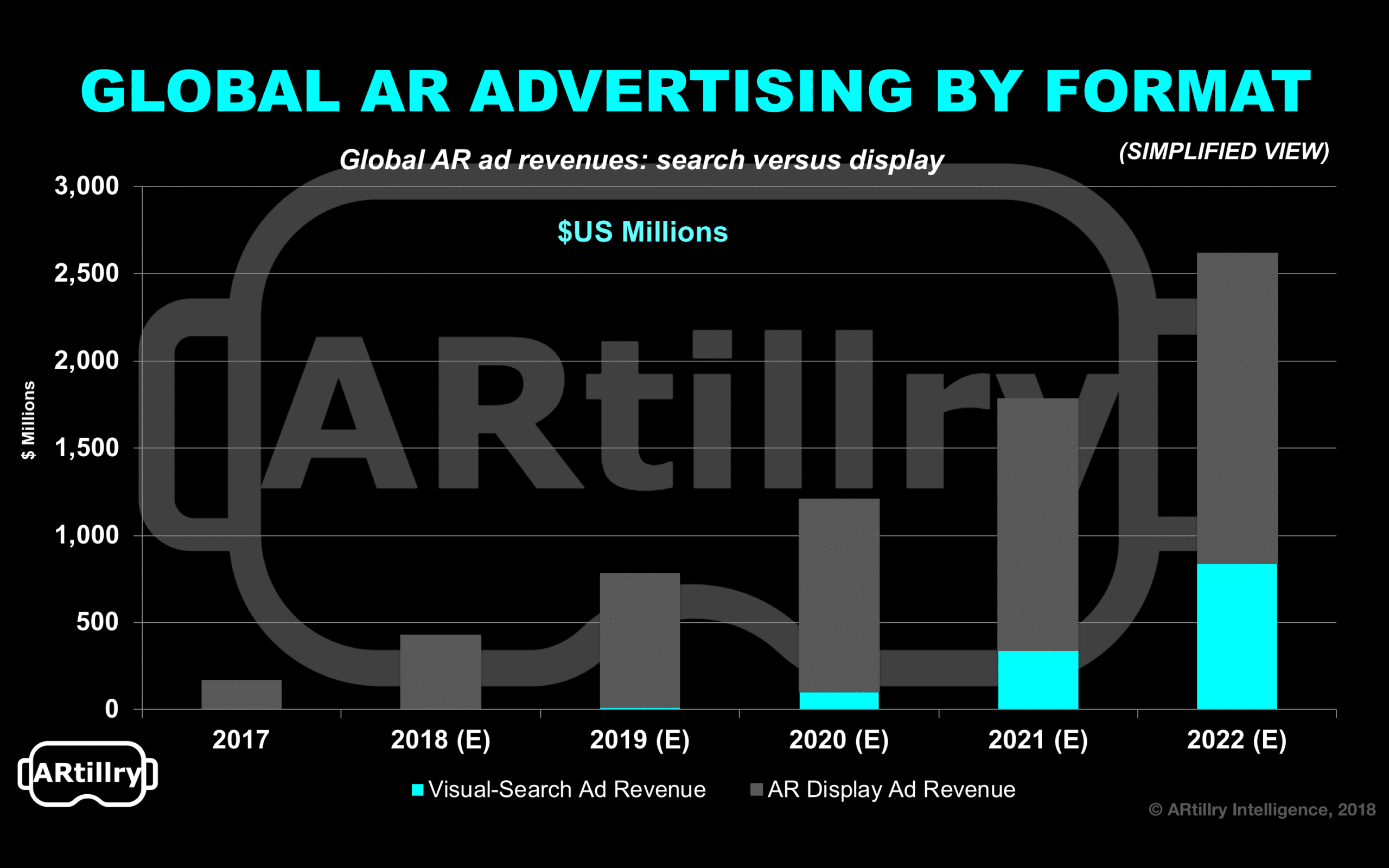

More to the social theme of this report, ARtillery Intelligence has projected $414 million in AR ad revenue in 2018, growing to $2.5 billion by 2022. Almost all of that was from branded AR Lenses. Early leader Snapchat dominates, but Facebook will catch up quickly given its larger global scale.

Proof Points

Beyond the dollars spent to reach AR users in social channels, how is user behavior developing? For this question, we turn to the consumer AR survey* co-produced with our data partner Thrive Analytics. Here, a large sample (n=2,198) is given the chance to report AR usage and sentiments.

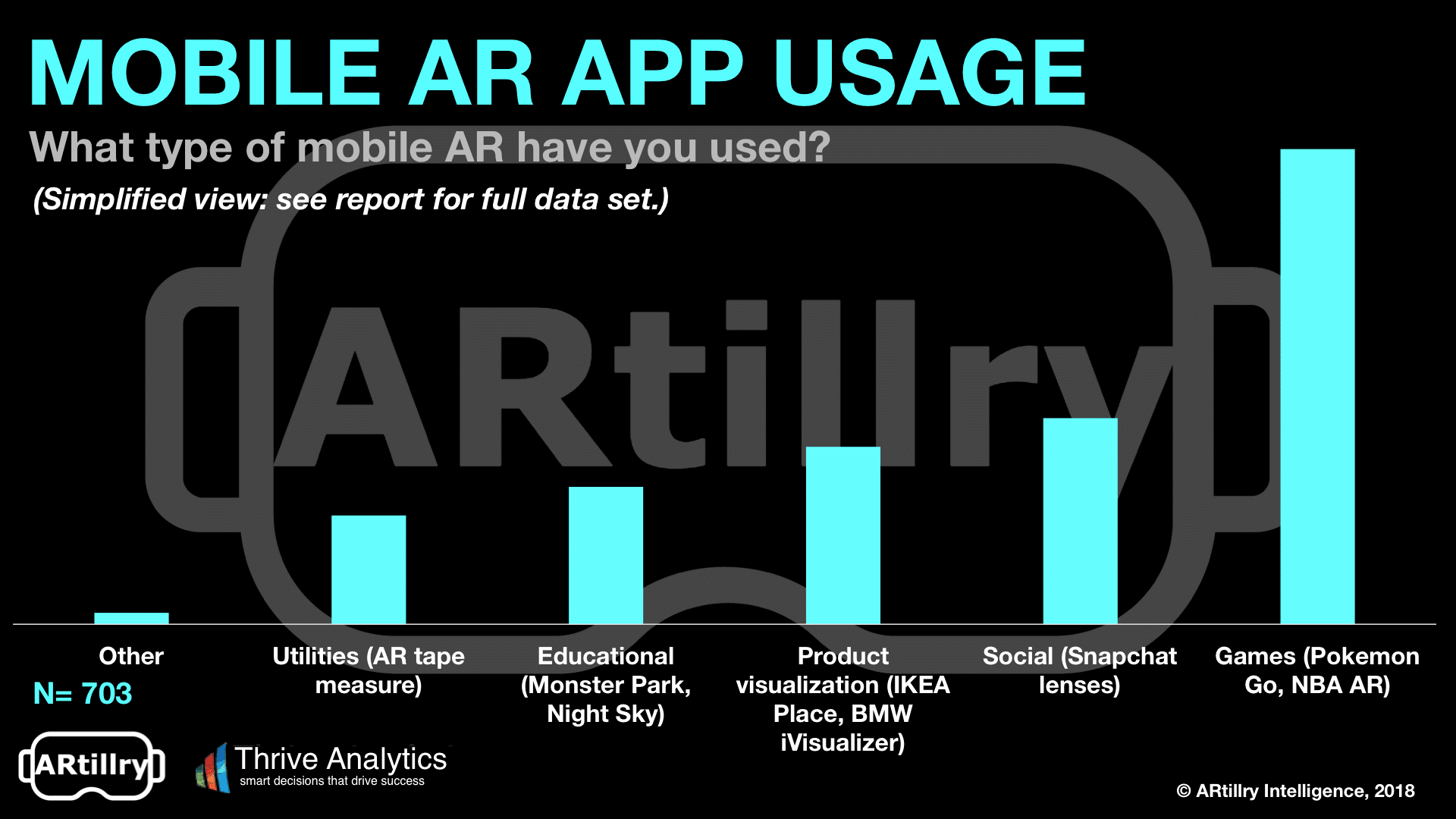

Among mobile users surveyed, 32 percent have used AR. Within that sub-segment, the largest share of users have used games. This is due to the prevalence and popularity of Pokémon Go. Indeed, it represents most people’s introduction to AR – the reason we call it AR’s “gateway drug.”

But second place in AR usage goes to Social apps (or social features within apps). This is due mostly to Snapchat lenses, which were named specifically in the survey question. High usage is also validated by Snapchat’s own figures, which report 70 million daily active users for AR Lenses.

Drilling down into frequency, social AR users exhibit promising results. Specifically, among the categories of AR apps in the above survey, we asked respondents how often they use AR. Games scored high in terms of weekly active users (78 percent), as did social apps (45 percent).

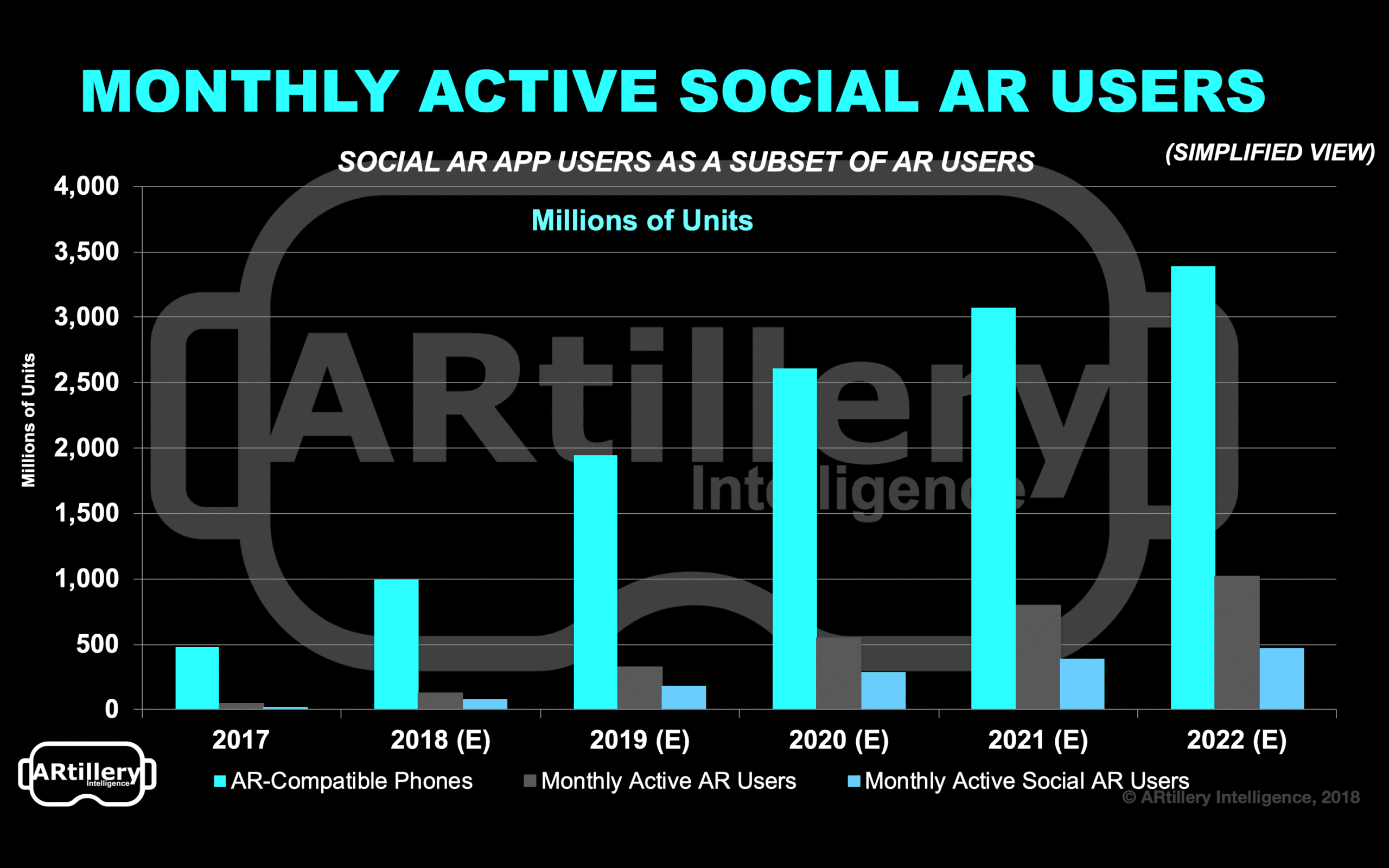

Panning back to the overall market, the above figures have guided our market sizing, which includes total users of social AR (beyond just Snapchat). That number currently stands at 78 million, growing to 468 million by 2022. This will be a key area to watch, tied to AR’s overall health.

See more details about this report or continue reading here. *The included survey data come from Wave I of the survey. Wave II will publish next month.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.