This post is adapted from ARtillery Intelligence’s report, Lessons From AR Revenue Leaders, Part II: Niantic. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

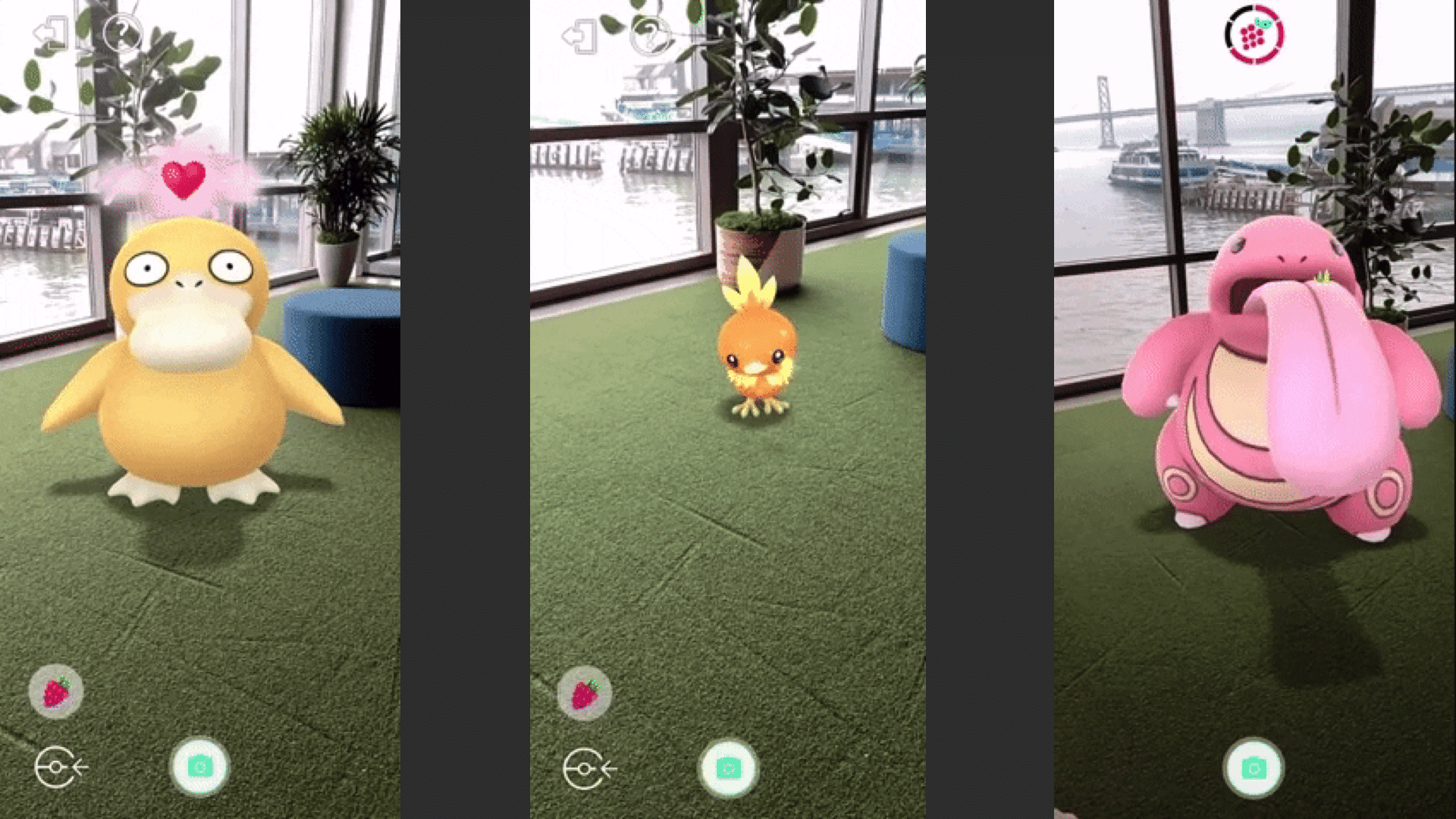

Picking up where we left off in examining Niantic’s business strategy, its biggest move may be yet to come. Though the company has risen to prominence with its breakout hit, Pokemon Go, the larger play may be its location-based AR gaming platform: The Real World Platform.

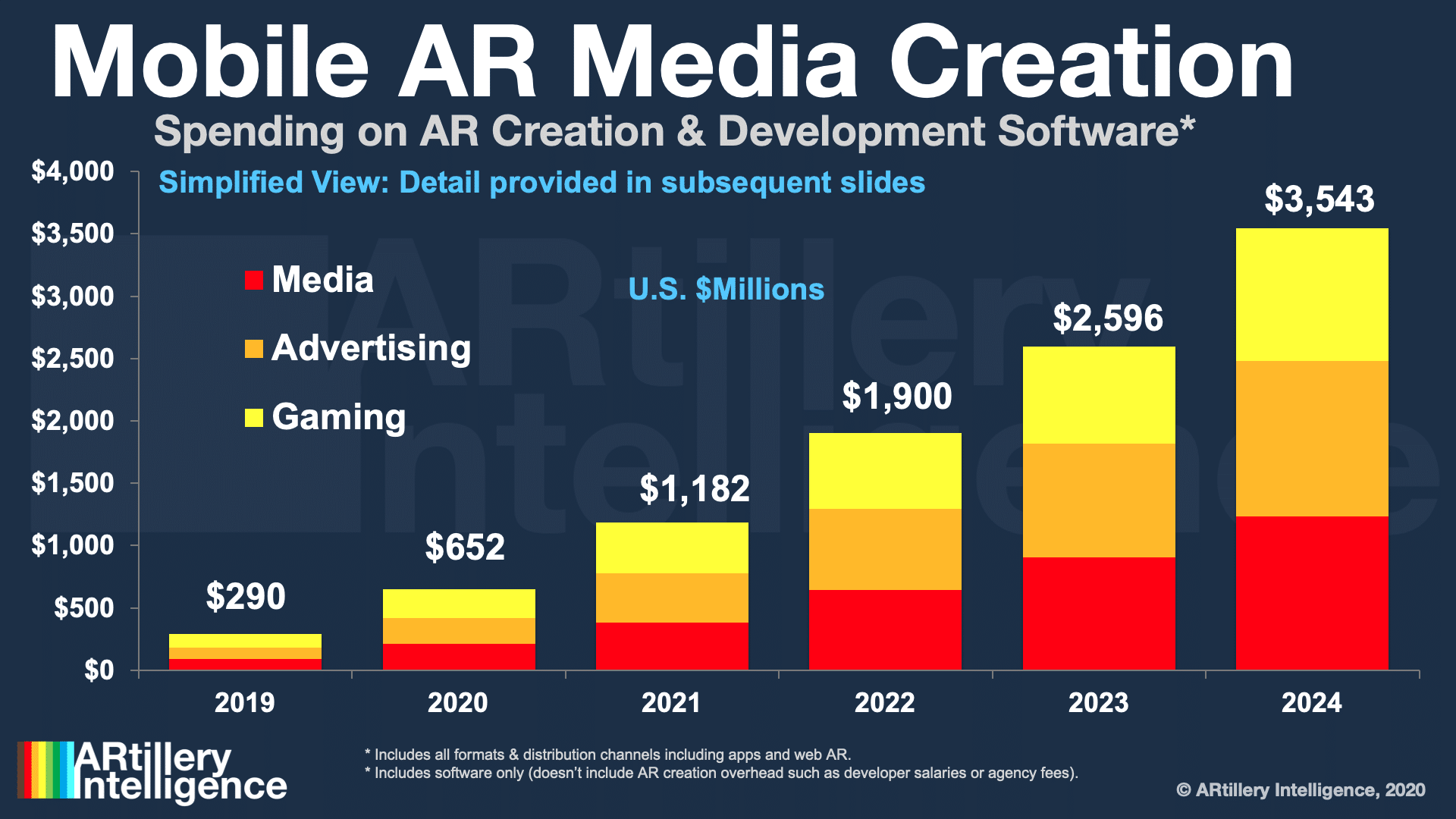

This goes back to the principle of building blocks, examined in a recent ARtillery Intelligence report and in its 2020 spatial computing predictions. These include tools that work towards democratizing advanced AR capability for developers. Examples include Unity, Adobe Aero and 8th Wall.

Niantic is the latest company to go down this road, but in a slightly different way. The Pokémon Go creator has turned its AR architecture into a platform on which others can build apps and games. This represents a possibly-opportune model we’re calling “AR as a Service.”

“Our mission is about getting people outside and exploring the world,” said Niantic CTO Phil Keslin at AWE. “To achieve this requires the creation of a plethora of experiences, not just our own. And that requires many contributors which means a platform is needed to make it a reality.”

Scalable Revenue Stream

Going deeper, Real World Platform productizes the underlying software for Niantic’s popular AR games. This not only achieves democratization but does so in a way that’s analogous to one of the biggest democratization tools the tech world has ever seen: Amazon Web Services (AWS).

In other words, just like AWS, Niantic built its engine primarily to power its own product. But then it realized that it can be its own platform. And like AWS, it could be a highly scalable revenue stream, making it opportunistic for Niantic and a valuable utility for the industry.

“AWS and [Google Cloud] weren’t built as compute platforms for everybody,” said Keslin at the same AWE presentation. “They were built to support the applications of Amazon and Google. Then they decided ‘we have excess capacity, let’s turn it into something that our users can use’.”

This could be a valuable toolset given that it will enable app developers to build experiences on top of the infrastructure that Niantic spent years building the hard way. That includes things like scaling up to surges in user behavior and creating compelling game mechanics.

Mapping the Future

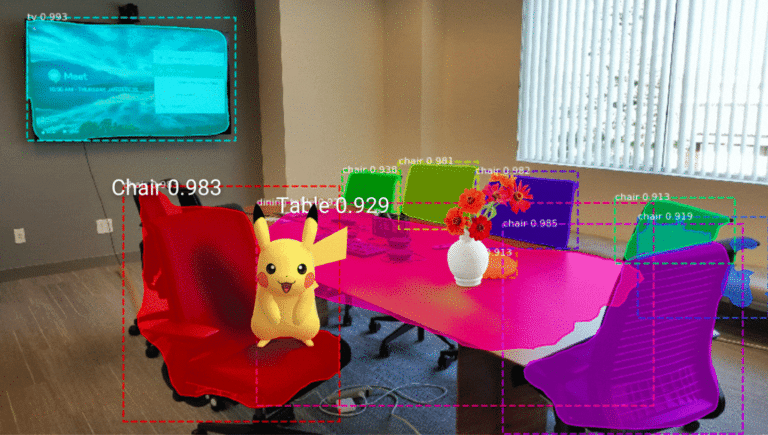

This all sounds great, but the real proof will be in the platform’s execution and functionality. This includes the platform’s capabilities, elevated by acquisitions such as Escher Reality (multi-player & social AR) and Matrix Mill (occlusion and computer vision) and 6d.ai (AR Cloud scene mapping).

Mapping is one area where Niantic has developed aptitude. That’s obviously core to location-based apps. Based on its ongoing IP development and acquisitions, plus crowdsourced world-mapping from Pokémon Go players, Niantic gains even firmer grasp of a proprietary AR Cloud.

“Pokémon are spawned because we know generally what’s at a particular location,” said Keslin. “There’s a map that describes that for us. That’s just one instance of the maps that you have to use to create these types of apps. It’s an understanding of the world around you.”

So there are many moving parts — network capacity, mapping and game mechanics. Now that Niantic has gotten proficient in these areas, it’s logical to productize the whole thing as a platform. That way, developers can run with it and build apps that take AR to the next level.

Planet-Scale AR

Altogether, this will contribute to Niantic’s vision for “Planet Scale AR.” The idea is to have robust computer vision and machine learning to contextualize real-world items. Then, scene mapping from Matrix Mill and social capabilities from Escher Reality can infuse more UX magic.

Moreover, Niantic’s 6d.ai acquisition infuses more AR cloud-building competency. Both companies were already aligned in the “crowdsourced” approach mentioned above, and 6d.ai’s underlying technology should help Niantic embolden its location-relevant data layer.

Niantic is in a strong position with momentum, brand equity and cash. It’s now using that to double down on IP and positioning as an AR tech leader. The platform approach also lets it diversify – adding Saas or platform-based revenue streams to ads and in-app purchases.

We’ll pause there and circle back in the next installment to continue the discussion of how Niantic holds AR product and business lessons. Meanwhile, check out the full report here.