One striking realization about spatial computing is that we’re almost seven years into the sector’s current stage. This traces back to Facebook’s Oculus acquisition in early 2014 that kicked off the current wave of excitement….including lots of ups and downs in the intervening years.

That excitement culminated in 2016 after the Oculus acquisition had time to set off a chain reaction of startup activity, tech-giant investment, and VC inflows for the “next computing platform.” But when technical and practical realities caught up with spatial computing….it began to retract.

Like past tech revolutions – most memorably, the dot com boom/bust – spatial computing has followed a common pattern. Irrational exuberance is followed by retraction, market correction, and scorched earth. But then a reborn industry sprouts from those ashes and grows at a realistic pace.

That’s where we now sit in spatial computing’s lifecycle. It’s not the revolutionary platform shift touted circa-2016. And it’s not a silver bullet for everything we do in life and work as once hyped. But it will be transformative in narrower ways, and within a targeted set of use cases and verticals.

This is the topic of ARtillery’s recent report, Spatial Computing: 2020 Lessons, 2021 Outlook. Key questions include, what did we learn in the past year? What are projections for the coming year? And where does spatial computing — and its many subsegments — sit in its lifecycle?

Bright Spot

Picking up where we left off in the last installment in this series, one of AR’s bright spots is social lens engagement and monetization. In fact, one of the most popular forms of consumer AR so far has been lenses, distributed through social channels like Snapchat and Facebook.

These lenses have lent themselves to brand sponsorship and paid distribution – a business model propelled by a few factors. Not only is advertising the primary business model of the aforementioned social players, but lenses themselves are conducive to branded experiences.

For example, branded AR lenses in channels like Facebook and Snapchat let consumers visualize products on “spaces & faces” through the smartphone camera. This involves paid distribution, which is similar to, but different than, brands’ self-distributed AR efforts, such as their own apps.

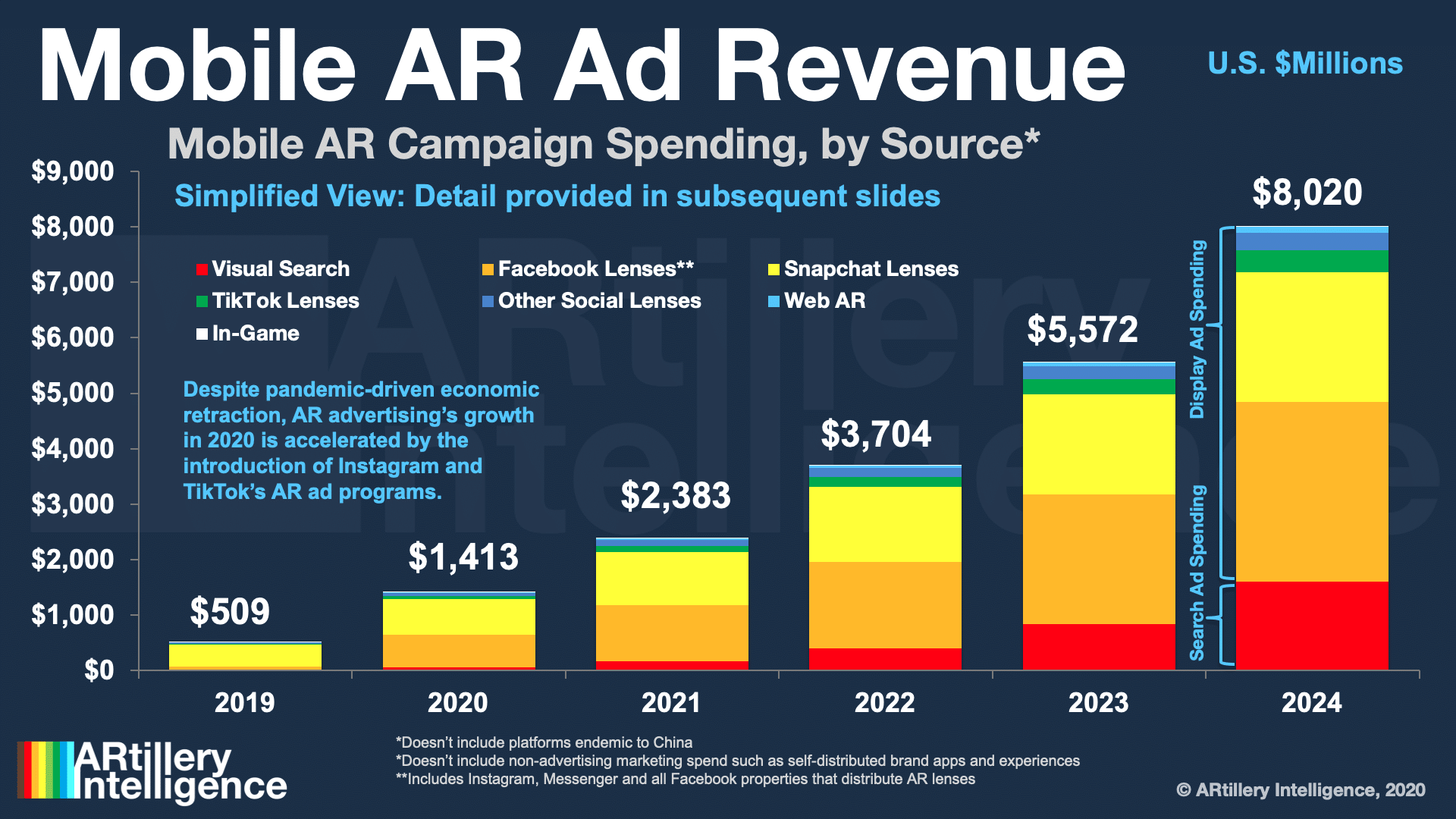

This branded/paid lens channel represents one of the leading AR sub-sectors today, with campaign spending estimated to reach $1.4 billion in 2020 according to ARtillery Intelligence’s Global Mobile AR forecast. This total is projected to grow to just over $8 billion by 2024.

This ad spend is part of a broader area we call “camera marketing,” which includes the entire value chain of AR-based brand promotion. Beyond the above revenue (paid distribution), there’s also an ecosystem forming around creative production, 3D models, and other key elements.

Creative Muscles

So what’s driving the above advertising revenue? First, users are demonstrating high engagement with AR lenses as a way to enhance already-popular activities including media-sharing and enhanced selfies. Second, advertisers are attracted to those eyeballs.

More specific to AR’s advantages, advertisers are drawn to its ability to let them flex creative muscles and transcend 2D media where they’ve been confined for years. There’s also a strong business case shown in campaign performance that continues to validate AR advertising’s ROI.

Lastly, AR offers versatility. It can achieve upper-funnel engagement to reach Superbowl-sized audiences in places like Facebook’s News Feed. And it can drive lower-funnel conversions through immersive product try-ons. Few ad media can claim this full-funnel capability.

As for who’s doing what to tap into that advertiser demand, Snapchat is in the lead, due mostly to its focus on AR, and the medium’s alignment with its “camera-company” mission. Facebook also looms large with greater global scale in its flagship app and News Feed distribution.

Facebook has also begun to distribute AR through other properties like Messenger and Portal. But the real opportunity is Instagram, where AR aligns with its camera-forward audience and business model. Instagram has already cultivated a product-discovery use case that’s fertile ground for AR.

Meanwhile, wild cards include TikTok which has ample — though uncertain — AR potential. There’s also visual search, which carries the high user intent that made web search such a strong business. Other developing channels including web AR, which has the most potential reach.

Rethink and Redeploy

The elephant in the room in all of the above is a global pandemic. As is the case across the global economy, mobile AR sectors will be impacted unevenly by ongoing global lockdowns. Given that software mostly fares well in shelter-in-place life, the impact on mobile AR will be mostly positive.

For example, quarantine-friendly consumer AR fare like social lenses are trending up, and social distancing compels enterprise remote-AR support. These factors will boost near-term adoption while exposing the technology… which in-turn supports its longer-term sustained adoption.

But when it comes to advertising, one thing counteracting the above factors is the fact that it’s a famously recession-prone spending category. In the end, AR ad revenues will grow in 2020, but estimates have been adjusted down to a slower rate than was projected pre-pandemic.

Longer-term, mobile AR advertising could ultimately benefit as recessions cause advertisers to rethink and redeploy budget to more effective and cost-efficient formats. In fact, this is what happened to search circa-2003 and social advertising circa-2009. Snap is already seeing this.

AR could benefit from a similar shakeup by grabbing ad spend. Moreover, brands that try it may discover its virtues and add it as a permanent part of their marketing mix. This cycle is how emerging ad tech can inflect, and we expect to see similar with AR in the post-Covid era.