One striking realization about spatial computing is that we’re almost seven years into the sector’s current stage. This traces back to Facebook’s Oculus acquisition in early 2014 that kicked off the current wave of excitement….including lots of ups and downs in the intervening years.

That excitement culminated in 2016 after the Oculus acquisition had time to set off a chain reaction of startup activity, tech-giant investment, and VC inflows for the “next computing platform.” But when technical and practical realities caught up with spatial computing….it began to retract.

Like past tech revolutions – most memorably, the dot com boom/bust – spatial computing has followed a common pattern. Irrational exuberance is followed by retraction, market correction, and scorched earth. But then a reborn industry sprouts from those ashes and grows at a realistic pace.

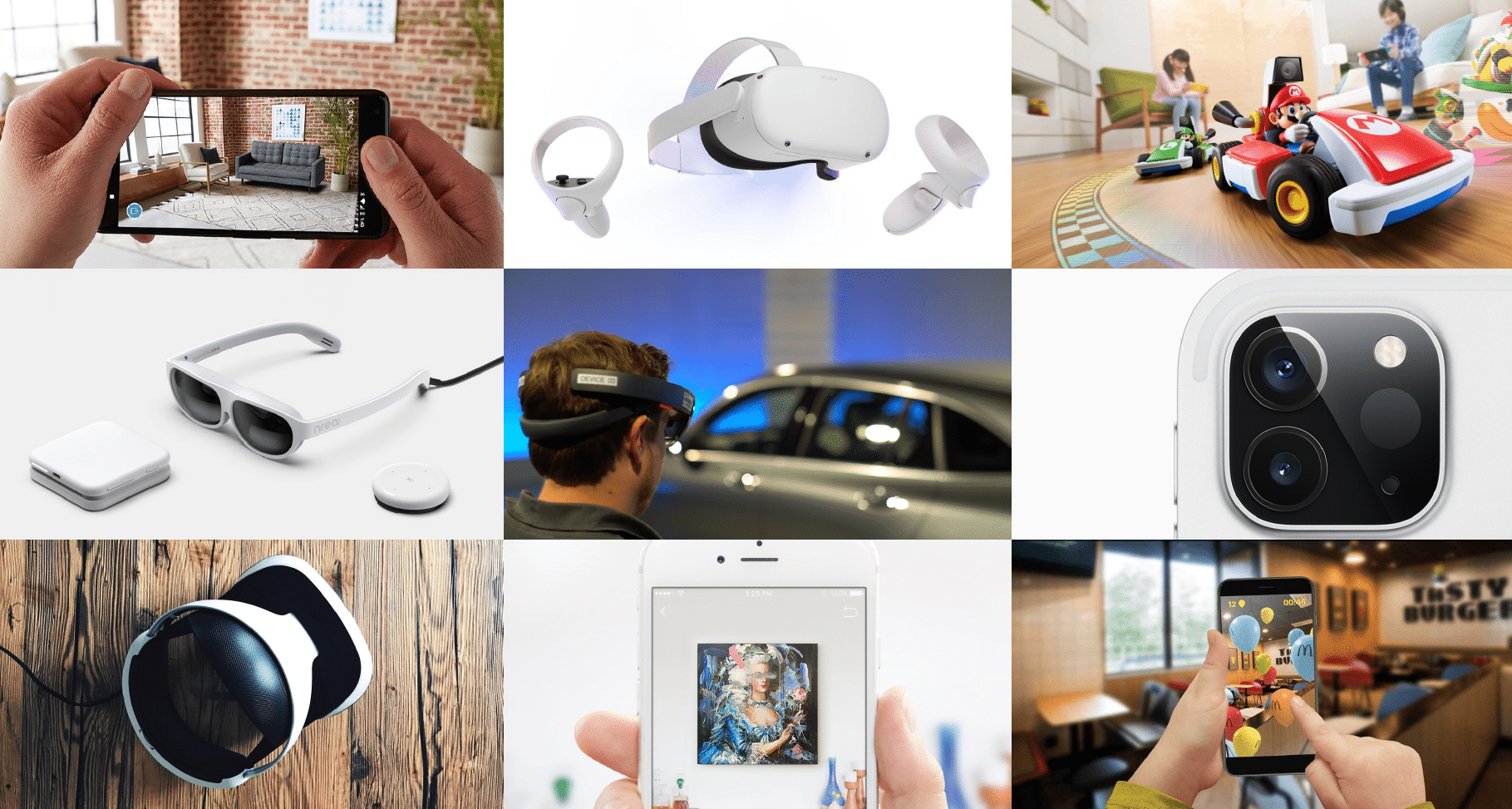

That’s where we now sit in spatial computing’s lifecycle. It’s not the revolutionary platform shift touted circa-2016. And it’s not a silver bullet for everything we do in life and work as once hyped. But it will be transformative in narrower ways, and within a targeted set of use cases and verticals.

This is the topic of ARtillery’s recent report, Spatial Computing: 2020 Lessons, 2021 Outlook. Key questions include, what did we learn in the past year? What are projections for the coming year? And where does spatial computing — and its many subsegments — sit in its lifecycle?

Pokémon Go-ing Strong

Picking up where we left off in the last installment in this series, another high-performing mobile AR category is location-based gaming. But rather than attribute the category in general, credit is more-accurately owed to its market-share leader, Pokémon Go. That’s right….it’s still going strong.

Though generalist tech press have moved on to other shiny objects, Pokémon Go is at the height of its popularity and continues to break new records. The latest figures from Sensor Tower estimated that the game passed $1 billion in 2020 year-to-date revenue in November.

This makes 2020 Pokémon Go’s biggest year on record… and it only measured to November 1st. It also put the game on a $1.2 billion annual run, which would be 33 percent year-over-year growth. This is notable considering an accelerated pace from its prior growth rate.

That trend line can be seen in the chart below. To be clear, this isn’t first-party Niantic data, but Sensor Tower’s extrapolations (and ARtillery’s run-rate calculation). Pokémon Go’s lifetime revenue is also notable, which Sensor Tower pegged at $4.2 billion as of November.

Lessons & Learnings

One of the remarkable things about Pokémon Go’s growth and sustained play over four years, is that the aforementioned record-setting period in 2020 coincided with a pandemic. Indeed, global lockdowns and shelter-in-place orientation don’t inherently align with the game’s migratory play.

Here we’ll credit Niantic’s ingenuity to pivot quickly and adjust game mechanics to accommodate stationary at-home play – easier said than done from a UX perspective. The result: instead of usage declines, it was able to ride the wave of gaming’s broader Covid-era inflections.

This fits the profile for Niantic and its ability to achieve $4.2 billion in lifetime revenue, as noted. Not only did it defy odds in 2020, but in a broader sense. It’s rare for mobile games to sustain active play for so long, due to challenges in maintaining novelty and ongoing challenge.

As examined in a recent ARtillery report, Niantic has accomplished this through timely in-game updates, well-devised game mechanics, and underlying design principles. Those include product philosophies like using AR sparingly as a value-added feature, rather than a primary component.

Business Model Innovation

Beyond product innovation, Niantic’s revenue milestones likewise validate business-model innovation. In-app-purchases (IAP) are a fitting revenue model, given the behavioral economics of microtransactions. Beyond AR, the model drives $70 billion annually in mobile gaming.

Not only is IAP validated in mobile gaming, but it’s fitting to AR’s early stages when users hesitate to pay upfront for apps. IAP is likewise supported by ARtillery’s consumer survey with Thrive Analytics. 30 percent of prospective AR users report willingness to pay via IAP.

ARtillery also projects mobile AR aggregate in-app-purchases at $1.4 billion in 2020. This aligns with Niantic’s previously cited $1.2 billion run rate, given that it’s the sector’s dominant revenue leader. If those projections sustain, aggregate in-app-purchases could approach $2 billion in 2021.

Stepping back, this is worth watching as Niantic does the AR industry a favor through large-scale deployment. That can shine a light on market dynamics and demand signals, which in turn amount to valuable intelligence in early and undefined stages of any consumer technology.