One striking realization about spatial computing is that we’re almost seven years into the sector’s current stage. This traces back to Facebook’s Oculus acquisition in early 2014 that kicked off the current wave of excitement….including lots of ups and downs in the intervening years.

That excitement culminated in 2016 after the Oculus acquisition had time to set off a chain reaction of startup activity, tech-giant investment, and VC inflows for the “next computing platform.” But when technical and practical realities caught up with spatial computing….it began to retract.

Like past tech revolutions – most memorably, the dot com boom/bust – spatial computing has followed a common pattern. Irrational exuberance is followed by retraction, market correction, and scorched earth. But then a reborn industry sprouts from those ashes and grows at a realistic pace.

That’s where we now sit in spatial computing’s lifecycle. It’s not the revolutionary platform shift touted circa-2016. And it’s not a silver bullet for everything we do in life and work as once hyped. But it will be transformative in narrower ways, and within a targeted set of use cases and verticals.

This is the topic of ARtillery’s recent report, Spatial Computing: 2020 Lessons, 2021 Outlook. Key questions include, what did we learn in the past year? What are projections for the coming year? And where does spatial computing — and its many subsegments — sit in its lifecycle?

Endgame

Picking up where we left off in the last installment in this series, AR’s fully actualized form hasn’t arrived yet. We’re talking of course about AR glasses. This is the AR modality that will unlock the technology’s true potential. While mobile AR has achieved scale, it’s not AR’s endgame.

AR glasses have arrived if we consider enterprise deployments. There, AR glasses’ stylistic drawbacks aren’t as much of an issue as they are in consumer markets. Though there are form-factor issues such as comfort and heat, the enterprise has the early lead in AR spending.

Notably, those spending shares could flip as AR glasses get sleeker and more commercially viable. Consumer markets are generally bigger than enterprise markets due to population sizes, but enterprise spending often leads in early days of emerging technologies.

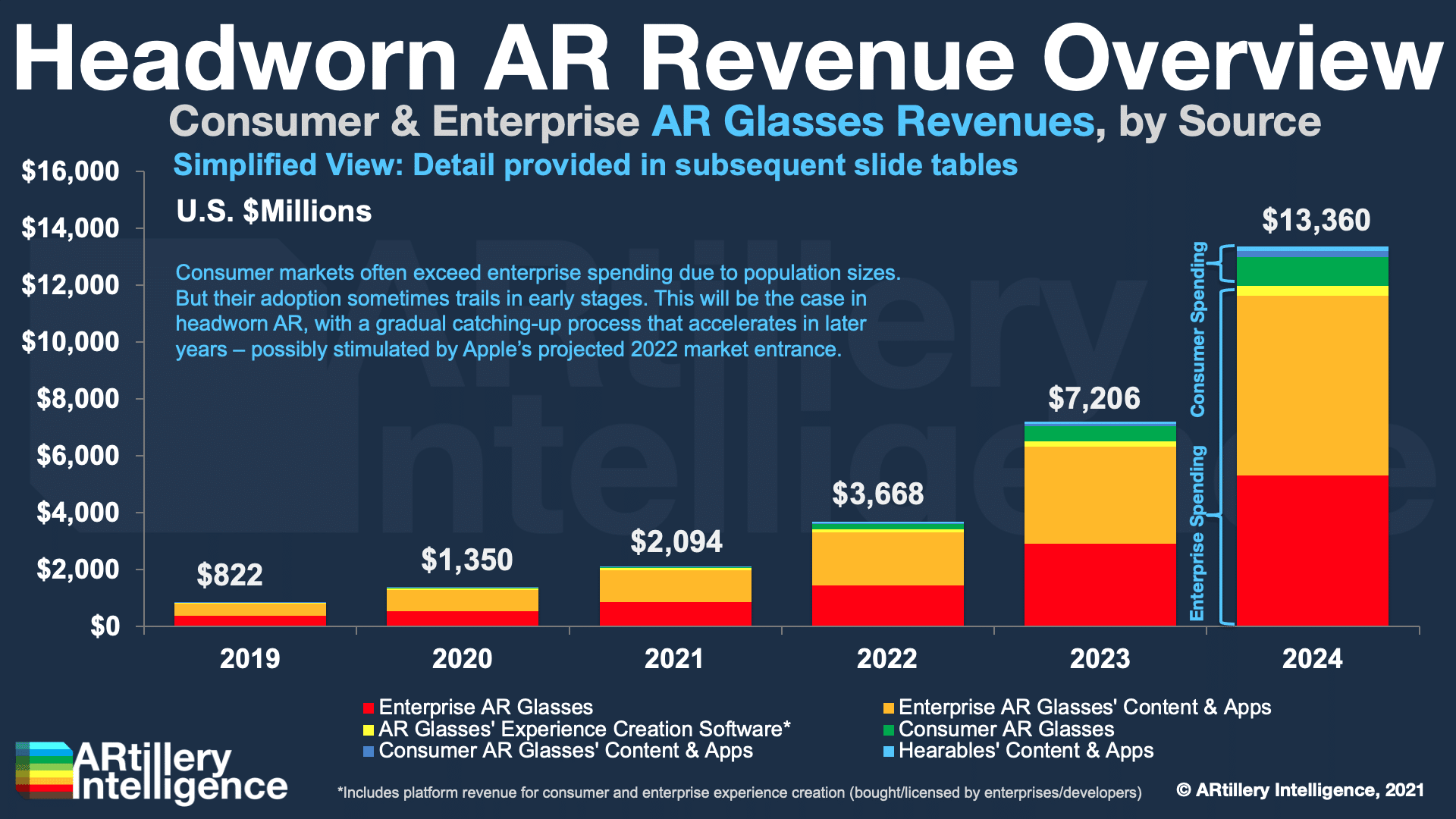

To quantify that, ARtillery Intelligence projects AR glasses spending to grow from $822 million last year to $13.4 billion in 2024. Enterprise spending is 98 percent of that total today but will retract to 90 percent by 2024 and continue to decline until consumer/enterprise trendlines intersect.

But that could take several years, not just due to requisite technical advancements, but also the cultural acceptance that we examined last week. As seen in the Google Glass era, cultural acceptance and comfort levels for face-worn hardware (with a camera, no less) is an uphill climb.

But history tells us if anyone can accomplish that feat of mainstreaming emerging tech – or at least catalyze the process – it’s probably Apple.

Apple of My Eye

Apple’s track record in mainstreaming emerging tech – also known as its “halo effect” – is the reason why you likely hear so much chatter about its rumored smart-glasses. The stakes are high for the AR industry, as Apple’s eventual moves could accelerate its ability to achieve scale.

But the question is what’s Apple’s strategy and what will its prospective glasses be and do? Starting with the former, Apple’s AR glasses strategy is driven by similar factors as its wearables play: to future proof its core hardware business in the face of a maturing smartphone market.

Apple AR glasses could accomplish this by both propping up and succeeding the aging iPhone. The former happens as it creates reliance on the iPhone for local compute. In other words, the iPhone gains importance – and user incentive to upgrade – if it powers your smart glasses.

The iPhone succession plan is meanwhile accomplished through a suite of wearables that replaces the iThings at the center of our computing lives. That could mean line-of-sight graphics through AR glasses, spatial audio from AirPods PRO, and biometrics from Apple Watch.

This theory fits the profile for Apple’s signature multi-device ecosystem play. Its marketing will emphasize that the whole is greater than the sum of its parts, so you should own several devices (sound familiar?). In this way, AR glasses will be a key puzzle piece in Apple’s future road map.

We’ll pause there and pick things up in the next installment with a deeper examination of what Apple’s AR glasses could be and do. Meanwhile, read the full report here.