A common AR industry sentiment is that the smartphone will pave the way for smart glasses. Before AR glasses achieve consumer-friendly specs and price points, AR’s delivery system is the device we all have in our pockets. There, it can stimulate demand for AR experiences.

This thinking holds up, but a less-discussed product class could have a greater impact in priming consumers for AR glasses: wearables. Among other outcomes, AR glasses’ cultural barriers could be lessened by conditioning consumers to wearing sensors on their bodies.

Meanwhile, tech giants are motivated toward wearables. They’re each building wearables strategies that support or future-proof their core businesses, where tens of billions in annual revenues are at stake. For example, Apple’s wearables offset iPhone sales declines.

But how will wearables continue to penetrate consumer markets and benefit AR glasses? This is the topic of a recent ARtillery Intelligence report, Wearables: Paving the Way for AR Glasses. The device class continues to grow and acclimate the world to AR glasses still to come.

High Stakes

Though not a new tech category, wearables penetration continues to grow. And given that AR’s endpoints are head-worn, the question is if wearables can acclimate consumers to putting sensor-based tech on their bodies. Wearables sales momentum puts larger stakes on the question.

In fact, wearables are one of the fastest-growing consumer tech sectors. Canalys reports that smartwatch unit shipments grew 12 percent year-over-year in Q1 2020 (pre-pandemic). Strategy Analytics reports 20 percent smartwatch growth, reaching 13.7 million units in Q1 2020.

ABI Research has a similar take, reporting that wearables unit shipments were up 5 percent in 2020. This signaled wearables’ resilience, prior to Covid-era declines and supply-chain impediments in several hardware-based businesses. This is already bouncing back.

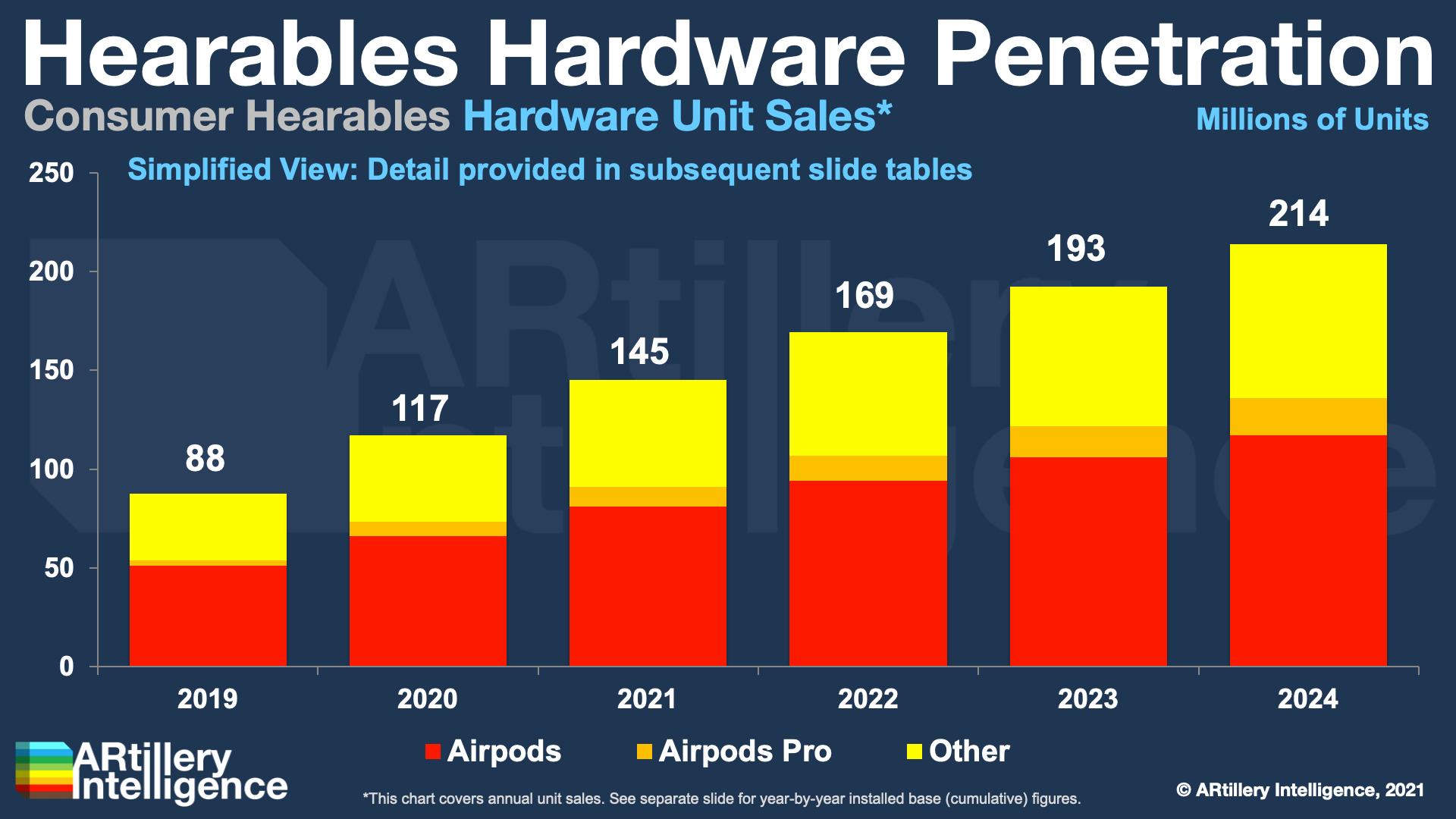

ARtillery Intelligence recently projected in its Headworn AR forecast that hearables annual base will grow from 88 million in 2019 to 214 million in 2024. Hearables include devices such as Apple AirPods that could someday house textured and intelligent “audio AR” content.

Halo Effect

So what’s driving wearables growth? Part of it is the popularity and product/market fit that Apple’s AirPods and Watch have accomplished. This has created a classic Apple “halo effect” on the wearables sector. It has stimulated demand beyond Apple’s own wearables products.

Further propelling growth are tech-giant motivations. That’s especially true for Apple, which continues to double down on Watch and AirPods. As noted, It sees wearables offsetting near-term iPhone revenue deceleration; and future-proofing its hardware-heavy profit machine.

One theory is that Watch and AirPods could eventually converge with glasses in a holistic suite that augments reality from several angles. This could replace (or augment) the current suite of iThings, which notably fits the profile for Apple’s ARPU-driving multi-device ecosystem approach.

Wearables also continue to perform well financially, which emboldens Apple’s motivation to continue investing. Watch and AirPods are rising stars in Cupertino, whose revenue growth comes close to offsetting iPhone revenue declines as the smartphone market continues to mature.

This revenue reconciliation is just one task that wearables have at Apple. The other is to buttress the iPhone succession plan, where Apple has a lot riding. There won’t be a single iPhone replacement but rather an iPhone-dependent wearables suite, including smart glasses.

We’ll pause there and circle back in the next installment to discuss how wearables continue to grow, thereby priming the pump for AR glasses.