Like many analyst firms, market sizing is one of the ongoing practices of AR Insider’s research arm ARtillery Intelligence. A few times per year, it goes into isolation and buries itself deep in financial modeling. One such exercise zeroes in on headworn AR revenues.

This is one of the main subdivisions of spatial computing – others including mobile AR and VR. They’re all related and share technological underpinnings, but are driven by separate market forces such as their respective hardware bases (see methodology and inclusions).

So what did the headworn AR forecast uncover? At a high level, global headworn AR revenue is projected to grow from $1.86 billion in 2023 to $5.34 billion in 2028, a 23.52 percent CAGR. This sum consists of consumer and enterprise spending and their revenue subsegments.

Drilling down, our latest Behind the Numbers installment looks at the high-level drivers and dynamics for the above revenue figures. Who is spending what on headworn AR, considering both consumer and enterprise adoption? And what revenue categories are seeing the most action?

Headworn AR Global Revenue Forecast: 2023-2028

By the Numbers

Starting at the top, AR headsets are projected to grow in unit sales from 455,947 in 2023 to 2.07 million in 2028. That will create an installed base of 5.79 million units by 2028, and is partly driven by a 2024 inflection – the first full year of Vision Pro and Ray-Ban Meta sales.

Enterprise spending leads with 180,010 units in 2023, growing to 419,645 in 2028. Consumer AR glasses will trail enterprise in early years but then pull ahead in later years with 1.65 million units projected in 2028. This makes consumer markets the long-run AR leader.

Why is this? Consumer markets are generally larger than enterprise markets, though they can often trail in early stages. That pattern is pronounced in AR where most hardware isn’t yet stylistically viable for consumer markets, causing them to lag relative to style-agnostic enterprises.

But putting all of the above into perspective, the 5.79 million installed base in 2028 is dwarfed by the global smartphone installed base by almost 641 to 1. So though AR glasses could grow fast and from a small base, they have quite a ways to go to reach any semblance of ubiquity.

Snap Uplevels AR: Hands on With Spectacles Gen 5

Naming Names

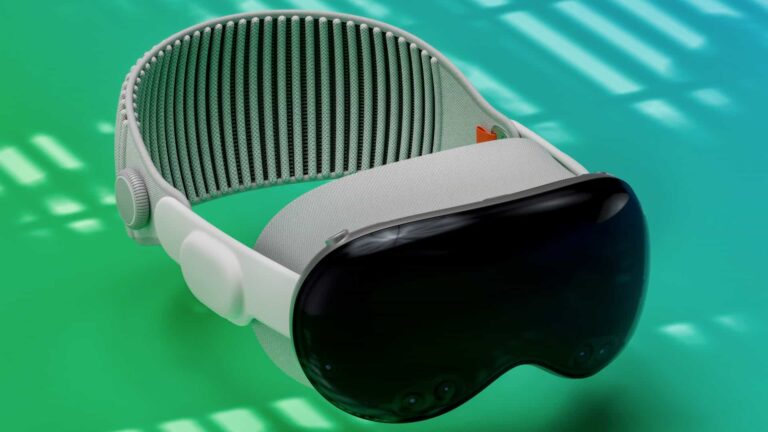

To name names, the AR market will be partly accelerated by Vision Pro’s impact and a classic Apple halo effect. But it will be gradual as Apple is playing a long game. It wanted to demonstrate in v.1 what’s possible at any cost – hence a cost-prohibitive price tag for most consumers.

In other words, it wanted to create a device that everyone covets. And it prefers gripes about the cost rather than quality. Like other Apple products historically, it’s the first step in a master plan that will stretch out for years as the price comes down, quality improves, and Apple does its thing.

Snap Spectacles and Meta Orion also launched in the last month alone to preview AR’s future. Though neither is available to consumers (Orion isn’t available at all), they offer confidence in where we are with headworn AR, and what will be within the realm of near-term possibilities.

Elsewhere in the headworn AR landscape, Microsoft’s U.S. Army contract to supply battle-geared HoloLens units has faced considerable headwinds and congressional budgeting friction. Despite a recent boost from Palmer Luckey’s Anduril, this will continue to be a moving target.

Is the AR Industry Getting More Realistic?

Reality Check

Meanwhile, a new breed of slimmed-down and AI-fueled consumer smart glasses is seeing meaningful traction. These focused approaches eschew the do-everything bulk that only works for enterprises, and include Ray-Ban Meta Smartglasses (audio AR) and Xreal Air 2.

Taking those one at a time, Ray-Ban Meta Smartglasses show that optics – and their many design challenges – aren’t needed for a worthwhile user experience. AI can instead drive value in relevant multimedia delivery. This represents a more focused lite AR approach that resonates.

Similarly, Xreal Air 2 eschews dimensional AR for a simpler and more focused proposition – private viewing environments for large-screen 2D gaming & entertainment. Apple has propelled this use case in its Vision Pro marketing, while our consumer survey data further supports it.

Furthermore, until fully-immersive AR is viable in consumer-friendly form factors, these simpler experiences will gain more traction. This realization has caused a refocusing and reality check for the headworn AR industry to stop trying to necessarily go to market with full-blown (SLAM) AR.