This post is an excerpt from the ARtillry Intelligence Briefing, Smart Money: Insights from AR & VR Investors. It pulls from the section of the report that examines areas where nearer term opportunity and scale exist… namely mobile and enterprise.

Enterprise

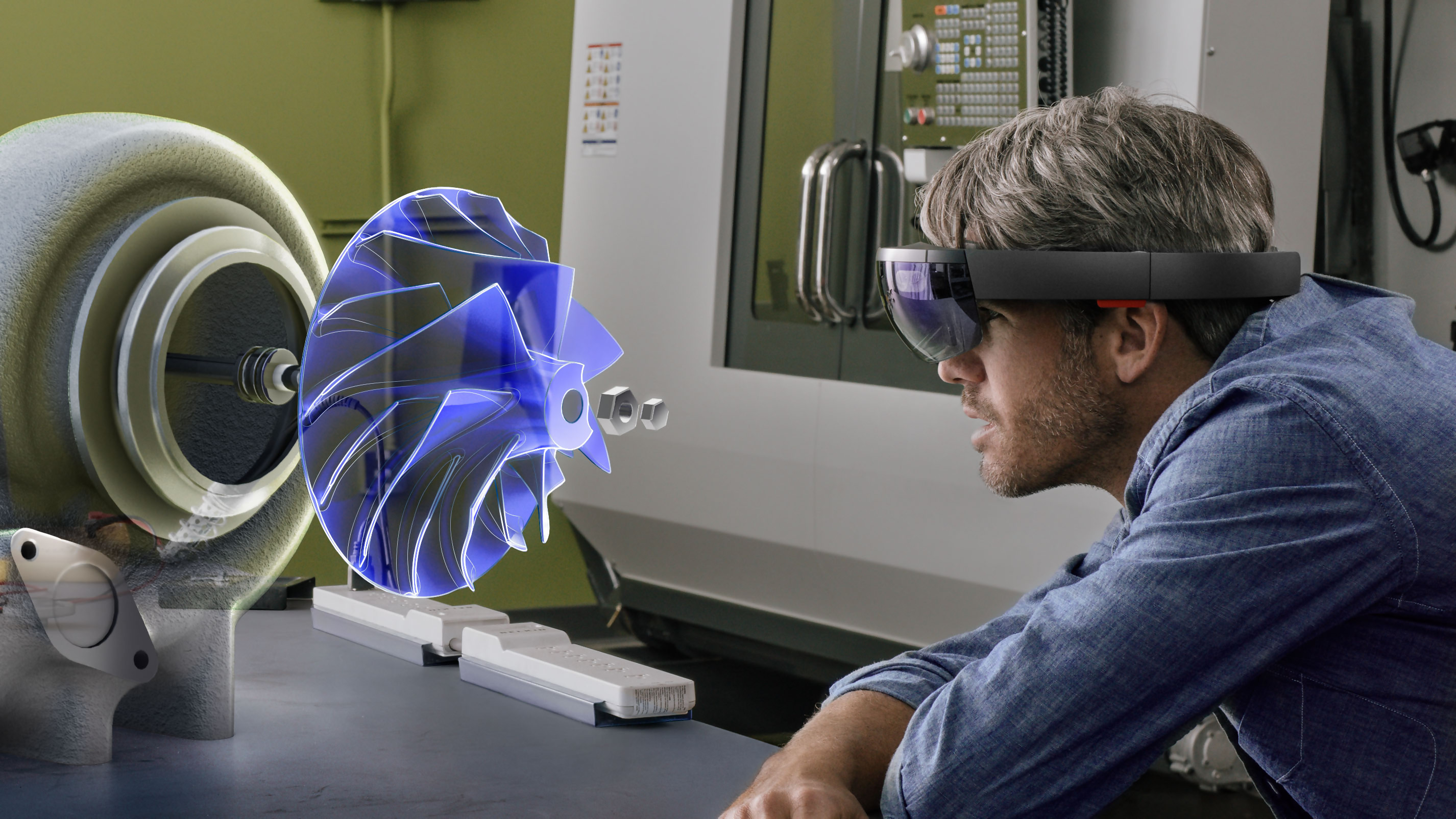

The second area that holds nearer-term opportunities for AR and VR is in the Enterprise. The adoption drivers are strong due to clear cost savings that can be achieved in areas like guided assembly and maintenance, remote design collaboration and other costly enterprise activities.

“In the B2B setting, an interesting area is corporate training,” Comcast Ventures’ Yang told ARtillry. “For anyone who has worked at large corporations, you have mandatory training for legal or compliance reasons. VR or even AR [can] solve that or make the training less brutal, frankly.”

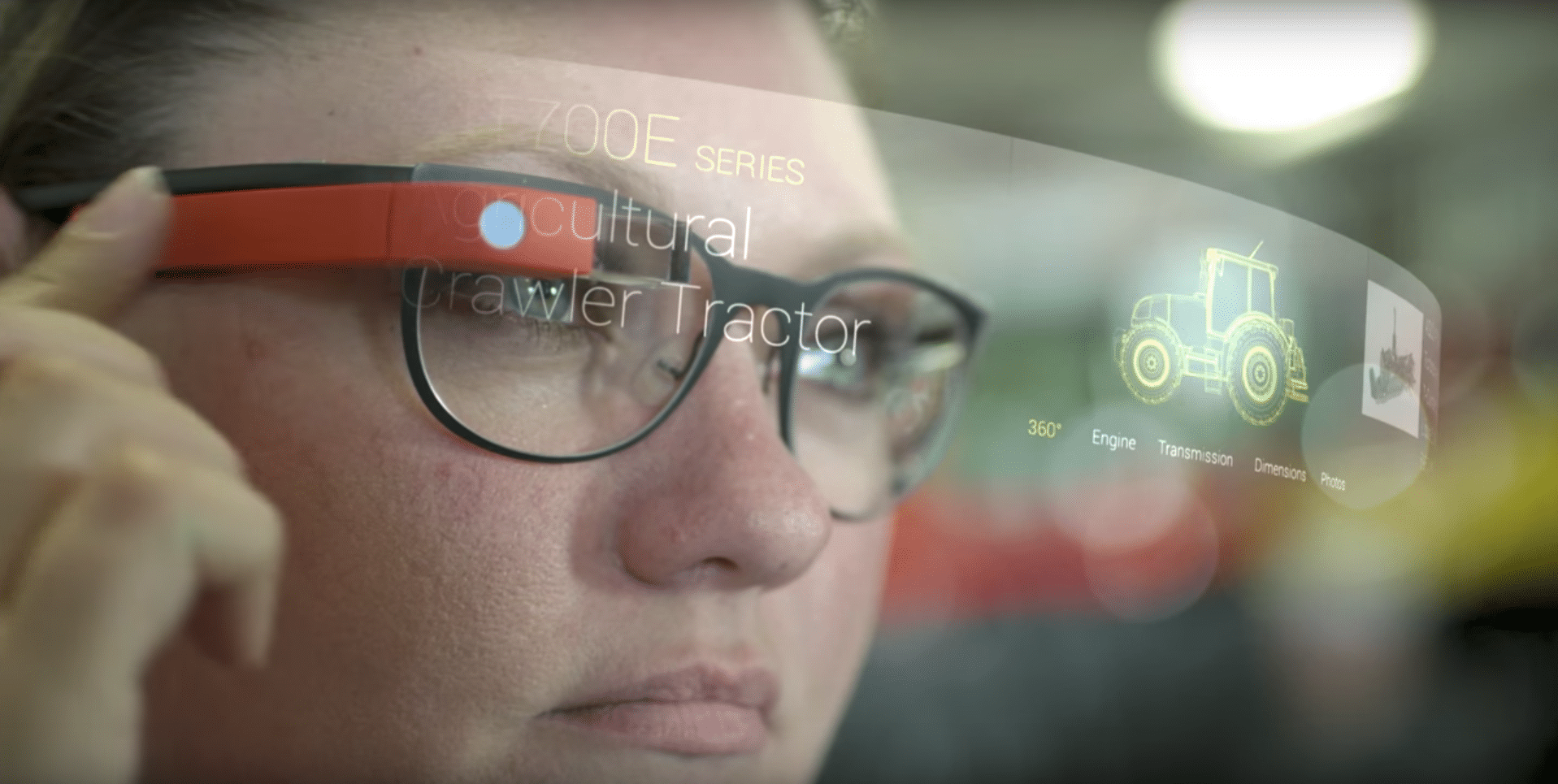

In training and other functions, it usually involves graphically-guided assistance on one’s field of view, using AR glasses such as ODG, Daiquiri or Google Glass Enterprise edition (GGEE). Google Glass has been rebuked for its failure in consumer markets, but has found solid footing in the enterprise.

Google in fact reports that GGEE reduces manufacturing and assembly time by 25 percent and inspection time by 30 percent. It also reduced medical doctors’ administrative work from 33 percent of their day, to ten percent. And DHL gained a 15 percent boost in supply chain efficiency.

“For us there are clearer benefits in the enterprise,” Presence Capital’s Amitt Mahajan told ARtillry. “You can really model out what [AR and VR] mean for a business, or how much it’s going to affect their bottom line and what that means in terms of a payback period for hardware investments.”

Presence Capital is among a short list of venture firms blitzing AR and VR as part of a central and defining investment thesis. In just two years, the seed-stage fund has invested in 33 AR and VR Companies. And 27 of those are enterprise-focused according to Mahajan.

The firm doesn’t categorically preclude consumer-geared investments, like VR gaming, but it does raise the bar for them. In other words, because they lack the desired enterprise-focus, consumer AR and VR apps need to have a prevailing counterbalance, like a rock-star entrepreneur.

“All of our entrepreneurs are great but on the consumer side, our bar is higher,” said Mahajan. “There are very few cases when we say ‘We think gaming and VR are going to be big, so let’s invest in it.’ It’s much more like, ‘This is a phenomenal person, let’s back them.’”

Another key advantage for enterprise AR and VR is less buyer resistance. Besides price, AR and VR’s biggest consumer adoption barrier is style, especially when asking someone to put something on their face (notwithstanding mobile AR). But that’s not an issue at work.

“Almost all of the reasons to not adopt these things as a consumer go away in the enterprise,” said Mahajan. “If you make an employee more effective, or you make it so that they are able to perform a job at all, the form factor does not matter. People will put that thing on.”

Transforming Work

Mahajan’s interest in enterprise goes beyond unit economics and productivity advantages, though they are favorable. He sees a much larger vision of transforming the institution of “work.” This can have broader societal and macro-economic impact, such as reducing unemployment.

“I have this thesis that we can help people take on new jobs, even ones they have no training for,” said Mahajan in reference to Presence Capital portfolio company Scope AR. “The idea that you don’t need knowledge to perform in a given role is pretty powerful.”

Scope AR for example, lets workers perform assembly or maintenance while guided by graphics or live remote support. This can eliminate the need for highly-skilled professionals to complete tasks. It also has cost savings for enterprises, which no longer need to dispatch experts to remote locations.

“We’re seeing use cases across virtually every heavy industry,” Scope AR CEO Scott Montgomerie told ARtillry. “Automotive, utilities, telcos, energy, mining, oil & gas… you name it. It’s wherever there are remote workers, or there’s no one on site that can solve a problem.”

Looking forward, Mahajan believes we’ll see a trend towards specialization in enterprise AR. As AR becomes more recognized and demanded by enterprises, the market size will justify that verticalization. And the technology could naturally drive towards specialization as AR matures.

Comcast Ventures’ Michael Yang agrees, and believes that more successful enterprise AR ideas and execution will come from this vertical focus. Specifically, he looks for entrepreneurs with specific industry perspective, rather than generalists or opportunists applying AR & VR to various industries.

“For a general-purpose developer, trying to understand a vertical is harder,” he said. “I’m looking for people from oil and gas, or aerospace or construction who envision AR overlays that make processes more efficient and intelligent. That’s the future we’re particularly excited about.”

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.