This post is adapted from ARtillry’s latest Intelligence Briefing, AR Business Models: The Top of the Food Chain, Part II. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

The “four horsemen” tech giants in this report mostly have consumer-based AR initiatives. But Microsoft has placed its chips on an enterprise approach with HoloLens. This isn’t surprising given that its DNA is very much tied to enterprise software and computing, such as its ubiquitous office software for enterprise productivity.

As further background to Microsoft’s motivation, it has enjoyed decades of dominance in the PC era, followed by a decade of inferiority in the smartphone era. It now sees AR (or mixed reality in its terminology), as a way to return to grace and dominance with an emerging field.

This can also be compared to Facebook: Driven to not miss the boat again with hardware that’s the dominant consumer touch point (smartphone), Facebook invested heavily for the next era (Oculus). Microsoft has done similar, but by building rather than buying. And its vessel is HoloLens.

This positions it with not only hardware but a software platform (Windows Mixed Reality) licensed to other headsets manufacturers; and tied into its foundational desktop operating system. Altogether, it achieves vertical integration — the same strategy by which its longtime nemesis Apple rose to power.

Mixed Metaphors

Carrying the above strategy, Microsoft has branded its approach as Mixed Reality. And with the aforementioned enterprise focus, Windows Mixed Reality will be anchored in Windows’ installed base. Enterprise overall will be a strong early market for AR, before consumers adopt en masse.

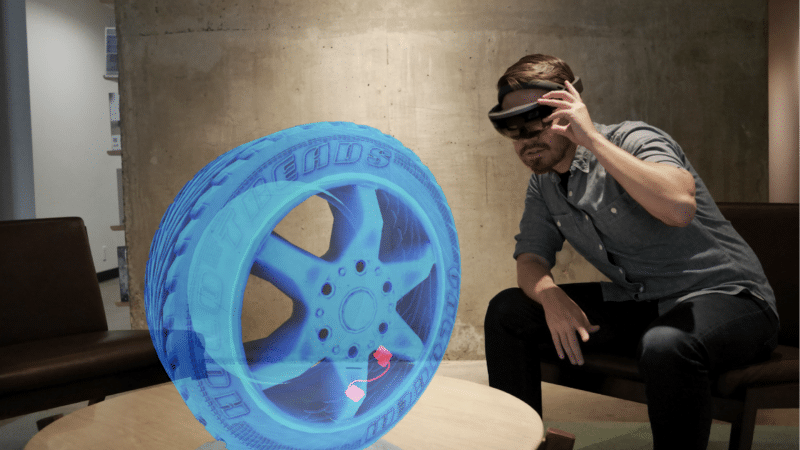

That early adoption is mostly due to the ROI story in functions like design and assembly. That in turn results from increased productivity, reduced mistakes and overall cost savings. And cultural resistance to glasses-based AR adoption (style, privacy, etc.) isn’t present in enterprise contexts.

One example is the HoloLens-assisted refinery management at Chevron. The energy giant uses HoloLens for maintenance and inspections. There, it utilizes HoloLens’ Remote Assist feature to empower on-site workers with remote expert assistance, thus improving operational efficiencies.

But even though AR has adoption and market size advantages, Microsoft isn’t ignoring VR. In fact, one component of Windows Mixed Reality (WMR) is a leading positional tracking system that’s inherited from HoloLens. This is valuable IP which Microsoft will continue to utilize across XR efforts.

As background, WMR (and HoloLens) has inside-out positional tracking, which eliminates the setup and cord-laden orientation of outside-in tracking systems like HTC Vive’s Lighthouse. It achieves this through mesh-based scene mapping, which scans room contours to better localize and track motion.

Microsoft has intelligently decided to utilize that asset by licensing WMR to third-party hardware manufacturers to build sub-$500 VR headsets. Starting with partners like Acer and HP, this will accelerate VR consumer adoption with price competition for capable mid-range headsets.

Vertical Challenge

Altogether, Microsoft is pursuing many paths to immersive technology. It’s vertically integrated by owning the hardware (HoloLens), OS (Windows) and application layer (WMR). As shown historically by Apple, that approach can engender an elegant linking of hardware and software.

At the same time, it’s pursuing the traditional Microsoft model that licenses software to third-party hardware manufacturers (think: Windows-based PCs). That misses out on the quality control and product design of vertical integration, but it has economic advantages in high margins and scale.

While pursuing both of these strategies, WMR all the while stays true to Microsoft’s DNA by playing to its strengths in enterprise applications. And the whole thing will utilize and stem from the massive installed base — in both consumer and enterprise worlds — of the Windows operating system.

Altogether, Microsoft is in a position to own the technology stack, accelerate its market penetration, and lower costs through economies of scale. This could place it in an advantageous position among tech giants pursuing AR. In the ‘Four Horsemen’ construct, it just might be the dark horse.

To continue reading, see ARtillry’s latest Intelligence Briefing, AR Business Models: The Top of the Food Chain, Part II.

For deeper XR data and intelligence, join ARtillry PRO and subscribe to the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.