As suggested by our rants on “native-thinking,” any emerging medium requires a new set of rules and best practices. With AR & VR, it’s not just content and design: equally important is how consumption is measured.

This is where Austin-based Thrillbox plays. With the philosophy that immersive media’s usage patterns require new and native measurement tools, it designs and builds analytics software. And one key principle is innovating beyond heat-maps, says COO Benjamin Durham.

“Heat maps allow you to understand where someone is looking, They don’t empower you with understanding of what they’re looking at,” he told ARtillry. “This is an inefficient representation that’s heuristic: it requires a human to look at it which means you’re creating a bottleneck.”

This push towards new and native is importantly balanced out by some degree of familiarity. This is important when clients are enterprises with set comfort levels. Thrillbox strikes this balance by adapting established practices of consumption analytics to immersive media like AR & VR.

“While there’s a lot of excitement around immersive media, there are quite a few pain points that aren’t really being tackled,” said Durham. “We’re working with brands and devising ways to make immersive work with existing omni-channel monetization, optimization and monitoring.”

Hot Spot

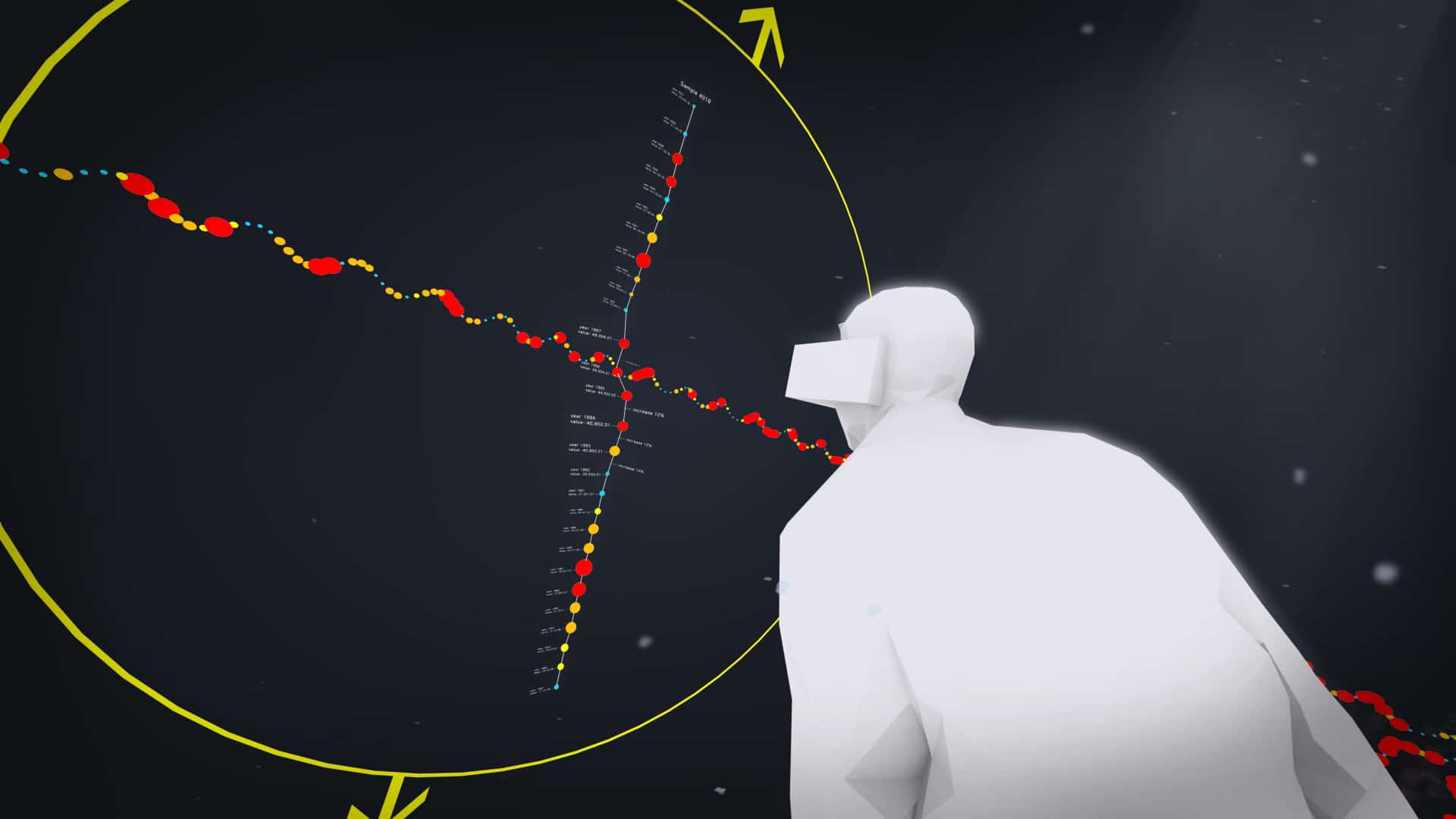

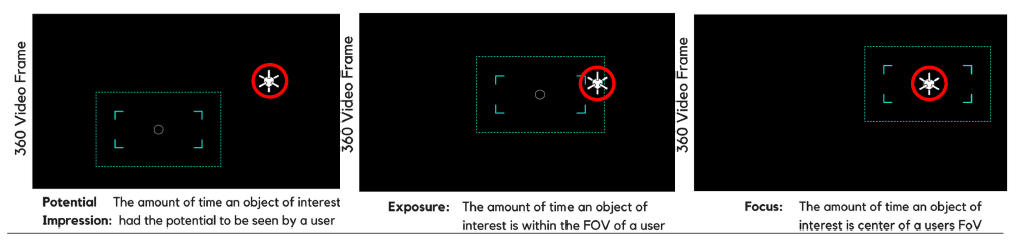

The way this all comes together is through a system that analyzes micro meta-data within immersive media, such as a 360 video. It applies machine learning and object classification to identify points of interest, such as a brand logo. Then it measures that item’s viewability.

Built from IAB banner ad viewability standards — again, balancing the old and new — it tracks the nuances of 360 viewing patterns. This includes a head-tracking based system that measures potential impressions (item in frame), exposure (time in frame), and focus (time centered).

“We’re collecting 15-20 data points per frame,” said Durham. “That lets us make assessments. For example, out of the potential 10 seconds, an item was in frame for seven seconds and in focus for five. From there we can measure attention and assign viewability scores.”

View Stream

One of Thrillbox’s differentiators as an immersive tech analytics platform is to look beyond immersive tech. Sticking once again with a theme of blending the old and new, it takes a cross-channel approach by using immersive media analytics to re-target content in other channels.

In other words, immersive media is one of many formats consumers engage with. So why not extract its analytics to inform content and ad targeting in places like social media. This makes it a sort of “view stream” versus the ad industry standard “click stream,” says CMO Britt White.

“When a user downloads an app, they can opt-in to social media sharing, which then enables us to present them 2D videos or supplementary information,” said Durham. “That goes beyond just collecting information within immersive to present more information within immersive.”

Importantly, this creates a more favorable ROI story for enterprises and agencies considering 360 video. Instead of seeing it as a standalone investment, it can be viewed more holistically as a long-term (and privacy-friendly) way to profile user behavior and target ads accross channels.

“Our goal is to get people to think about how data from immersive can be used to supplement traditional ad placement,” said Durham. “If you do a lot of 2D video, you don’t have to abandon it. You can make 360 video that helps you place that 2D video in front of people better.”

Vertical Challenge

As for where all of the above comes into play, it’s broadly applicable but requires some customization for specific contexts. Much of it relates to optimizing content and ad delivery per the above examples, but there can still be nuances accross business verticals.

To develop that vertical-specific playbook and steer the product development accordingly, Thrillbox is currently working with “lighthouse” clients in a few major verticals. We received their names on the condition of non-disclosure, but can safely say that they’re all marquee brands.

This approach lets Thrillbox build benchmarks for immersive content engagement. Some of these benchmarks will be unique to specific verticals, while some are universal and can apply accross the board. In both cases, the usage data becomes valuable for product development.

“In entertainment you want to know how long someone is viewing, or what’s the point of abandonment,” said Durham. “That’s different from education where you want to make sure a student is paying attention. Or in auto, in VR showrooms, what types of details in the vehicles are users are looking at? and where to provide information for purchase to avoid cart abandonment.”

Speak the Language

The product itself takes form in a SaaS package for enterprises and brands to measure and optimize their immersive content. Larger companies can opt for packages that are customized, while pre-built packages are also available off the shelf for defined personas.

This furthers the theme of lowering friction for immersive content. Along those lines, Thrillbox is in tune with macro trends such as the nearer-term AR & VR scale in mobile and enterprise. But mostly it’s about creating a product that speaks the language of brands and content creators.

“With our having a mobile centric approach, we’re working on ways in which we can integrate behavioral data sets so that it can work with different ecosystems and the methods that chief marketing officers and CIOs currently use,” said Durham. “Immersive just integrates with it.”

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header Image Credit: Read Write