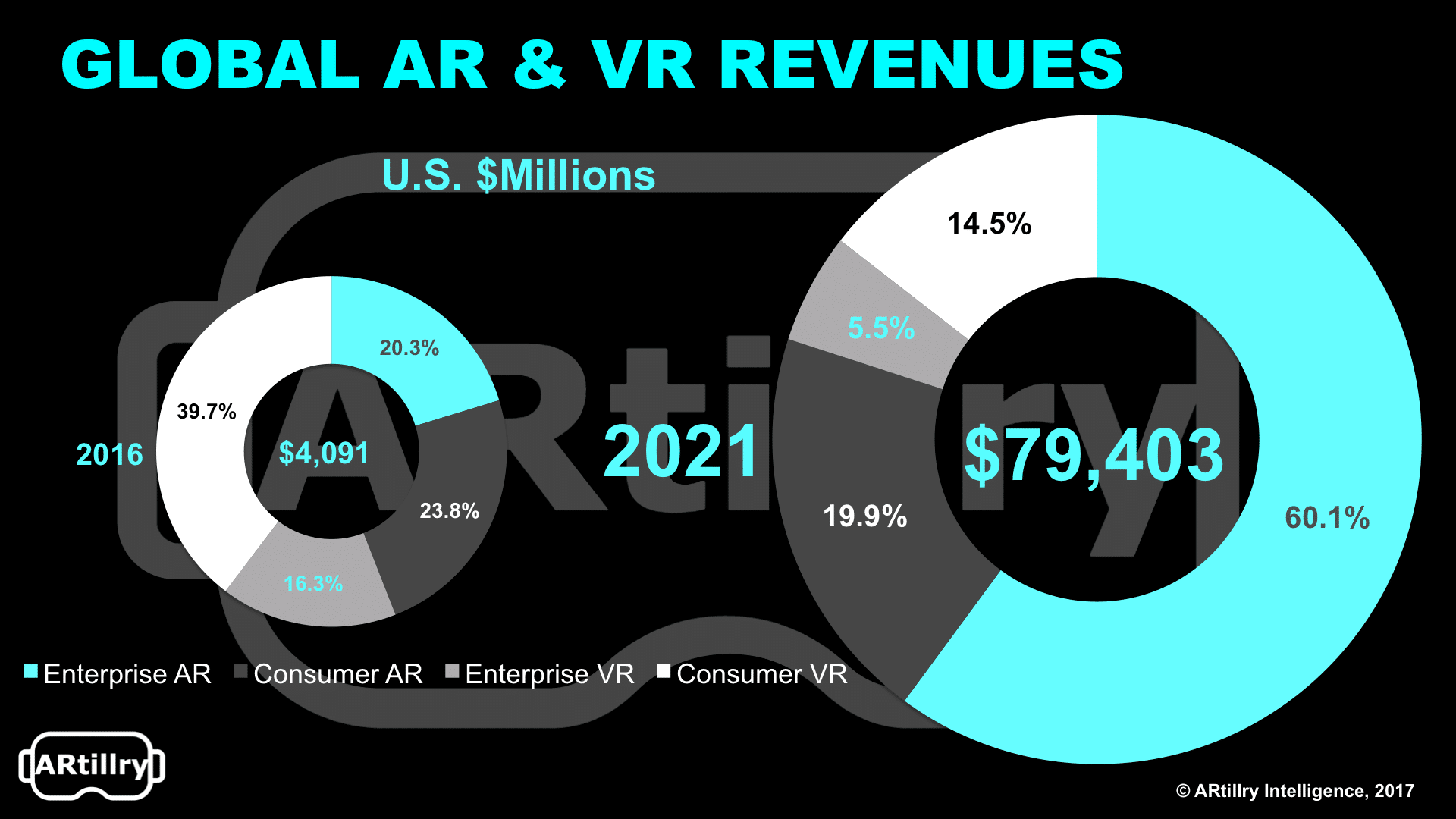

Among the sub-sectors of the XR spectrum — AR, VR and consumer and enterprise segments of each — consumer VR has the third fastest growth and third largest eventual market size after consumer AR (explored last week).

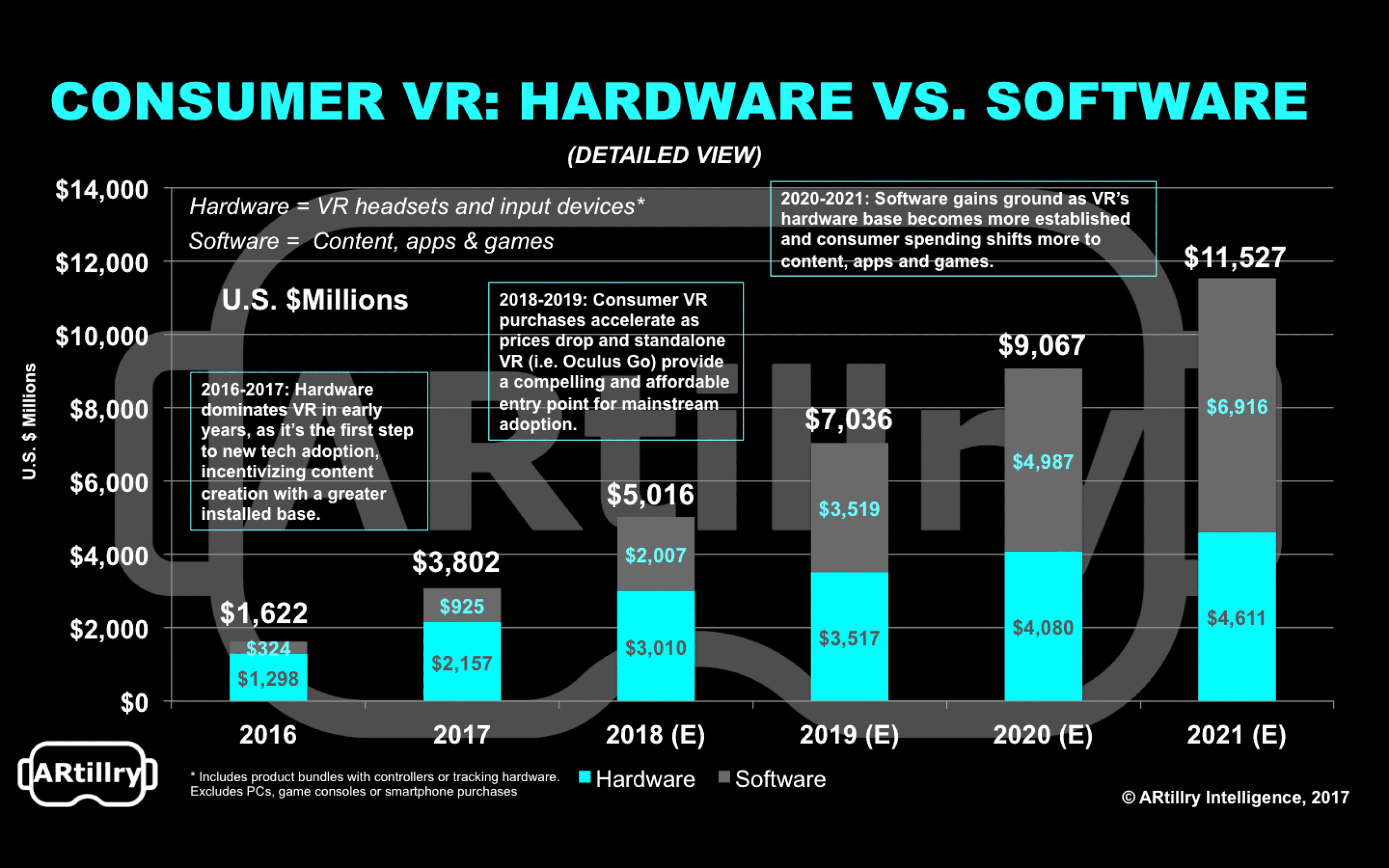

This was one of the main findings in ARtillry’s latest XR revenue forecast. Specifically, consumer VR will grow from $1.6 billion in 2016 to $11.5 billion in 2021. But what’s driving that revenue growth? It’s a combination of hardware, software and falling prices for headsets.

Price competition among VR headset manufacturers will be a big consumer adoption driver. Oculus Go, at a $199 price point, will hit a sweet spot for quality and affordability, and will drive mainstream VR adoption and education starting in 2018 as we examined recently.

Oculus – with the advantage of Facebook-backing – has the flexibility to apply loss-leader pricing in order to trade margins for market share. That will give it a strong competitive position versus players that are dependent on hardware revenue (i.e. HTC, Samsung).

Consumer VR will be hardware-dominant in early years, as is often the case with emerging tech. As that installed base is established over time, it paves the way for software (in this case, games and apps) which will eventually eclipse hardware revenues with a faster refresh cycle.

A greater hardware installed base will also incentivize VR content creators, resulting in more robust VR content libraries and greater software spending per user (ARPU). That will be a key piece of the puzzle, given content’s importance as an adoption driver.

That’s the short version. Stay tuned for more data, and see more forecast details and methodology here.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.