VR headset sales are a key metric for the industry health. An installed base incentivizes content creators to build things, which in turn drives consumer hardware sales… which then incentives more developers — a virtuous cycle.

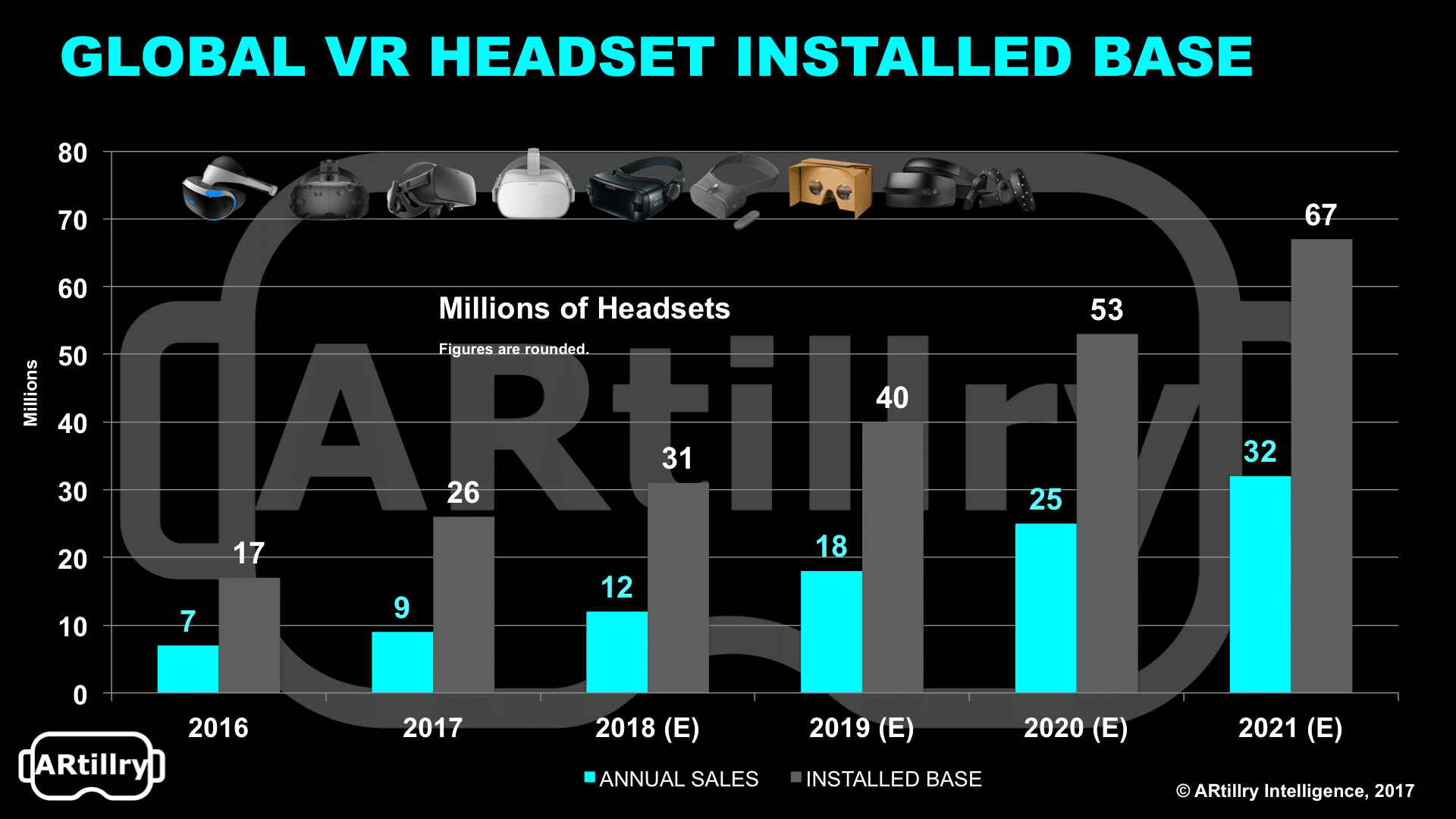

VR’s slow start is because that cycle is hard to initiate without subsidies or loss-leader pricing (as Oculus Go will do). It’s a classic chicken & egg dilemma. Meanwhile, where do we stand? ARtillry Intelligence data pegs VR’s installed base at 26 million, growing to 67 million by 2021.

Here it’s important to differentiate annual unit sales (a common metric) and installed base. The latter is cumulative so is generally larger, and is based on a two-year hardware replacement cycle. Meanwhile, unit sales were about 9 million last year, growing to 32 million by 2021.

As we’ve examined, the magic number for installed base is 100 million. History has taught us — most recently with smartphones — that base creates a robust ecosystem of content (per incentive) and supporting technologies. Once 100 million units is hit, things start to accelerate.

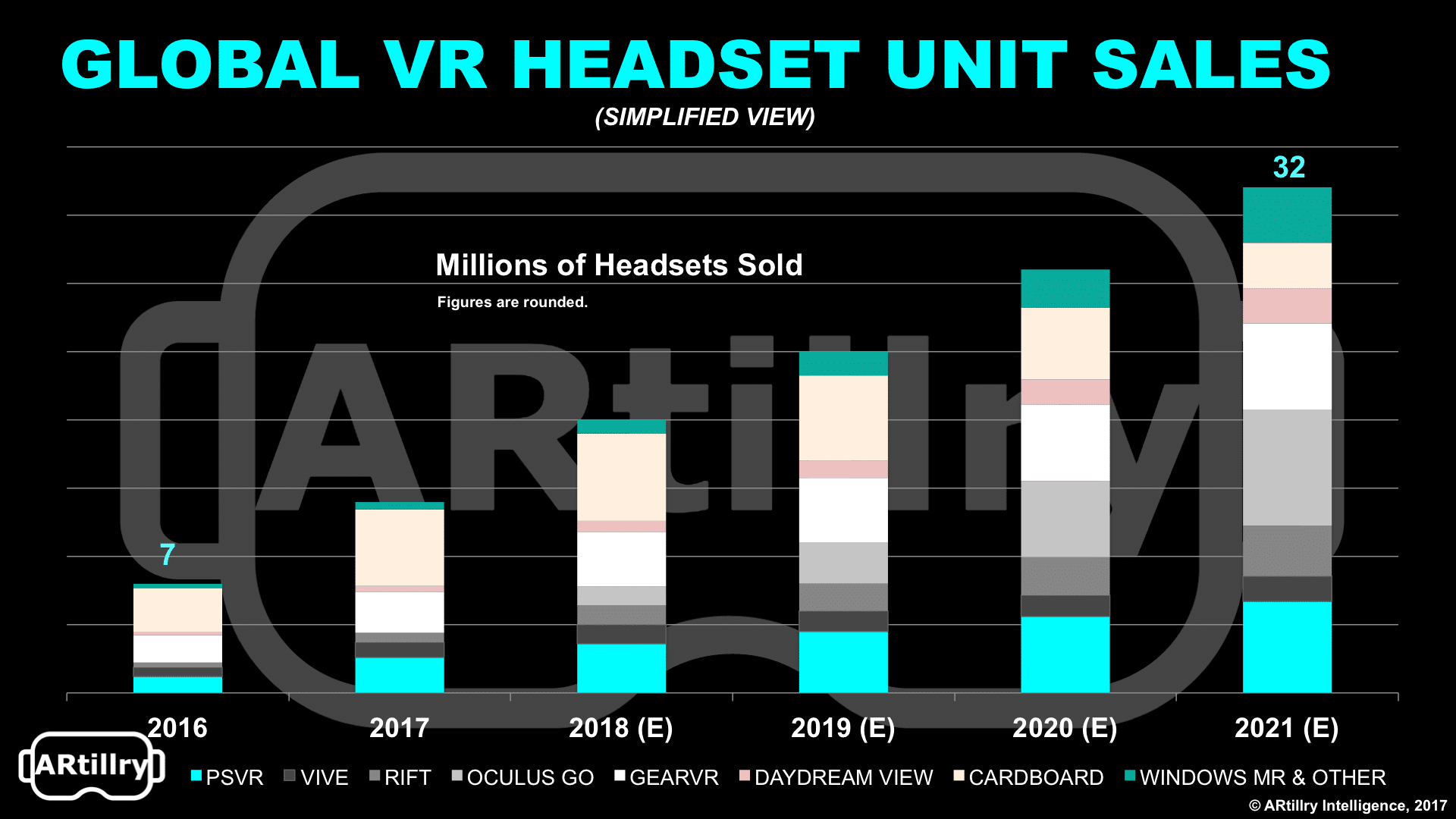

As for the breakdown of headset sales, cardboard currently leads, due to its low price. Gear VR is also well penetrated due to its tenure in the market. And PSVR has seen relatively strong sales because of the compatibility and installed base (about 60 million) of existing PS4’s in the market.

Moving forward, we project big things for Oculus Go. As mentioned briefly above and broken down in our recent analysis, it will apply loss leader pricing to build a longer-term platform strategy. That will have the by-product of giving VR sales the jolt it needs, and get that virtuous cycle turning.

Simplified view: detailed breakdown available in full report

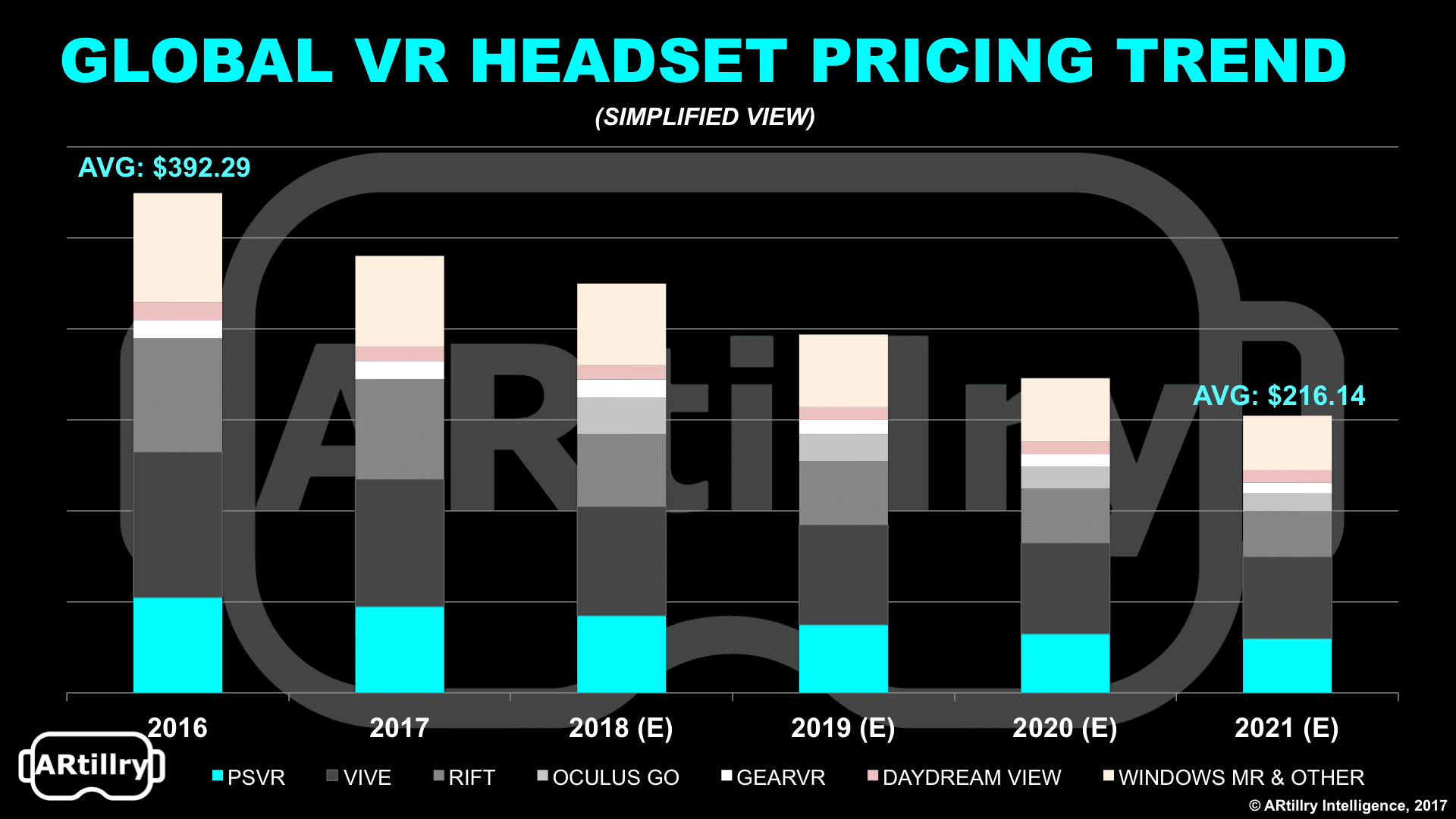

Simplified view: detailed breakdown available in full report

This can also be seen in VR headset pricing, which trends downward over time per Moore’s Law. By 2021, the average price for a headset will be just above $200. ARtillry Intelligence consumer survey data meanwhile indicates that $200 is a key price point, below which demand spikes.

These prices include bundled hardware like controllers and input devices, but don’t include external tracking systems, PCs or gaming consoles. There will be much more to watch, most importantly, Oculus Go’s impending release, likely at Facebook’s F8 conference in May.

For a deeper dive on AR & VR insights, subscribe to ARtillry Intelligence Briefings, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Oculus