ARtillry Briefs is a video series that outlines the top trends we’re tracking, including takeaways from recent reports and market forecasts. See the most recent episode below, and past installments are here.

One third of consumers have used mobile AR, and half of those do so weekly. This is according to our latest Intelligence Briefing, which examines original survey data (n=2198) produced with Thrive Analytics. It’s also the topic of the latest ARtillry Briefs Episode (embedded below).

These usage levels are higher than expected and supportive of mobile AR’s growth and scalability that we’ve quantified in the past. But more than sheer usage, mobile AR’s frequency is a key success factor that’s tied to many of the potential AR revenue models we examined last month.

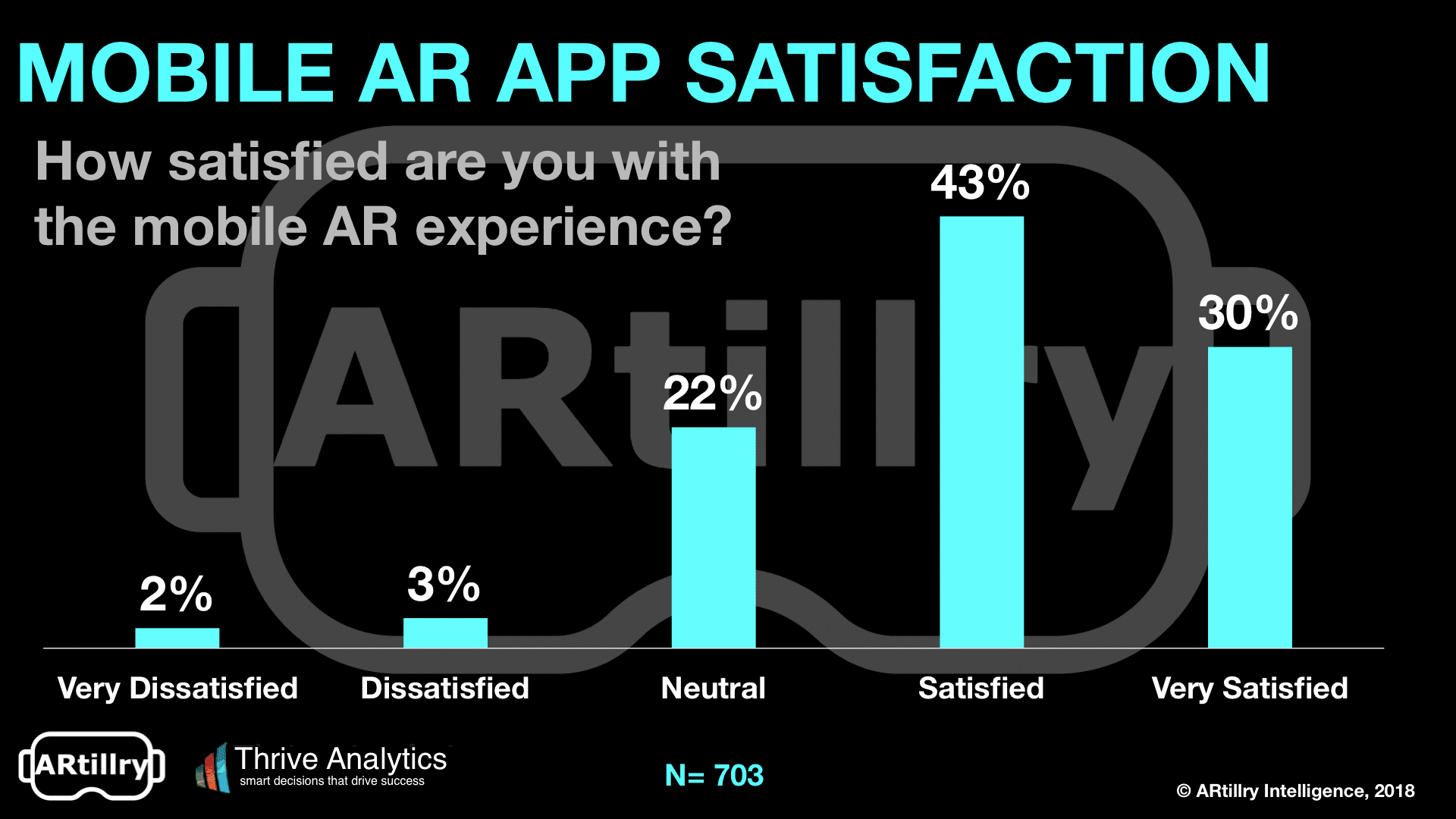

Users are also liking the experience, with 73 percent of respondents reporting moderate or high satisfaction (see chart below). But the news isn’t all good: That high satisfaction starkly contrasts sentiments of non-users, who report low likelihood of adopting soon, and an explicit disinterest.

This disparity between current-user satisfaction and non-user disinterest underscores a key challenge for AR: you have to “see it to believe it.” So In order to reach high satisfaction levels, apps have to first be tried. This presents marketing and logistical challenges to sway the masses.

In other words, Mobile AR’s strengths lie in its highly visceral and immersive experience. But those same factors make it so that the experience can’t be captured through traditional marketing like ad copy or even video. This makes mobile AR’s features a bit of a double-edged sword.

So it’s a question of how to accelerate that consumer education and acclimation. Lots of signs point towards social apps which can help AR achieve viral growth and a network effect, as we examined yesterday. Evidence of that can been in things like Snapchat’s AR lenses.

Speaking of social, it was one of the top categories in our AR survey along with gaming, which wasn’t a big surprise given Pokemon Go’s popularity. As for desired apps, those two categories likewise scored high, indicating they’ll continue to be top AR categories for user engagement.

Moving on to price sensitivity, there was again a strong disparity between current users versus non-users in terms of what they’re willing to pay. This has lots of implications for pricing models, including in-app purchases which tend to optimize yield, especially in gaming and social apps.

Interestingly, many of these dynamics mirror our corresponding VR study, including marketing and logistical challenges. But the good news for AR is that it will be an easier road than VR because “zero cost hardware” (the phone you already own), and less technological invasiveness.

See the episode below, preview the report that it’s based on here, and stay tuned for more written and multimedia commentary.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.