This post is adapted from ARtillry’s latest Intelligence Briefing, AR Business Models: The Top of the Food Chain, Part I. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

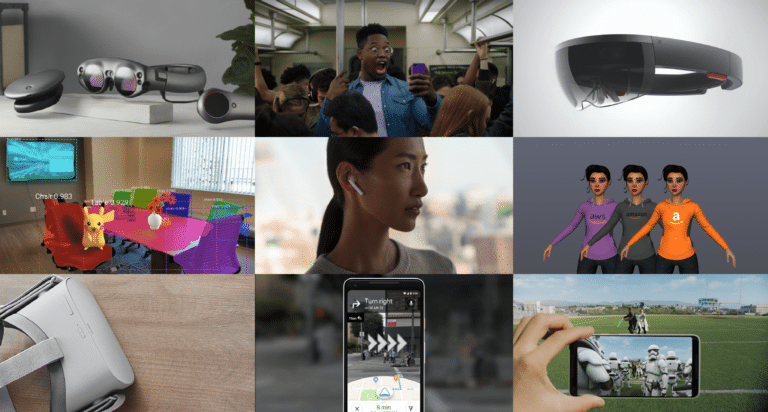

What are the leaders in today’s technological landscape doing in XR? More importantly, what does this mosaic of investment and innovation tell us about the trajectory and velocity of immersive computing? There are patterns and strategic takeaways materializing.

One place to start such an analysis is with the simple yet multi-dimensional question of “Why?” In other words what are the motivating factors that drive deep-pocketed tech giants to chase XR ambitions? Answering that question can reveal insights about aligning with XR market trajectory.

The answer to that question interestingly differs for most major tech companies. But on another level, the answers for each are similar. When looking at tech’s “four horsemen,” for example, each has XR motivations to protect or grow their core businesses and primary revenue streams.

Highly Motivated

For Google, it’s all about search. Its “version” of AR is visual search such as Google Lens and VPS. These boost search query volume, albeit visually instead of text-based. They also position the increasingly popular and millennial-favorite smartphone camera as a search input.

Consider Facebook’s core business: Its primary ad revenue correlates to the time we spend in its walled garden. So AR is a means to keep us in that environment longer through more compelling – and advertising-conducive – content to share with friends. Its “version” of AR is Camera Effects.

On to Apple, though it’s increasingly diversifying into software and services, its core business is hardware. So most moves it makes are to make iThings more attractive to consumers. AR is no exception, as more immersive and visually-compelling apps, via ARkit, make iPhones sexy again.

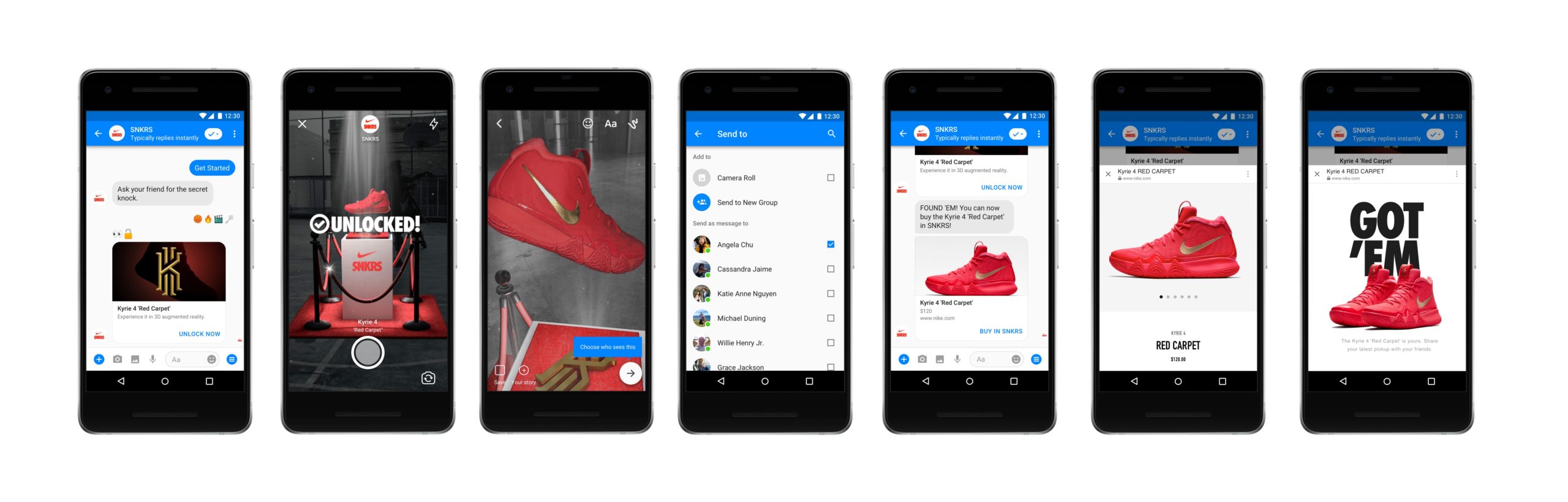

The fourth horsemen, Amazon, is likewise making big XR moves. Its AR product visualization features engender more informed shoppers who buy more and return less: big factors for the margin-obsessed giant. And its Sumerian platform is seeding future business for AWS.

It doesn’t end with the four horsemen. Microsoft, which could justifiably be a horseman, is making big moves in enterprise AR (Hololens) and consumer VR (Windows Mixed Reality). Snapchat is an early mover in mobile AR, as is Niantic which is in the midst of an ambitious AR platform play.

Altogether, this landscape has discernible patterns. And in all of the industry speculation about where (and when) XR is going, analyzing the top of the food chain provides key clues for anyone in the game of opportunity spotting — investors, enterprises, startups, etc.

Case in Point: Google

Drilling down on the above companies, a quick example can be seen in Google. And a key question when examining tech giants’ motivations for, and influence on, XR is to ask how they will monetize it. For Google, there are several answers to that question, which is a moving target.

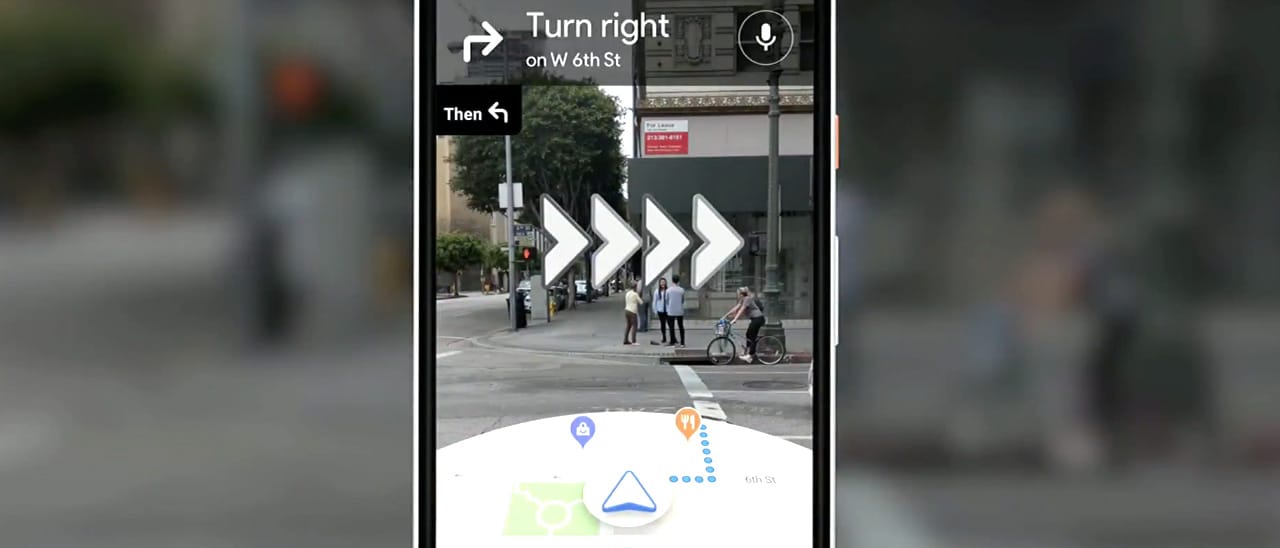

As mentioned, Google’s AR initiatives support its core business model. For example, its visual positioning service (VPS) ties to its core mapping and search functions. Visual search similarly aligns with Google’s core mission to provide information to answer users’ search “queries.”

In other words, Google sees AR as a way to boost query volume and quality – its primary revenue source. AR is inherently a form of search, but instead of typing or tapping queries, the search input is your phone’s camera and the search “terms” are physical objects.

“Think of the things that are core to Google like search and maps,” said Google’s Aaron Luber at ARIA. “These are things we’re monetizing today that we see added ways we can use [AR]… All the ways we monetize today will be ways that we think about monetizing with AR in the future.”

As background, Google has a longstanding goal to boost query volume and search performance since the smartphone’s introduction. The app-heavy use case and declining cost-per-click from mobile searches are negative forces that Google is challenged to counterbalance in other ways.

So far, that includes things like voice search. As we enter an age of visually-immersive computing, Google wants to position the increasingly-popular smartphone camera as a search input. Visual search and VPS are ways to ensure its positioning in the next era of monetizable search.

“A lot of the future of search is going to be about pictures instead of keywords,” Pinterest CEO Ben Silberman said recently. His claim underscores another key factor that indicates visual search’s potential appeal: millennials. The buying-empowered generation has a high affinity for the camera.

For more, check out our latest report on this topic and stay tuned for continued analysis.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.