XR Talks is a series that features the best presentations and educational videos from the XR universe. It includes embedded video, as well as narrative analysis and top takeaways. Speakers’ opinions are their own. For a deeper indexed and searchable archive, subscribe to ARtillery PRO.

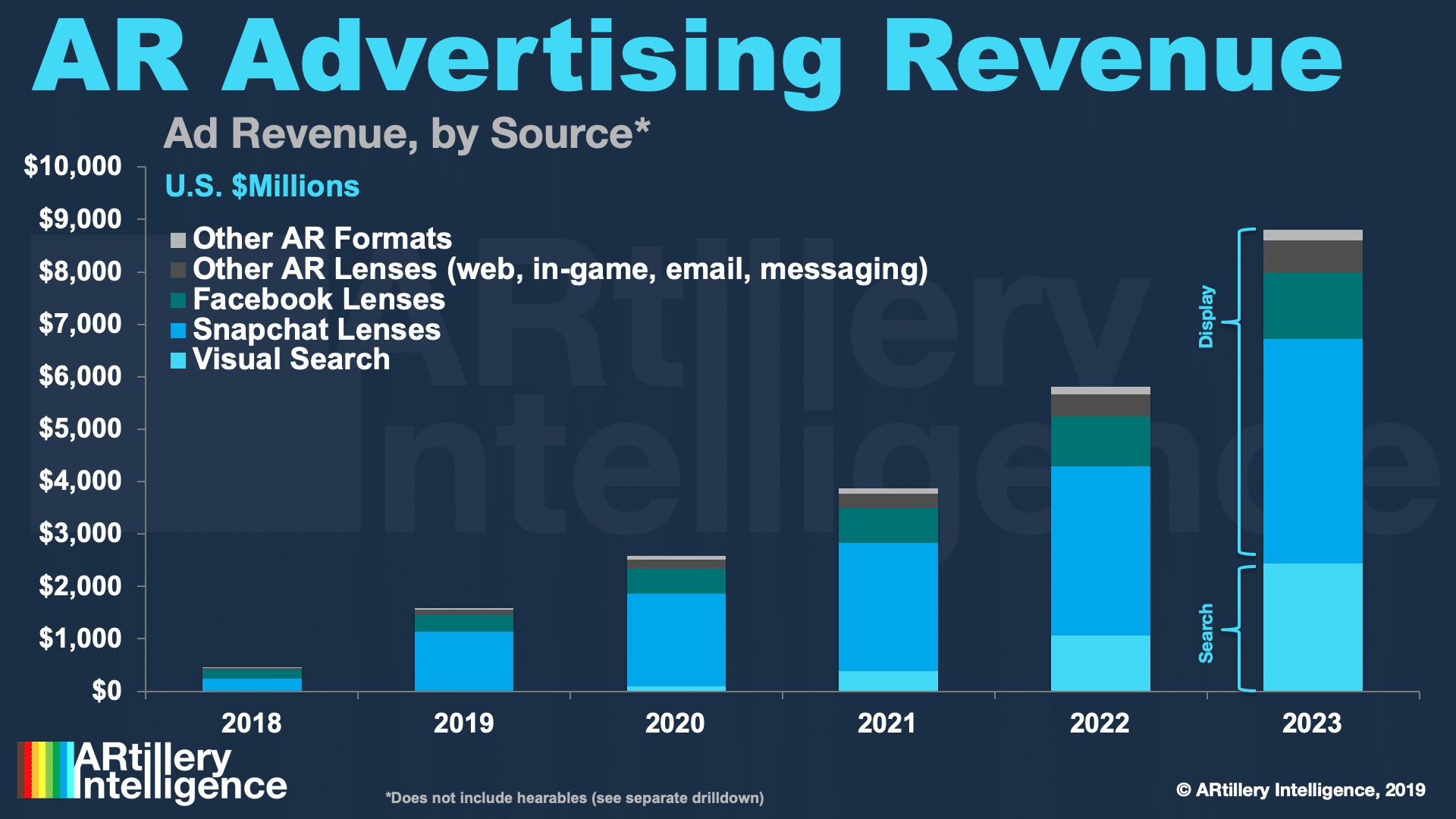

In the early market-building and “table-setting” phases of AR’s lifecycle, one bright spot is advertising. Brands are attracted to AR’s ability to demonstrate products in immersive ways. That translates to actual revenue, considering an estimated $1.58 billion spent last year.

The AR ad ecosystem is meanwhile filling out, including distribution channels like Snapchat, low-friction platforms like 8th Wall, developers themselves and creative agencies. There’s also connective tissue like Poplar, which facilitates AR campaigns and connects brands to AR creators.

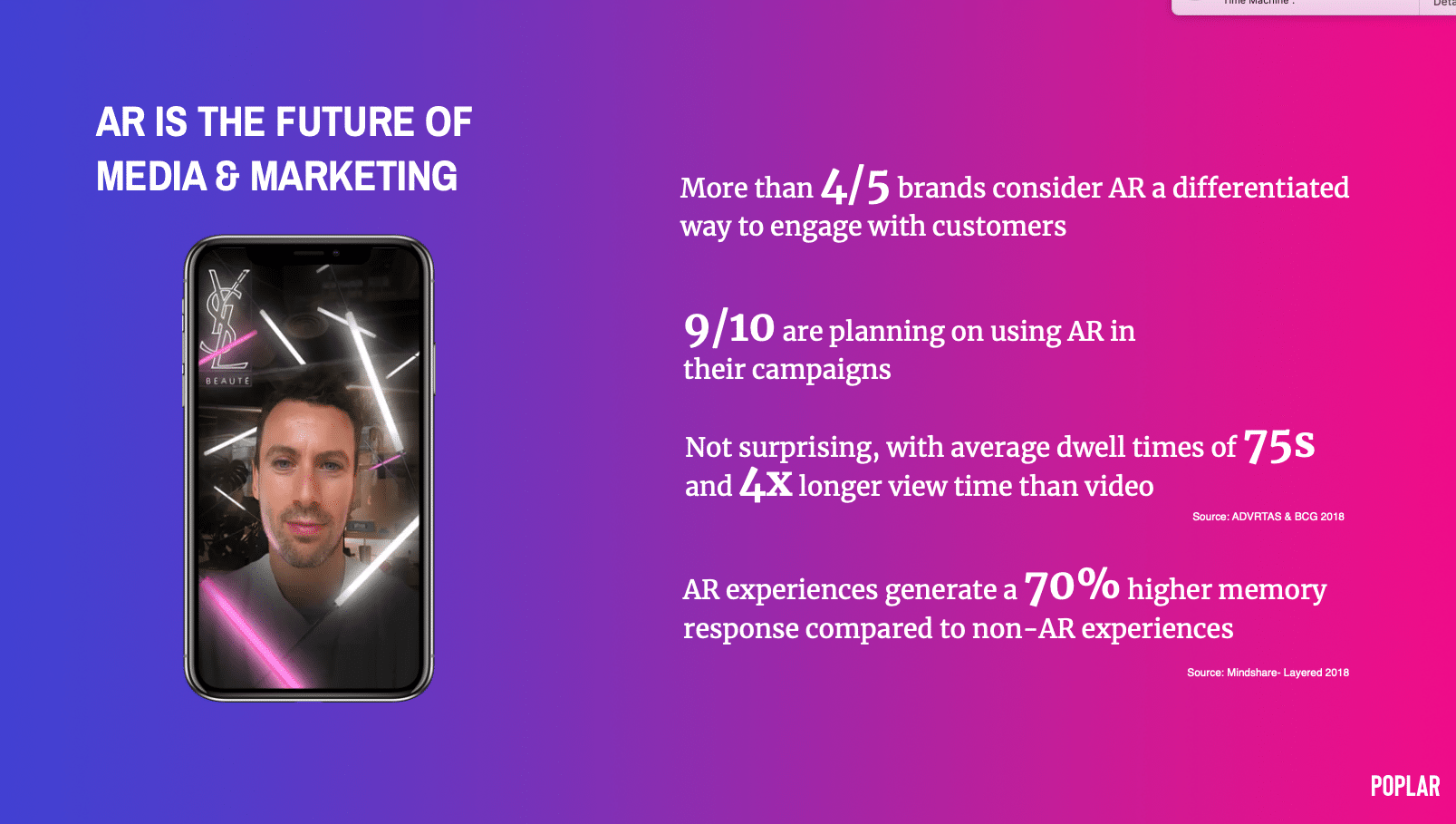

“We’re seeing more and more of these face filters or augmented reality campaigns all over social media,” said Poplar founder & CEO David Ripert at AWE Europe (video below). “AR is going to revolutionize media and marketing. We see a lot of engagement compared to display ads.”

This includes lots of AR ad campaign analytics that Poplar tracks. For example, it pegged average AR session lengths at 75 seconds, which is 4x that of video advertising. This is a key metric for AR engagement, which transcends common mobile “vanity metrics” like app downloads.

But despite these attractive metrics, AR can still be intimidating to brand advertisers, agencies and others on the “buy-side” of the ad ecosystem. Here, Poplar has done the industry a favor with a sort of public-service announcement with lots of definitions around AR advertising options.

For example, there’s a question of format. That includes everything from face filters (front-facing camera) to world lenses (rear-facing camera) to portals. These each have different pros and cons, and the key is to set campaign goals at the onset, then choose the AR options that best align.

Face filters align with influencer marketing for instance, because brand-ambassadors can literally wear a product on their face (if applicable). Socially-distributed campaigns like Snapchat sponsored lenses can also boost a brand’s follower count… if that’s the advertiser’s goal.

Goals can also include direct-response commerce, such as demonstrating products in 3D. This can happen in-store or at home, based on advertiser goals. This can impact distribution strategy, as it’s harder to download an app in a store aisle versus marker-based Web AR activations.

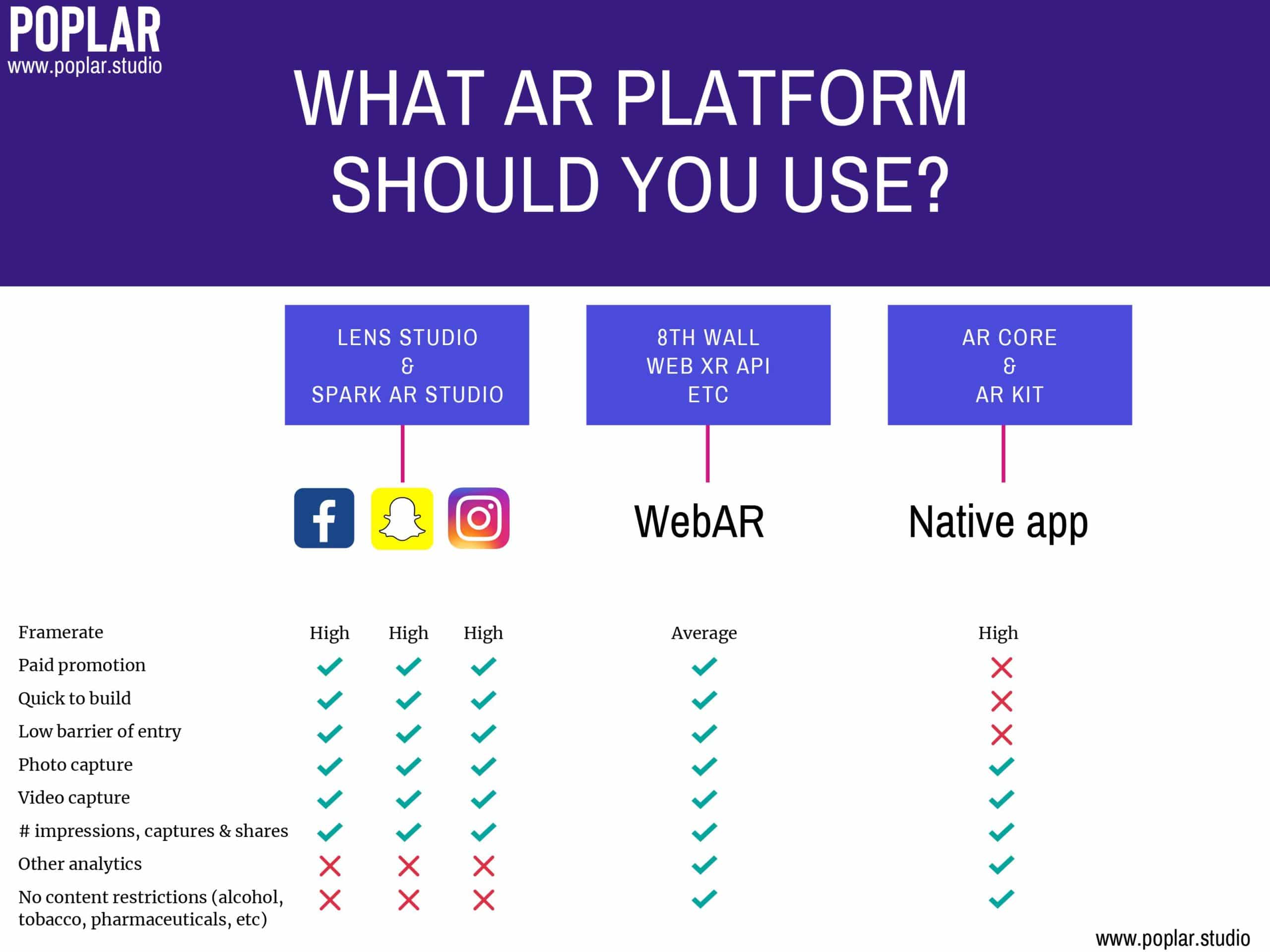

This brings us to the all-important choice of developer platform and distribution channel. The main options include social apps like Facebook and Snapchat, web AR and native apps. And they each carry different pros, cons and capabilities as shown in the above quick-reference table.

For example, web AR has lots of advantages we’ve examined in the past, such as less friction for users to launch a given experience. But it doesn’t have the organic discovery (e.g. social feed) that Facebook can offer, nor can it support video capture. Again, it all depends on campaign goals.

Conversely, web AR is advantaged over social apps if the advertiser wants more granular analytics. AR advertisers who choose social apps are beholden to the analytics provided. That includes basic metrics such as number of lens engagements… but not session lengths.

Here, Ripert has a pro tip for those who choose web AR: Because it happens on the mobile web, they can use good-old Google Analytics to gain lots of granular insights about the engagement metrics. Web AR also lets developers push updates a lot faster than with native apps.

There are also technical considerations like how fast the experience has to load, as well as how photorealistic and volumetric it has to be. It’s likewise important to choose how people will find a given AR experience, whether its print media, in-store activations or social discovery.

As for examples, Island Records achieved a $.20 CPM which compares with video CPMs of up to $20. King was able to send users of it’s AR mini-game to the App Store to download its mobile titles. And Speedo reduced costly restocking with more informed in-aisle purchases.

Each of these case studies and several more Ripert provides have the common theme of choosing the right set of AR options to meet advertiser goals. But before even getting to that point, it’s important to go into AR for the right reasons by asking oneself if it’s additive to begin with.

“Why are you creating this? Is AR something you find interesting ‘just because?'” posed Ripert. “Is there actually a purpose to it, like to inform your audience [or] demonstrate a product. If you aren’t doing any of those, it’s possible that AR isn’t the right tool for you at the moment.”

See the full talk below, including more considerations, campaign strategies and options for AR advertising. And see Polar’s related AR advertising guide here.

For deeper XR data and intelligence, join ARtillery PRO and subscribe to the free AR Insider Weekly newsletter.

Disclosure: AR Insider has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: AWE, YouTube