Data Dive is AR Insider’s weekly dive into the latest spatial computing figures. Running Mondays, it includes data points, narrative insights and takeaways. For an indexed collection of data and reports, subscribe to ARtillery Pro.

In “new normal” shelter-in-place life, lots of businesses are suffering — especially high touch services and local storefronts. But a handful of others, mostly in tech, are exceeding normal usage levels. That includes quarantine-friendly fare like Zoom and casual games.

Snapchat has planted itself in the latter category as a pervasive medium for shelter-in-place masses — especially millennials and Gen-Z. That point is emphasized by the fact that Snapchat offers much-needed escapism and whimsy in lens-adorned communications.

Supporting that, we previously reported Snap’s month-over-month usage in late March. Those included a 10x surge in the Snap Camera desktop tool, 50 percent more video calls, and 25 percent more time spent playing with lenses. Session lengths are a key AR metric.

Elsewhere, as reported by AR Post, several independent lens creators are seeing evidence of AR usage surges. Albert Guler’s Inception-inspired spinning top lens saw 500,000 views in two days, while CyreneQ’s toilet paper hat lens saw 11,365 more playtime than her baseline levels.

Doubling Down

Meanwhile, Snapchat has layered on more data that further validate these principles. Specifically, it saw a 37 percent increase in Snaps being sent with a Lens AR experience during late March compared to late February. Playtime with sponsored lenses increased by 18 percent.

The latter is happening as brands are forming campaigns around communicating support and Covid-era messaging to consumers. There’s some combination of altruism and optimism there, but branded lenses we’ve seen have been tasteful and/or utilitarian compared with most TV ads.

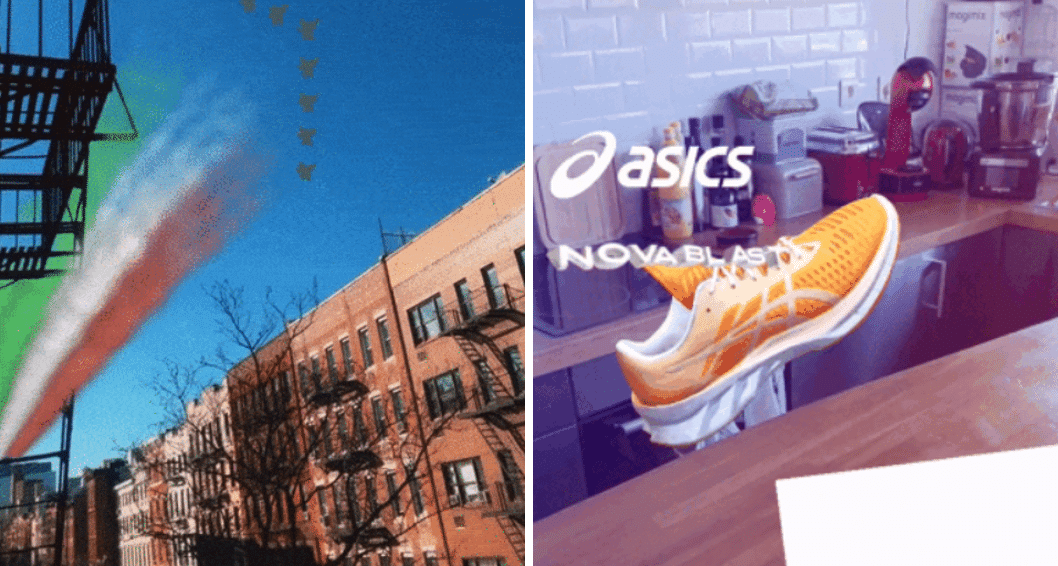

This includes a lens simulation of a fighter-jet flyover from the Italian Air Force. It was meant as a salute to Italians sheltering in place. The lens recreates the flyover itself — including Italian flag vapor trails — and a corresponding face filter to personify the message (as face filters do…).

Beyond upper-funnel branding plays, there’s also usage deltas around lower-funnel action-oriented lens engagement. Specifically, sponsored lens swipe-ups (activating a product try-on or website visit) increased 22 percent in late march versus the pre-Covid late-February baseline.

The campaign example there is Asics’ Atomic-Design powered lens that let users play with a game-like animation starring its Novablast running shoes. As is increasingly happening, this included a “shop now” button that sent users to the Asics site to browse & purchase.

Lockdown-Friendly

Expanding on those two campaigns, AR lenses can span the purchase funnel as we keep saying. The playfulness and propensity for long session lengths can instill brand impression and recall rates (key branding KPIs), while interactive try-ons can boost conversion rates (concrete ROI).

That’s often the case in normal times, but it’s clear now that Snapchat — and AR lenses in general — are lockdown friendly. That stands to reason because of the whimsy and escapism mentioned above. But it’s also because lenses are tied to e-commerce which is itself having a moment.

These continue to be telling figures from Snap, representative shifting demand signals. We’ll circle back with more as we continue to observe “new normal” user data. The current environment could also force new AR perspectives and discoveries that stick with us as things return to normal.

Meanwhile, stay tuned for a report next week from our research arm ARtillery Intelligence that will dive deep on the latest insights and breakdowns of the AR advertising landscape.