![]() “Behind the Numbers” is AR Insider’s series that examines strategic takeaways from the original data of its research arm, ARtillery Intelligence. Each post drills down on one topic or chart. Subscribe or login to access the full library of data and reports.

“Behind the Numbers” is AR Insider’s series that examines strategic takeaways from the original data of its research arm, ARtillery Intelligence. Each post drills down on one topic or chart. Subscribe or login to access the full library of data and reports.

Industry rhetoric about AR’s world-changing status sometimes outweighs evidence that it’s captivating consumers today. Though we see some signals, such as lens engagement figures from Snapchat and others, we’re often “flying blind” when it comes to consumer AR sentiment.

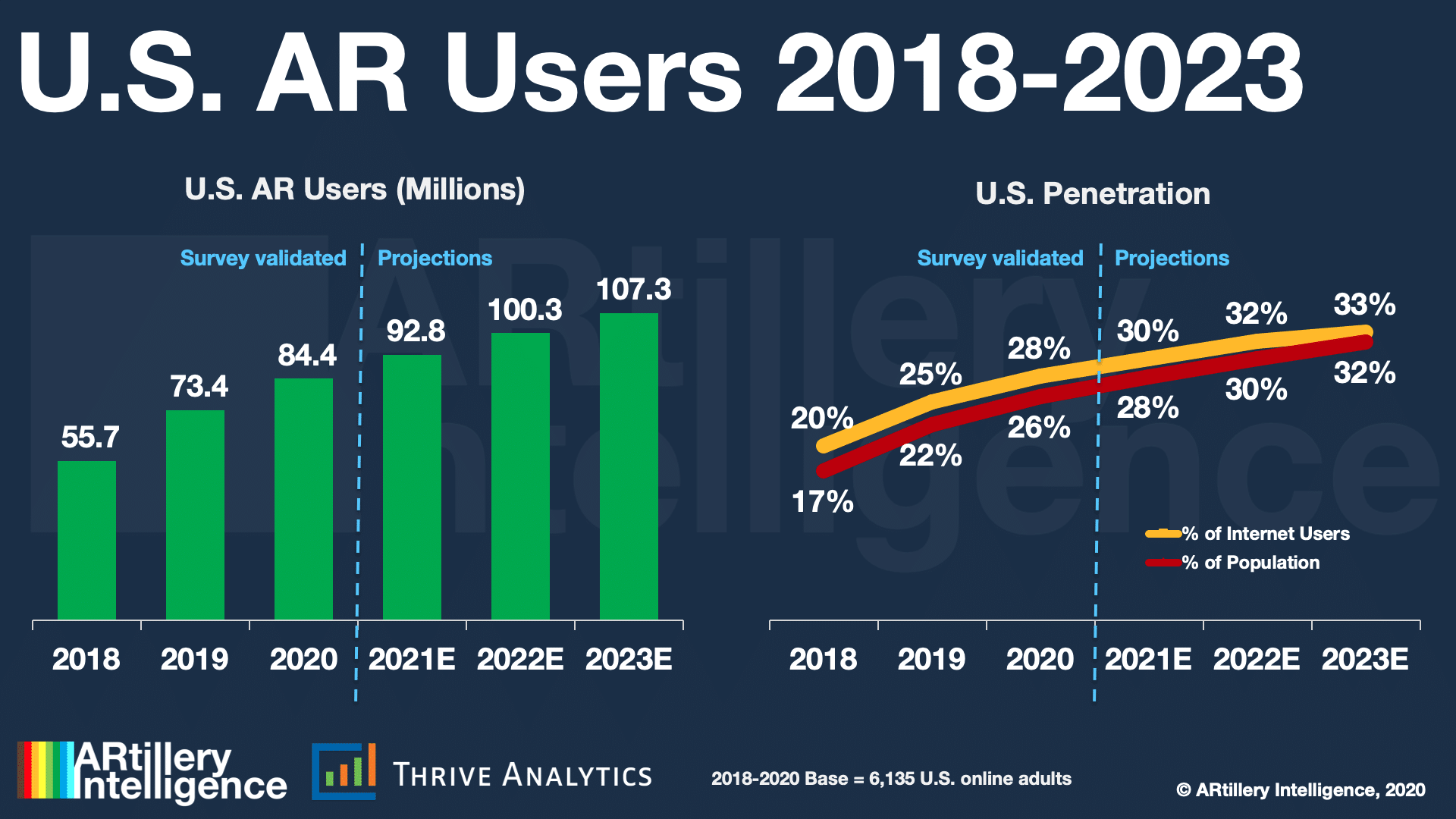

Looking to fill that gap, AR Insider’s research arm ARtillery Intelligence has completed Wave III of its annual consumer survey report. Working with consumer survey specialist Thrive Analytics, it wrote questions to be fielded to 1000+ U.S. adults and produced a report based on the results.

Known as AR Usage & Consumer Attitudes, Wave III, it follows similar reports over the last few years. Three waves of research now bring new insights and trend data to light. And all three waves represent a collective base of 6,135 U.S. adults for robust longitudinal analysis.

Among the topics: How is mobile AR resonating with everyday consumers? How often are they using it? How satisfied are they? What types of experiences do they like most? How much are they willing to pay for it? And for those who aren’t interested in mobile AR… why not?

Instilling Replayability

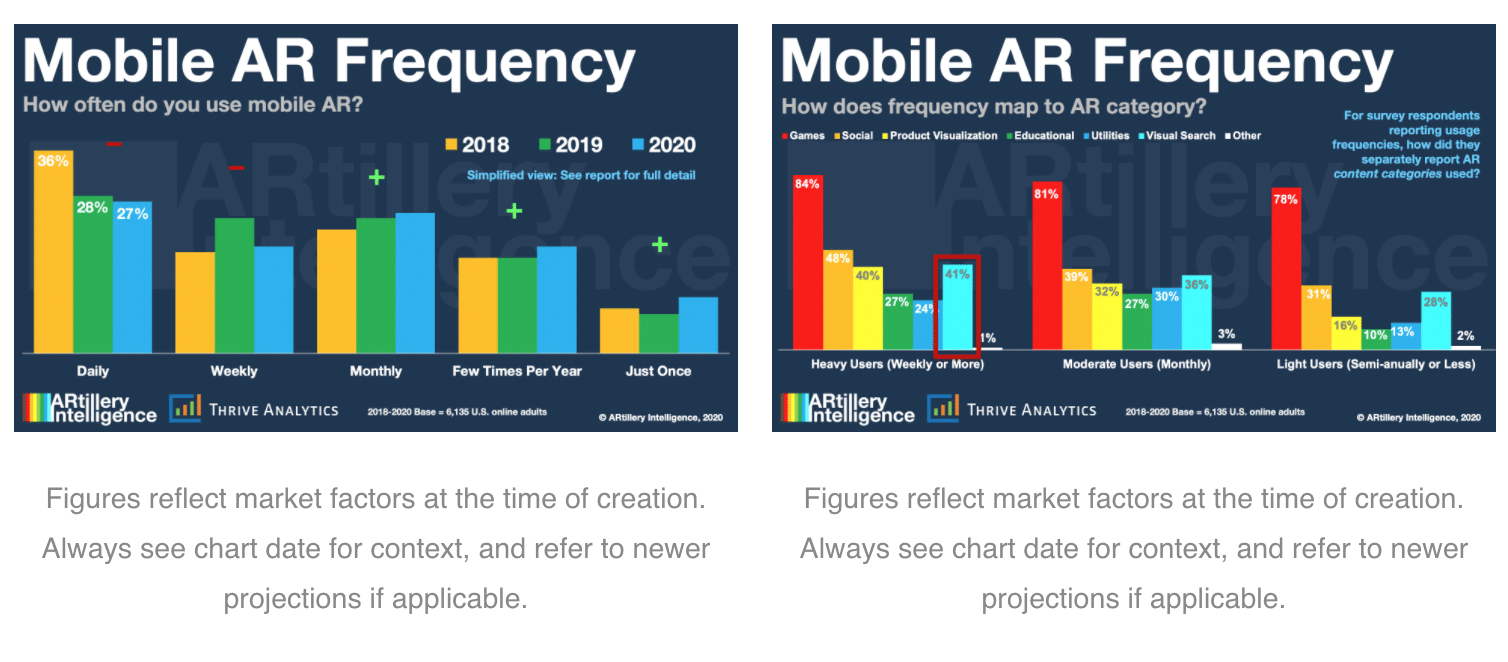

Picking up where we left off in examining consumer AR sentiments, a key variable for mobile AR success is how often it’s used. Due to arm fatigue and other factors, shorter sessions should be counterbalanced by high-frequency. The name of the game is to instill active use or “replayability.”

Mobile AR experiences that fuse the novelty of augmentation with frequent or repeatable activities show the most monetization potential. These behaviors include social messaging, gaming, and utilities like visual search, as explored below. These are things that happen daily or more.

Drilling into the data, 71 percent of mobile AR users are active at least monthly, 46 percent at least weekly, and 27 daily. These are high figures by mobile app standards and indicate that the active-use challenges that often plague the broader universe of mobile apps aren’t as prevalent in AR.

But the bad news is that daily and weekly use are down from 2018 and 2019. This could be due to disappointment that’s set in after the circa-2017 AR hype cycle. Though AR interest in the wake of that period has waned, it should bounce back as AR experiences and acclimation advance.

Drilling Down: Frequency + Category

Staying with the topic of frequency, we can gain additional dimension by combining the variables examined so far in this report. In other words, what AR categories are driving the most repeat usage? By AR categories, we mean main classifications like gaming, social and commerce.

For survey respondents reporting usage frequencies above, how did they separately report the AR content categories they’ve used? Just like overall AR category results, AR gaming leads in various frequency subdivisions. Social AR likewise follows in each frequency grouping.

But going deeper into AR categories at different frequency levels reveals new insights. For example, social AR and product visualization scored relatively high among daily AR users. This indicates these two AR use cases are naturally recurring and can be used to boost engagement.

Visual search had a similar divergence across frequency levels. Its engagement levels are greatest among heavy users (41 percent) compared to moderate (36 percent) and light (28 percent) users. This validates the assertion that visual search is naturally a high-frequency action.

We’ll be back with more report excerpts and tidbits. Meanwhile, check out the full report here.