As we approach a new year, it’s time for our annual ritual of synthesizing the lessons from the past twelve months and formulating the outlook for the next twelve. Notably, when kicking off this thought exercise, we realized that several of the topics look similar to last year.

Though there are lots of developments and new insights, the topical containers that house those insights are beginning to coalesce into standard buckets. We’re talking mobile AR engagement & monetization; AR cloud development; enterprise AR and the gradual march of VR.

This standardization is good news in that it signals spatial computing’s exciting – yet insecure – early days have transitioned to an adolescent period of its lifecycle. We have a firmer grasp on what’s working….versus 2017’s wild speculation on the technology’s world-shifting impendence.

So where is spatial computing now, and where is it headed? What’s the trajectory of each of the above subsegments? This was the topic of the latest ARtillery report, Spatial Computing: 2020 Lessons; 2021 Outlook. It looks back and looks forward, including concrete predictions.

Prediction 1: AR Glasses Inch Forward

Drilling down into one of the report’s predictions, AR glasses will make progress in 2021….but they won’t reach revolutionary status nor inflect (that could start to happen the following year). Smart glasses are of course the AR modality that will unlock the technology’s true potential.

AR glasses have already arrived if you consider deployment in enterprise settings. There, stylistic drawbacks aren’t as much of an issue as they are in consumer markets. There are still form-factor issues such as comfort and heat, but enterprise AR has the early lead in sector spending.

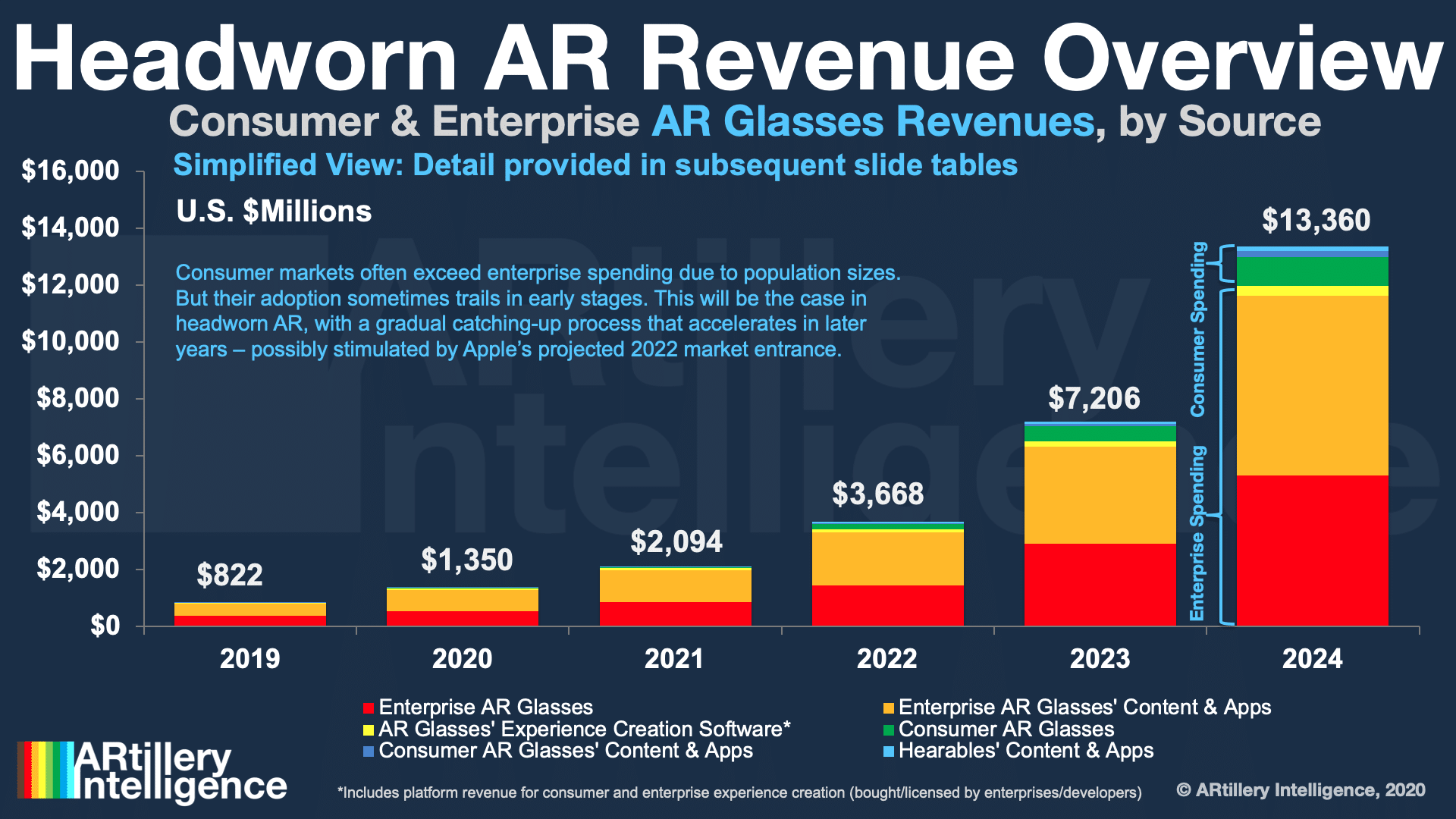

Notably, those spending shares could eventually flip as AR glasses get sleeker and more commercially viable. Consumer markets are generally bigger than enterprise markets due to population sizes, but enterprise-spending often leads in early days of emerging technologies.

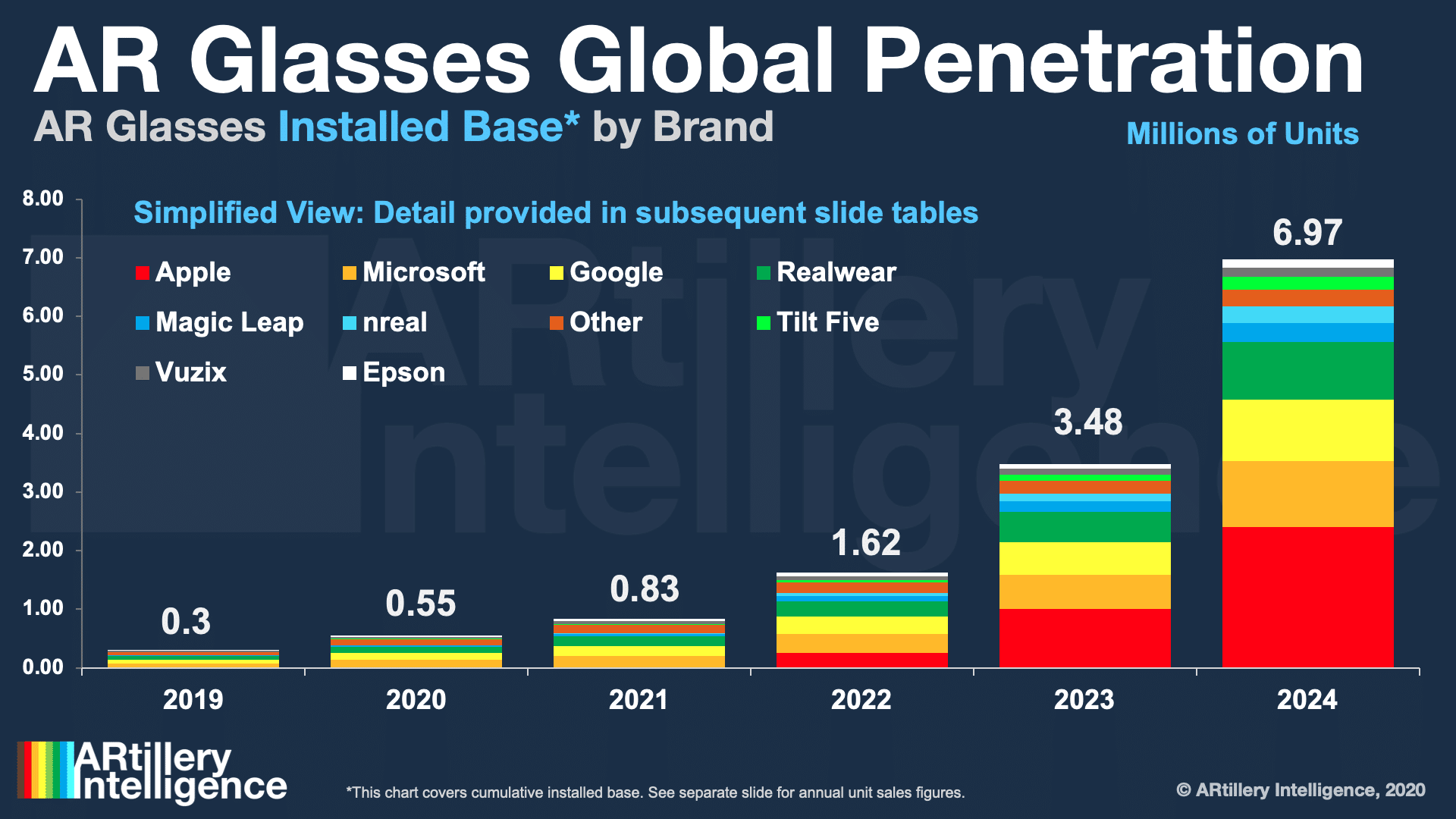

To quantify that, ARtillery Intelligence projects AR glasses spending to grow from $822 million last year to $13.4 billion in 2024. Enterprise spending is 98 percent of that total, but will retract to 90 percent by 2024 and continue to decline until consumer/enterprise trendlines intersect.

But that could take several years, not just due to requisite technical advancements, but also cultural acceptance. As shown in the Google Glass era, cultural receptivity and comfort levels for face-worn hardware (with a camera, no less) will be a years-long uphill climb.

But history tells us if anyone can accomplish that feat of mainstreaming emerging tech – or at least catalyze the process – it’s Apple.

Apple of My Eye

Apple’s track record in mainstreaming emerging tech – also known as its “halo effect” – is the reason why you likely hear so much chatter about its rumored smart-glasses. The stakes are high for the AR industry, as Apple’s eventual moves could accelerate its ability to achieve scale.

But the question is, what’s Apple’s strategy and what will its prospective glasses be and do? Starting with the former, Apple’s AR glasses strategy is driven by similar factors as its wearables play: to future proof its core hardware business in the face of a maturing smartphone market.

Apple AR glasses could accomplish this by both propping up and succeeding the aging iPhone. The former happens as it creates reliance on the iPhone for local compute. In other words, the iPhone gains importance – and user incentive to upgrade – if it powers your smart glasses.

The iPhone succession plan is meanwhile accomplished through a suite of wearables that replaces the iThings at the center of our computing lives. That could mean line-of-sight graphics through AR glasses, spatial audio from AirPods PRO, and biometrics from Apple Watch.

This theory fits the profile for Apple’s signature multi-device ecosystem play. Its marketing will emphasize that the whole is greater than the sum of its parts, so you should own several devices (sound familiar?). In this way, AR glasses will be a key puzzle piece in Apple’s future road map.

Concrete Projections

To synthesize all of the above into a concrete set of potential market outcomes, here’s what we think will happen in 2021:

— Consumer AR glasses won’t arrive en masse in 2021 nor reach anything resembling ubiquity.

— Still, there will be progress made in key areas like consumer acclimation.

— That will continue to happen through smartphone-based AR, as well as the continued growth in wearables, including hearables.

— The latter’s momentum will sustain, reaching 145 million units in 2021. In doing so, they’ll help acclimate consumers to head-worn sensors.

— More importantly, we predict that Apple or Google will begin to make hearables more functional as “audio AR” devices by developing more intelligent apps that augment reality through contextually-relevant and spatially-aware audible cues.

— This could be followed by third-party SDKs to scale development, akin to what Apple has done with iOS-orbiting SDKs like tvOS and watchOS.

— As for the timing of Apple’s AR Glasses, we could see them arrive in 2022, meaning there’s a chance we’ll see an announcement in Q4 2021 (as Apple’s hardware announcement cycles go). But we’re not holding out for that. 2022 is likely when we’ll get to see them unveiled (press leaks notwithstanding).

We’ll pause there and circle back in the next installment with another prediction from the report. Meanwhile, check out the full report here, and get more color in the video below.