One question that looms large these days is what the post-Covid world will look like. How much of the past 18-months — for better or worse — will stick with us in the form of new habits? The “better” part includes digital transformation that Covid has accelerated in several areas.

For example, the world has collectively raised its game with respect to digital video conferencing savvy. Brands and retailers have meanwhile gotten savvier when it comes to eCommerce functionality — including online shopping and local fare such as curbside pickup.

But where does AR sit in all of this? In the industrial enterprise, the technology aligns with remote work given capabilities like “see what I see” remote support. And for consumers, AR helps visualize products in eCommerce, thus bringing back some degree of product dimension.

There’s evidence that the latter has gained traction over the past 16 months. It’s growth comes from piggybacking on Covid-driven eCommerce inflections, but it’s also sustained on its own merits in letting consumers gain a greater sense of product confidence before buying.

That buyer confidence is a key factor, as it drives eCommerce performance. Specifically, AR can boost conversions by as much as 300 percent and reduce returns by as much as 40 percent. These KPIs in turn reinforce AR investments for the brands and retailers adopting it.

New Evidence

In addition to the above evidence for AR’s Covid-era lift, a new report from Snap and Foresight Factory further validates its ongoing traction. Based on surveying consumers (n=20,000), it’s clear that AR has grown in the Covid-era….and is well-positioned for a post-Covid world.

Drilling down on survey findings, here are the highlights:

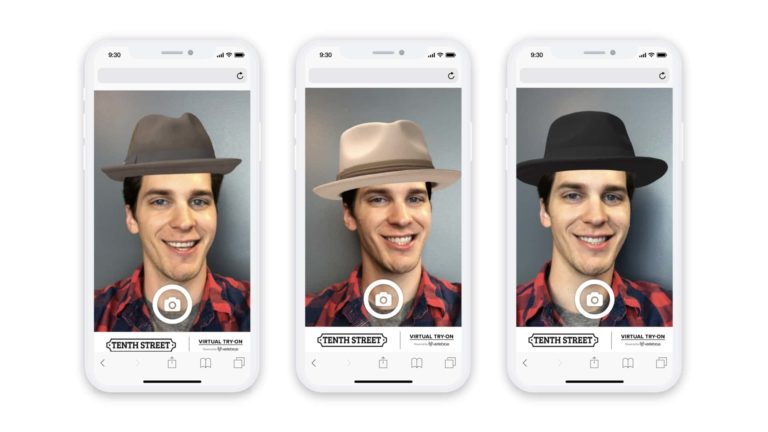

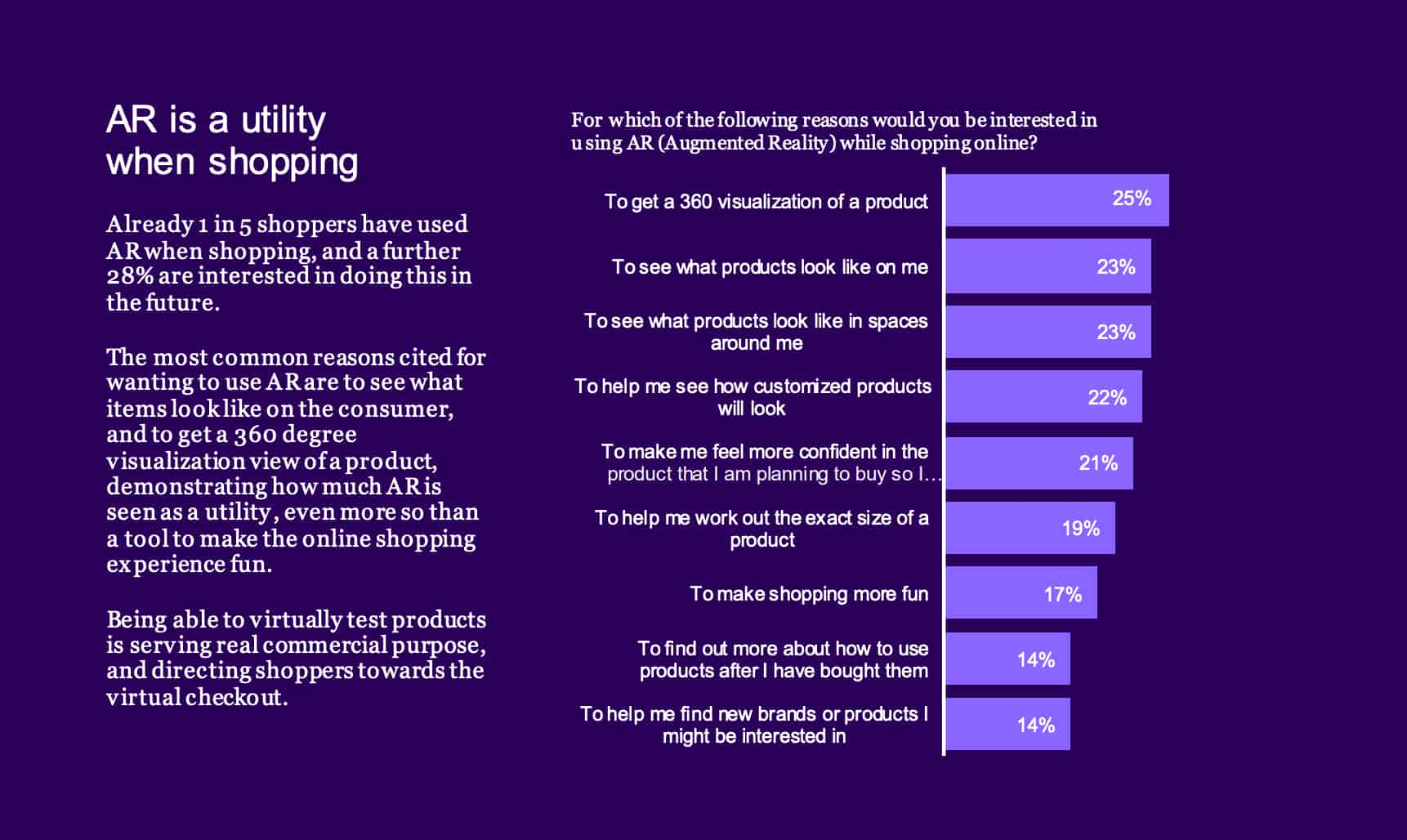

— 1 in 5 consumers have used AR when shopping, and 28 percent are interested in doing so in

the future. Top use cases include virtual try-ons (e.g. clothes), and visualizing products in one’s space (e.g. home goods).

– 62 percent of U.S. consumers who have used AR during their shopping flow claim that it influenced a purchase.

– 2 in 5 U.S. shoppers expect AR to be available to visualize products when they’re shopping for clothes, beauty, furniture, luxury or cars.

– 4 in 10 U.S. shoppers say that not being able to to see and try on products is the biggest detriment to online shopping… but this could be alleviated by AR features from retailers and brands.

– As for AR-infused in-store shopping, 35 percent of US consumers would go out of their way to visit a store if it had interactive virtual services such as smart mirrors for trying on clothes or makeup.

– Based on current momentum and other macro factors, Foresight Factory projects a 37 percent increase in Gen-Z shoppers in the U.S. who use AR before buying a product.

Mere Exposure Effect

These results bring us back to the question of the post-Covid world. Will Covid-driven AR shopping habits sustain as permanent behavior through a classic “mere exposure effect?” Consumers have gotten a taste for more immersive shopping and some may never go back.

In addition to well-known eCommerce benefits, AR supports “touchless” in-store shopping as indicated in the survey results. Smart mirrors enable virtual try-ons, while mobile AR enables at-home product visualization….thus lessening trips to the store or time spent in-aisle.

But when it comes to these in-aisle interactions, much will hinge on consumer sentiments and health guidance. Will consumer confidence be shaken indefinitely when it comes to in-store shopping? Or will we go back to pre-Covid mindsets and shopping habits eventually?

The likely outcome is a “hybrid” post-Covid world, where positive new habits discoveries can be cherry-picked for permanent implementation. AR is on that list of tools that will help consumers shop smarter. And retailers who meet that demand will have an edge in the post-Covid era.

Meanwhile, this is all underscored by existing growth in “camera commerce.” According to our research arm, ARtillery Intelligence, AR will influence $57.8 billion in physical goods spending by 2025. That will be a moving target so we’ll keep watching and reporting back.