Like many analyst firms, market sizing is one of the ongoing practices of AR Insider’s research arm, ARtillery Intelligence. A few times per year, it goes into isolation and buries itself deep in financial modeling. One such exercise recently zeroed in on headworn AR revenues.

This takes the insights and observations accumulated throughout the year and synthesizes them into hard numbers for spatial computing (see methodology and inclusions/exclusions). It’s all about an extensive forecast model coupled with rigor in assembling reliable inputs.

So what did the latest headworn AR forecast uncover? At a high level, revenue is projected to grow from $1.59 billion in 2020 to $17.7 billion in 2025, a 61.8 percent CAGR. This sum consists of AR glasses consumer and enterprise spending in hardware and software.

Drilling down, our latest Behind the Numbers installment zeroes in hardware unit sales. How many AR glasses are shipping today? And how is that projected to grow over the next few years? These are key questions as hardware is the starting point for an ecosystem in any emerging tech.

Starting Point

Starting at the top, AR headsets are projected to grow in unit sales from 250,000 in 2020 to 4.03 million in 2025. That correlates to an installed base of 8.53 million units in market by 2025. These totals include enterprise and consumer hardware, the former leading in early years.

Specifically, enterprise accounts for 227,000 units in 2020, growing to 1.87 million in 2025. Consumer AR glasses will trail enterprise in early years but will pull ahead in later years with 2.16 million units projected in 2025. This makes consumer markets the long-run AR revenue leader.

Why is this? Consumer markets are generally larger than enterprise markets, though they can often trail in early stages. That pattern is pronounced in AR where the hardware isn’t stylistically viable yet for consumer markets, causing them to lag relative to style-agnostic enterprises.

Those consumer AR market barriers will alleviate over time through improving standards and specs for consumer-grade smart glasses (size, weight, style, etc.). Another accelerant that accounts for the steep growth above is the ultimate wild card in the AR glasses world: Apple.

In Perspective

Speculation on the timing and substance of Apple’s AR market entrance could fill its own article. For now we’ll say that it will likely dominate consumer AR market share due to a current void, and Apple’s track record in mainstreaming emerging tech through its signature halo effect.

There will also be success stories in specific vertical markets such as Tilt Five’s AR gaming-focused approach. We could then see other purpose-built hardware develop over time in different verticals and use cases as the AR market matures. Snap Spectacles also could be formidable.

On the enterprise side, sales will be driven by strong ROI for AR-guided productivity in areas like assembly, maintenance, and field service. Growth will also be driven by military applications, including Microsoft’s $22 billion U.S. Army’s contract (though its had its ups and downs).

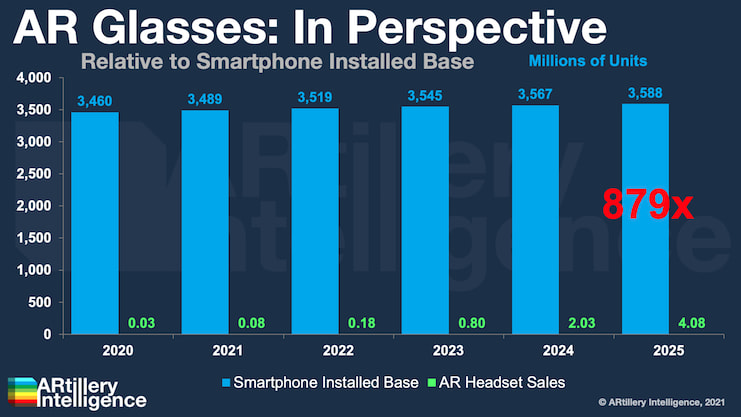

But putting all of the above into perspective, the 8.53 million installed base in 2025 is dwarfed by the global smartphone installed base by about 879 to 1 (see chart above). So though AR glasses could grow fast and from a small base, they have a ways to go for mainstream penetration.

We’ll keep tracking the sector’s performance as it makes that years-long ascent…