Spatial computing – including AR, VR, and other immersive tech – continues to alter the ways that we work, play, and live. But there have been ups and downs, characteristic of hype cycles. The pendulum has swung towards over-investment, then towards market correction.

That leaves us now in a sort of middle ground of reset expectations and moderate growth. Among XR subsectors, those seeing the most traction include AR brand marketing and consumer VR. Meta continues to advance the latter with massive investments and loss-leader pricing.

Beyond user-facing products, a spatial tech stack lies beneath. This involves a cast of supporting parts. We’re talking processing muscle (Qualcomm), experience creation (Adobe), and developer platforms (Snap). These picks and shovels are the engines of AR and VR growth.

So how is all of this coming together? Where are we in XR’s lifecycle? And where are there gaps in the value chain that signal opportunities? This is the topic of ARtillery Intelligence’s recent report Reality Check: the State of Spatial Computing, which we’ve excerpted below.

Intent Signaling

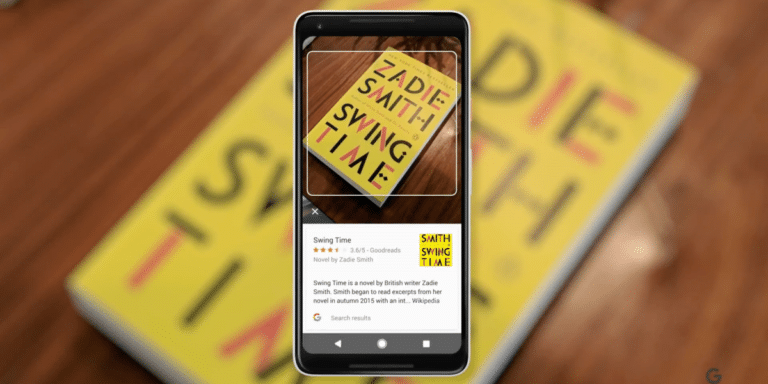

After examining social AR lenses in the last installment, we switch gears to another flavor of AR: visual search. It lets users point their phones at objects to identify them. This physical act carries strong “intent signaling,” which is the same factor that makes web search so lucrative.

Google calls visual search “search what you see.” It brings the on-demand utility of web search and puts a visual spin on it. In that way, visual search inherits the value of web search, while finding unique and native value that flows from its visual and proximity-based use case.

For example, use cases showing early promise include shopping, education, and local discovery. Users can see details about a new restaurant by pointing a phone at it. This could be more natural and intuitive than the traditional act of typing or tapping text into Google Maps.

For all these potential use cases, common attributes include broad appeal and high frequency… again, just like web search. These factors give visual search a large addressable market in both quantity of users and volume of usage – which are ingredients for killer apps.

These use cases have another common attribute: shopping. The endgame is monetizable visual searches for shoppable items. Holding up one’s phone to identify real-world items flows naturally into transactional outcomes or brand marketing. And that’s what Google is all about.

Amplifying these benefits is another factor: Generation Z. It has a high affinity for the camera as a way to interface with the world. And this will only grow as Gen Z gains purchasing power and phases into the adult consumer population. This makes visual search a future-proofing move.

Knowledge Graph

As noted, Google is primed for visual search. Its knowledge graph – built from 20+ years as the world’s search engine – offers a training set for AI image recognition, including consumer products (Google Shopping) general interest (Google Images), and storefronts (Street View).

Google is also highly motivated to lead the way in visual search. Along with voice search, visual search helps the company boost query volume, which correlates to revenue. That motivation translates to investment, which will accelerate the development of visual search overall.

But Google isn’t alone. Pinterest Lens and Snap Scan are keen on visual search, with approaches that trace back to their core products. To that end, Google will work towards “all the world’s information,” while Pinterest works with food & style, and Snap prioritizes fun & fashion.

As this materializes, ARtillery Intelligence projects that visual search will grow from $166 million last year to $2.26 billion in 2026. Though it’s under-monetized today, it will grow to a leading share of mobile AR ad revenue by 2026, driven by the high-intent use case noted above.

Why is it under-monetized? It’s less established than other AR ad formats such as social lenses. Visual search players are also experimenting with UX design and user traction before they monetize. But there’s momentum, as Google alone sees 10 billion visual searches per month.

We’ll pause there and circle back in the next report excerpt with the snapshot of another XR subsector and what we learned from it in the past year. Meanwhile, check out the full report here.