One of the biggest misperceptions in the tech world is that VR is in the gutter. Some have even pronounced its time of death. These sentiments represent the pendulum swing from VR’s overhyped status circa 2016. It didn’t fulfill world-changing proclamations trumpeted at the time.

Overblown expectations aside, VR is doing just fine and is growing at a healthy pace for an emerging technology that faces practicality headwinds. In fact, signals tracked by our research arm ARtillery Intelligence, indicate VR is on an upswing after declining about 10 percent in 2020.

That decline was mostly due to Covid-inflected supply-chain impediments. But demand remained strong. And that demand was given a place to go when Oculus Quest 2 Launched. Not only did it scratch the right quality/price itch, but Facebook made moves to beef up its supply chain.

Evidence of sales surges could be seen after Quest 2 launched. The broader VR market likewise emitted positive signs, which we recently rounded up. Now just a month later, there’s already a critical mass of milestones for another VR data roundup. So here we go again…

Report Card

Jumping right in, we’ve aggregated several VR data points and milestones for this week’s Data Dive. These follow last month’s similar roundup, making this VR’s January report card.

— In last week’s Facebook earnings call, the company revealed that its non-ads revenue more than doubled (165 percent) year-over-year in Q4. This was driven mostly by Quest 2 sales.

— This follows the announcement earlier this month that Oculus Quest 2 surpassed Quest 1’s active user base in just its first seven weeks in the market.

— In the same Facebook earnings call, it announced that more than 60 Oculus Quest titles (about 30 percent of the Oculus Store) have surpassed $1 million in revenue, up from 20 titles that reached that milestone in March.

— Generally aligned with the above, The Venture Reality Fund’s Tipatat Chennavasin reported earlier this month that more than 20 percent of Oculus store titles have reached $1 million in revenue.

— Speaking of game revenue, The Walking Dead: Saints & Sinners exceeded $29 million across all VR platforms in its first year.

— While announcing I Expect You to Die 2 this week, Schell games revealed that the first title booked $6 million in lifetime revenue — a total that stood at $2 million on Quest alone in June.

— Valve announced earlier this month that monthly connected VR headsets on Steam VR have exceeded 2 million.

— Valve also announced retrospective 2020 stats: SteamVR tallied 1.7 million new VR users in 2020, while total VR sessions totaled 104 million, average VR playtime was 32 minutes (up 30 percent from 2019) and VR game revenue grew 71 percent year-over-year (39 percent from Half-Life: Alyx alone).

— On the hardware front, Valve announced this week that the Index is among Steam’s five best-selling products for 13 weeks in a row… despite supply shortages.

— Soon after securing $20 million in Series C funding last month (covered in our last roundup) RecRoom announced this month that it surpassed 1-million monthly active VR users.

— Total Quest games reviews — a proxy for game sales volume — have exceeded 250,000 and surpassed Oculus Rift-based game reviews after less than two years in the market.

— Less indicative of VR revenue growth (but still interesting), Beat Saber and Job Simulator were named as 2020’s top VR downloads on PSVR.

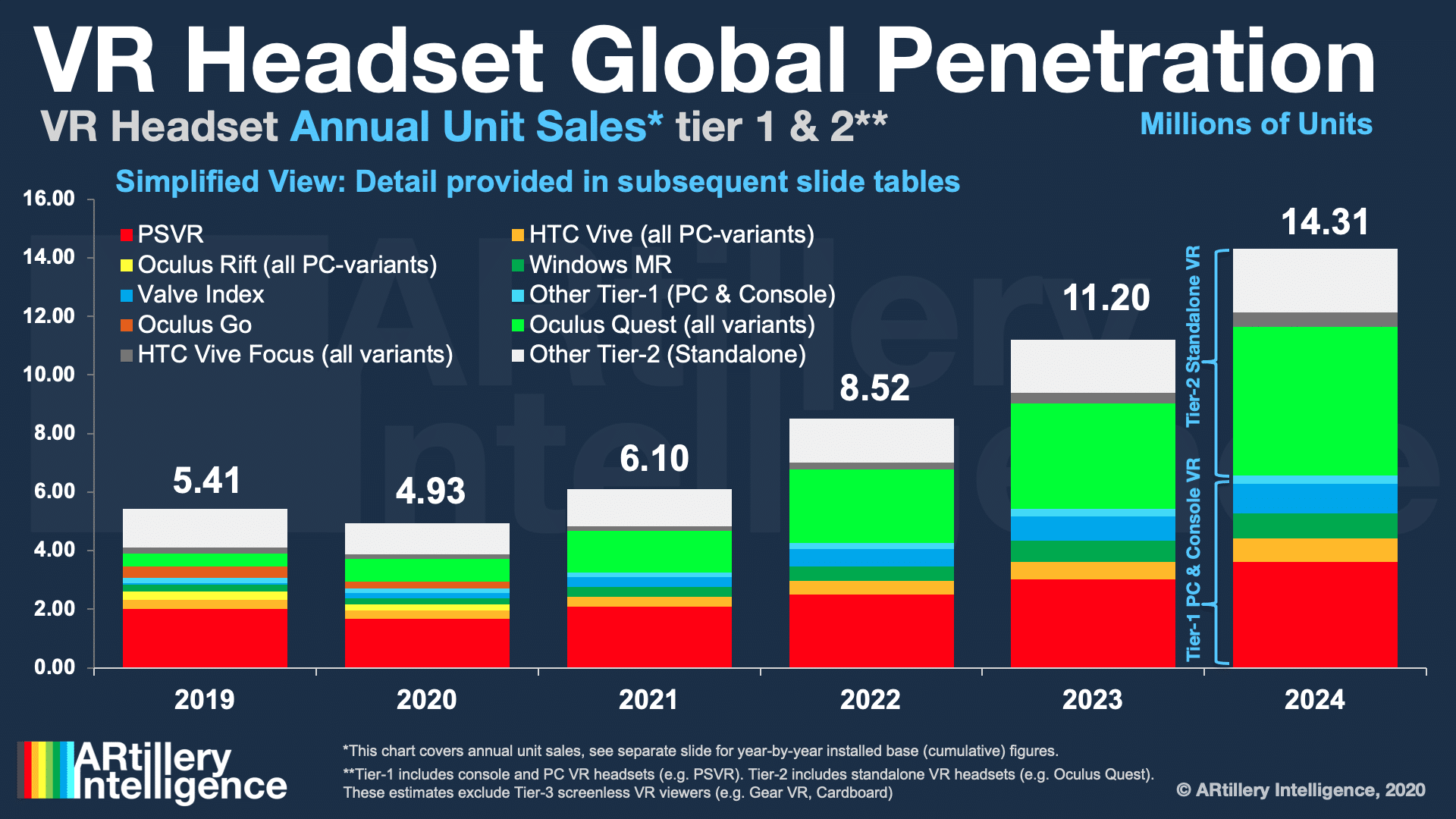

— Stepping back for additional context on the trajectory of VR industry levels, below are projections from our research arm ARtillery Intelligence that indicate hardware (unit) growth and market shares.

Telling Signs

Among all of the above VR milestones — an admittedly disparate array — those that were announced last week during Facebook earnings are perhaps the most impactful. Facebook continues to lead the way in VR so its traction represents an important temperature reading.

Unpacking those results, the most telling data point is the impact that VR had on Facebook’s non-ads revenue, where Oculus is counted. Though unit sales details weren’t revealed (as usual), the magnitude of VR’s impact is clear given Quest 2’s dominant part in driving 165 percent growth.

50 Quest titles exceeding $1 million is also important. This quantifiable success for game developers means a clear path to revenue in VR content creation. That will in turn incentivize more content creation (and venture funding), which is needed to get the VR flywheel spinning.

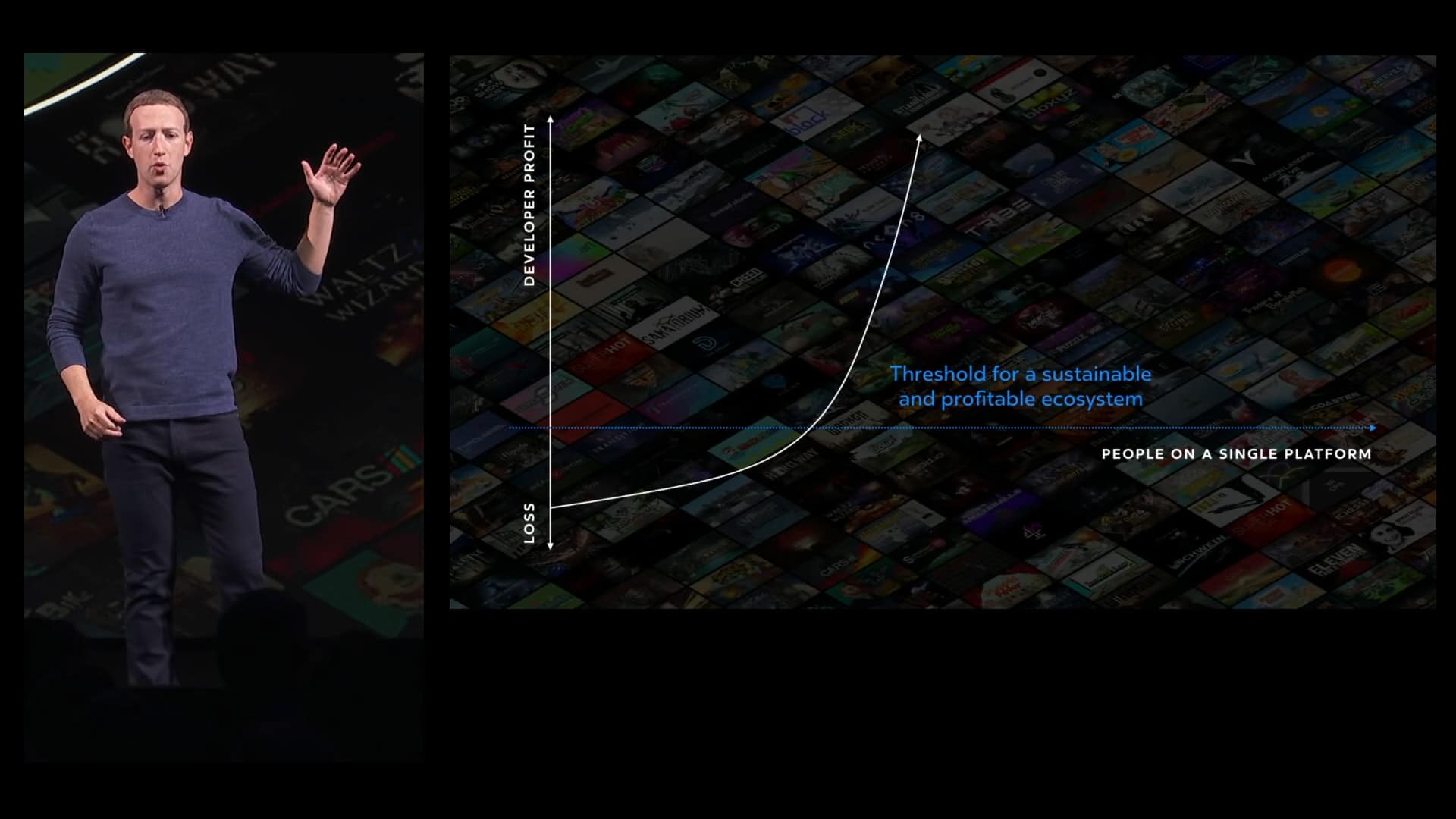

Mark Zuckerburg often repeats this point and did so last week. There’s a virtuous cycle of content that drives hardware sales, which in turn incentivizes more content… and around we go. For a fully actualized content ecosystem, he says Facebook needs an installed base of 10 million units.

“The big question is what is it gonna take for it to be profitable for all developers to build these large efforts for VR? To get to that level, we think that we need about 10 million people on a given platform. That’s the threshold where the number of people using and buying VR content makes it sustainable and profitable for all kinds of developers. And once we get across this threshold, we think that the content and the ecosystem are just going to explode.”

Ongoing Excercise

An installed base of ten billion is a far cry from the famous “1 billion” figure that Zuckerberg stated as VR’s goal at the 2017 Oculus Connect 4. ARtillery pegs Quest’s lifetime sales at about 1.5 million units. As that accelerates, it could reach 10 million in-market units in the next 3-5 years.

Speaking of forecasting, we’ll circle back in the next few weeks to estimate Quest Q4 sales based on last week’s Facebook disclosures (like this). Using known quantities to devise unknown ones is an important and ongoing exercise to size up sales figures in VR’s early and uncertain times.