Editor’s note: ARtillry Intelligence produces global forecast updates twice per year. See the latest figures here.

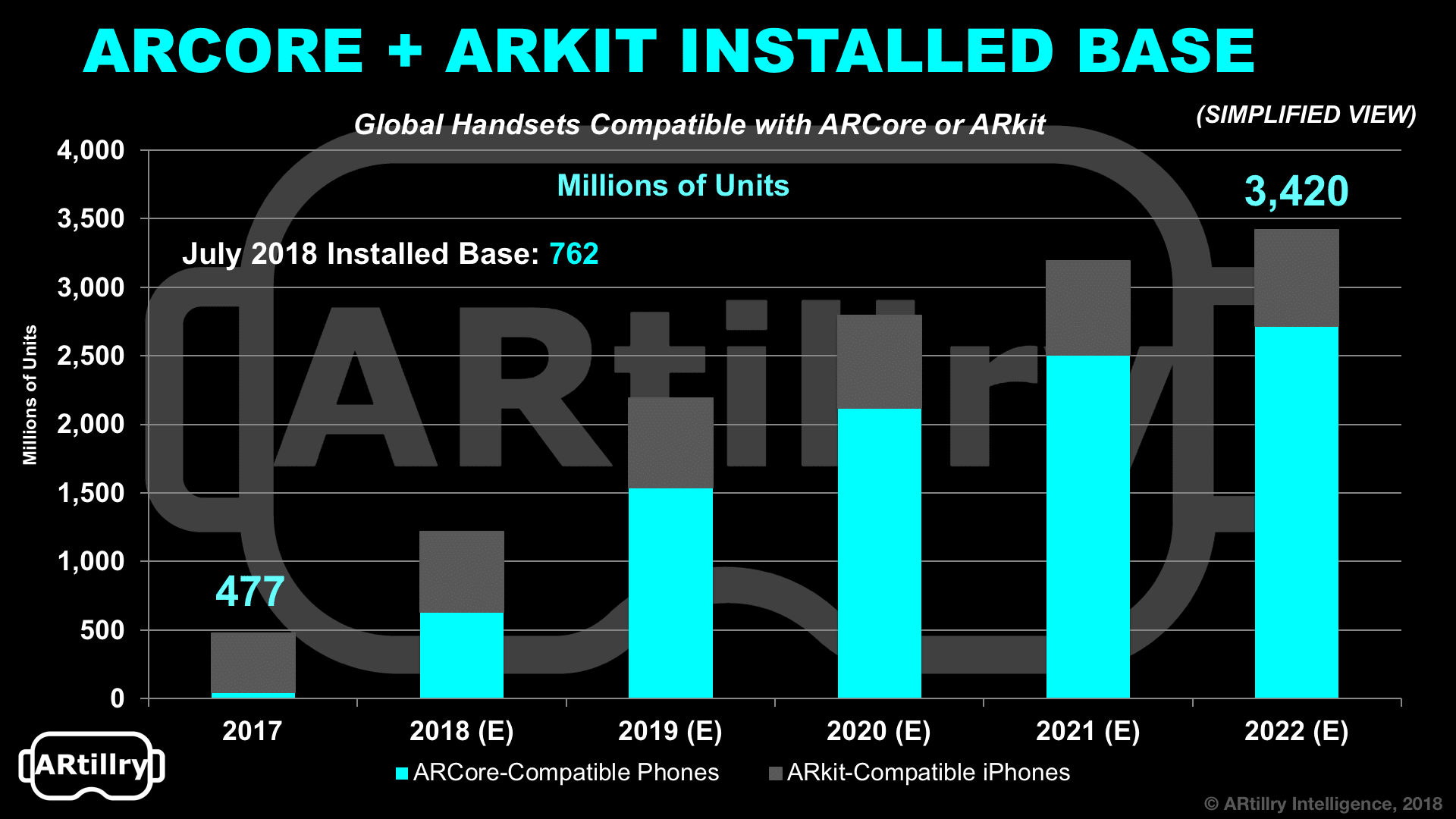

There’s been a lot of excitement over mobile AR. But to really quantify the opportunity requires a deeper look at the installed base of AR-compatible devices. So ARtillry set out to do just that in its latest report, ARCore & ARkit: The Acceleration of Mobile AR.

The verdict: There will be almost a half billion AR-compatible smartphones by the end of 2017 and 3.4 billion by 2020. That may seem like steep growth, which it is, but it’s a function of hardware replacement cycles for iOS and Android (2.5 years), which will turn over rapidly.

The Tortoise and the Hare

One thing that’s clear is Apple has the short-run reach advantage. This is due to a more unified hardware and software set that supports wider ARkit compatibility. But Google will have the longer-term scale as ARCore compatibility cycles into the larger Android universe.

That will take longer for ARCore, given a fragmented base of Android devices that makes it difficult for Google to mandate AR-capable optics, and to push software updates comprehensively. In fact, only 16 percent of Android devices usually run OS versions released in the previous year.

ARtillry’s forecasting involves a unit-penetration model based on cumulative smartphone sales that go back 10 quarters (average replacement cycle), while also factoring in AR compatibility. That means A9 chips (or greater) for ARkit, and Android 7.0 (or greater) for ARCore.

Beyond OS, there are hardware specs, such as optics and sensor calibration. Currently the Pixel, Pixel 2 and Samsung Galaxy S8 are compatible with ARCore but we’ll see more OEMs comply over time, starting with Huawei, Asus and LG. For ARkit, iPhones 6s or later have the goods.

Quality vs. Quantity

There are also qualitative differences between ARCore and ARkit that will determine positioning. It won’t be a winner take all market, just as iOS and Android have coexisted for years. And there’s evidence they’ll have some compatibility, or at least portability of graphical assets.

But they’ll still compete on many levels, and there are signals that indicate competitive differentiation on both sides. Google has greater scale and a technical lead from years invested in Tango. But Apple has more control over the hardware in its classic vertical integration.

ARkit also has technical advantages in the iOS development stack (i.e. Metal and Swift), which integrate elegantly with ARKit. But ARCore has a broader arsenal of lower-friction development tools (Tilt Brush and Blocks) and support from adjacent software (Daydream and Lens).

ARkit and ARCore also carry their parents’ DNA. For Apple, it’s all about apps; for Google, the web. For developers, that means ARCore could reach more users, but ARkit could be more monetizable though standard app revenue models (i.e. downloads, in-app purchases, etc.).

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.