![]() This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

This post is adapted from ARtillery Intelligence’s report, AR Advertising Deep Dive, Part I: The Landscape. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

AR continues to evolve and take shape as an industry. Prominent sectors include industrial AR, social, gaming, and shopping. But existing alongside all of them is AR advertising. This includes paid/sponsored AR lenses that let consumers visualize products on “spaces & faces.”

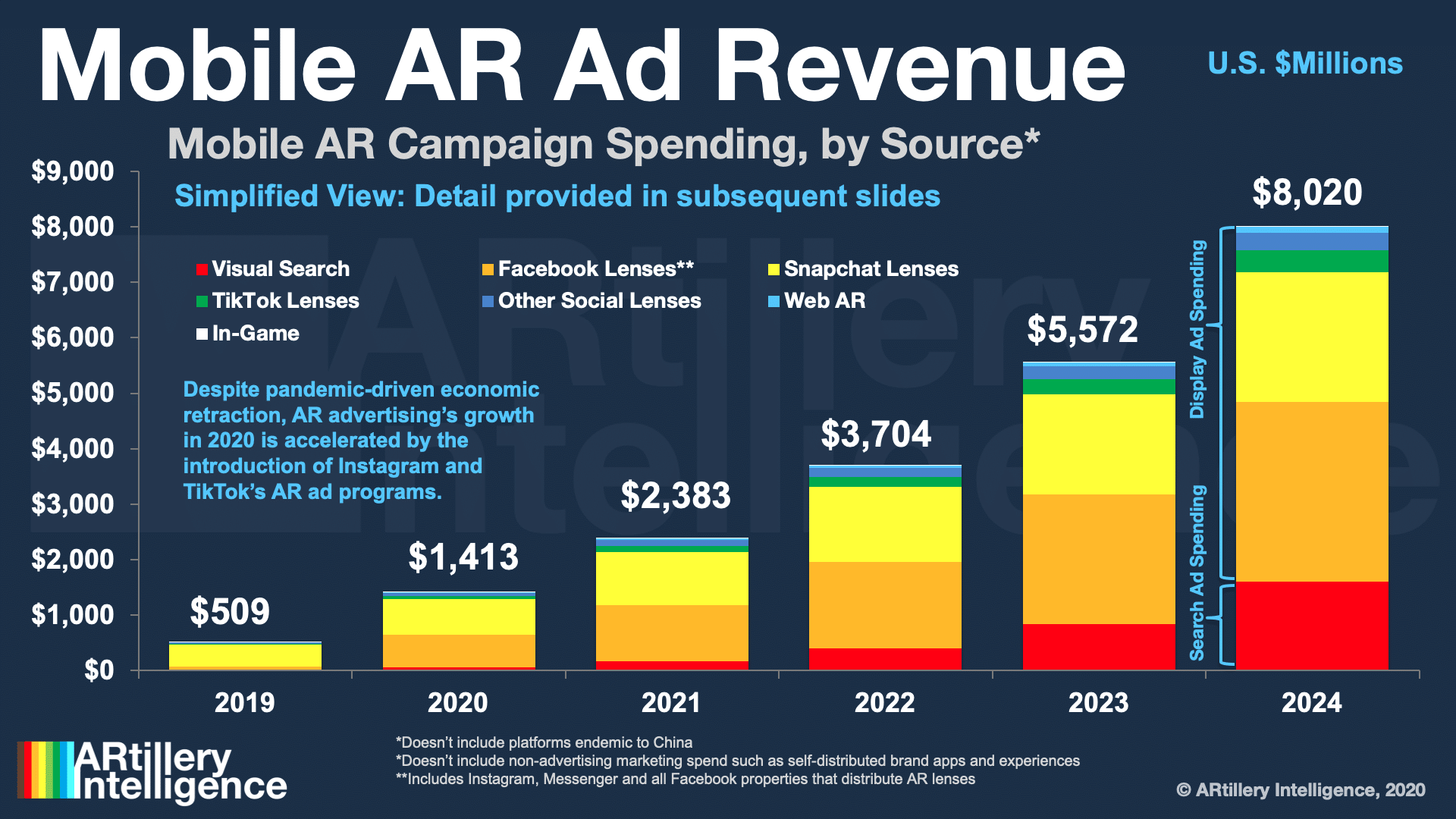

Advertising is one of the most lucrative AR subsectors, on pace to reach $1.41 billion this year and $8.02 billion by 2024. These figures measure the money spent on sponsored AR experiences with paid distribution on networks like Facebook and Snapchat.

As we’ve examined in past reports, the factors propelling this revenue growth include brand advertisers’ growing affinity for AR. Its ability to demonstrate products in immersive ways resonates with their creative sensibilities, transcending what’s possible in 2D formats.

Beyond that high-level appeal, there’s a real business case. AR ad campaigns continue to show strong performance metrics. This was the case in “normal” times and has accelerated during the COVID era, when retail lockdowns compel AR’s ability to visualize products remotely.

Level Setting

Picking up where we left off last week, we’ll pause to step back and define “AR advertising.” It involves paid media placements that allow consumers to activate their smartphone cameras and superimpose branded animations on the real world for promotional purposes.

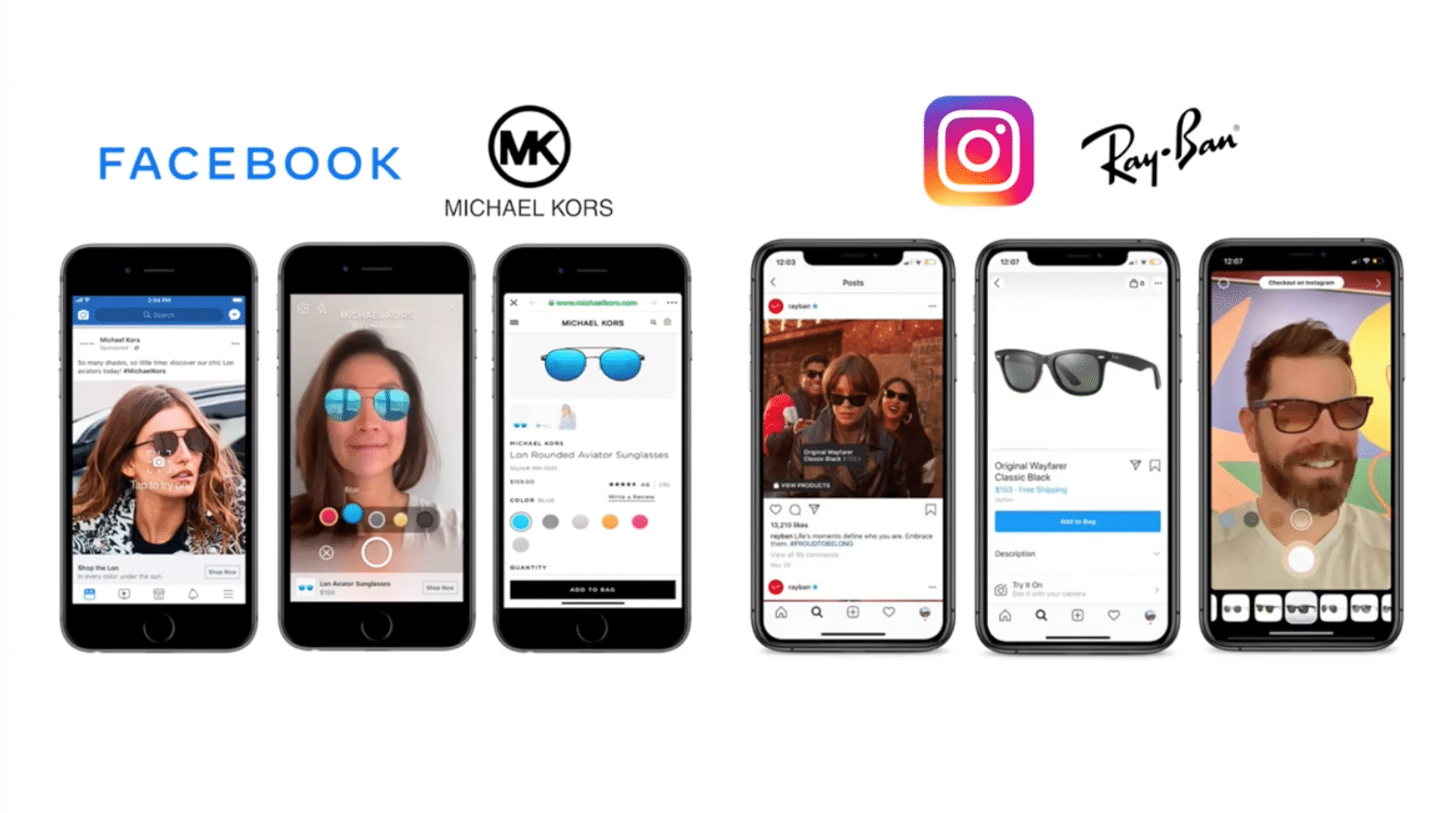

To further clarify, this involves paid placements to promote and distribute AR experiences, such as sponsored AR lenses in Facebook and Snapchat. It doesn’t include self-distributed AR within a company or brand’s own apps, such as AR furniture visualization in the IKEA Place app.

The latter falls under the category of AR commerce. These are related but separate areas. AR advertising of course leads to commerce, but it’s a different area of spending (quantified in the above chart) in terms of how companies budget and execute promotional strategies.

To put it another way, AR advertising and commerce flow into each other, just as advertising’s goal is to drive commerce in the ways we’ve examined. But commerce can also happen outside of paid ad campaigns, such as a company’s own app, web properties, and self-distributed AR.

Creative Sensibilities

AR advertising’s revenue growth is being driven by a few key factors. One is that brands are attracted to the technology’s ability to demonstrate products in immersive ways. That appeals to their creative sensibilities – erstwhile stuck in 2D media and confining formats like mobile banners.

Adoption is also driven by results. There’s a feedback loop of campaign performance, results and ROI. This causes AR ad investment to grow through recurring campaigns among brand advertisers, as well as new entrants that hear about its effectiveness through case studies.

“We’ve shown in our first test of AR ads that the AR version of the ad, when A/B tested against a non-AR ad, drives statistically-significant more conversion,” Facebook’s Elise Xu said at an AWE Europe event. “The next step is making the creation of these assets far easier and cheaper.”

Another influential factor that’s driving AR advertising is its ability to span the consumer purchase funnel. It’s conducive to upper-funnel reach and lower-funnel response. This is a relatively rare attribute in advertising media, as a sliding scale exists between endpoints of the funnel.

Best of Both Worlds

Drilling down on funnel stages, upper-funnel advertising includes things like TV, newspaper and billboard advertising: it’s all about reach and brand awareness. Lower funnel advertising includes things like search: it’s all about high-intent action, but it’s not optimal for brand awareness.

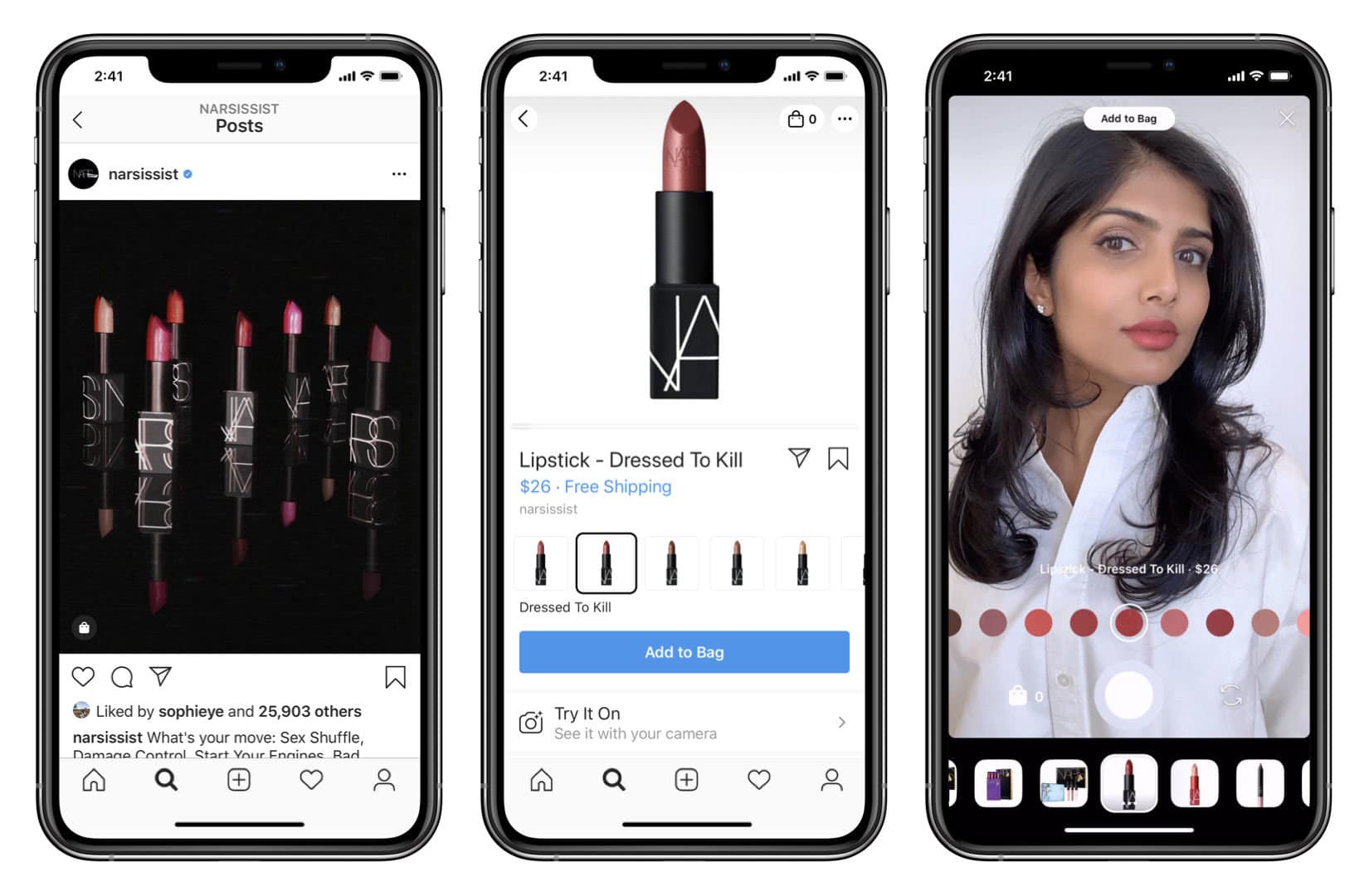

AR can span the funnel by achieving high-reach distribution in places like Facebook’s News Feed and Snapchat’s Lens Explorer. From there, it can achieve high-performance when users activate immersive product try-ons, then convert to purchasing items on the spot.

That last step in the funnel — the actual transaction — is the most impactful. AR’s inherent visualization can boost these conversion rates, which are also accelerated by transactional functionality that’s increasingly incorporated into lens-forward social channels like Instagram.

We’ll pause there and circle back next week with more. Meanwhile, to demonstrate AR campaigns that map to these funnel stages (and some that combine them), our research arm ARtillery Intelligence recently published a report on AR advertising case studies. Check it out here.