This post is adapted from ARtillry’s latest Intelligence Briefing: Mobile AR: App Strategies and Business Models. It includes some of its data and key takeaways. More can be previewed here and subscribe to access the full report.

Augmented Reality (AR) comes in various forms, such as smartphones and smart glasses. Those are further segmented into consumer and enterprise uses. But the point along that spectrum that’s gained the most traction is consumer-geared mobile AR, utilizing the smartphones we all carry.

Apple’s ARkit and Google’s ARCore have democratized mobile AR with app-building tools, while Pokémon Go and Snapchat put it on the map with mainstream-friendly AR features. Though these apps aren’t “true AR,” it doesn’t matter: they’ve done AR a favor by supplying its gateway drug.

These early AR apps have also done the industry a favor by beginning to validate product and revenue models. What AR features do consumers want to use? And what will they pay for? Pokémon Go and Snapchat have already begun to answer these and other strategic questions.

Pokémon Go for example drove almost $1 billion in revenue in the second half of 2016 alone. It did this through in-app purchases and brand-collaborations to drive local offline commerce. These are a just a few potential business models that will develop and drive mobile AR revenues.

Meanwhile, giants like Amazon, IKEA and BMW are pursuing AR strategies and likewise teaching us important lessons. For example, should AR live within standalone apps or be incubated as a feature within already-established apps? And what should AR features be called to attract mainstream users?

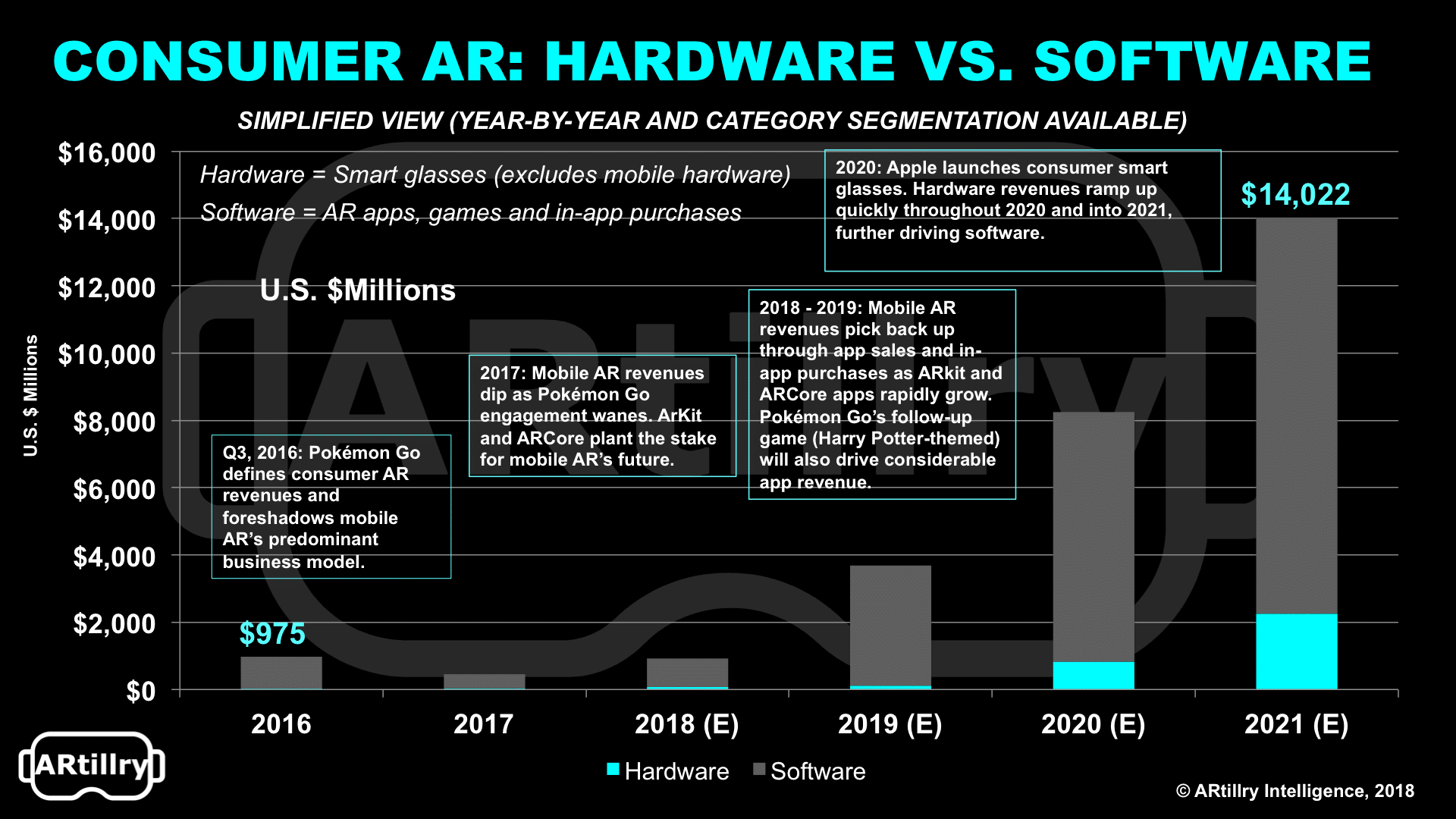

In terms of market size, ARtillry Intelligence projects consumer AR revenues to grow from $975 million in 2016 to $14.02 billion in 2021. Until 2021, most of that revenue will come from mobile AR apps, as smart glasses aren’t yet viable for consumer markets due to cost and style.

But how will this revenue materialize and what product and revenue models will be best positioned? In addition to industry giants and early movers mentioned above, the ecosystem contains developers, startups, media companies and brands. How will they deliver content and build value with mobile AR?

The best way to answer these questions is to examine today’s best practices, historical lessons and market trajectory. This report sets out to do that by surveying the landscape, and uncovering product and revenue strategies for anyone interested in tapping the mobile AR opportunity.

Key Takeaways

Smart glasses will dominate enterprise AR in the near term, while smartphones dominate consumer AR.

— As popularized by rudimentary AR like Snapchat and Pokémon Go, this involves graphical overlays that interact with the world seen through your smartphone camera.

— Smartphone ubiquity and componentry – image processing, sensors, camera – position it well for AR.

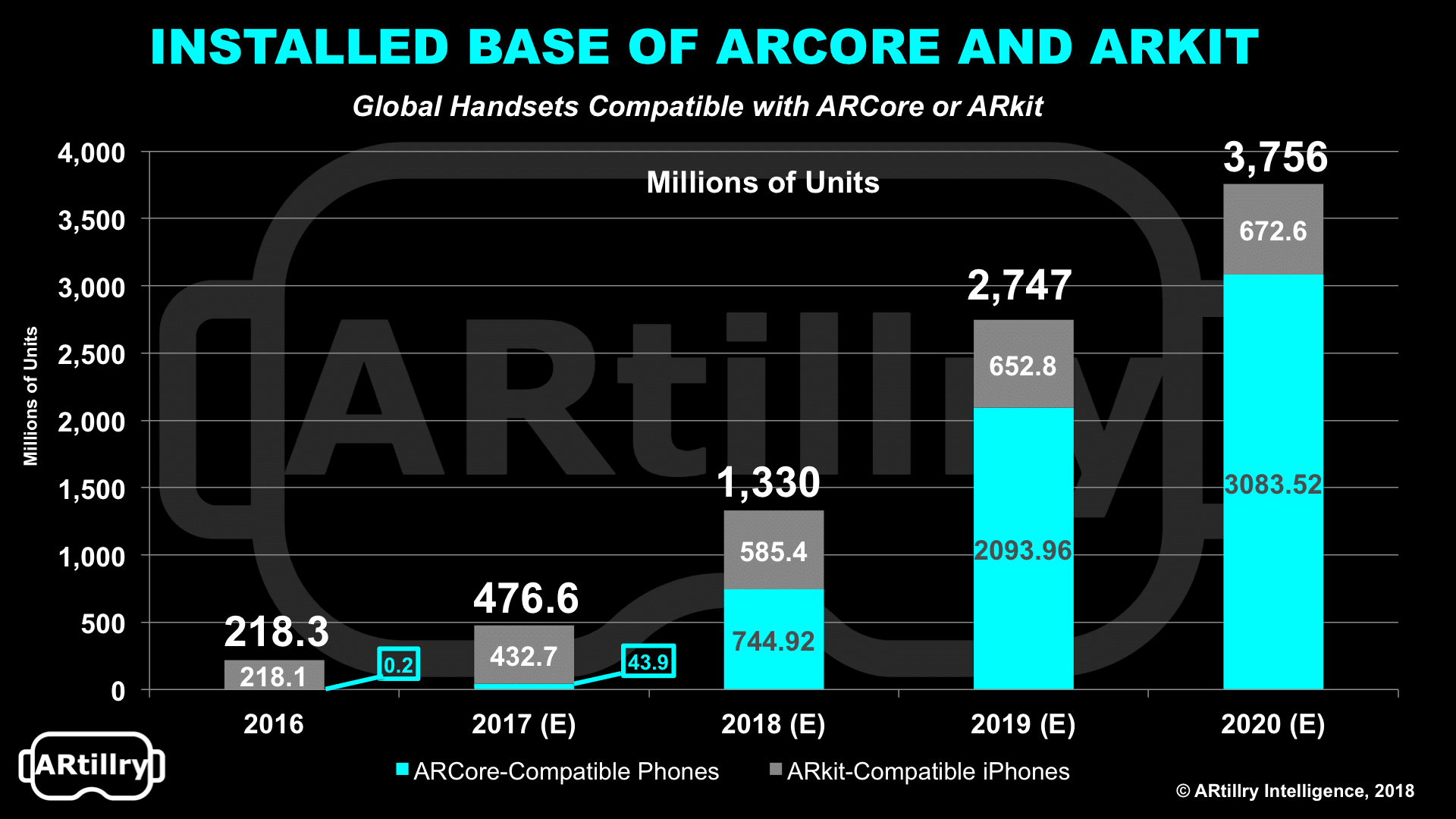

ARkit and ARCore further democratize mobile AR through software that does the back-end heavy lifting.

There are 476 million AR-compatible smartphones today, growing to 3.8 billion by 2021.

Consumer AR revenue will grow from $975 million in 2016 to $14.02 billion in 2021.

— Most of this derives from mobile AR, until 2021 when consumer smart glasses begin to gain traction.

— Mobile AR revenue will be software dominant, including apps, in-app purchases and commerce.

— Mobile AR strategies and differentiation therefore reside mostly at the app level.

Despite positive signals, mobile AR is still challenged

— Mobile AR resembles iPhone apps ten years ago: underdeveloped capability, standards and demand.

Product strategies will evolve natively with AR, but also include fundamental/historical app tactics.

— Native thinking (“AR-first”) should dominate app design, rather than porting existing media into AR.

— Incubating AR features within established apps can be a stepping-stone to standalone native apps.

— Consider alternatives to industry terms like “AR” (historical example: Snapchat)

— Build AR experiences that happen in short bursts, due to arm fatigue and battery drain.

— Successful apps will address real consumer utility and demand, rather than “tech-first” engineering feats.

— “Solutions in search of problems” won’t succeed, such as apps that solve pain points that no one has.

— Apps built solely around novelty could succeed in download volume but languish in active/repeat use.

— Combining AR novelty with sticky behavior (e.g. social communication) is showing signs of success.

Business models will likewise follow a combination of native evolution and established principles.

— In-app purchases are proven in gaming and social apps, versus upfront purchases.

— Visualizing large items will enable commerce-based monetization such as car and home shopping.

— Commerce-based AR monetization success stories so far include BMW, IKEA, Amazon and Houzz.

— Google will pursue visual search (Google Lens), including cost-per-action local commerce.

— AR advertising could eventually drive revenue but doesn’t yet have meaningful reach and scale.

— Forthcoming models to watch include Niantic’s Harry Potter AR game and Snapchat’s AR Geofilters.

Platform choice is important: Align goals with respective scale and strengths of ARCore and ARkit.

— ARkit has an early advantage in platform reach, but ARCore will achieve greater long-term scale.

— ARkit has better software and hardware calibration, but ARCore could be more open and flexible.

Before any of the above, clearly defined ROI goals are a critical first step to AR product strategies.

— This will inform and dictate all other strategic directions, and make or break AR app outcomes.

— Doing AR for AR’s sake – or to check an item of a list – will set any AR product up to fail.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.