This post is adapted from ARtillry’s latest Intelligence Briefing, Mobile AR Usage & Consumer Attitudes. It includes some of its data and takeaways, including original survey research. More can be previewed here and subscribe for the full report.

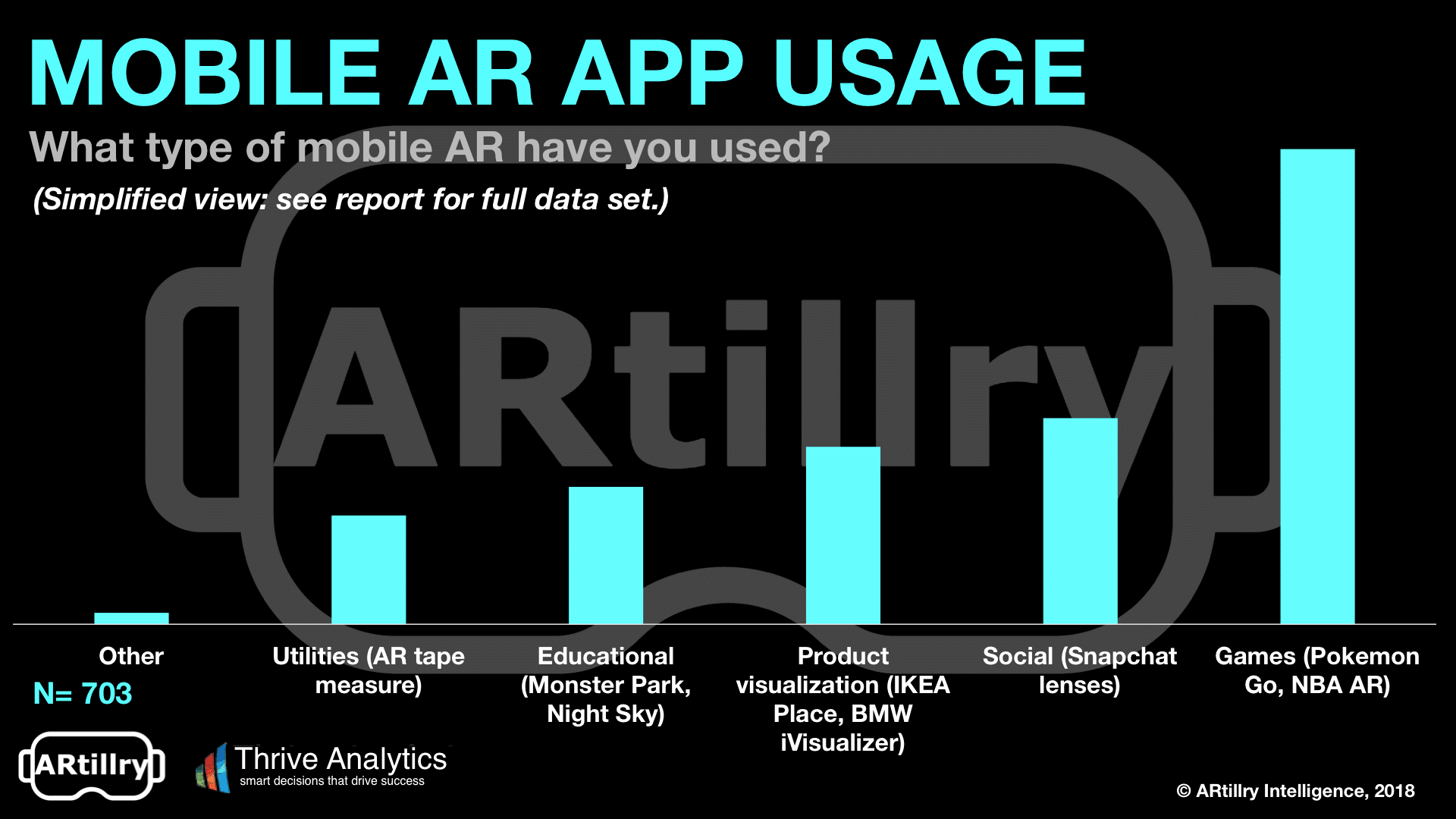

Mobile AR’s high reported frequency covered earlier could be due to the types of apps being used. And there we see inherently sticky and repeat-use apps score high in our survey responses. Specifically, games received the highest score by far followed by social (see below).

“Games” can mostly be taken to mean Pokémon Go – implicit in its high market share, and explicit in the survey question that was asked. Its addictive play and viral nature has created a clear lead in usage among AR apps. This holds telling signals for success factors for app developers.

As for what those factors are, it requires an entirely separate report (this was covered in last month’s Intelligence Briefing). But in short, it’s all about game mechanics that strike an optimal balance of challenging play, attainable leveling-up, easy onboarding and novel AR features.

We’ve already seen apps attempting to clone these game mechanics or “reskin” them to different brands, such as Ghostbusters. Most successful among these will likely be Niantic’s follow up to Pokémon Go, which will apply its architecture and game mechanics to a Harry Potter theme.

Moving on to social apps, their high-usage ranking is likely due to Snapchat’s AR lenses. This once again carries the merits of a frequent and sticky behavior: social messaging. It’s also inherently viral because of the social two-way or one-to-many framework of Snapchat.

The thing to watch next is Snapchat’s forthcoming AR features. These include AR Geofilters, which adds an AR twist to the already-proven geofilters ad format. Geofilters also happen to be monetized, which could signal new areas of mobile AR revenue. Valuable lessons will emerge.

To acknowledge other categories, product visualization and utilities offer user value. Though less frequent, product visualization apps like IKEA Place and BMW’s iVisualizer can save consumers time and headaches, as examined last month, by enabling informed purchases.

Regarding education, mobile AR offers visual learning that’s effective and appealing to children. It can also apply to higher education, particularly the sciences, given 3D visualization of complex objects. And the price is right, given the “zero-cost hardware” of an existing smartphone.

Demand Signals

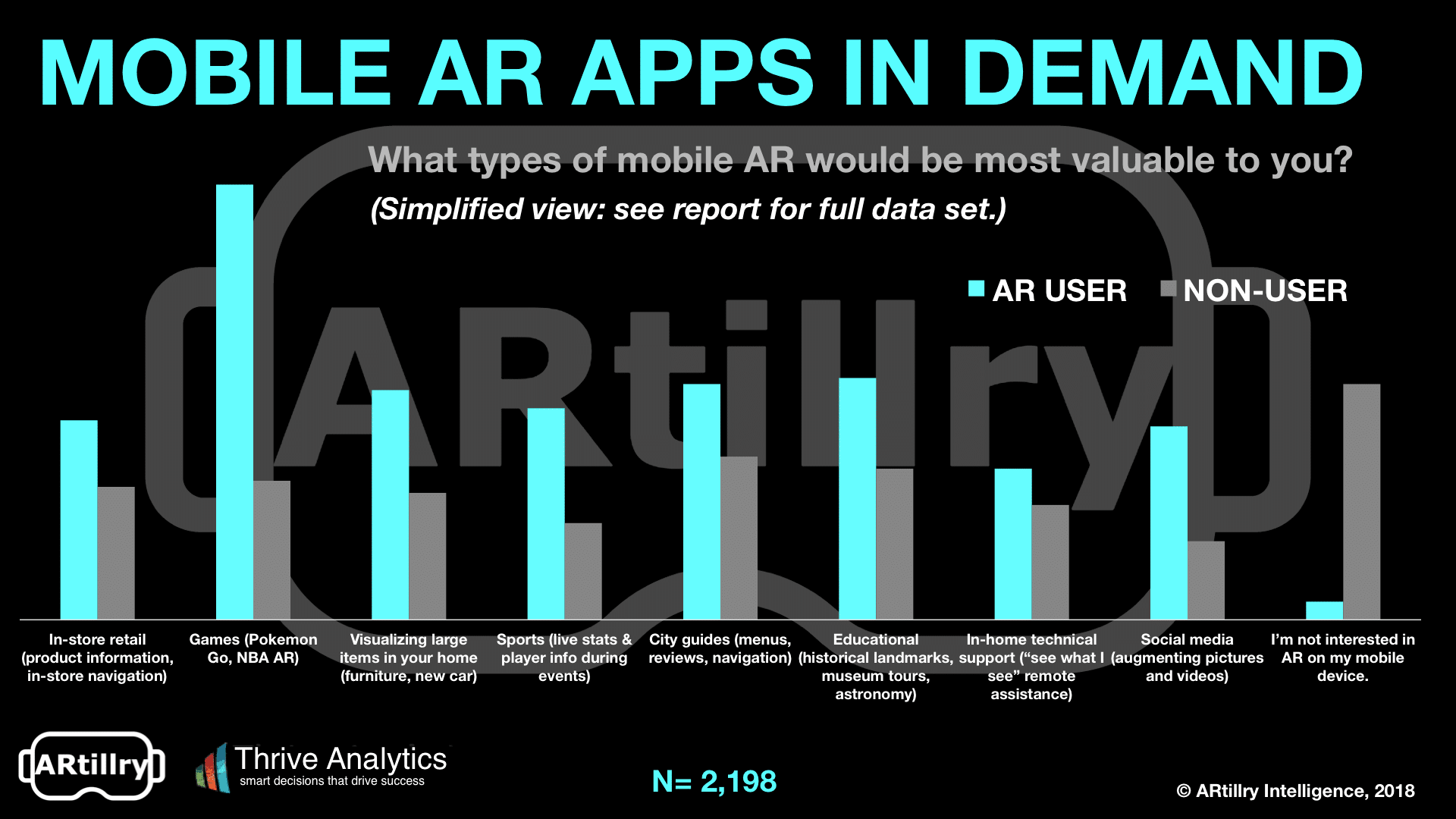

Perhaps more important than consumers’ current usage is their sentiment about what’s coming next. Gaming again was the clear winner, and there’s likewise demand for education and product visualization. But here, we also see new categories emerge.

These include city guides, sports and retail. City guides and retail align well with AR, given the potential to overlay product info like reviews and promotions. Moreover, they’re monetizable and come at a time when brick & mortar retail is hungry for innovation.

Speaking of hungry for innovation, AR in sports can let team owners create more compelling arena experiences, such as player stats and additional layers of entertainment. Meanwhile broadcasters can battle cord-cutting with compelling “second-screen” mobile AR features.

Here we also see an important trend – users are more vocal about desired apps than non-users. This is shown across all app categories above, and validates a key disparity: Users are “sold” and highly engaged. Non-users show explicit disinterest… but mostly because they haven’t tried it.

This is an important finding, which we’ll explore next.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.