This post is adapted from ARtillry’s latest Intelligence Briefing, The Camera is the New Search Box: Ads in AR. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

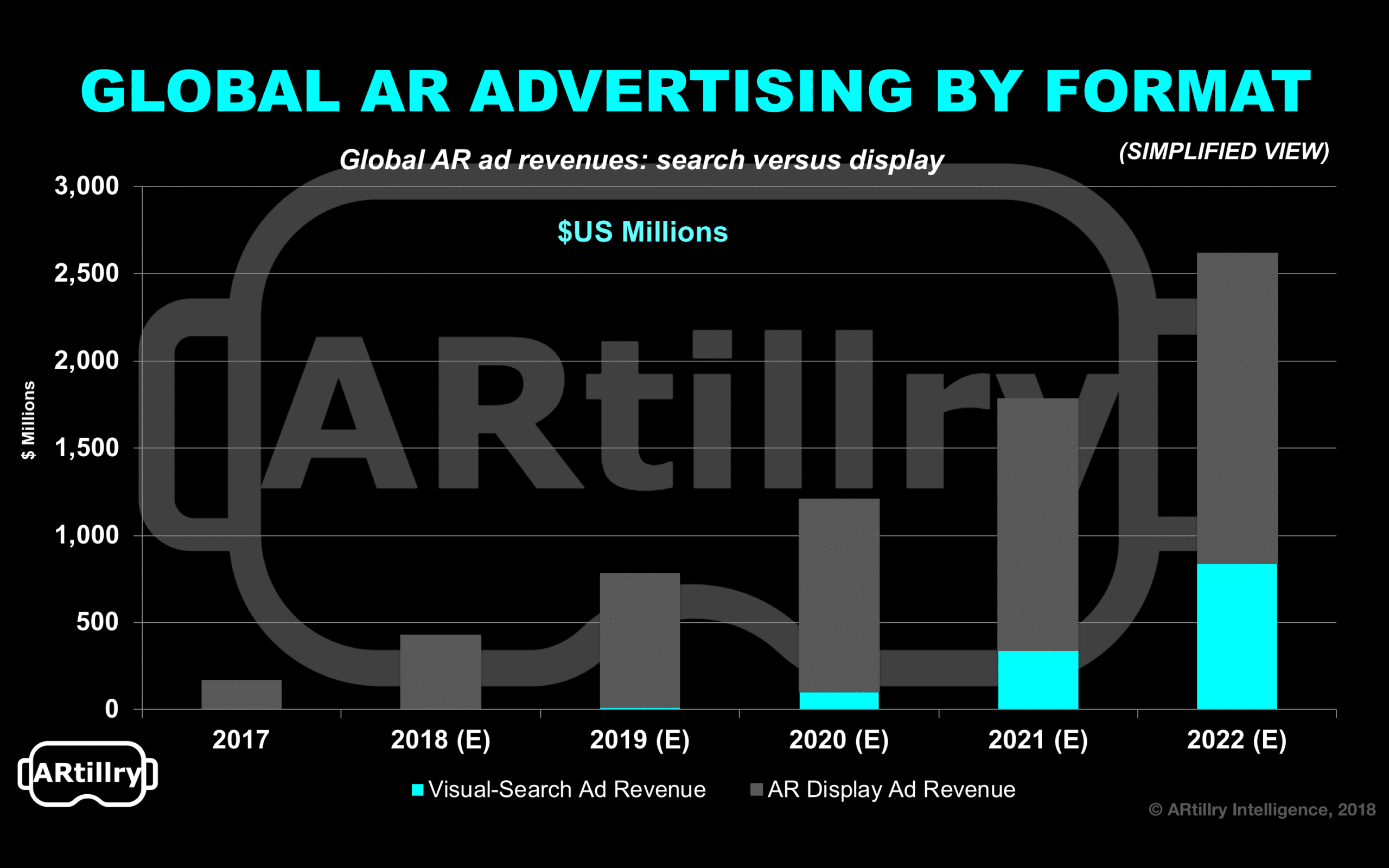

Based on the dynamics examined in our latest report and recent posts, ARtillry Intelligence has quantified the revenue outlook for AR advertising. These figures are a component of our Global XR Revenue Forecast but are broken out in greater depth for the first time here.

Specifically, we project AR advertising to grow from $167 million in 2017 to $2.6 billion in 2022. Notably, this is dominated by display-oriented AR advertising in the near term. Over time, search-based AR advertising (visual search), will gain share for many reasons we examined recently.

This “late arrival” for visual search also follows a historical pattern. Display advertising was a predominant format in the web’s early days before search advertising started to emerge. This is partly due to more complex and sophisticated technology, such as search algorithms.

In AR, visual search will also require more evolution in computer vision and the AR cloud. Though it’s convenient to envision the act of pointing one’s phone at objects to receive qualifying information, its “prime-time” status requires technology still in development by Google and others.

In Perspective

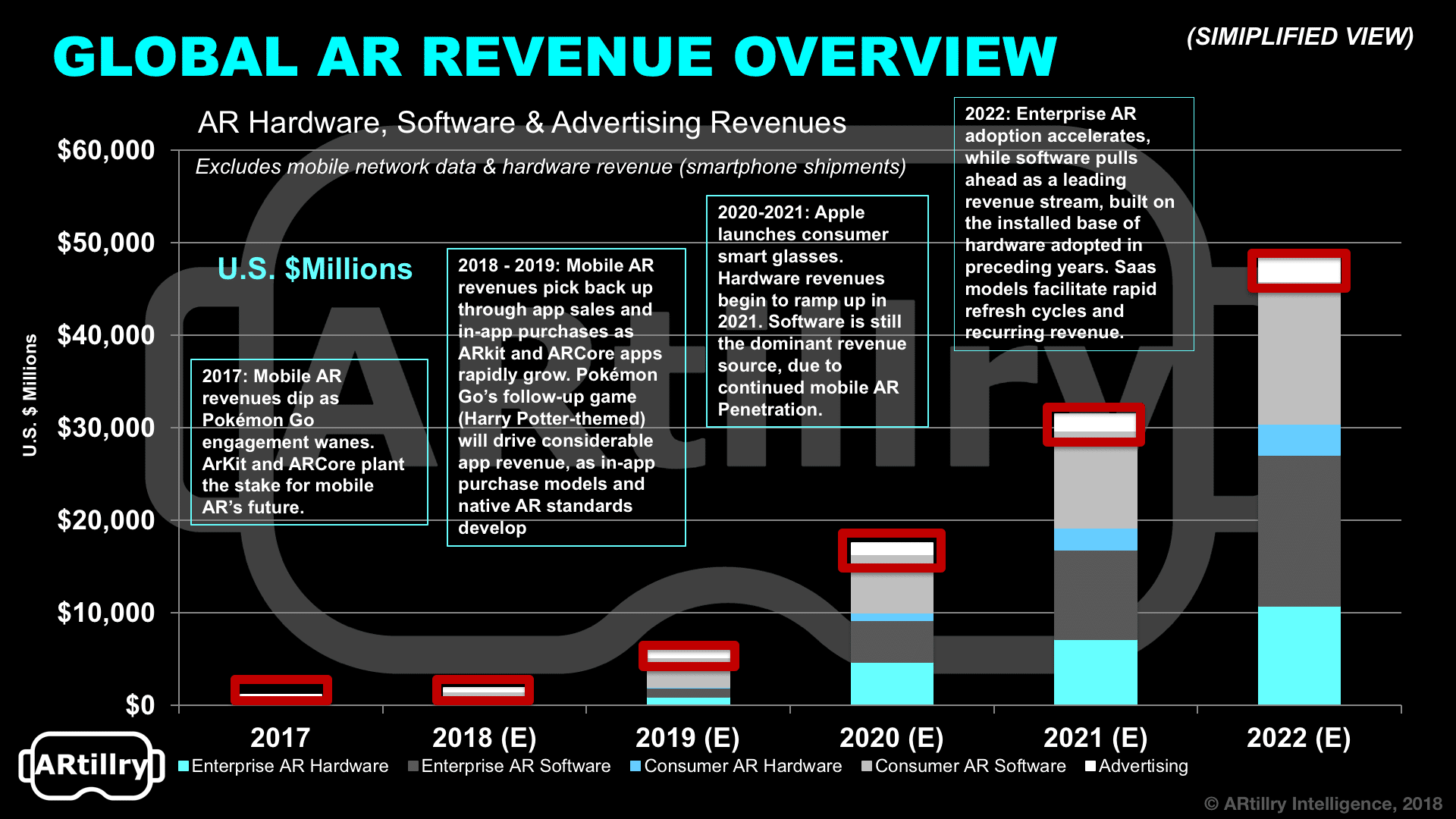

Panning back, AR advertising will be a relatively small portion of overall AR revenues. That overall pie also includes AR software (e.g. app purchases) and hardware (AR glasses),. These are each driven by different market dynamics and growth curves explored in our Global Forecast.

Specifically, advertising will hold a 14.8 percent share of AR revenues in 2017, shifting to 5.4 percent in 2022. Reduction in share isn’t due to a deficiency in AR advertising but accelerated growth in other opportune areas of AR, such as consumer and enterprise hardware and software.

To put this further into perspective, mobile ad revenues today are about $107 billion. Though that’s sizeable, it’s only 10 percent of the $1.1 trillion mobile industry, including hardware, software, apps and other revenue drivers. A similar share breakdown will play out in mobile AR as it matures.

It’s also important to specify what’s being measured. AR advertising includes money spent on paid AR campaigns, such as the case studies we examined. It doesn’t include “marketing” spend, such as brands that develop their own AR apps (measured under enterprise AR software spend).

Furthermore, devising these figures involves the “bottom-up” market-sizing methodology which involves granular ad revenue dynamics such as campaign pricing and spending. For example, factoring in revenues of current leaders in this category such as Facebook and Snapchat.

All About Analytics

One factor as AR advertising, and AR in general, will be “native” thinking. The idea is to build new experiences around AR, rather than tacking AR to existing UX. Also known as “AR-first,” we learned similar lessons in “mobile-first” design principles of the last decade, including advertising.

That not only applies to mobile apps and ads but how they’re measured. Just like AR ads will evolve, analytics will have to evolve with them. That means metrics that align with user behavior and that capture engagement. We’ve seen the same ongoing evolution with mobile ads.

In fact, we wrote an op-ed in 2009 that argued mobile engagement shouldn’t be measured with the same metrics as the desktop PC. Things like clicks and impressions don’t do justice to mobile’s more immersive engagement (e.g. touch). A similar scenario now faces AR.

This can be viewed as an opportunity. Due to relatively laggard advertiser behavior, we’re still measuring mobile ads with clicks and impressions. “Legacy” metrics will likewise follow AR ads for years. This signals opportunity for anyone who can break out of this mold.

Otherwise, misaligned ad metrics like click-through-rates will define AR ads. But AR advertising’s value will only be realized when metrics truly capture user intent and behavior. Whether that’s gaze-based or action-oriented (e.g. store visits), there will be lots of transformation to watch.

For a deeper dive on AR & VR insights, see ARtillry’s new intelligence subscription, and sign up for the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.