Snapchat remains one of mobile AR’s early leaders. Social lenses and selfie masks have become synonymous with AR. In the same spirit of our analysis of Google, Facebook, & Niantic, how will immersive tech boost Snap Inc’s business?

First, it should be acknowledged that Snapchat and Pokémon Go get flak for not being “true AR.” (non-SLAM). But in the long run, it doesn’t matter: they’ve done AR a favor as its “gateway drug.” They’ll accelerate AR adoption, due to consumer acclimation and comfort levels they established.

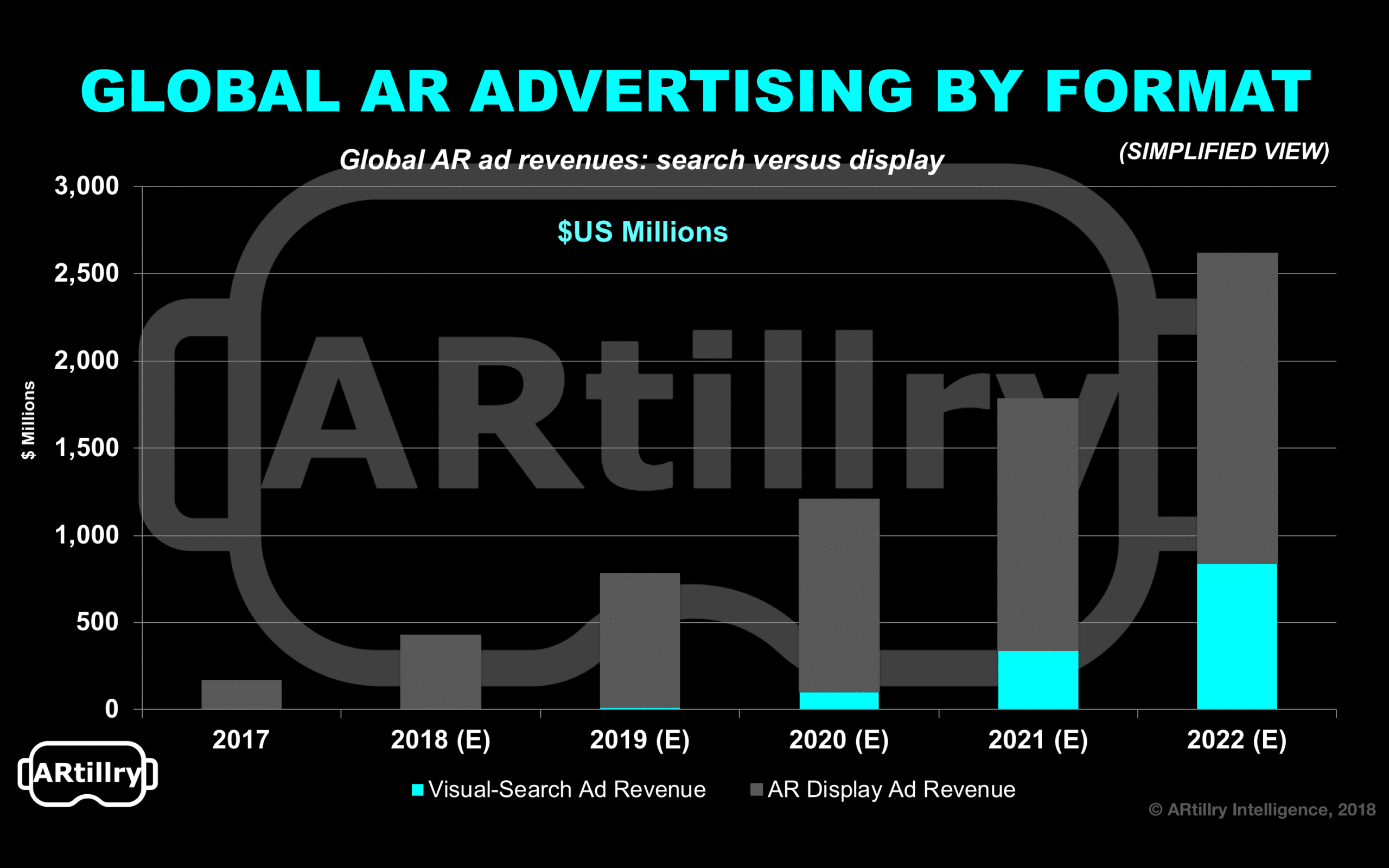

From a business perspective, Snapchat has embraced AR as an ad revenue opportunity, such as branded AR Lenses. This has vaulted Snapchat as an early leader in AR monetization. In fact, it currently holds a large share of the mobile AR advertising revenues we’ve calculated.

Segmenting our figures by company and going back to our bottom-up forecasting methodology (which calculates AR ad revenues from campaign volume and unit economics), we estimate Snapchat’s AR ad revenue to be $236 million of the $428 million spent on AR ads this year.

Turf Battle

Similar to Facebook, Snapchat’s AR play works on two levels. The first is to boost its ad revenues by giving advertisers a more engaging format to capture user interest and conversions. And those campaign performance indicators are proving out (see the case study below).

The second level involves using AR to engage its user base to both attract new users and to grow session lengths for existing users. Those goals lead back to ad revenue, but focus directly on its

usage metrics at a time when Snapchat’s user growth continues to slow, due to Facebook.

Though Snapchat is an early leader among social networks integrating AR, it is subject to continued competition from Facebook. In the same style that Facebook copied key Snapchat formats like stories, it’s already doing the same with AR lenses, such as its Camera Effects.

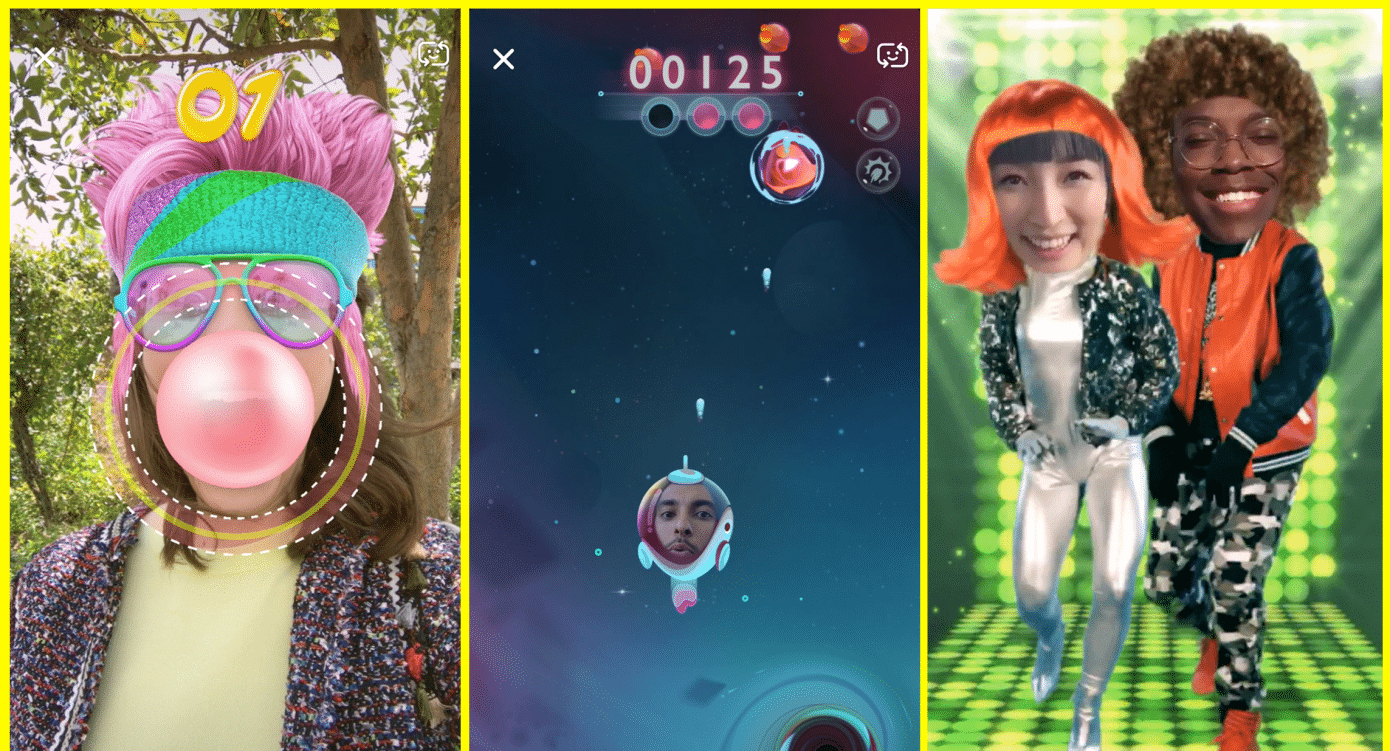

Snapchat has responded by opening up its AR platform for developers: Lens Studio. Previously, it limited AR lens development to its own in-house development team. It’s also moved towards more synchronous AR experiences with Snappables, which ads more social AR appeal and use cases.

The Long Game

Snapchat will have to maintain that open attitude if it’s to compete with the volume of AR content and user engagement that Facebook is capable of. Just like Facebook’s copying of other Snapchat formats, it can gain AR market share quickly based on its two billion global users.

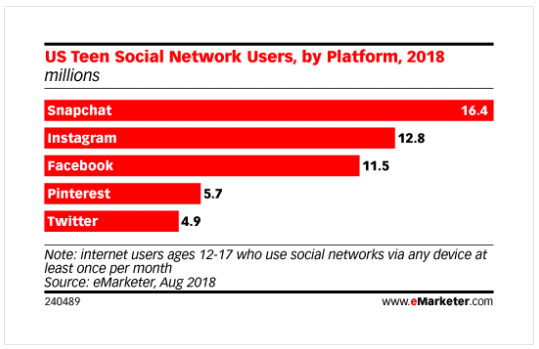

Meanwhile, one advantage Snapchat has over Facebook is its relative affinity among Millennials and Generation Z. Facebook, despite its global scale, faces daunting attrition among younger generations (see above), while Snapchat remains strong. This could be where the battle is waged.

Longer term, it could be all about glasses-based AR. Like Apple, Snapchat is likely planning for that long-term play. Also like Apple, it’s mobile efforts could be a training ground for that endpoint, for both users and developers. And Spectacles could have a similar “conditioning” function.

“That’s the secret strategy or the Trojan horse: How do you get enough sensors in people’s hands at a cheap price or on their face,” Ubiquity 6 CEO Anjney Midha said recently. “That sets them up for very immersive AR experiences or any kind of VR experiences a year or two years from now.”

Case Study: Shoe Drop

As an example of Snapchat’s AR ads, Foot locker and Jordan Brands recently ran an AR campaign. Using Snapchat’s “Ad to AR” format, users swiped up on a related story to reveal a branded lens. The lens featured an AR animation for a new shoe release and Gatorade flavor.

Specifically, users could launch the AR overlay, which featured the new shoe in an animated sequence placed in their immediate surroundings (video below). The gamified and animated appeal drove an average play time of 45 seconds, and four million total impressions.

Though it wasn’t the case in this campaign, Snapchat’s AR lenses can be integrated with its “shoppable AR” program. This lets advertisers integrate transactional functionality so users can purchase goods right within Snapchat, rather than being bounced to an app or website.

This commerce infusion will be a key evolution in AR advertising, given the potential for lower-funnel, high-intent interactions. As time goes on and advertisers gain greater comfort and skill with AR advertising, better commerce functionality will allow them to take a “full funnel” approach.

https://youtu.be/lcuEmgbBQyw

How Much Does it Cost?

Currently, Snapchat offers a few options. The example given above for Foot Locker’s campaign involves the relatively new “Snap Ad-to-AR” ads. One of its points of appeal is cost: It has been reported to be more economical than branded AR lenses (though Ad-to-AR includes lenses).

Specifically, Ad to AR ads are auctioned at $3 to $8 CPMs, then placed programmatically and targeted to relevant users and affinity groups in Snapchat’s social graph. Using these prices and reported reach, we’ve estimated the cost of the above Foot Locker campaign to be $22,000.

This compares to branded lenses which cost $40,000 per day to run, plus an $8-$20 CPM. The difference between “Ad to AR” and branded lenses is how they’re distributed. The former are delivered through Snap Ads, while the latter are pushed to the lens carousel of targeted users.

Though this is admittedly a sample of one, it’s a valuable data point to calibrate how AR ad pricing is shaping up today. Just like in the early days of smartphone advertising, more data will become available. We’ll be watching closely and collecting it as that happens.

For deeper XR data and intelligence, join ARtillry PRO and subscribe to the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.

Header image credit: Snap, Inc.