This post is adapted from ARtillry’s latest Intelligence Briefing, AR Business Models: The Top of the Food Chain, Part II. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

Picking up where we left off last week in examining Facebook’s AR strategies and drivers, how does VR play into its master plan?

Starting with Oculus Go, it could be a boon for Facebook/Oculus and for the larger VR industry’s consumer penetration. As we and others have written, Go could jolt VR adoption, given its highly-competitive pricing that hits a consumer sweet spot, and its frictionless user experience.

As background, Oculus Go is priced at $199 to bring higher-end VR to a greater swath of the mainstream public, and to better seed a VR marketplace. Oculus has the luxury (Facebook) of treating VR hardware as a loss leader to build market share and a longer-term platform strategy.

But that approach comes at a cost: to sacrifice margins for market share. The latter is motivated by the fact that platform wars are won through momentum set in early days to attract users. Then there’s a virtuous cycle of developer interest, incentive, content creation… and more users.

Put another way, it’s all about attracting users by any means to seed a marketplace and establish an installed base. That economically attracts developers who create content, which attracts more users. Those users in turn attract more developers… and the virtuous cycle commences.

Meanwhile, consumers win by receiving a strong value on hardware from Oculus. But not everyone wins: companies reliant on short-term hardware margins (Samsung, HTC, etc.), find it harder to compete with such pricing. HTC Focus already delayed U.S. distribution plans.

Overall, it’s a lesson in loss-leader economics, and strategic positioning in early days of platform wars. We saw the same thing in the smartphone OS wars. And like then, consumers benefit most. Prices should continue to drop, along with an arms race for VR quality and content libraries.

Content is King

Speaking of content, it’s where Oculus Go holds another key advantage. This helps overcome chicken and egg challenges and fragmentation that have dampened VR adoption. There are 1000 games and apps available for Go, thanks to the Oculus-compatible library from Gear VR.

Doubling down on this advantage, Facebook invested in content creation and user experiences such as lean-back entertainment (Oculus TV), social interaction (Rooms) and live sports (Venues). The latter is interesting in that live sports are a key differentiator for broadcasters.

To do this, Facebook is working with prominent content partners like Hulu, Netflix and NextVR (for live events). This makes sense, given that Oculus Go’s lower-end specs make it optimized for lean-back entertainment and casual games, as opposed to graphics-intensive gaming.

But the real endgame for Facebook’s VR initiatives is to lead and own the next generation of hardware where highly immersive social interaction happens. And like Apple, if it owns the hardware – and thus the user touch point – It gains vertical integration to better control its destiny.

This is something Facebook missed by not launching a smartphone as a direct consumer touch point. It instead has to reach consumers through apps that operate on devices that Google and Apple control. It therefore lacks vertical integration and the ability to optimize and tune hardware.

Given Mark Zuckerberg’s vision of a VR future, that’s not a barrier he wants to face again. Though smartphones are highly conducive to social engagement and connectivity, Facebook sees VR as an even greater bedfellow for the future of digital social interaction… but it could take a while.

Noble Quest

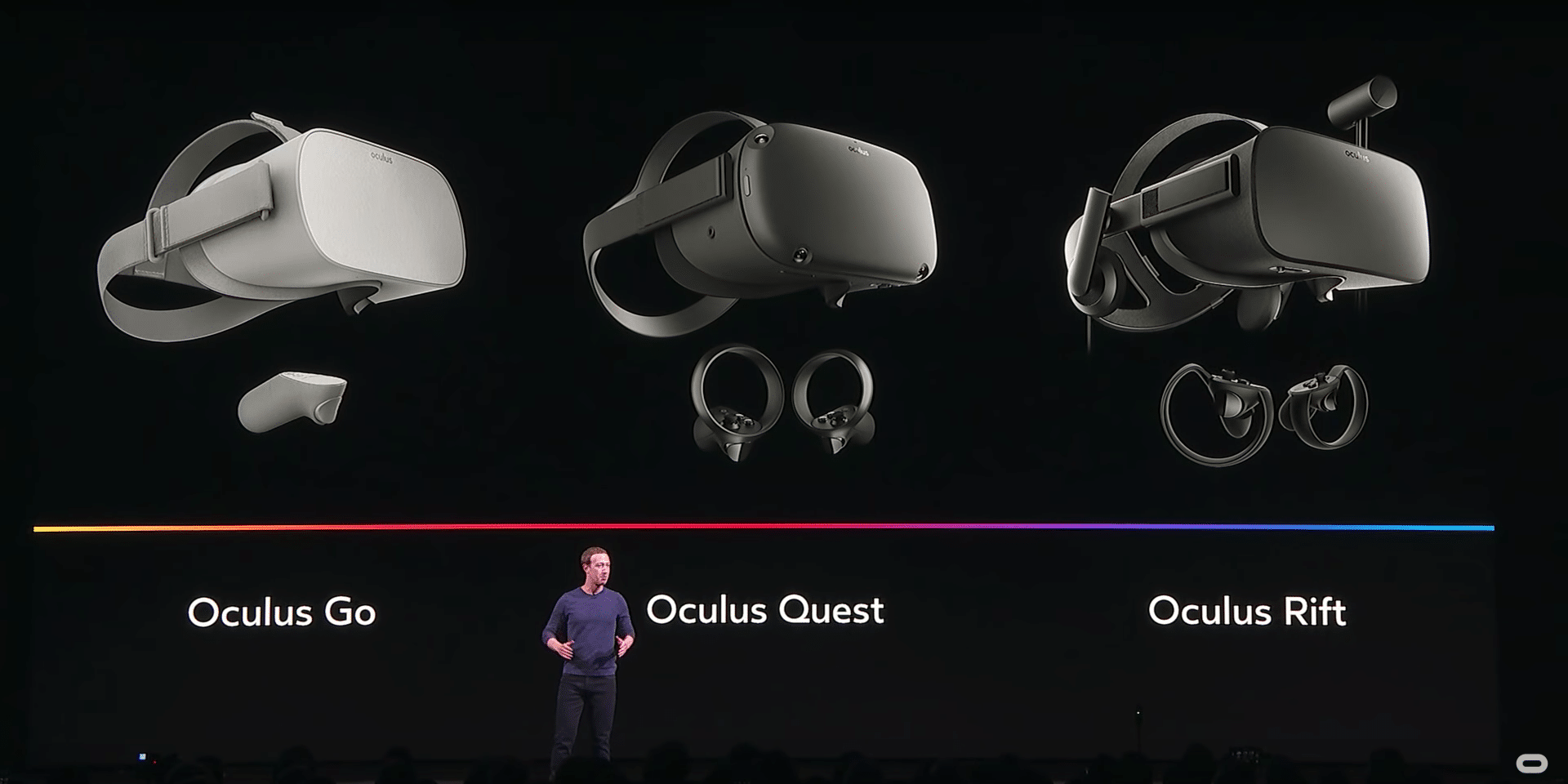

Meanwhile, Oculus’ latest move is to launch the Quest headset at its OC5 event. This is its attempt for a mass-market tier-1 headset. It features high-end VR specs such as hand presence and full (six degrees of freedom) positional tracking, but in an untethered package like Oculus Go.

All of this comes at a $399 price tag. At $200 more than Oculus Go, there’s a big enough delta to avoid cannibalization, but strong enough value in feature upgrades. Those include most notably inside-out positional tracking for headset and hand controllers, unlocking Rift-like gaming.

And like Oculus Go, the price is strategically set at a margin-neutral or loss-leader approach to seed a market and longer-term platform play. But the question remains if it’s too high above the “magic price” of $200 that’s we’ve pinpointed as an inflection point for consumer demand.

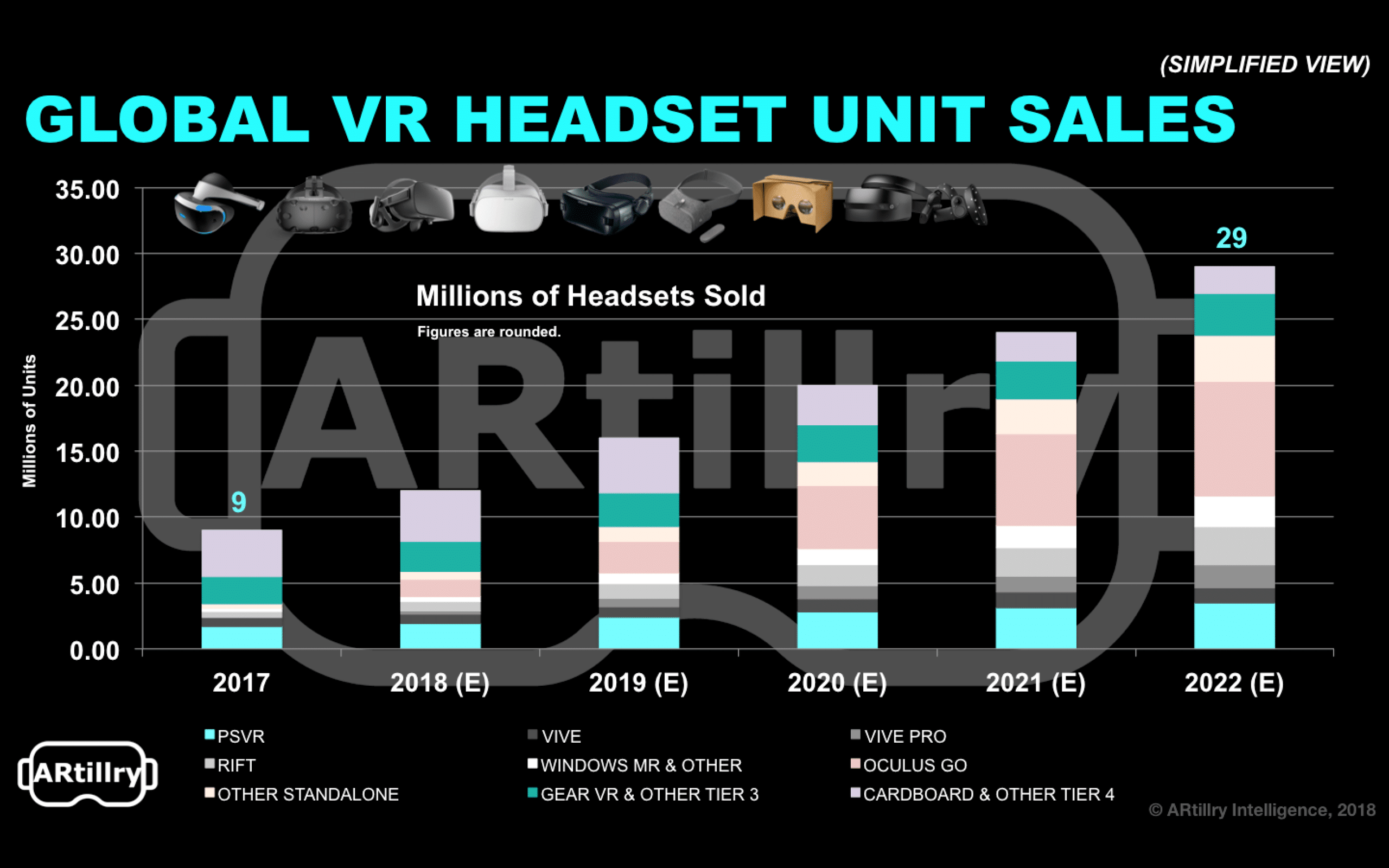

Panning back to the full product line, there’s economic optimization around three tiers — Go, Quest & Rift — to capture demand across market segments. This could help inch closer to Zuckerberg’s lofty goal of one billion VR users, though he admits there’s still a ways to go.

“From here, we’re going to make some big leaps in both tech and content for the future generations of each of these products,” said Zuckerberg. “It’s still early but this is the basic roadmap. This is what we need to do for VR to succeed, and to get to the future that we all want.”

To continue reading, see ARtillry’s latest Intelligence Briefing, AR Business Models: The Top of the Food Chain, Part II.

For deeper XR data and intelligence, join ARtillry PRO and subscribe to the free ARtillry Weekly newsletter.

Disclosure: ARtillry has no financial stake in the companies mentioned in this post, nor received payment for its production. Disclosure and ethics policy can be seen here.