ARtillery Briefs is a video series that outlines the top trends we’re tracking, including takeaways from recent reports and market forecasts. See the most recent episode below, including narrative takeaways and embedded video.

Recent reports from AR Insider’s research arm ARtillery Intelligence have covered topics like winning product models and lessons from sector leaders. But to put more substance and validation behind those narratives, we decided to ask consumers how they feel about mobile AR.

So we set out for answers. Working closely with Thrive Analytics, ARtillery Intelligence authored questions to be fielded through its established survey engine to more than 1000 U.S. adults. The result is wave III of the mobile AR survey, and a narrative report to unpack the results.

In addition to the report itself, the latest episode of ARtillery Briefs breaks down a few of the top takeaways. Below is an episode summary as well as the video itself.

AR Flavors

So what did they find out? Starting at a high level, 26 percent of respondents have used mobile AR. And almost half of those do so at least weekly. This is a strong metric given the longstanding challenges among mobile apps to sustain recurring usage outside of a few core apps.

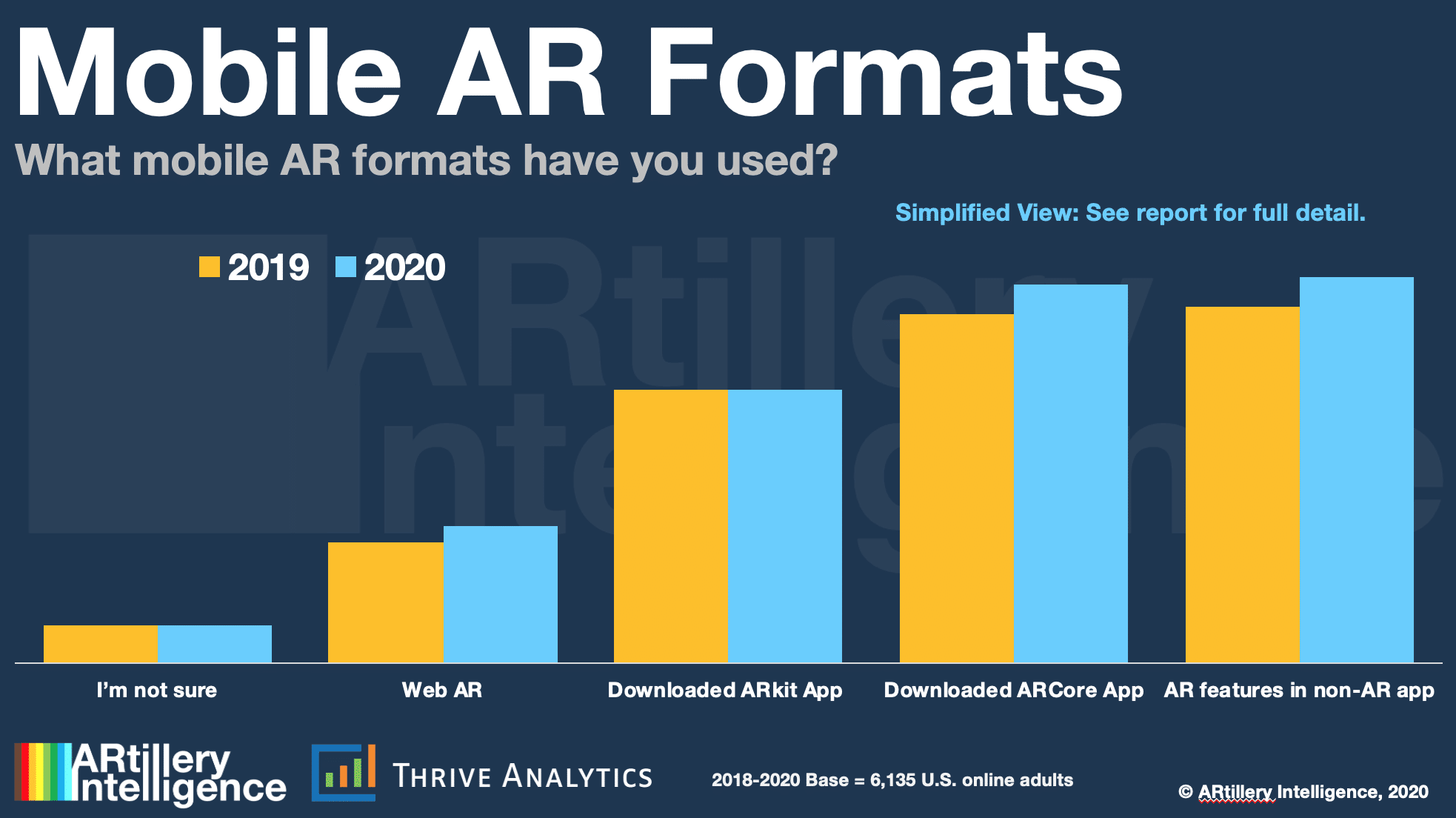

As for the types of AR experiences respondents have tried, AR-as-a-Feature took the top spot, followed by ARCore and ARkit. AR-as-a-feature defines experiences like Snapchat Lenses where AR has been applied to non-AR apps. Its traction is due to piggybacking on already-popular apps.

Among these formats, it’s also important to note that Web AR is on the rise, with about 18 percent of current AR usage. We’re bullish on this approach, due to its easy onboarding in browser-based experiences that can be shared through universal web links, rather than forcing app downloads.

The commonality with AR-as-a-feature and WebAR is that they reduce adoption friction. AR is too early and unproven to get users to go out of their way to download apps. So success in early days is found through reducing the points of friction that sit between users and AR activation.

Good News, Bad News

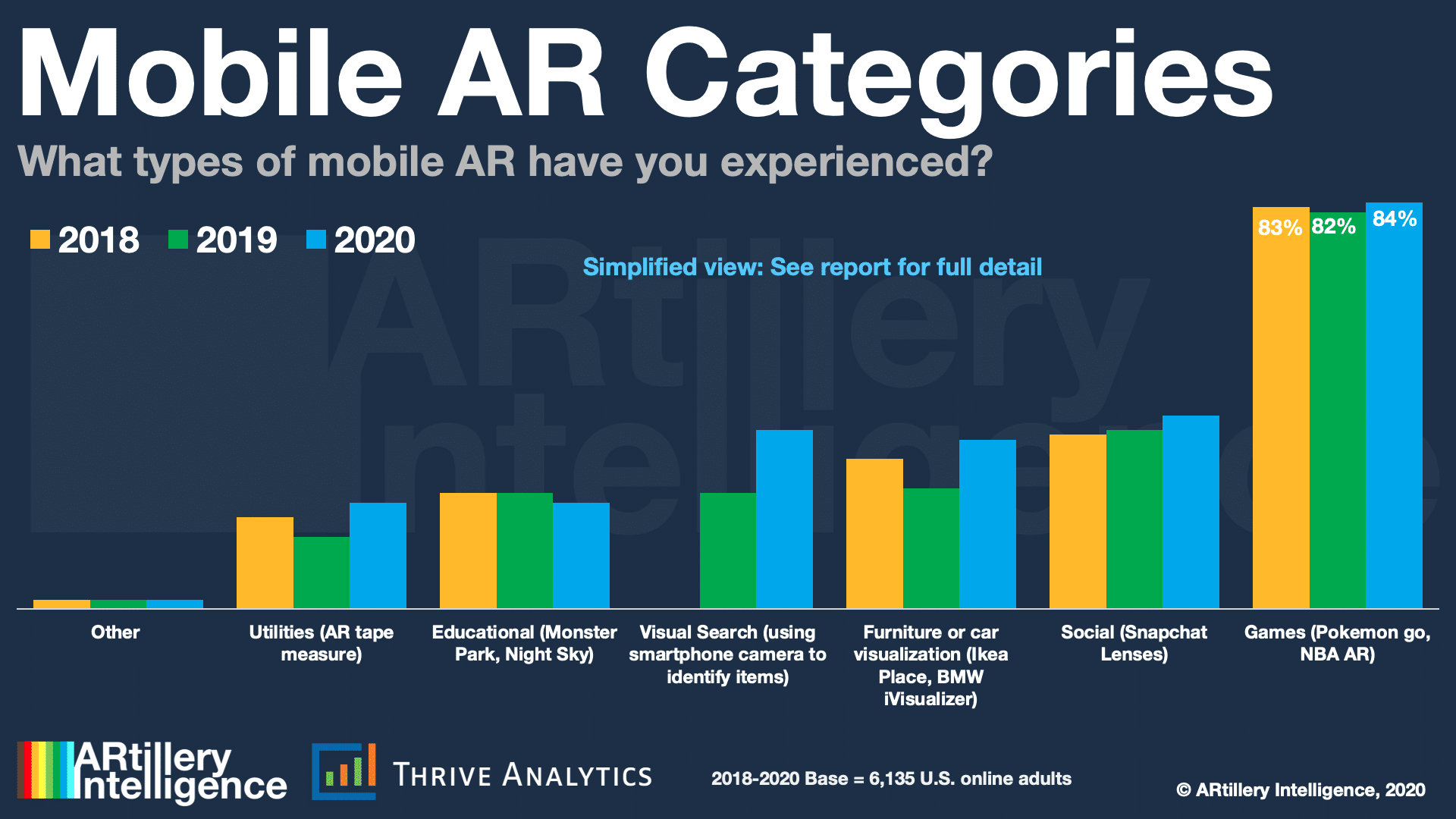

In terms of content types, gaming leads which is attributable to Pokemon go, followed by social AR, which is due to AR lenses. That’s followed by product visualization to “try before you buy,” and then visual search which helps identify real-world items by pointing your phone at them.

In fact, visual search was the biggest mover, growing 13 points over wave II of the research. This validates our theory about the rise in AR behaviors that have utility and frequency. Visual search is what we call an all-day activity, just like search itself. And its monetization potential is high.

Another positive sign was 68 percent of respondents reported high satisfaction with mobile AR. But that contrasts non-users, who report low likelihood of adoption and explicit disinterest. This is an ongoing theme in several waves of this research, signaling AR’s marketing challenge.

The issue is that users love it, but you have to try it first to really “get it.” But yet it’s hard to compel non-users and get them to see the value because it can’t be captured in traditional marketing like photos or even video. So like VR, it boils down to a classic chicken and egg dilemma.

Plain-Spoken Marketing

Meanwhile, things can be accelerated in a few ways, such as plain-spoken marketing. Best practices can be seen in Snapchat Lenses and Pokémon Go, which rarely use terms like “AR” in user-facing ways. Google calls visual search “search what you see,” rather than tech jargon.

Other best practices for accelerating consumer adoption include bolting AR to repeatable or high-frequency activities. One of those is visual search, as noted, but there’s also messaging and communications, where Snapchat has found fertile soil for AR to enhance multimedia sharing.

Speaking of Snapchat, AR traction can be found in tying AR to a social graph. This can accelerate growth through virality and network effect. Instagram and TikTok are the next companies to watch in this sense. Finally, gamification can boost AR stickiness, as shown by Pokémon Go.

In summary, these survey results are positive confidence signals for AR, but there’s still a ways to go. The name of the game is plain-spoken marketing, reducing friction, and positioning AR to enhance existing comfort-zone activities. That’s where the first AR’s killer apps will likely emerge.

Check out the full report for more, and the latest ARtillery Briefs episode below.