This post is adapted from ARtillery Intelligence’s report, Lessons From AR Revenue Leaders, Part II: Niantic. It includes some of its data and takeaways. More can be previewed here and subscribe for the full report.

Picking up where we left off in examining Pokemon Go’s design principles, Niantic is also showing best practices in its business model. Indeed, it’s often cited among a small handful of AR players today that are generating real revenue, including an estimated $3 billion+ to date.

Its chosen form of monetization is primarily in-app-purchases (IAP). This is a payment model that’s inherited from the mobile gaming world, where it approaches $70 billion in annual revenue on the behavioral economics of microtransactions. This can be seen in hits like Fortnite.

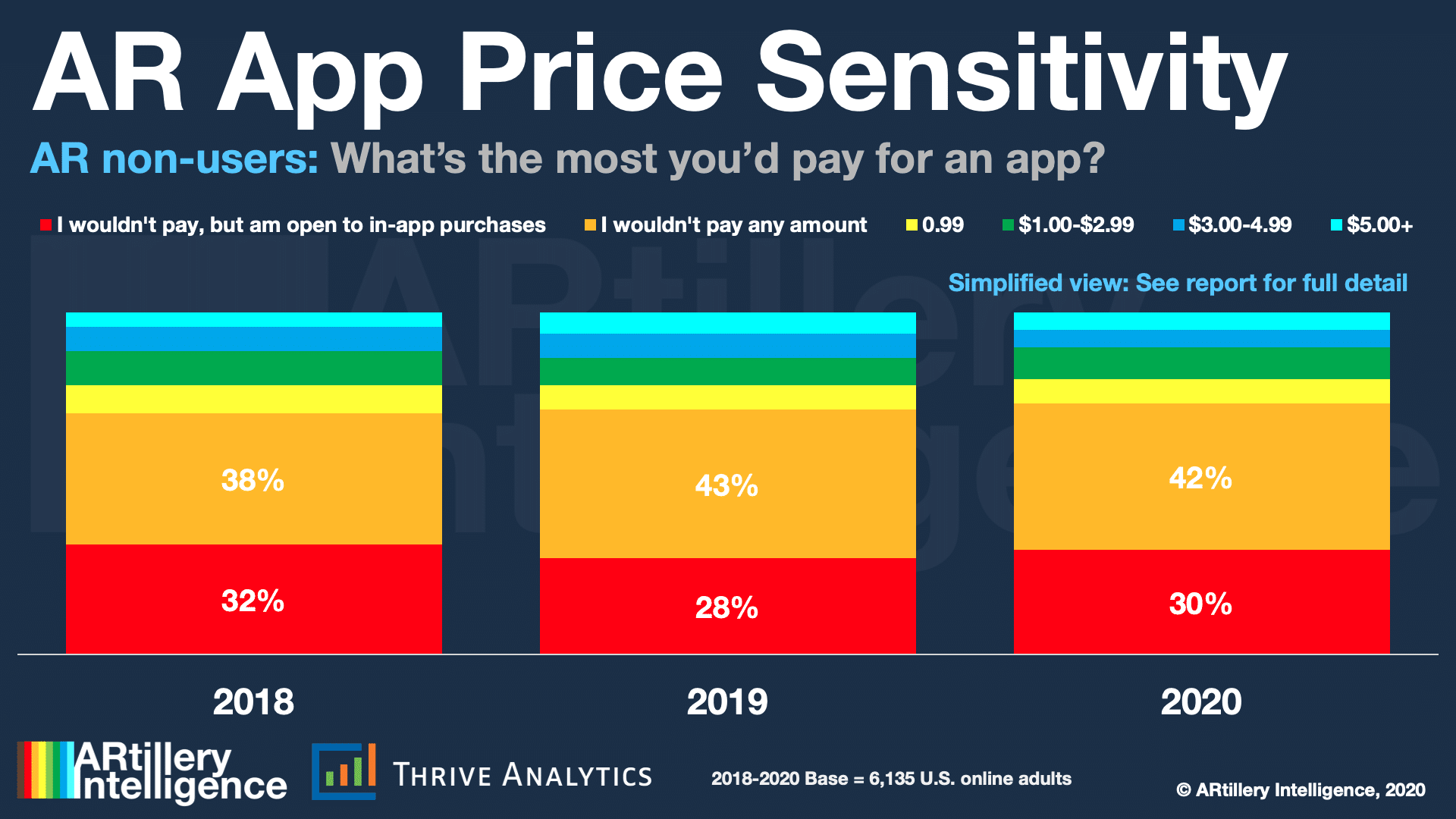

Not only is IAP validated in mobile gaming but it’s fitting to AR’s early stages when users hesitate to pay upfront for premium apps. This is supported by ARtillery Intelligence consumer survey data with Thrive Analytics (see below) and its recent report on top AR business models.

Specifically, 30 percent of new or non-AR users report that they won’t pay upfront for AR apps but would consider IAP. This is the most popular answer of any paid option in the survey. One takeaway is that AR is too early and unproven to get users to pay upfront for apps.

Based on these and other signals, ARtillery Intelligence has an optimistic outlook for IAP in its market sizing. In its Global AR revenue forecast, IAP is a leading revenue source among AR sub-sectors, projected to grow from $863 million in 2018 to $4.9 billion by 2023.

Maintaining Growth

A remaining question is how Pokémon Go will sustain growth. Growth rates naturally diminish as revenue escalates and period-over-period growth is calculated from a larger base. So the name of the game for maturing companies is to get creative with adjacent revenue streams.

To do this, Niantic is already exercising some business model innovations to diversify revenue. These measures are related to, but different than, the in-game updates examined previously to sustain player engagement. They include new revenue streams from existing player activity.

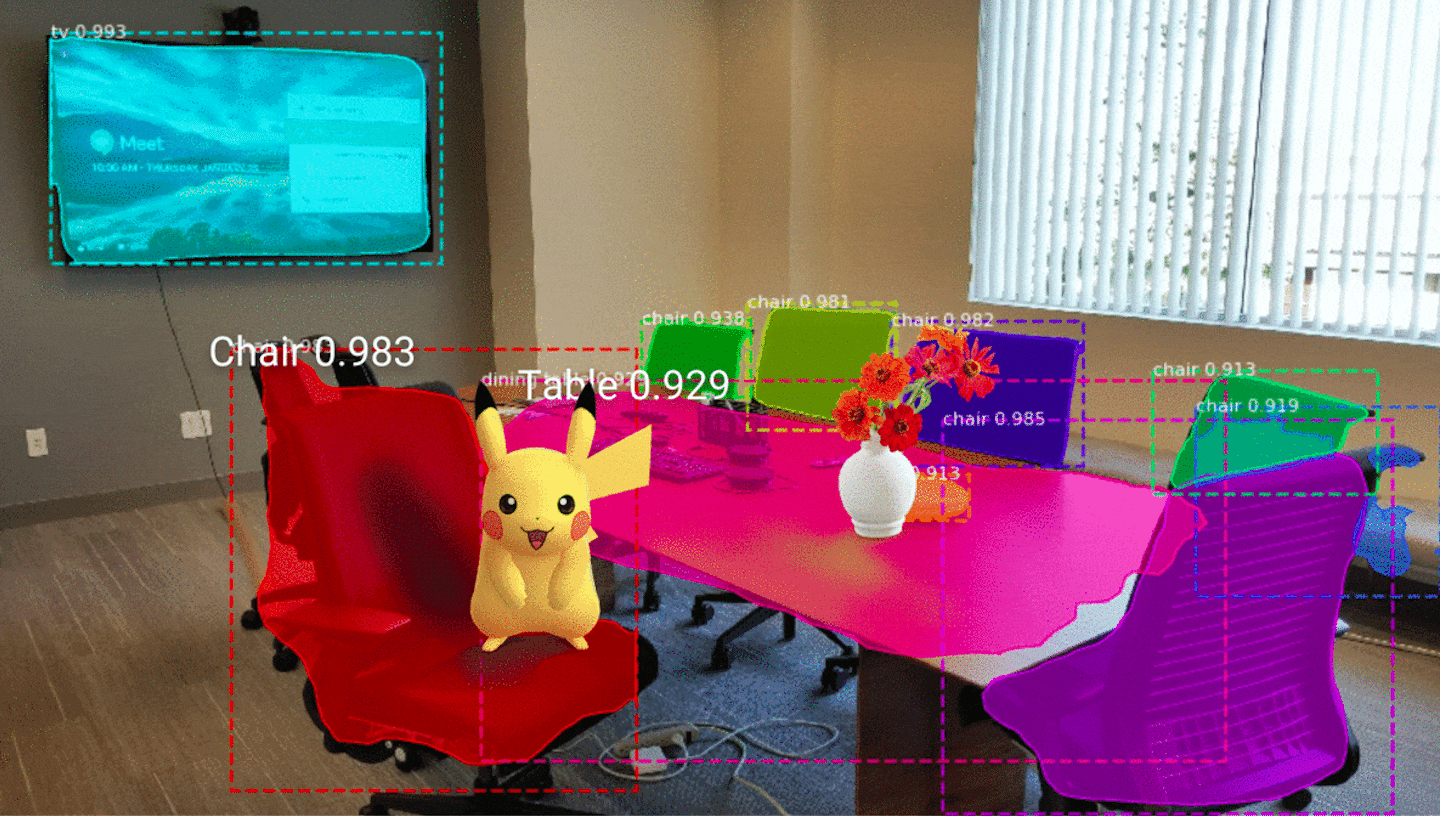

For example, Niantic’s Real World Platform will add software and platform-based revenue streams to its existing mix of player and business/advertiser spending. This platform is built from all of the experiences, game architecture and best practices cultivated within Pokémon Go.

Niantic can also grow IAP through geographic expansion. The U.S. leads in 2019 annual revenue ($335 million) followed by Japan ($286 million) and Germany ($54 million). This leaves greenfield opportunities in areas that haven’t been traversed by Pokémon Go’s roaming legions.

The Long Tail

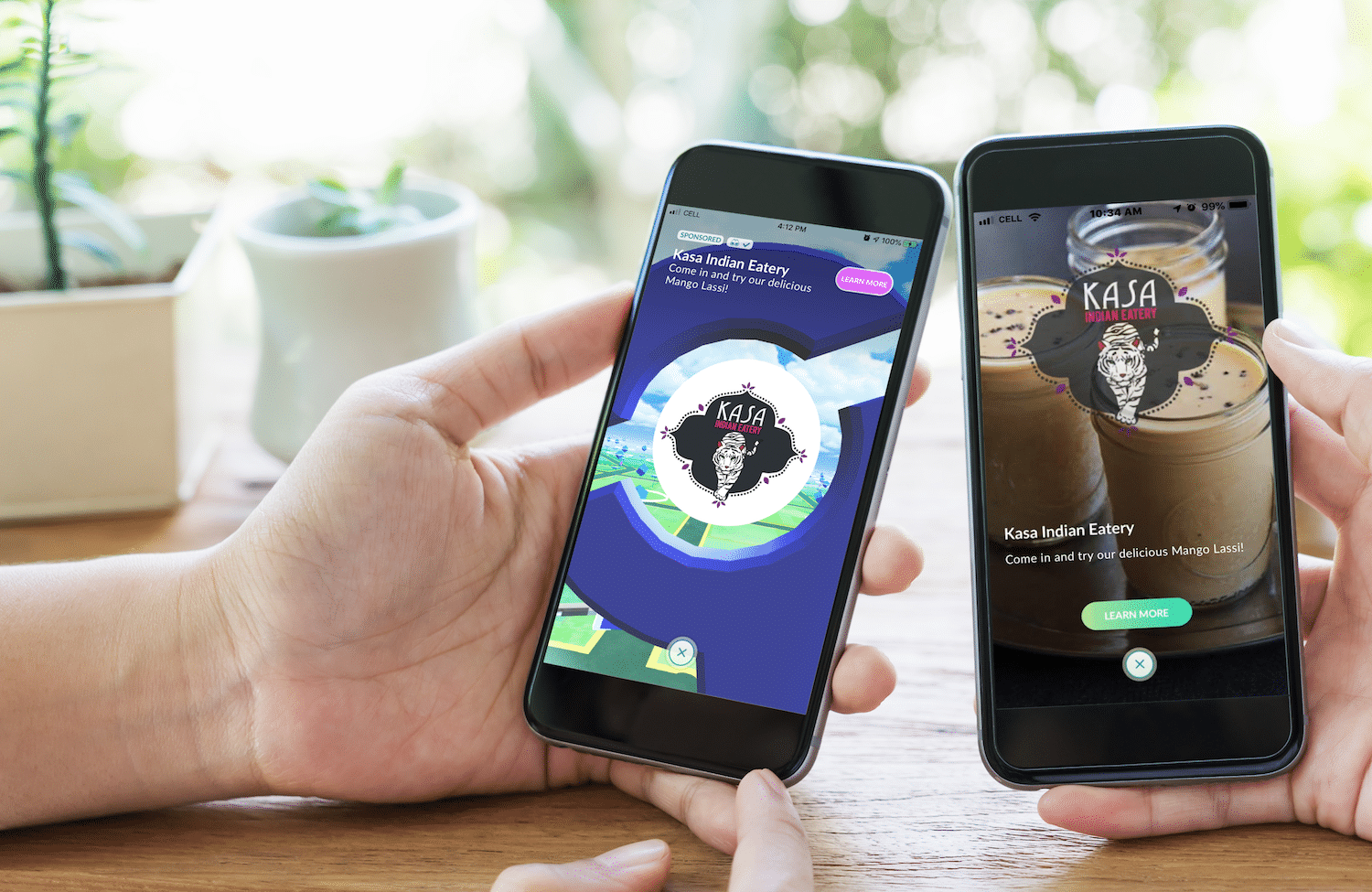

Another way to grow revenue is through adjacent products, such as Niantic’s existing in-game brand sponsorship program. Previously available to multi-location brands, it recently expanded it to tap the long-tail small-business (SMB) market for self-serve campaigns to drive foot traffic.

This allows local businesses to have physical locations designated as official in-game waypoints. These are the Pokéstops and Gyms where players descend in large numbers. This is done on a per-location basis and can be managed by local businesses to get footfalls when needed.

This essentially happens as an offshoot of Pokémon Go’s Wayfarer program, which lets players vote on locations for Pokéstops and Gyms. SMBs can select locations in a more on-demand fashion and for a price. It runs them $30 per month for a Pokéstop and $60 per month for a Gym.

The lower tier lets SMBs change Pokéstop images and descriptions monthly. The higher tier lets them schedule raids monthly and change a Gym’s image and description bi-weekly. To prevent sponsorship overload, SMBs can have one stop or gym per location and 30 per chain.

These sponsorship options essentially offer levels of in-game promotion and foot traffic. For example, the raids offered at the higher tier often involve 5-10 players working together, meaning more footfalls. And SMBs can schedule these raids strategically during slow business hours.

Options also include the ability for SMBs to include deals/coupons in-app. And beyond getting players to a location, additional promotions can help keep them there. Niantic claims that it will roll out more such features, like letting SMBs host “mini-games” to further boost dwell times.

For players, this can be organic as they work up a hunger through the game’s physical play. And for multi-location brands, it can be more effective than traditional marketing when it comes to driving tangible foot traffic. It’s particularly fitting to fast food, coffee and convenience stores.

At a press event, Niantic CEO John Hanke characterized the move as additive to gameplay and supportive to local businesses. Niantic has a penchant for altruism in its mission to get kids out of the house, as mentioned earlier. This adds fuel in simultaneously supporting local economies.

“It’s the anti-Amazon,” said Hanke.

We’ll pause there and circle back in the next installment to continue the discussion of how Pokémon Go holds AR product and business lessons. Meanwhile, check out the full report here.