Data Dive is AR Insider’s weekly dive into select spatial computing figures. Running Mondays, it includes data points and strategic takeaways. For an indexed library of data, reports, and multimedia, subscribe to ARtillery Pro.

Data Dive is AR Insider’s weekly dive into select spatial computing figures. Running Mondays, it includes data points and strategic takeaways. For an indexed library of data, reports, and multimedia, subscribe to ARtillery Pro.

Proof points for AR’s efficacy as a shopping tool continue to roll out. We’ve heard this rallying cry for AR commerce for a few years, but it takes on new meaning during Covid-era retail lockdowns. The value of visualizing products remotely in 3D is suddenly amplified.

Panning back, pandemic-induced global lockdowns have a polarizing effect on businesses, as we’ve examined. Some sectors grow (gaming, eCommerce), while others plummet (bars, events). AR lenses are in the former bucket for both practical and recreational reasons.

Practicality drivers include commerce-enablement, as noted. Recreational drivers are AR’s escapism and whimsy. Moreover, they’re tied to an area that sees Covid-era inflections: digital communications. These factors boost the AR lens growth that was already underway.

But among all of the AR sub-sectors that are “Covid-advantaged,” shopping and commerce could be most primed. AR’s value not only shines amidst Covid-era retail lockdowns, as noted, but it could also support post-COVID “touchless” retail shopping (more on that in a bit).

Accelerated Adoption

To validate the above hypotheses, we’re already seeing evidence of AR shopping growth. AR-focused creative Agency Camera IQ reports 1.9x growth in consumer AR engagements in Q2 versus Q1. This growth was seen across the AR experiences it builds for its brand clients.

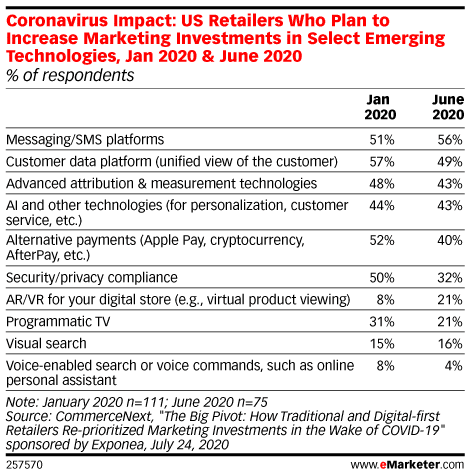

Other signals flow from retailer survey data. A July 2020 poll by CommerceNext and Exponea indicates that 21 percent of U.S. retailers expect to invest in AR visualization for their online store, up from 8 percent in January (see below). These results also include VR shopping.

Though we should always be wary of aspirational sentiments (talk is cheap), a 13 point rise in AR affinity in just six months is meaningful. Just as “necessity is the mother of invention,” survival mode has forced the normally tech-laggard retail sector to be more adaptive and tech-forward.

“Advertisers may have historically thought about AR as the shiny object in the media plan — the tactic that is attention-grabbing or innovative enough to win an award, but not necessarily a business driver,” Mindshare associate direct Courtney Christ told eMarketer. “But now more than ever […] brands are thinking about how AR can provide more utility.”

Post-COVID World

As noted, the ability to visualize products in 3D assumes new value when we can’t see them physically in store aisles. In that way, AR offers the best of both worlds in being able to safely/remotely visualize products in 3D, while enjoying eCommerce convenience and pricing.

So it’s clear that AR’s value is elevated today. The bigger question is if the current period exposes the technology in ways that instill permanent consumer habits. In other words, will AR’s existing (and gradual) growth curve inflect and accelerate due to its Covid-era exposure?

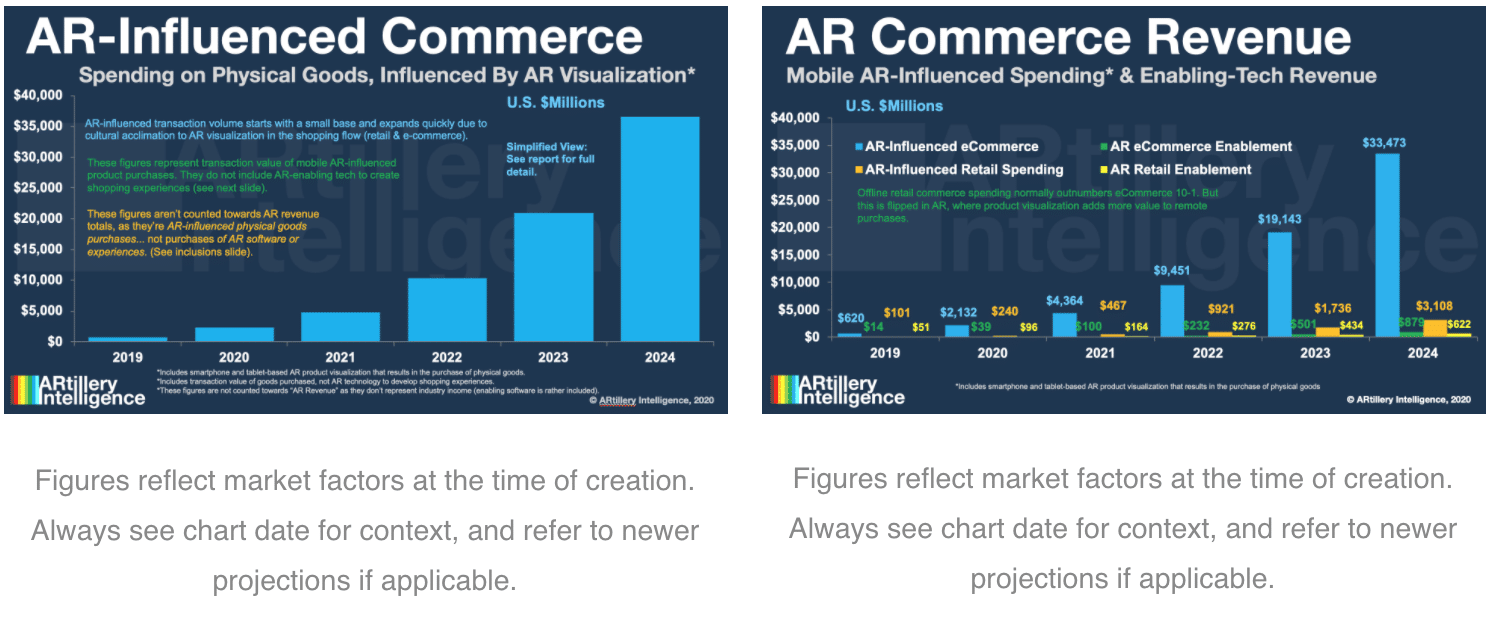

All of these factors inform the market sizing of our research arm, ARtillery Intelligence. Its latest AR revenue forecast estimates consumer spending on AR-influenced purchases to grow to $36 billion by 2024 (see above). This isn’t “AR revenue” but AR-guided consumer spending.

These projections have accelerated with Covid-era eCommerce growth. And as physical retail returns, we project a “touchless” era with fertile ground for AR. Because it contextualizes products through overlays versus contact, it could have a coveted role in a Post-Covid world.