Spatial computing is like any other area of the economy that’s been disrupted in the Covid age. Everything from consumer demand to investor theses has shifted. The impact has been positive and negative, depending on sector alignment with Covid-era demand signals.

Put another way, the spatial computing spectrum has several subdivisions, each governed by different market factors and target markets. That includes AR, VR and the enterprise and consumer subsectors of each. There’s also the division of hardware and software.

That last distinction is key, as global lockdowns have caused supply-chain impediments that hit hardware markets hard. Conversely, software only requires delivering bits rather than atoms, while it’s further advantaged by streaming entertainment’s alignment with shelter-in-place life.

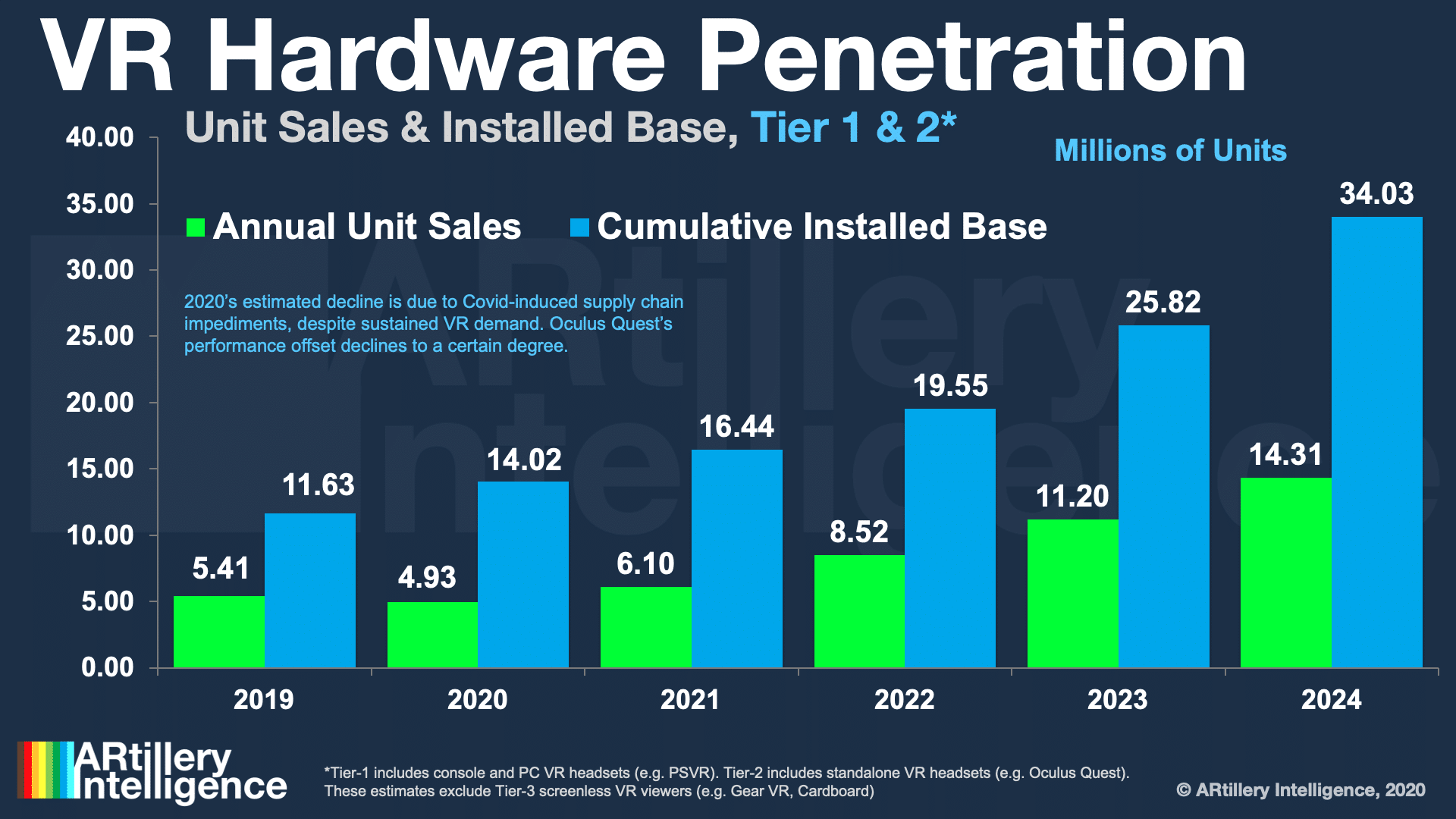

VR, for example, straddles these factors. Demand grew in 2020 along with Covid-inflections in gaming, leaving Oculus Quest and Valve index sold out part of the year. But supply chain issues further detracted availability. The net effect was an estimated 10 percent aggregate decline.

Market Shakeup

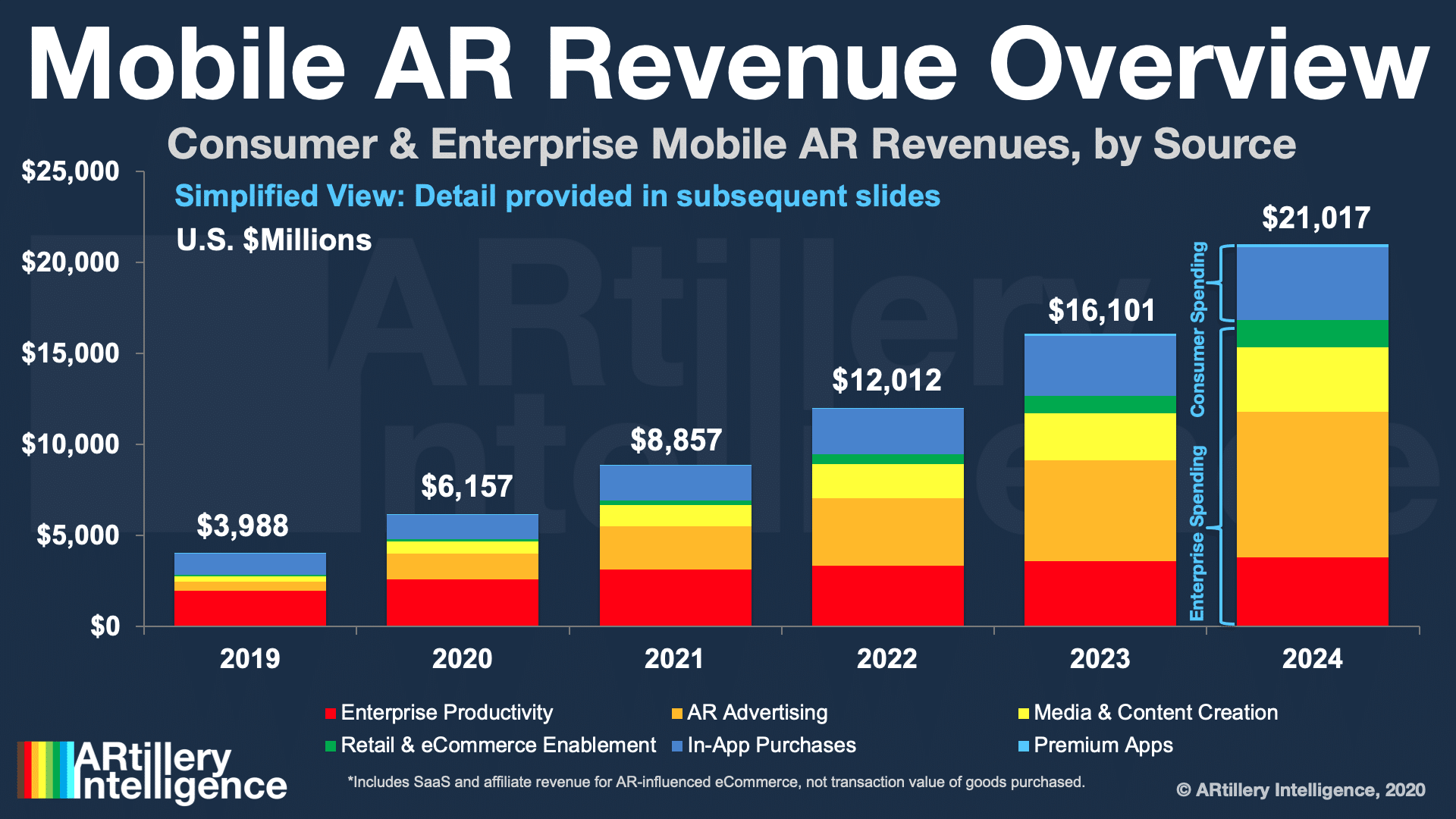

Taking another example, mobile AR has fared well in the Covid era. Applying some of the above variables, there are no devices to ship as mobile AR experiences piggyback on existing ubiquitous hardware. Covid restrictions don’t impede software downloads as much as hardware shipments.

Furthermore, mobile AR experiences are well aligned with Covid-era demand signals. For example, AR lenses offer escapism and whimsy to sheltered-in-place masses, while they’re also tied to digital communications. The latter is a Covid-advantaged area in general…just ask Zoom.

Another branch of mobile AR that’s inflecting is advertising and commerce. Immersive product visualization can bring back some of the dimension and immersion that’s lost in retail lockdowns. This has boosted brands’ self-distributed AR marketing (apps), as well as paid ad campaigns.

In both cases, AR supports distanced shopping. This happens on two levels as AR product visualization lets you spend less time in stores, while in-aisle visual search lessens the need to pick up objects while in the store. The latter could have a place in post-Covid touchless retail.

AR advertising meanwhile has an interesting dynamic as ad budgets are usually hit hard in economic downturns. But downturns also force brands to rethink and redeploy ad budgets to emerging performance-based formats. So AR advertising’s strong ROI has a chance to shine.

This cycle tends to accelerate existing shifts towards emerging ad media. In fact, this is what happened to search circa-2003 and social advertising circa-2009. AR could benefit from a similar shakeup by grabbing ad spend. Brands that try it and like it could be new AR converts.

Alternate Universe

The same “converts” cycle is happening in other non-AR areas of the economy. Covid-pressured behavior — or survival — has forced digital adoption on brands and consumers. The new perspectives that result could represent semi-permanent habits in a post-Covid world.

That will be the case with remote work and events to some degree. Being forced into productive remote-work systems has caused many companies to discover more streamlined orientations that they never would have encountered in an alternate universe with no Covid.

Of course, this is merely a “silver lining” construct, not meant to marginalize the pain and death that’s ensued over the past nine months. But many businesses will come out stronger and battle-tested while emerging tech sectors — including spatial computing — could accelerate.

The question is what the post-Covid world will look like. We won’t adopt all of the new-normal ways of doing business, but also won’t go fully back to the old normal. So the “next normal” will be an optimal hybrid of the two that cherry-picks the best new discoveries of the Covid era.

Back to spatial computing, how will it fare in the post-Covid world? VR is still a wild card for the hybrid-era of remote work and events. AR product visualization could support touchless shopping, while enterprise AR remote assistance and guided assembly support distanced work.

Speaking of wild cards, Apple’s rumored AR glasses in 2022 or 2023 could accelerate spatial computing more than any pandemic could. That’s the power of Apple’s proven halo effect and ability to mainstream emerging consumer tech categories. But that’s still two years away.