Several market factors have converged over the past year to create fertile ground for VR. It’s Covid-aligned in that it supports remote communication and escapism. VR also piggybacks on broader inflections in gaming. These demand signals coincide with the catalyst that is Quest 2.

Speaking of Quest 2, its reviews are unanimously positive and the price is right. The latter stems from Facebook’s long-term VR strategy that lets it sacrifice margins to build a network effect and win market share. This loss-leader pricing gives us a device that’s cheaper than it should be.

After compiling evidence for Quest 2’s momentum to back up these claims, we’re returning to a similar exercise but for the broader VR market. If Quest 2 is having an impact, it’s going beyond its own sales and extending a “halo effect” on the VR market, especially games and software.

Evidence Aplenty

Whether a VR uptick is due to Covid-factors, pent-up demand or Quest 2’s halo effect, its signals are evident. Here are the recent demand signals and data points we’ve captured.

— Google searches for “VR headset” nearly doubled in Q2 2020, driven by sheltered individuals interested in virtual interaction and connectivity.

— VR Chat has reached a record 24,000 concurrent users, about half of which were in VR.

— Topgolf Pro Putt passed $1 million in sales, selling more than 50,000 units in the Oculus Quest app store. More than 30 percent of owners are frequent players.

— Half-Life Alyx has become Steam’s highest-rated and used VR game, surpassing 2 million owners and inflecting the number of active headsets on Steam.

— Speaking of Steam, it released its list of top VR titles for 2020. This doesn’t specify usage stats but is generally notable in terms of comparing top games’ relative traction.

— 15 percent of Star Wars: Squadrons Owners played in VR.

— One in ten VR players owns Arizona Sunshine according to the game’s maker, Vertigo.

— As part of a series of new feature rollouts (see below), RecRoom announced that it has exceeded 3 million user-created Levels and 40 million monthly visits. It has also tripled its player base in the past year.

— Speaking of RecRoom, it has secured $20 million in Series C funding, further validating investor confidence in the scaling potential and network effects of social VR.

Ready This Time

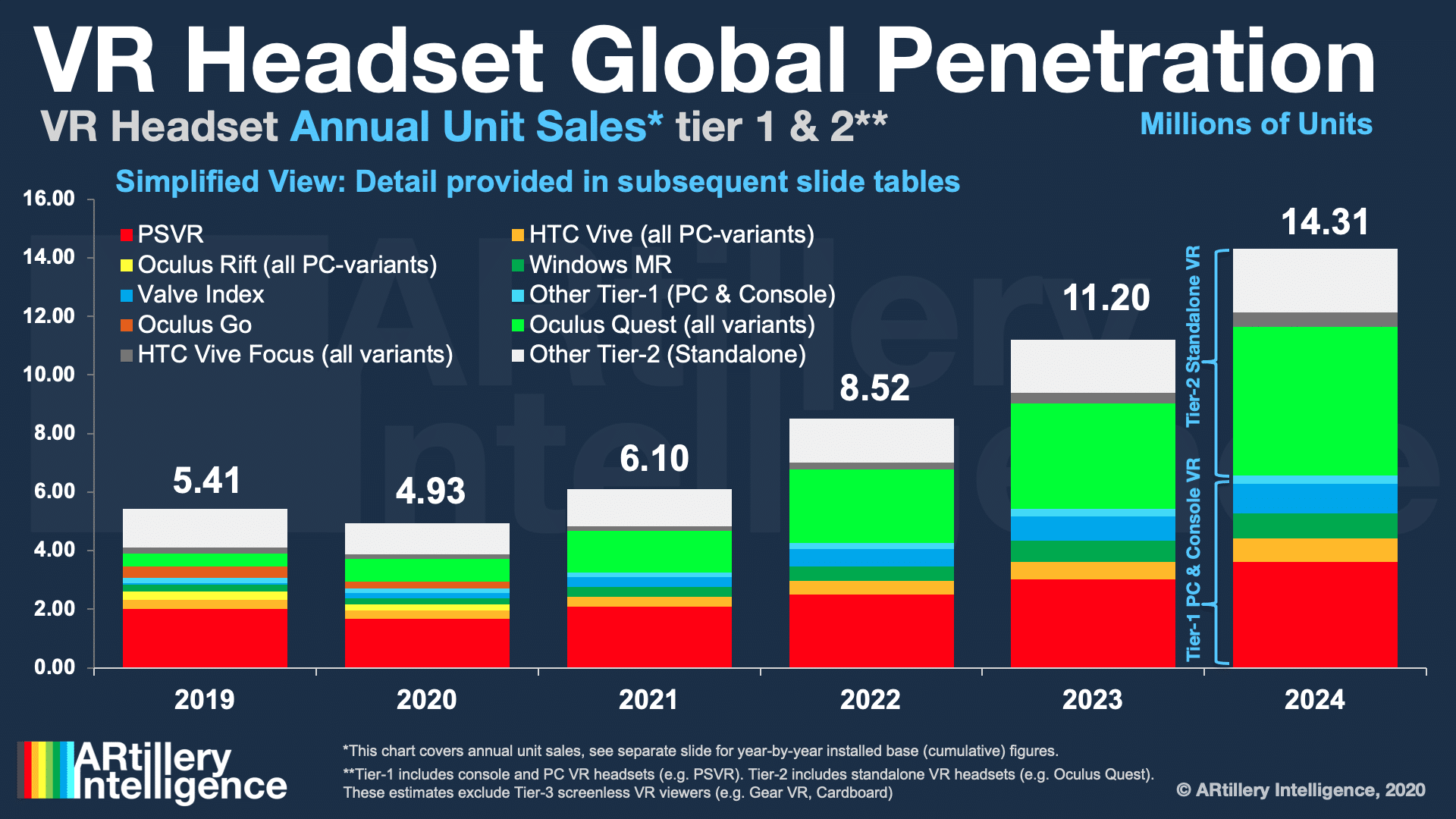

The above broadly supports projections from our research arm, ARtillery Intelligence, which foresees VR revenue growing from $4.9 million last year to $12.2 million in 2024 (with a pandemic dip in 2020). That correlates to 5.41 million unit sales in 2019 and 14.31 million in 2024.

To address 2020’s pandemic decline, it’s primarily due to supply-chain impediments. In other words, demand wasn’t lacking as VR aligns with Covid-advantaged sectors like gaming. So declines were all about supply. The net effect was a 10 percent year-over-year dip in units sold.

This decline could have been worse if it weren’t for Facebook’s beefed-up supply chain for Quest 2. After learning from Quest 1’s shortages, It has mostly met Quest 2’s substantial demand levels throughout Q4 and is experiencing fewer shortages than it did last year at this time.

Quest’s undersupply throughout 2020 was mostly due to the aforementioned Covid-inflicted supply-chain issues. But stock levels were already low, due mostly to unanticipated demand throughout the holiday 2019 timeframe. So a few factors contributed to the undersupply.

Spec-Advantaged

Regardless of the reason, Oculus gained key demand insights, which it now factors in to Quest 2’s supply-chain strategy. It has scaled up to meet greater demand, so Quest 2’s penetration — big or small — at least won’t be supply-constrained. And that could help raise all boats.

Meanwhile, it’s not just about Quest 2. PSVR continues to be the market share leader, piggybacking on 100 million+ Playstation 4 units (and Playstation 5 potential). Other spec-advantaged hardware will ride a post-Covid rebound, including Valve Index and HP Reverb g2.

That rebound will be fueled by pent-up demand as well as VR’s alignment with Covid-accelerated sectors like gaming, remote work, and virtual events. But beyond the current period, these factors could have long-term effects that sustain in a post-Covid hybrid-world of remote work and events.

Meanwhile, we continue to see evidence that things are moving in that direction, including the sampling of data points above. We’ll keep watching for more clues.