Like many analyst firms, market sizing is one of the ongoing practices of AR Insider’s research arm ARtillery Intelligence. A few times per year, it goes into isolation and buries itself deep in financial modeling. The latest such exercise zeroes in on mobile AR revenues.

This takes the insights and observations accumulated throughout the year and synthesizes them into hard numbers for spatial computing (see methodology and inclusions/exclusions). It’s all about an extensive forecast model coupled with rigor in assembling reliable inputs.

So what did the latest forecast uncover? At a high level, global mobile AR revenue is projected to grow from $6.87 billion in 2020 to $26.05 billion in 2025, a 30.5 percent CAGR. This sum consists of mobile AR consumer and enterprise spending and their revenue subsegments.

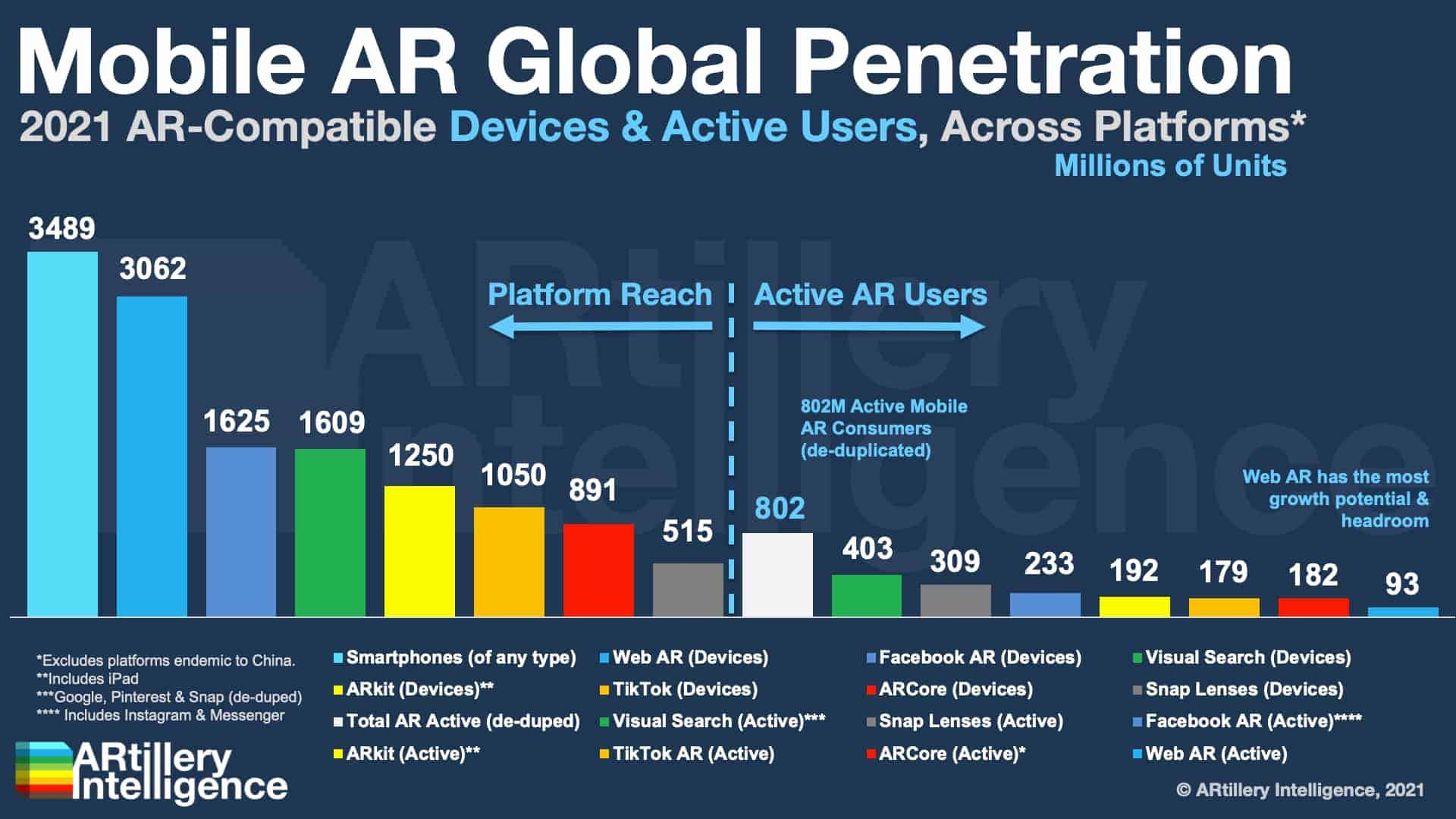

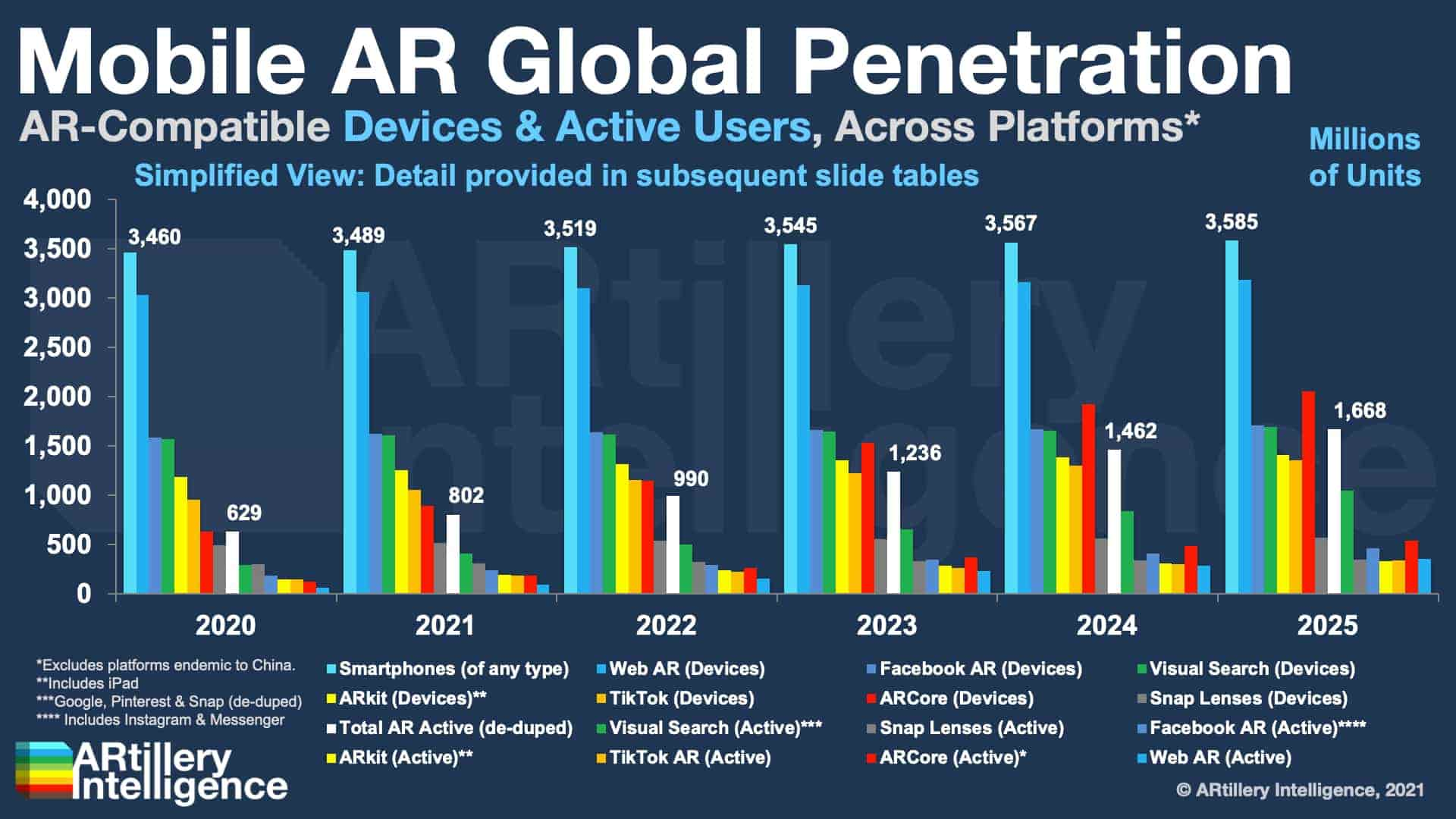

Drilling down, our latest Behind the Numbers installment looks specifically at the mobile AR hardware base. How many devices are AR-compatible? How many of those represent active AR users? And how does that lay the foundation for the above revenue growth?

Confidence Signal

One factor that has always been a confidence signal for mobile AR is the sheer size of the smartphone installed base. Compared to the uphill battle that AR glasses face, mobile AR — though challenged in its own ways — has an easier climb due to ubiquitous hardware.

But more important than the smartphone base is the growing share of that universe that’s AR-compatible. This is the subdivision of smartphones that can run AR experiences. That number has been paraded around industry events and editorials for the past few years as “one-billion+.”

This figure — based on Apple’s ARkit and Google’s ARCore — is no longer relevant because the landscape of AR-enabled devices is increasingly fragmented by several platforms including social apps and web AR. And these platforms’ presence on mobile devices has lots of overlap.

This means that the question of how many devices are AR compatible isn’t as simple as it used to be. Any device is likely to be compatible with many AR platforms at once. In fact, that’s most often the case given similar (though slightly varied) hardware requirements across platforms.

So there’s no longer a single answer — or monolithic “one-billion+” figure — to the question of how many AR-compatible devices exist. For anyone looking for an easy answer, it would be accurate to point to the largest platform, web AR, with 3.06 billion AR-compatible devices.

As for the other platforms on that list, Facebook’s Spark AR is projected to have 1.6 billion AR-compatible smartphones, followed by ARkit (1.25 billion), TikTok (1.05 billion), ARCore (891 million), and Snapchat (515 million). As always, all figures represent year-end estimates.

Compatability & Correlation

The key word in the above analysis is “compatible,” as it tallies devices that are AR-ready. A more important figure is how many are AR-active. Just like above, we run into the reality of platform overlap here, making it challenging to pinpoint one figure for global AR active devices.

By developing a de-duplication formula to reconcile the overlap, ARtillery Intelligence estimates that AR active devices at the end of 2021 will total 802 million. This is projected to grow to 1.67 billion by 2025 as more advanced hardware cycles in, and as AR acclimates culturally.

But it’s important to note that there isn’t necessarily a correlation between compatibility rankings and active-use rankings. For example, web AR’s compatibility lead is matched against its trailing active use — a mark of growth potential and ample headroom for the nascent AR modality.

TikTok is in a similar boat with promising reach but underdeveloped AR. Snapchat Lenses conversely have the lowest compatibility among platforms (515 million) but the highest active monthly use (309 million). This gives it the greatest ratio of AR users per compatible device.

Facebook sits somewhere in the middle with a diversified AR approach (News Feed, Messenger, Portal). But Instagram could be the real ace up its sleeve given a cultural match with camera-forward users, and natural monetization with its product-discovery use case.

Lastly, visual search — as a collective total of Google Lens, Pinterest Lens, Snap Scan, and others — ranks well with 1.6 billion compatible AR devices and just over 400 million active users. This is the area of AR that’s a sleeping giant in its potential to unleash camera commerce.

Double-Edged Sword

When looking at the AR market’s expansion through all these platforms, the question is whether or not it’s a good thing. Platform fragmentation is inevitable in any opportune new format. Self-interested players will build moats and walled gardens to establish their parcel of the opportunity.

That self-interest can be a good thing in that it motivates investment, which in turn accelerates industry growth. In fact, one of the biggest confidence signals for AR is the many tens of billions that tech giants are paying to plant their stakes and jumpstart their network effects.

But platform fragmentation can also impede adoption for users and developers — both of which are already on the fence with AR. A fragmented base of users divides developers’ already-finite incentive to build things into smaller pieces. And users get confined to walled gardens.

This brings us full circle to market-sizing for increasingly-complex markets. Though it’s more work to pinpoint device compatibility and active users among a growing set of AR platforms, it’s at least a sign that mobile AR is growing. We’ll keep tracking where that growth is headed.