Industry rhetoric about AR’s world-changing status sometimes outweighs evidence that it’s captivating consumers today. Though we see some signals, such as lens engagement figures from Snapchat and others, we’re often “flying blind” when it comes to consumer AR sentiment.

Looking to fill that gap, AR Insider’s research arm ARtillery Intelligence has completed Wave V of its annual consumer survey report. Working with consumer survey specialist Thrive Analytics, it wrote questions to be fielded to 102,000+ U.S. adults and produced a report based on the results.

Known as AR Usage & Consumer Attitudes, Wave V, it follows similar reports over the last few years. Five waves of research now bring new insights and trend data to light. And all five waves represent a collective six-digit sum of U.S. adults for robust longitudinal analysis.

Among the topics: How is mobile AR resonating with everyday consumers? How often are they using it? How satisfied are they? What types of experiences do they like most? How much are they willing to pay for it? And for those who aren’t interested in mobile AR….why not?

Pole Position

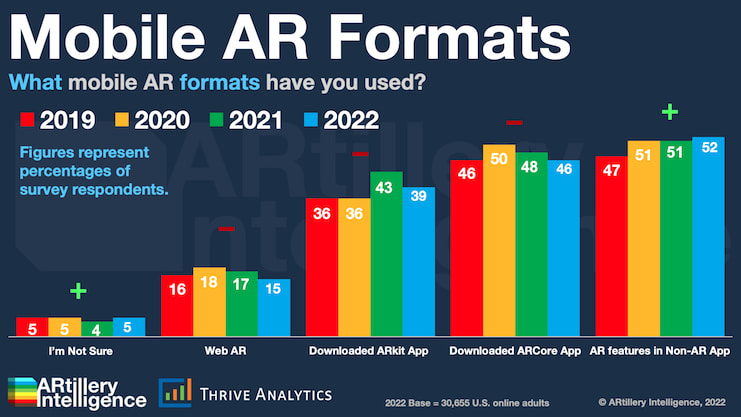

After examining mobile AR user penetration and demographics last week, we move on to the question of how and in what formats they engage. Indeed, AR continues to fragment into several different access points including OS-based platforms, social channels, and the web.

Starting with the former, Apple and Google’s AR developer kits (ARkit and ARCore) were early to democratize the development of AR experiences. That, plus the fact that they have a pole position in being bolted to the top mobile operating systems, has given them an edge.

Specifically, 46 percent of AR users report using ARCore apps while 39 percent use ARKit apps. This split is surprising due to these platforms’ market shares. Though ARCore will eventually reach a larger Google Android global base, ARkit today has an early lead of compatible iPhones.

But what lies beyond these primary native AR platforms? As we’ve examined, apps aren’t always the optimal vessel for AR, given download friction and “activation energy.” That leaves two formats seen in these survey results – one that’s already performing and one that’s primed to.

AR as a Feature

The “already-performing” format is what we call “AR-as-a-feature” (ARaaF) which received the most responses at 52 percent. This format lowers barriers by planting AR within popular apps. In fact, the most-tasted AR flavors – Pokémon Go and Snapchat Lenses – represent ARaaF.

Meanwhile, the “primed” format is web AR. This is defined by AR experiences that are delivered in the mobile browser. Its advantage? Because AR is still early and unproven, there’s little motivation for consumers to go through the typical friction involved in downloading apps.

Web AR is conversely activated with just a web link – or other calls-to-action such as QR codes – and avoids platform-compatibility issues. As we examined in a recent report and in AR market sizing, this makes web AR’s reach outshine other channels with about 3.1 billion devices.

To be fair, web AR still has some quality and capability deficiencies compared to apps, whose native libraries better sync with device hardware and sensors. But that’s quickly changing due to the work of innovative startups like 8th Wall. This will be something to watch closely.

We’ll pause there and circle back in the next installment to examine other consumer AR sentiments, such as what content categories they engage most…