Like many analyst firms, market sizing is one of the ongoing practices of AR Insider’s research arm, ARtillery Intelligence. A few times per year, it goes into isolation and buries itself deep in financial modeling. One such exercise recently zeroed in on headworn AR revenues.

This takes the insights and observations accumulated throughout the year and synthesizes them into hard numbers for spatial computing (see methodology and inclusions/exclusions). It’s all about an extensive forecast model coupled with rigor in assembling reliable inputs.

So what did the latest headworn AR forecast uncover? At a high level, revenue is projected to grow from $1.85 billion in 2021 to $35.1 billion in 2026, an 80.7 percent CAGR. This is steep growth that leans on a few potential wild cards and inflections, such as Apple’s market entrance.

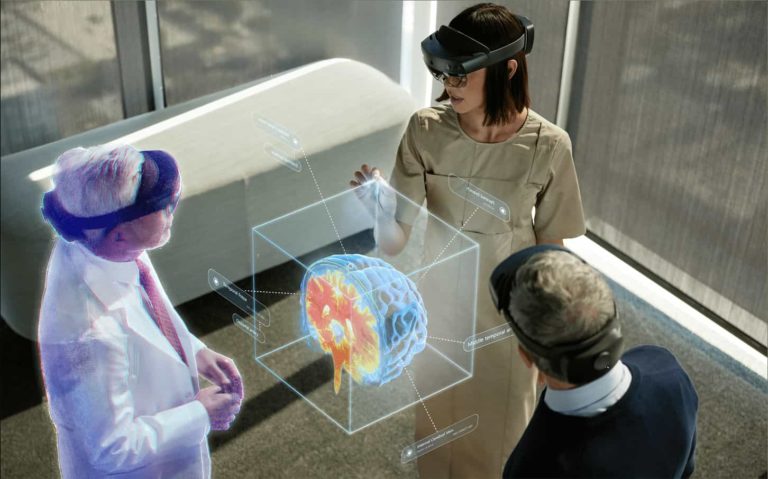

Drilling down, our latest Behind the Numbers installment zeroes in on enterprise spending. Among the above revenue totals, how much is being spent by enterprises? We’re talking about investments to boost productivity and operational efficiencies through line-of-sight guidance.

Addressable Market

Jumping right in, enterprise AR spending will grow from $1.79 billion in 2021 to $21.6 billion in 2026, a 64.6 percent CAGR. This steep growth is due to advancements in AR glasses, as well as a steady transition from mobile AR (see separate forecast) to headworn AR.

This spending includes AR hardware and software that enables line-of-sight or live-guided support for assembly, maintenance, or tech support. It also includes software that helps enterprises (or software vendors that serve them) author AR experiences that fit the same description.

This area’s strength and growth potential stems from its broad applicability. It can include everything from assembly to heavy-equipment maintenance to IT operations. These functions cut across several industries and verticals, causing a sizeable addressable market.

Beyond revenue, another way to quantify this is in units. Enterprise AR headsets are projected to grow from 308,000 in 2021 to 2.85 million in 2026. The former makes up the lion’s share (79 percent) of the 390 million AR headsets sold overall, including consumer markets.

Why is this? Consumer markets are generally larger than enterprise markets, though they can often trail in early stages. That pattern is pronounced in AR where the hardware isn’t yet stylistically viable for consumer markets, causing them to lag relative to style-agnostic enterprises.

Historical Patterns

Enterprise AR isn’t without its own growth impediments. For example, it often faces organizational resistance to change. One symptom is the dreaded “pilot purgatory.” But AR continues to demonstrate a strong business case that will eventually overpower cultural resistance.

As this happens, adoption could follow a similar pattern as enterprise smartphone adoption a decade ago, including a tipping point, followed by accelerated adoption. This is a historical pattern that could play out, though on a smaller scale due to AR’s cost and invasiveness.

Meanwhile, an adoption accelerant looms: the economy. AR lets companies be more effective with less headcount using things like remote support in assembly and maintenance. This has already gotten the chance to shine, given the remote work needs of the Covid era.

Going back further, retiring baby boomers caused a skills gap, which AR helped fill. It does this by placeshifting subject matter experts (e.g., remote support) while transferring institutional knowledge through immersive training. That need is evident again in the “great resignation.”

We’ll pause there and circle back in the next behind-the-numbers installment with more numbers and narratives.