Immersive brand marketing continues to be a leading spending category in AR. In fact, it’s one of the few that derives meaningful revenue. Beyond a few outliers, consumers largely aren’t paying for mobile AR experiences, meaning most are brand-sponsored rather than user-bought.

As we noted in last week’s Behind the Numbers, AR marketing is projected to grow from $3.4 billion in 2022 to $14.5 billion by 2027. This includes creation platforms (e.g., 8th Wall) and paid amplification (e.g., sponsored lenses). We’ve projected the latter to hit $3.5 billion in 2023.

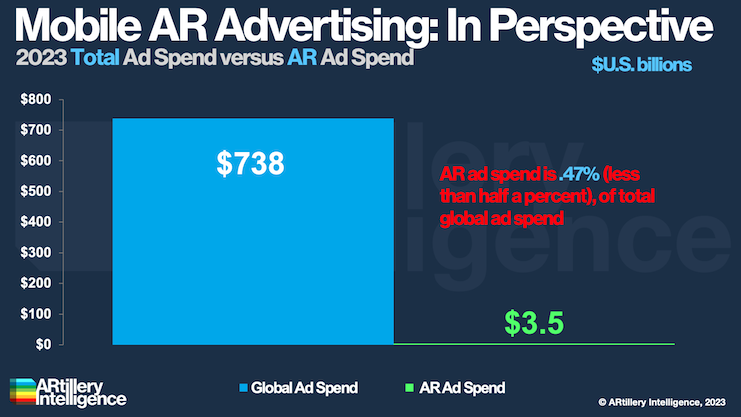

But understanding the scale of that ad spend requires panning back to put it into perspective. To demonstrate, what would you guess is AR’s share of total global ad spending? We’ve seen aggressive guesses of “at least 10 percent and as much as 25 percent of digital ad spending.”

Though the optimism is appreciated, the share is much smaller. Given that global advertising spending is about $738 billion, that means AR’s $3.5 billion in 2023 represents a spending share of .0047. This is .47 percent or – in more plain-spoken terms – just under half of one percent.

Glass Half Full

Though the above reads as pessimistic, there’s a glass-half-full message intended. All that space that hovers above AR’s ad spending share represents headroom. While overall ad spending is reaching maturity and decelerated growth, AR advertising is growing at a 33.8 percent CAGR.

AR advertising is still challenged in lots of ways including some resistance from comfort-bound brand marketers (more on them in a bit). But it’s still a good place to be. Younger markets are where growth opportunities and upside lie. It’s small now, but it has to start somewhere.

To back that up with a historical example, mobile advertising was once an inconsequential portion of global ad spend. Today it holds a commanding 74 percent share of digital advertising. AR won’t hold the same prowess as mobile advertising broadly speaking, but it will be meaningful.

Like mobile advertising, that growth will happen gradually (the current stage), then inflect when it reaches a tipping point. That’s when it goes from an experimental initiative among the Pumas and Pradas of the world to a more common piece of brands’ omnichannel marketing mix.

Carrot or Stick

One way the above sequence will play out is through consumer conditioning. The early adopter brands noted above will start to whet consumers’ appetites for things like dimensional product try-ons. Gradually, that will condition user habits, which evolve into expectations.

Those consumer expectations will then pressure all those resistant brand marketers to finally come on board. They won’t have much choice because it will be table stakes at that point. Put another way, many consumer brands will adopt AR eventually, whether by the carrot or the stick.

To rest on another historical example, the above sequence is how digital photography became ubiquitous in eCommerce. It’s hard to imagine a day when online product listings didn’t contain several images from every angle (and 3D spinners in some cases), but that was the reality.

Of course, AR is more technically complex than photography, which is why this adoption sequence will take longer. That’s what we’re currently seeing in the drawn-out adoption cycle for AR brand marketing. AR innovators with the patience to stick with it could see ample payoff.